TERADAT SANTIVIVUT/iStock via Getty Images

The ProShares VIX Mid-Term Futures ETF (BATS:VIXM) provides exposure to medium-term VIX futures.

From a portfolio perspective, I believe the VIXM ETF may appeal as a tail hedge, since it has less decay than more popular VIX products like the ProShares Ultra VIX Short-Term Futures ETF (UVXY) or the iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX).

Looking at the past 5 years, a small allocation to VIXM in a diversified portfolio could have significantly improved overall returns and risk, as the VIXM ETF more than doubled during the COVID crash. However, in a depressed volatility environment like in 2017, the VIXM can lose significant value if the VIX futures curve is steep across all maturities.

Fund Overview

The ProShares VIX Mid-Term Futures ETF provides long exposure to medium-term VIX futures. The VIXM ETF tracks the S&P 500 VIX Mid-Term Futures Index (“Index”), an index designed to measure the returns of a portfolio of monthly VIX futures contracts with an weighted average maturity of 5 months to expiration.

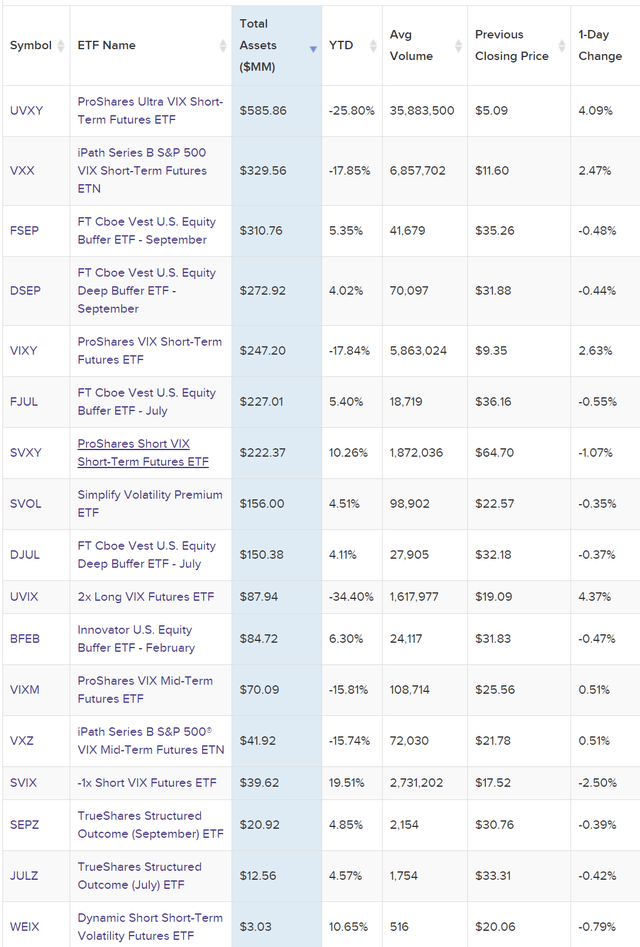

Out of the multitude of VIX products offered by ProShares and other managers, the VIXM is not that popular, with only $70 million in assets compared to leaders such as the UVXY ETF with almost $600 million in assets and the VXX ETN with $330 million (Figure 1). VIXM charges a 0.95% expense ratio, on par with other volatility-based products.

Figure 1 – Volatility-based ETFs (etfdb.com)

Portfolio Holdings

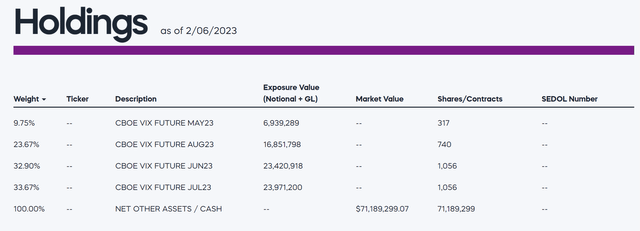

As described above, the VIXM ETF holds positions in VIX futures of varying maturities with a portfolio weighted average maturity of 5 months (Figure 2).

Figure 2 – VIXM holdings (proshares.com)

As time moves forward and the VIX futures get closer to maturity, the VIXM will sell the nearest term futures and redeploy the proceeds into futures with a longer time to maturity, to maintain the weighted average maturity of 5 months.

