Darren415

Proto Labs, Inc. (NYSE:PRLB) operates in a market that is expected to grow at a CAGR of more than 17%, and management is already selling outside the United States. In my opinion, more effort to develop PRLB’s digital model and economies of scale could bring significant EBITDA margin expansion. Considering the beneficial guidance given by analysts and management, I believe that the fair valuation is higher than the current market price. I obviously see some risks from competitors and inadequate technology offerings, however, Proto Labs looks promising.

Proto Labs: Innovative Business Model, Expecting Double-Digit EPS Growth, And Competing In The International Markets

Proto Labs claims to be one of the world’s largest and fastest digital manufacturers of customized prototypes and on-demand production parts.

In the annual report, management noted that the company can produce commercial-grade plastic, metal, and liquid silicone rubber parts in only one day. Some of the services offered by Proto Labs are shown below.

Company’s Website

Proto Labs operates in a growing and innovative market. I believe that the company has both the cash in hand and the know-how necessary to grow in the international markets. In my opinion, already operating in the international markets, Proto Labs will likely benefit from a larger target market as soon as the international revenue creeps up even higher:

Our international revenue accounted for approximately 21%, 20% and 22% of our total revenue in the years ended December 31, 2021, 2020 and 2019, respectively.

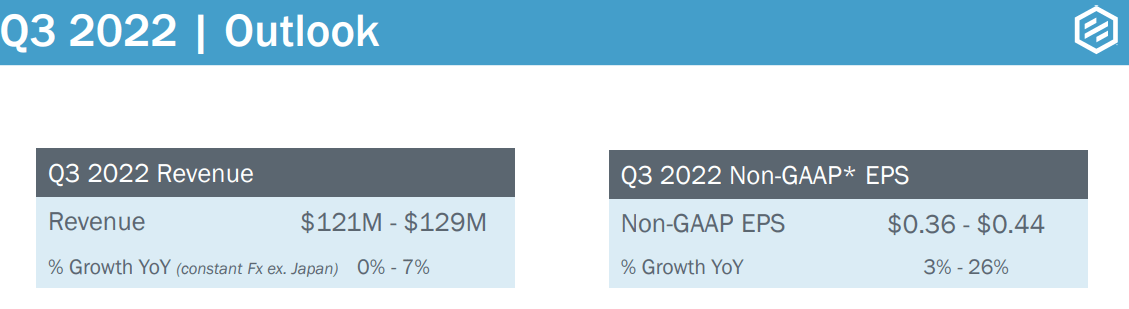

Proto Labs expects sales growth in Q3 2022 and growth close to 0%-7% y/y. Besides, non-GAAP EPS is expected to remain close to $0.36-$0.44 per share, with expected growth of around 3%-26%. I believe that only the beneficial guidance given by management is a sufficient reason to review the stock.

