AzmanL

Proto Labs, Inc. (NYSE:PRLB) is a custom manufacturer. Their operating segments are: injection molding, CNC machining, 3d printing, and sheet metal fabrication. The revenue breaks down into 46%, 36%, 13%, and 5% for each.

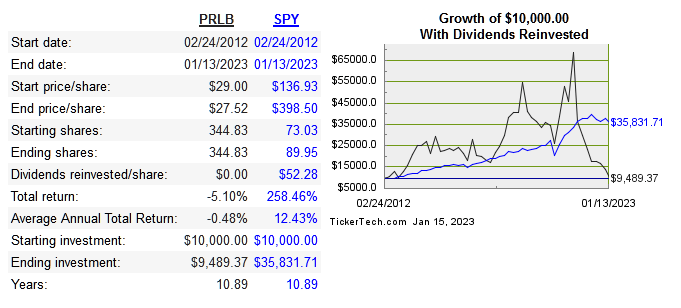

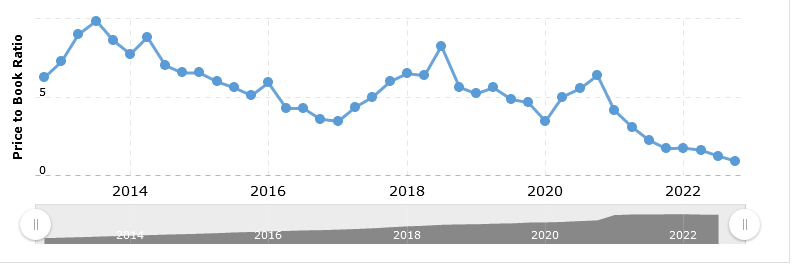

They serve the portion of the market that needs smaller orders and mainly for prototyping. They won’t be working with any huge companies to mass produce a generic product, the customer is someone who is looking to test out a design as a prototype. Customers are able to order a small batch of highly customized units, often produced and shipped in only a couple of days. Below is the share price performance since their IPO in 2012:

Dividend Channel

They’ve had positive FCF and net income every year as a public company. Even at today’s share price, they have passed the Buffett test of retained earnings versus market cap (at least one dollar in market value per dollar of retained earnings). Retained earnings are $381 million versus a market cap of $737 million. Below are the return on capital metrics, followed by margins over the past decade:

|

Company |

Revenue 10-Year CAGR |

Median 10-Year ROE |

Median 10-Year ROIC |

EPS 10-Year CAGR |

FCF/Share 10-Year CAGR |

|

17.3% |

13.8% |

13.7% |

11.7% |

18.7% |

|

|

65%* |

n/a |

n/a |

n/a |

n/a |

|

|

7.3% |

2% |

1% |

10% |

13.3% |

|

|

10.3% |

-6.7% |

-6.5% |

18.4% |

n/a |

|

|

14.6% |

-4.1% |

-4.1% |

n/a |

n/a |

|

Year |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|

Rev |

163 |

210 |

264 |

298 |

344 |

446 |

459 |

434 |

488 |

496 |

|

Gross Margin |

62.4% |

61.3% |

58.5% |

56.0% |

56.3% |

53.6% |

51.3% |

50.1% |

45.6% |

44.6% |

|

Operating margin |

31.5% |

28.9% |

25.4% |

20.7% |

21.0% |

20.0% |

17.4% |

13.8% |

8.3% |

6.5% |

|

Net Margin |

21.6% |

19.9% |

17.6% |

14.3% |

15% |

17.2% |

13.9% |

11.7% |

6.8% |

4.8% |

The issue now is that its days of fastest growth are over. Growth itself isn’t necessarily good, and as we saw above, the margins at all levels have declined as they grow. They haven’t reached their peak as far as revenue, but I think TAM is limited by the fact that the business model doesn’t cater to large companies with huge purchasing power as customers.

Capital Allocation

The company has clearly been in growth mode since its IPO. They have made 3 acquisitions, and the share count was diluted over time, but debt was always kept to a minimum. The board has approved $50 million in repurchases, and I would definitely like to see the share count being reduced at current prices. I don’t expect this to happen, but they have reached a point where consistent repurchases can drive EPS as the topline slows.

