skynesher

Software stocks have come under attack yet again since mid-August. The group, as measured by the iShares North American Tech-Software ETF (IGV) rallied nicely on an absolute and relative basis vs the S&P 500 ETF (SPY) off the June lows.

The somewhat high-risk ETF now hopes to hang on to its relative low despite the fund breaking to fresh absolute lows since the first half of 2020. One small-cap software name reports earnings Tuesday night as market volatility spikes.

Software vs S&P 500: IGV Hanging On To June’s Relative Low

Stockcharts.com

According to CFRA Research, Progress Software Corporation (NASDAQ:PRGS) develops, deploys, and manages business applications. The company offers OpenEdge, a development software, which builds multi-language applications for secure deployment across various platforms and devices, as well as cloud; developer tools that consist of components for user interface development for Web, mobile, desktop, chat, and AR/VR apps, as well as automated application testing and reporting tools.

The Massachusetts-based $1.8 billion market cap software company within the Information Technology sector trades at a 19.3 trailing 12-month price-to-earnings ratio and pays a 1.7% dividend yield, according to The Wall Street Journal. Importantly ahead of earnings Tuesday afternoon, the stock has a 6.5% short interest float.

On valuation, PRGS trades at a very reasonable P/E ratio using forward estimated earnings. Of course, those outlooks are now questionable given such macro volatility and other tech-company negative preannouncements. Unfortunately, the stock has an “F” growth rating by Seeking Alpha and a poor D+ valuation rating. But an 11.5% three-to-five-year EPS growth rate is not that bad. That yields a PEG ratio under two for this small-cap software name. That looks like a decent value.

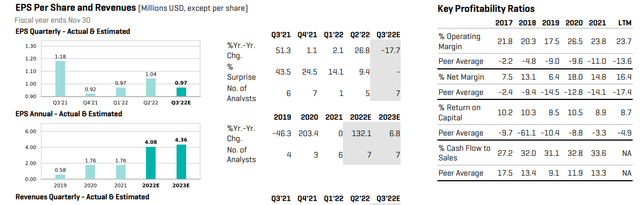

PRGS Earnings Forecasts & Key Profitability Ratios

CFRA Research

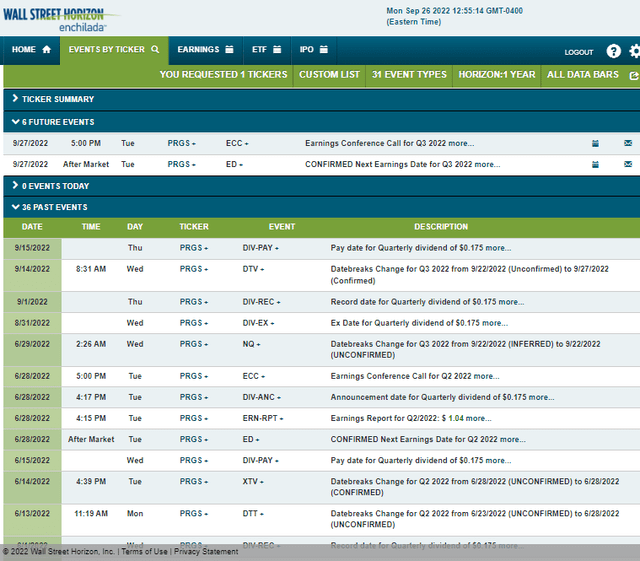

Looking ahead, Wall Street Horizon’s corporate event’s data show a confirmed Q3 earnings date of Tuesday, Sept. 27 after the close, with a conference call set to begin at 5:00 pm ET. You can listen live here. Progress’ calendar is light beyond that.

Corporate Event Calendar

Wall Street Horizon

The Options Angle

Digging into the earnings report, data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $0.97 which would be a drop from $1.18 earned in the same quarter a year ago.

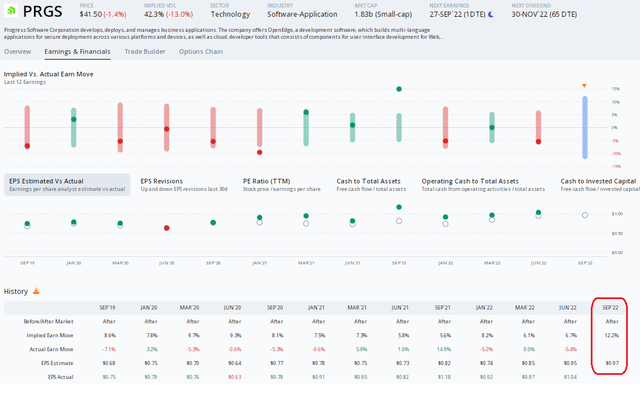

Options traders expect a big earnings-related stock price swing. Using the nearest-expiring at-the-money straddle, ORATS shows a whopping 12.2% expected move in PRGS after Tuesday night’s report. That’s relatively expensive compared to historical post-earnings share price change. Being a net seller of premium into and through the quarterly report makes sense to me. But what should be the directional bet on this fairly priced tech name?

Progress: Expensive Options But A Strong Earnings Beat Rate History

ORATS

The Technical Take

I see broad support in the low $40s for Progress. Back in 2020, the stock struggled to climb above that zone, but once it did, it was off to the races. I think being long here with a stop under $39 is a positive risk/reward setup.

Using the options, a bull put spread could make sense here where you would sell a higher strike put and buy a lower strike put. The strategy’s goal is to profit from neutral to bullish price action on the underlying stock.

Without options, you can simply go long with a stop under $39.

PRGS Shares Pull Back to Critical Support

Stockcharts.com

The Bottom Line

Progress Software has taken a beating in the last month and a half. But the stock is now back at key support. With a decent valuation, this could be a favorable opportunity for the bulls. There could be further downside, though, if shares break below $39.

Be the first to comment