Quarterly Presentation

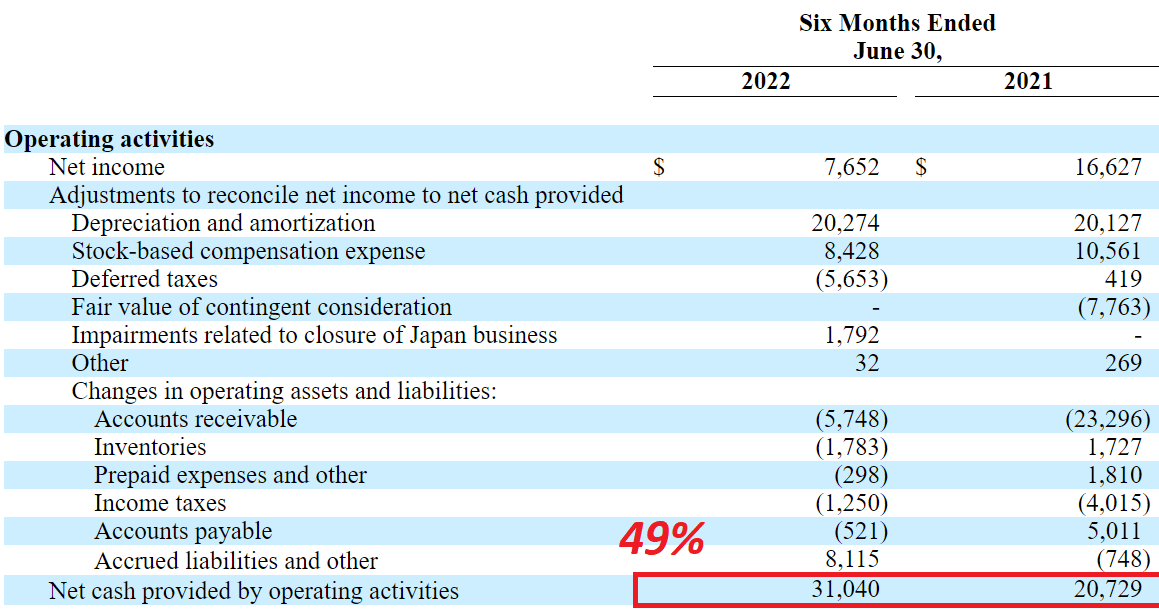

Cash Flow From Operations Increased By 49% In The Six Months Ended June 30, 2022

I believe that the most interesting thing about Proto Labs’ financials is the cash flow statement and the most recent CFO increase. On June 30, 2022, a net income of $7.652 million was reported, in addition to a depreciation and amortization of $20.274 million, a stock-based compensation expense of $8.428 million, and deferred taxes of $5.6 million. The company also reported impairments related to closure of Japan business worth $1.792 million, which may be considered extraordinary, and account receivable changes worth $5.748 million. Besides, with changes in inventories worth $1.783 million, the net cash provided by operating activities was $31.040 million. The CFO was 49% larger than what was reported in the period in 2021.

10-Q

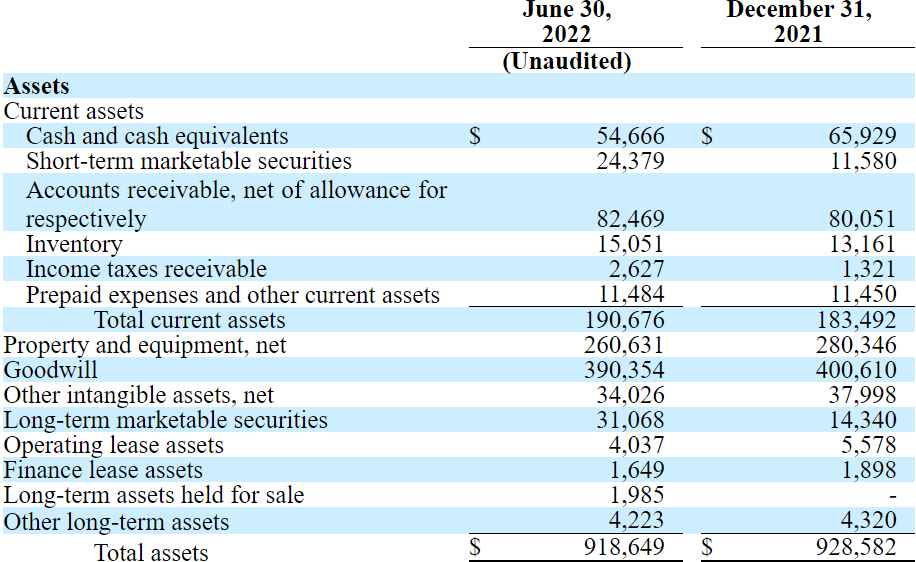

Balance Sheet

As of June 30, 2022, the company reported cash worth $54 million and $190 million in total current assets. Hence, with growing cash flow from operations, I believe that management has sufficient liquidity to run its business. The asset/liability ratio is close to 9x-10x, so I would say that the balance sheet is in very good shape.