Risk

The company is financially in a pretty strong position. Long-term debt is only at $2 million with a cash balance of $132 million. The business did attract competition, but at this point, the biggest risk is much slower growth. Revenue has grown at a CAGR of 17.3% for the past decade, yet assets have grown at a rate of 31%. This is a situation that can’t continue forever, and the shrinking margins have already shown what cost the growth came with.

There is little risk on a fundamental level, the biggest risk so far would have been paying a very high price near the peak and being too optimistic about growth. Now that the share price collapsed, we go to valuation.

Valuation

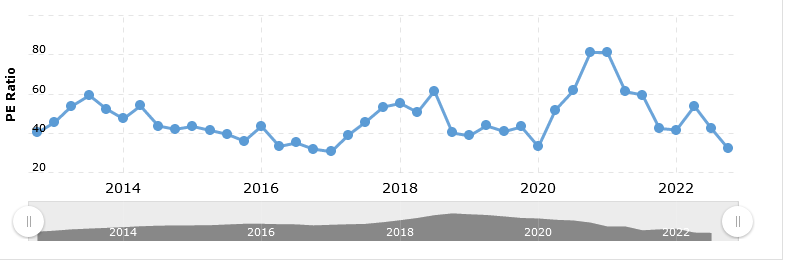

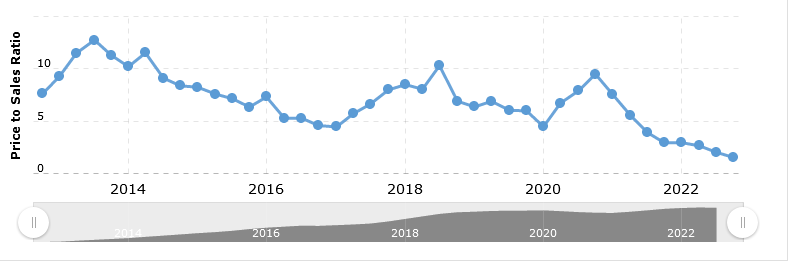

Shares are down 87% since the 2021 peak, but this kind of drawdown has happened to several other growth names, does this mean they all went from overvalued to now undervalued? Below, we compare multiples with peers, followed by historical multiples:

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

|

PRLB |

1.3 |

8.3 |

12.6 |

0.9 |

|

XMTR |

3.6 |

-19.4 |

-14.3 |

3.4 |

|

MTLS |

1.9 |

17.2 |

30.3 |

2.3 |

|

DDD |

1.9 |

-19 |

-12.2 |

1.7 |

|

SSYS |

0.8 |

-35 |

-7.5 |

0.9 |

Macrotrends

Macrotrends

Macrotrends

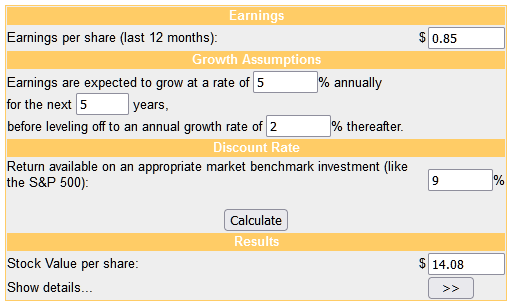

The only discount to be found is the historical P/B, but this still doesn’t mean PRLB is undervalued here. Next is the DCF model assuming slower EPS growth:

Moneychimp

Even with the massive drop in share price, I still consider the stock a bit overvalued considering slower growth going forward.

Conclusion

PRLB is a good business, but it is simply transitioning from a fast grower to a slow grower. When assets grow at a faster rate than revenue, we know that capital intensity is an issue which will have to be dealt with at some point.

Margins at every level have contracted, and the real cost of growth is now apparent. PRLB is a good company with good prospects for future growth, but it is no longer a high-flier. I consider the stock overvalued today, and would wait to see if it drops anymore.

Be the first to comment