Female Eco-warrior shouting into a megaphone Alistair Berg/DigitalVision via Getty Images

Introduction

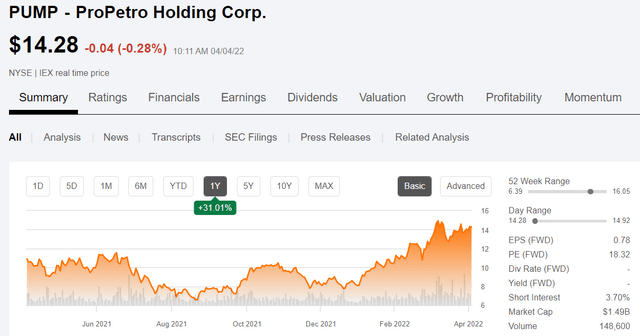

ProPetro (NYSE:PUMP), one of the select fracking companies with a stock ticker that reflects it segment of the industry, has been on the up recently. We last wrote up PUMP in December of 2020, and that article is linked here. Since December it has doubled, reaching a post 2018 peak in the $14’s. This is modest out-performance from their peer class. Most of the frackers have done about the same or close, including Liberty Oilfield Services (LBRT) rising to ~$16’s in recent trading, and was the subject of a Buy-rating in the last article-linked. The independent OFS cos have gotten a larger boost than the big players, Schlumberger, (SLB), and Halliburton, (HAL), as they were starting from a lower base.

Price graph for ProPetro (Seeking Alpha)

With the focus of the world now on lowering prices, and having some success in taking the price of WTI down from about $125 to the present level in the low $100’s, what do we think is the easiest course ahead for PUMP?

In this article we will touch on the impact of the recent news release regarding PUMP, and their Q-4 results to see if we can pick a price point where entry would make sense.

The thesis for PUMP

The shift to drilling is proceeding as we’ve discussed a couple of times. Rigs were up-3, to 673, and frac spreads were also up-3, to 273. There is tremendous political pressure for drillers to ramp up to put more oil on the market currently. At the same time the regulatory, and financial environment sends exactly the reverse message. We aren’t going to try and unpack all of the interplay between those two imperatives in this article. It’s all pretty well known and we have discussed most of it at length in recent articles.

My thinking is that the slow rise of rigs and frac spreads is going to continue. We’ve gained about 100 rigs, and 40 frac spreads since the first of the year. The rate of increase has slowed thanks to a bunch of reasons and leads me to think the curve will continue to flatten as the year progresses, although it will continue to ascend. In short, I am not expecting a huge rise in drilling and fracking as the industry just can’t respond in that fashion. The rigs-the smart rigs that people want, frac spreads-the Tier IV DBG spreads that people want, trained crews, pipe, sand and other commodities are barely keeping up now. Any thought that the industry can sustain an increase for any time, is a product of the wishful thinking that emanates from D.C. these days.

So where does PUMP fit into that scenario? Probably with equipment nearly sold out, or in the case of the Tier IV-DGB spreads- totally sold out, it should create a case for sharply improved margins.

David Schorlemer, CFO of PUMP comments in this regard-

So margin expansion is a priority, over marketing additional horsepower. We call it the pursuit of margin over market share, which is our most capital-efficient way to improve profitability.

We will ballpark PUMP EOY exits for utilization and margins a little later in this article.

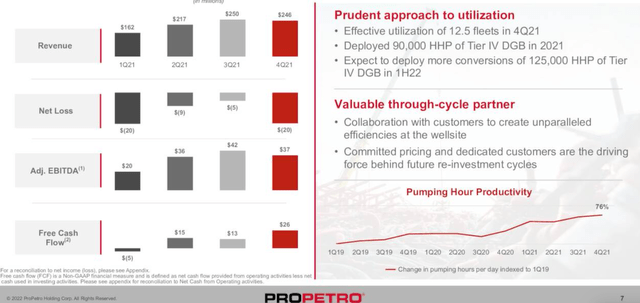

PUMP planned Tier IV upgrades (Seeking Alpha)

Q-4

PUMP generated $246 million of revenue a 2% decrease from the $250 million of revenue generated in the third quarter. Effective utilization was 12.5 fleets which decreased 9.4% from 13.8 fleets during the prior quarter. The lower revenue was a function of lower fleet activity and seasonality. Notably the drop in activity, was partially offset by some limited higher pricing. Guidance was given for the first quarter average effective fleet utilization, is 12 to 13 fleets with visibility to some downtime due to winter storms in February, sand supply and logistical constraints, and continuing repositioning of fleets included in that range. In January, our effective fleet utilization was 13.4 fleets.