10-Q

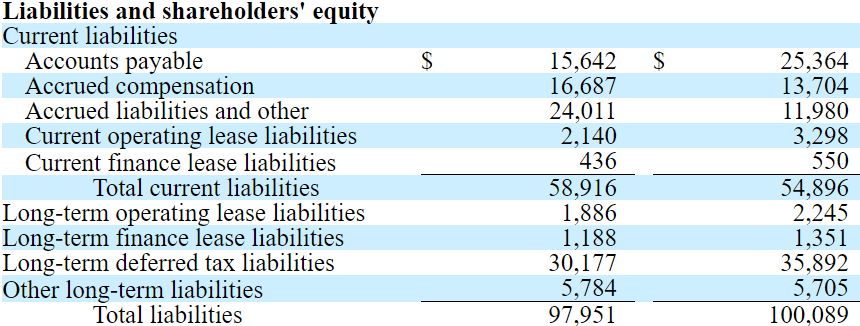

The list of liabilities does not seem worrying. Proto Labs reports accounts payable of $15.642 million and accrued compensation of $16.687 million. As for the current finance lease liabilities, they were $436 million, with total current liabilities of $58.916 million.

The company also noted long-term operating lease liabilities worth $1.89 million and long-term finance lease liabilities of $1.19 million, together with long-term deferred tax liabilities of $30.177 million. Finally, the total liabilities were $97 million.

10-Q

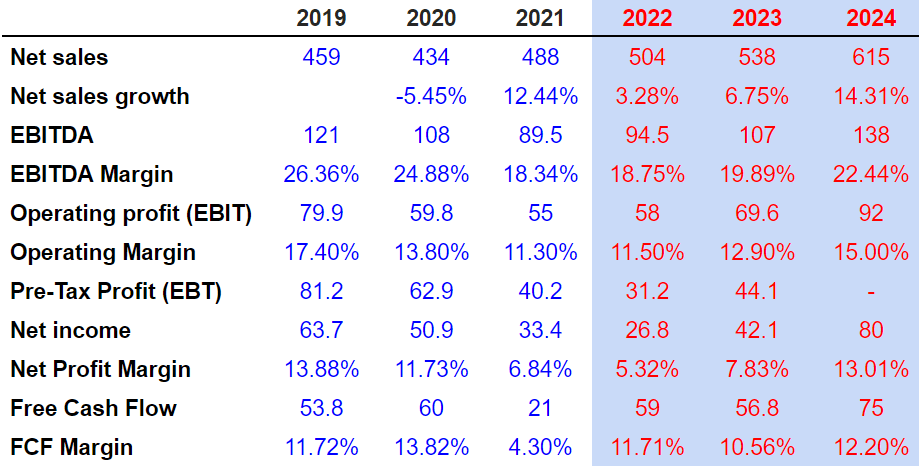

Expectations Include Sales Growth Close To 3%-14%, Stable EBITDA Margin Of 18%-22%, And FCF Margin Of 11%-12%

I researched the work of other analysts and was very surprised about what I found. I believe that most analysts are optimistic about the future FCF growth. Estimates include 14% sales growth in 2024, an EBITDA margin of 18%-22%, operating margin of 11%-15%, and FCF margin of around 11%-12%. The results include 2024 FCF of $74-$75 million and 2024 EBITDA close to $138 million.

Please have a look at the following numbers because some of my discounted cash flow models obtained some figures from the work of other analysts.

