PeopleImages

Volatility is back. Or is it?

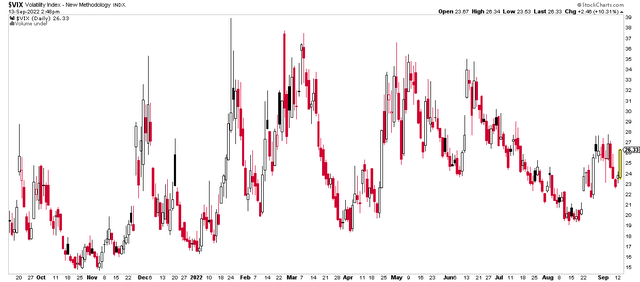

With the S&P 500 down about 3% as of this writing, the CBOE Volatility Index is up just 6.5% to 25.4. It used to be that such a big single-day drop in equities would warrant a spike in the VIX to, say, 30+. Such is not the case here in the third quarter of 2022. This year has featured many daily multi-percentage point changes in the broad stock market. Traders have become used to it. But is volatility at about 25% too low?

CBOE VIX Index: A “Soft” Spike to 26

Consider that an implied volatility reading at this level equates to an expected single-session move of 1.6%. That calculation is based on the math of volatility: Simply take the square root of the number of trading days in a year (252 or 253), then use that as your denominator with the VIX level as the numerator. We can perform a similar calculation to find anticipated weekly and monthly price changes in the S&P 500, too. Traders have priced in a 3.5% weekly swing and a 7.3% monthly move with the VIX a smidgen above 25.

That’s all nice and interesting from an academic point of view (although options traders on the floor of the CBOE are known to be able to perform those calculations like the back of their hands), but how can retail traders easily make bets on U.S. stock market volatility?

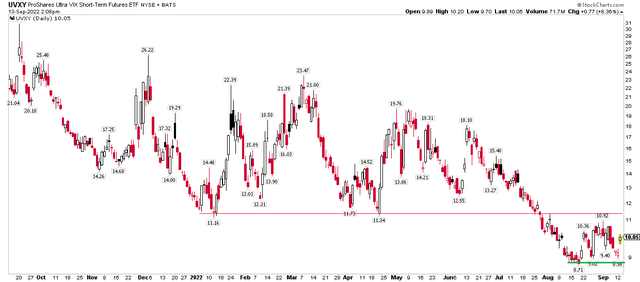

The ProShares Ultra VIX Short-Term Futures ETF (BATS:BATS:UVXY) is a popular way to play swings in implied volatility shifts on the S&P 500.

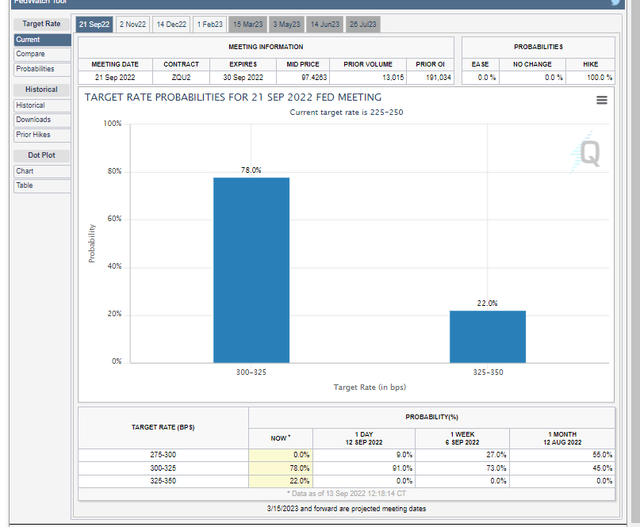

Following this morning’s hot CPI report, stocks immediately plunged and volatility increased. The Nasdaq was on pace for one of its worst days of 2022, down more than 4% by the afternoon. Bond traders have quickly “pivoted” from a 75-basis-point interest rate hike at next week’s Fed meeting to a 22% chance of a whopping full percentage point policy rate increase.

Fed Funds Futures Show a Small Chance of a 100bps Rate Hike Next Week

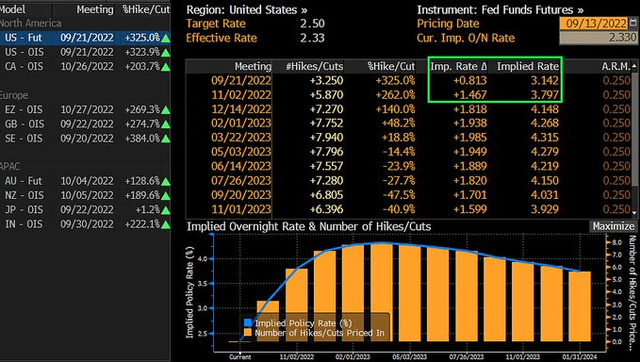

Looking through the early November FOMC gathering, the market has discounted almost two 75bp rate hikes.