Finally, adjusted EBITDA of $37 million for the fourth quarter decreased 12% sequentially compared to $42 million for the third quarter. The sequential decrease was primarily attributable to seasonality and a conscious effort to reposition assets to more profitable work.

For the fourth quarter, PUMP incurred $49 million of capital expenditures, which included approximately $15 million of accelerated 2022 CapEx largely in connection with the previously announced Tier IV DGB conversions.

They remain debt-free, and increased their cash position and liquidity by $27 million and $16 million respectively during the quarter, with cash of $112 million and total liquidity of $169 million.

Total availability on PUMP’s asset-based revolving credit facility decreased to $57 million, due to the seasonality of revenues, but has since increased to $75 million at the end of January. The outlook for full year 2022 CapEx spending is a range between $250 million and $300 million, with the spend weighted in the first half of the year, as we take delivery of their previously announced Tier 4 DGB conversions.

In addition, the full year guidance range includes approximately $100 million of fleet refurbishments and upgrades, including $50 million related to our previously announced Tier 4 DGB conversions, to be delivered in the first half of this year and the remainder to other opportunities.

However, they caution that as sand supply constraints and winter weather in February have created downtime that have disrupted operations. Things may be a bit wobbly in Q-1, to no one’s surprise even there was no true “Snowmageddon” event similar to 2021.

Risks for PUMP

The challenge for this independent fracker is actually implementing the price increases needed for margin expansion. It is good they are converting older equipment to the more ESG friendly Tier IV-DGB frac spreads at a steady rate. This is a change that must happen to meet the ESG commitments of their customers. We will discuss what sort of EBITDA margin they will need to command to justify these investments.

Logistics will also play a role in their success this year. In particular the frac sand market has tightened, as this Reuters article notes. Supply chain is an outlier that could impact results.

Mixed messages are rife in the fossil fuel segment of the energy space as I mentioned earlier. Over the short haul this could be a drag on PUMP’s plans.

A meaningful contract extension

It’s noteworthy that PUMP has their contract extended by Pioneer Natural Resources, (PXD) for the rest of this year, and possibly 2023. This locks in significant volume, but may limit upside for several frac spreads. The two companies have had a relationship since 2018 when PUMP bought PXD’s internal frac business. PXD took 16 mm shares in PUMP for 3/4 of the $400 mm paid for this business unit, for a 17% stake.

Your takeaway

PUMP is now selling for 8.9X EV/EBITDA. A bit pricey for a company in an industry segment where growth is restrained and margin improvement has yet to be significantly realized. But it should be coming.

Industry sources tell me that Tier IV-DBG upgrades run about $16 mm per 20 pump fleet. With the revenue for legacy Tier I, II fleets running about $37 mm per fleet/year, and an EBITDA payout of about $10 mm per year required to justify that $16 mm expense to upgrade, an article put out by Daniel Energy Partners, suggests that a 22% increase is needed to justify the expense. That would put the Tier IV DBG units generating $42-$45 mm per year.

With 3-4 new Tier IV DGB fleets going to work in 2022 EBITDA for the year should land out in the $208-$215 mm range. To keep the same EV/EBITDA multiple shares would need to adjust higher to $18-20.00 per share.

That’s about a 30% bump in the share price, which isn’t really enough to get me off the dime. We are neutral at the present price. If shares were to decline below $12.00 in a mass sell-off and nothing else changed in regard to the general higher for longer thesis for oil, I might be tempted.

Be the first to comment