MarketScreener.com

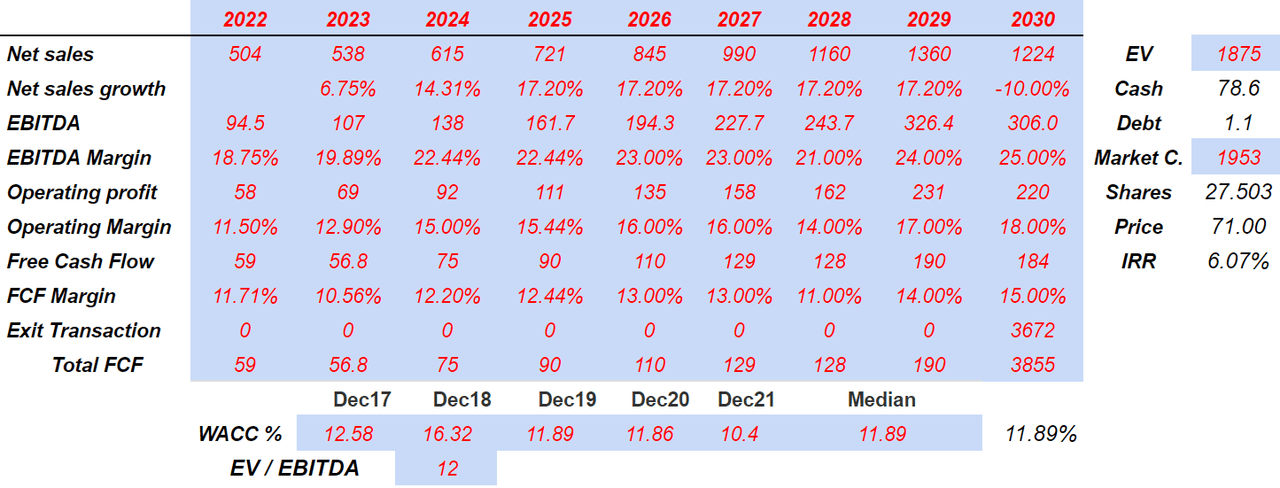

If Proto Labs’ Revenue Grows Like The Rapid Prototyping Materials Market, The Company Could Be Worth Even $67 Per Share

According to experts, the rapid prototyping materials market could grow at a CAGR of 17.2% from now until 2028. In this scenario, which is an optimistic one, I would assume that the company’s revenue growth will likely be close to that of the market.

The global rapid prototyping materials market is projected to grow from $491.7 million in 2021 to $1,496.7 million by 2028 at a CAGR of 17.2%.

In my view, if Proto Labs continues to expand its digital model, and clients accept it, revenue growth could be close to 17%. If more products are offered, economies of scale will likely increase, which may lead to better revenue growth. The following words are from the last 10-K:

Since our inception, we have focused on areas where we could automate the manufacturing process via our digital model. Our initial focus was on prototypes and simple parts and have added complexity over time. We have added product lines and expanded those product lines to meet the needs of our customers, which has ultimately driven our growth.

I also believe that more recognition from experts in the manufacturing industry could enhance Proto Labs’ brand. As a result, more clients will likely be willing to try the company’s MN injection molding facility or the other technologies offered by Proto Labs.

In 2021, our e-commerce platform was recognized by the World Economic Forum’s Global Lighthouse Network, recognizing our industry leading efforts to implement Fourth Industrial Revolution technologies at our Plymouth, MN injection molding facility.

Under this scenario, I expect that the lacuna of PL and the M&A efforts will likely enhance customer experience, and increase the retention of clients. Let’s note that this is close to the scenario offered in the last annual report by management.

Our launch of PL 2.0 and acquisition of Hubs in 2021, will provide the foundation for us to accelerate growth in 2022 and beyond. The enhanced customer experience and expanded offering portfolio is expected to drive higher customer satisfaction, higher annual revenue per customer and improved customer retention.

Also, with growing EBITDA margin of around 19% and 25%, operating margin close to 12% and 18%, and FCF margin close to 12%-15%, FCF would stay close to $56 million and $190 million. I also used an exit multiple of 12x, which is close to that of the market, and a discount of 11.89%. The results include an enterprise value of $1.87 billion, market capitalization of $1.9 billion, and a fair price of $71 per share. In my view, my figures are not far from reality.