Returns

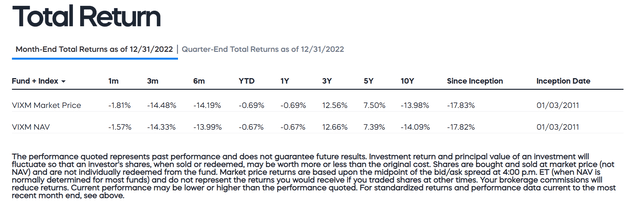

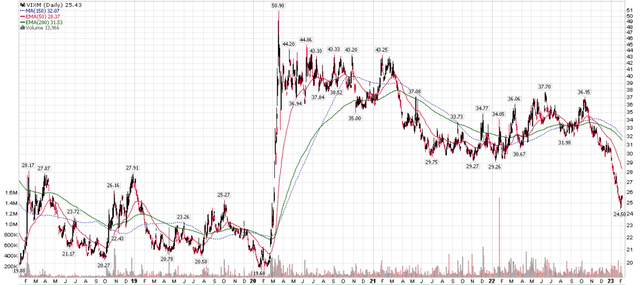

Figure 3 shows the VXX ETF’s historical returns. In the short-term, the VIXM ETF has been disappointing, returning -0.7% in 2022 despite the S&P 500 index falling by more than 18%. However, VIXM’s medium-term returns have been solid with 3Yr and 5Yr returns of 12.7% and 7.4% respectively, due to the inclusion of the COVID-pandemic spike in volatility.

Figure 3 – VIXM historical returns (proshares.com)

VIX Products Tend To Decay

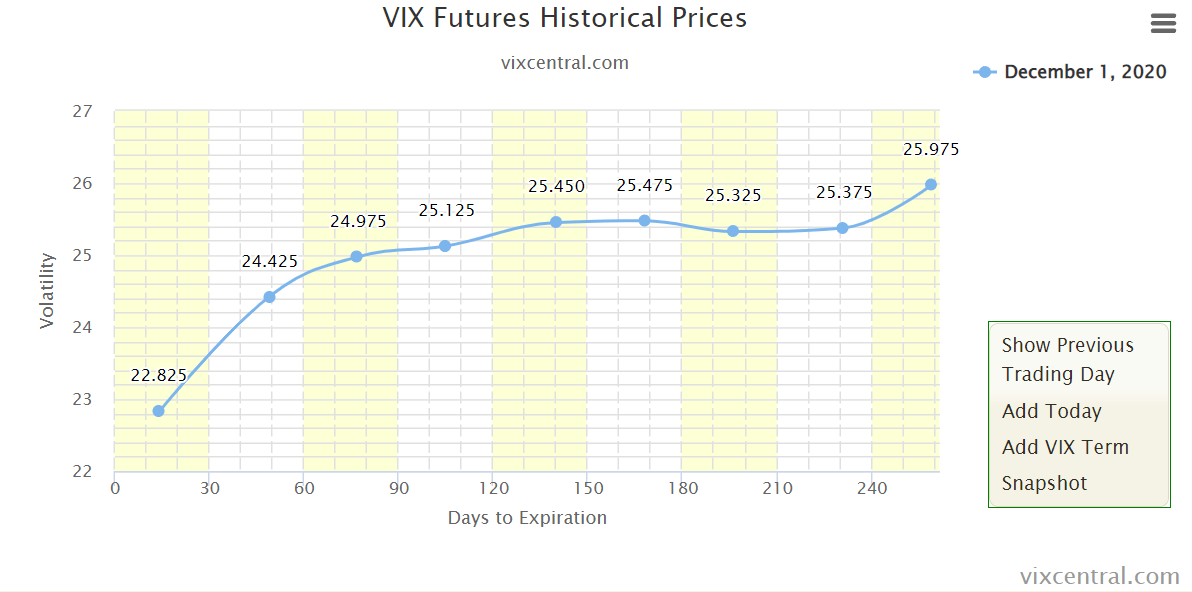

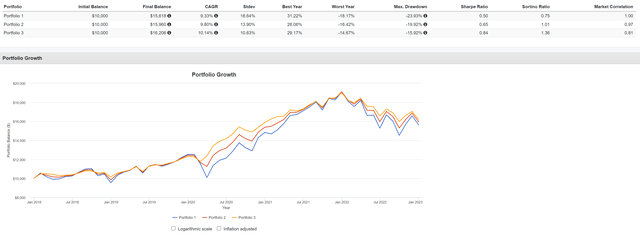

In general, I recommend investors stay away from VIX futures-based products that have pronounced decay. For example, the VXX ETF mentioned above focuses on the two front-month VIX futures, where the futures curve tend to be steepest and decay the greatest (Figure 4).

Figure 4 – Illustrative VIX futures curve (vixcentral.com)

Every month, assuming no shift in the overall level of volatility, the 1st month future will expire and the 2nd month future that VXX owns will ‘roll’ down to be the new 1st month future and its value will decrease. The VXX ETF will also need to buy new 2nd month futures to replace the one that rolled.

This negative roll expense pretty much guarantees that VXX ETN holders will lose money over the long-term. Since the current iteration of the VXX ETN was listed in 2018, the ETN has lost almost 90% of its value, despite the ETN gaining 6x during the COVID-pandemic in 2020 (Figure 5).