The Equivalent of Two 75bp Rate Increases Through Early November Is Priced In

Rates surged after the inflation report, too. The U.S. two-year Treasury yield jumped above 3.75% for the first time since November 2007 today. Cash is indeed trash as savers can easily snatch up one- or two-year Treasuries and earn nearly 4% on their money.

U.S. 2-Year Rate Climbs to the Highest Level Since 2007

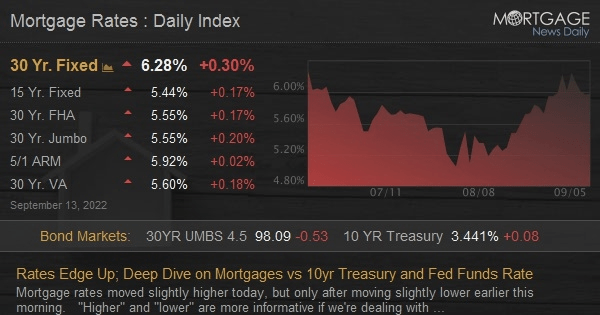

Along with higher short-term savings rates comes much steeper costs to borrow – particularly for first-time home buyers. According to Mortgage News Daily, Tuesday’s average 30-year fixed mortgage rate surged to tie its highest level since 2007 at 6.28%.

Mortgage Rates Commensurably Jump

Mortgage News Daily

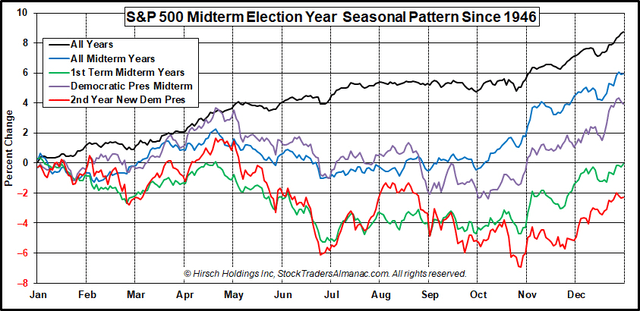

Turning back to the volatility trade, I believe that we could see further upside in UVXY through month-end. Consider that the latter half of September is prime time for the bears to roar – particularly during midterm election years. Jeffrey Hirsch (@almanactrader) is your go-to for all things seasonality. Hirsch shows that S&P 500 performance during mid-term election years gives bears the edge through month-end. But the bulls take the reins come October.

Long Vol Through September if History is a Guide

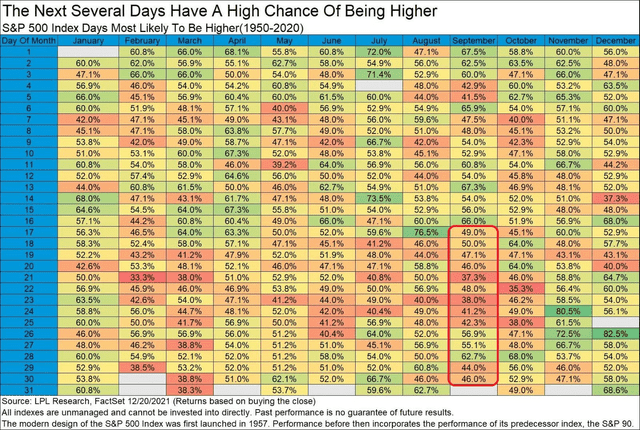

For all years, you can see how stocks often sink from Sept. 17 through 30, according to Ryan Detrick’s work.

September Is Bearish Over Its Back Half

I think we can squeeze another quick 10% out of UVXY over the next few weeks. I’d take profits when the fund reaches near $11.20 – that was key support earlier this year that could be new resistance. Could it rise higher? Of course. If we get a VIX index move to the 2022 highs in the mid-30s, UVXY could push to near $15.

UVXY: A Push Toward $11.20 In the Cards?

The Bottom Line

I think being long volatility now through month end is not a bad hedge. Today’s CPI report might well just be the catalyst to the usual late-September equity market volatility regime. UVXY is a solid way to play it. The 1.5x daily leveraged fund resets each day, so it’s not designed to be held very long. A time horizon out about two weeks seems appropriate here.

Be the first to comment