My DCF Model

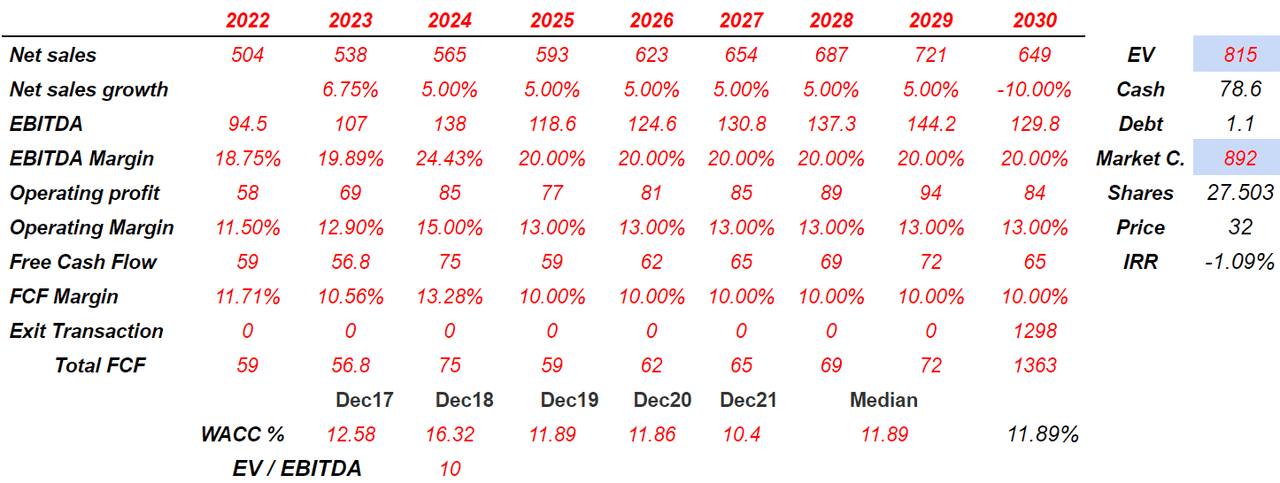

Under Bearish Conditions, I Believe That The Fair Price Could Stand At $32 Per Share

The company competes with a significant number of competitors all over the world. They may become more innovative than Proto Labs, or may offer cheaper products from jurisdictions outside the United States. Management disclosed a list of competitors in the last annual report:

Some of our current and potential competitors include captive in-house product lines, other custom parts manufacturers, brokers of custom parts and alternative manufacturing vendors such as those utilizing 3D printing processes.

Proto Labs may fail to adapt its technological resources to what customers need. According to the last 10-k, if the company offers a level of technological sophistication that exceeds what customers need, Proto Labs’ P&L may suffer. If the free cash flow does not increase as expected, the company’s fair valuation may also be lower. In sum, the stock price could decline.

With respect to our websites and quoting technology, it may become increasingly difficult to maintain and improve their performance, especially during periods of heavy usage and as our solutions become more complex and our user traffic increases across geographic regions.

Security breaches could be very harmful for Proto Labs. Keep in mind that management has to disclose that hackers or other malicious actors compromised the company’s systems. As a result, clients may decide to stop working with Proto Labs. Besides, the brand may be affected, and investors may sell shares in the market. Management disclosed the following risks in the last annual report.

These mandatory disclosures regarding a security breach often lead to widespread negative publicity, which may cause our existing and prospective customers to lose confidence in the effectiveness of our data security measures. Any security breach, whether successful or not, would harm our reputation and brand and could cause the loss of customers.

Under detrimental conditions, I assumed net sales growth of 5% from 2024 to 2029 and an EBITDA margin of 20% from 2025 to 2030. Also, with a free cash flow margin around 10% from 2025 to 2030, a WACC of 11%, and an exit multiple of 10x EBITDA, the implied market valuation would stay close to $892 million with a fair price of $32 per share.

My DCF Model

Conclusion

Proto Labs operates in a growing market. The company is already reporting significant CFO generation, and most analysts are expecting free cash flow increases in the coming years. In my view, if management continues to offer sophisticated mechanisms to design prototypes, and the digital model is even more accepted, revenue growth will likely increase. Under normal circumstances, I would expect that the EBITDA margin will likely increase as economies of scale play a role and internationalization increases. Yes, even considering potential risks, Proto Labs looks promising.

Be the first to comment