Figure 5 – VXX has lost 90% of value since inception (stockcharts.com)

Belly Of The Curve Has Less Decay

Although the VIXM ETF is also a VIX futures-based product (so it suffers from roll decay), the fact that it focuses on a weighted-average maturity of 5 months means that VIXM’s maturities tend to be clustered in the ‘belly’ of the VIX curve, where the curve has historically been flatter and the decay less pronounced. In fact, comparing the timeframe in figure 6 below and figure 5 above, we can see that the VIXM still has ‘positive’ returns of ~25% from the beginning of 2018, whereas the VXX ETF is down 90%.

Figure 6 – VIXM is still 25% higher than in early 2018 (stockcharts.com)

Bear in mind, the markets, as measured by the S&P 500 Index, have rallied ~50% since early 2018, so VIXM’s positive performance is even more impressive (Figure 6).

Figure 7 – S&P 500 has rallied ~50% since early 2018 (stockcharts.com)

Own VIXM As A Tail Hedge

While I recommend investors stay away from decaying VIX funds in general, a case can be made to own the VIXM ETF as a ‘tail hedge’, provided it is used as part of a portfolio.

For example, if we look at historical 5 year returns, although VIXM’s 7.5% average annual return is not impressive versus the SPDR S&P 500 ETF Trust’s 5Yr average annual return of 9.3%, the vast majority of VIXM’s returns came during the COVID-pandemic crash, when equity markets were crashing.

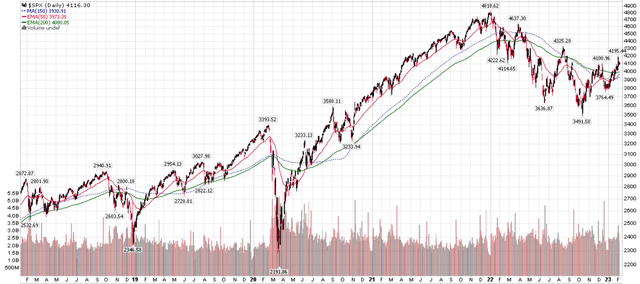

A simple portfolio constructed with 80 to 90% invested in the SPY ETF and 10 to 20% allocated to the VIXM ETF would have significantly outperformed simply holding the SPY ETF in the past 5 years, with better CAGR returns, lower volatility and smaller maximum drawdowns. Figure 8 shows the simulation results using time period January 2018 to December 2022, with Portfolio 1 being 100% SPY; Portfolio 2 being 90% SPY, 10% VIXM, and Portfolio 3 being 80% SPY and 20% VIXM.

Figure 8 – SPY vs. 90/10 SPY/VIXM vs. 80/20 SPY/VIXM (Author created with Portfolio Visualizer)

Risk To Owning VIXM

Of course, there is no free lunch. As I have highlighted above, the VIXM ETF also suffers from roll decay of its VIX future holdings, so in most years, without market crashes, the VIXM ETF is expected to lose money.

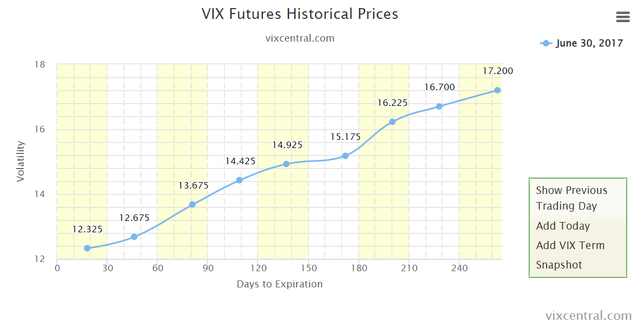

In fact, there are historical periods where the VIX term structure is very steep in the belly of the VIX curve. If the belly of the VIX curve remains steep for an extended period of time, like it did in 2017, then the VIXM ETF could see significant value decay. The VIXM ETF lost 49.5% of its value in 2017 as volatility was unusually suppressed, with a steep futures curve (Figure 9).

Figure 9 – Illustrative VIX futures curve in 2017 (vixcentral.com)

Conclusion

The VIXM ETF provides exposure to medium-term VIX futures. I believe the VIXM ETF may appeal as a tail hedge for investors with relatively less futures roll decay than more popular VIX products like the UVXY or VXX. On a historical 5 year basis, a small allocation to VIXM in a diversified portfolio could have significantly improved overall returns and risk, as the VIXM ETF more than doubled during the COVID crash. However, investors need to be mindful that the VIXM is still a VIX futures-based product at the end of the day and suffers from roll-decay. In a depressed volatility environment like 2017, the VIXM can lose significant value.

Be the first to comment