SolStock

PROG Holdings (NYSE:PRG) is a fintech holding company that provides leading financial solutions to consumers and retailers. The company operates in various segments including Progressive Leasing, e-commerce, and in-store point-of-sale lease-to-own solutions. approximately 98% of the company’s consolidated revenue comes from the progressive leasing segment.

The company provides competitive lease payment options along with flexible terms that are designed to help customers achieve merchandise ownership, through low initial payments and early buyout options. Since its inception, progressive leasing has funded more than 10 million leases.

Also, With the aim to serve less credit-worthy customers the company provides in-store point-of-sale lease-to-own solutions through approximately 24,000 third-party POS partner locations and e-commerce websites in 49 states.

Overview (annual report)

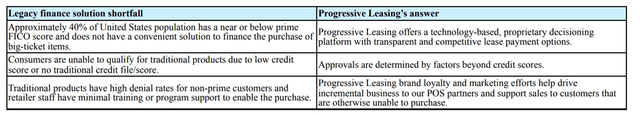

Furthermore, less creditworthy consumers are the main target customers for the company, and as per the data, about 40% of the U.S. population has a near or below-average FICO score and does not have a considerable financial source to purchase high-cost items, which shows that PRG has the very large addressable market to expand its business.

Application process (annual report)

Along with that PRG provides its customer convenient and quick access to its resources, which provides significant ease to the customers. The customer gets instant approvals, without checking their credit scores.

Also, having a low credit score makes it difficult to get financing for big-size purchases and in such conditions, lease-to-own remains the best option for the customers, which provides them instant access to finance and affordable monthly lease payments which they can pay according to their ability.

Over the period, the company has served customers relentlessly, which has resulted in strong customer loyalty. but from the last few quarters, general economic conditions have turned towards recession with inflation touching 40-year highs, in such adverse conditions customers face significant problems in paying the monthly lease payment, resulting in increased delinquencies and reduced new transactions.

But the business model is substantially strong, historically it has produced huge cash flows along with that the company has a significant addressable market where the company can grow its operations, in my view due to the higher delinquencies and adverse economic conditions, the stock has dropped significantly despite the sound business model.

Historical performance

In 2020, the company separated from Aaron’s (AAN) business and emerged as a new entity named PROG Holdings, Inc. in the last 2 years, the company has grown its revenue significantly, along with the production of huge cash flows.

Note that growth in the last two years might be attributed to the overall boom in the e-commerce industry and such growth along with the cash flow might not be sustained in the future.

Hence to analyze the actual earning power of the business it is important to understand the business dynamics, therefore investors must analyze the company’s historical performance, and to analyze it investors must analyze the performance of The Aaron’s Company because it is the only source for historical data.

To get a better look you can read my latest article on The Aaron’s Company, where I have discussed the historical performance in detail.

The historical performance of Aaron’s seems attractive. The company had managed to grow its operations even in the 2008 financial crisis, which shows that there is a substantial strength in the business model.

Strength in the business model

Focus on customer satisfaction along with the new and advanced technology implementation has given the business model a substantial strength, where customers get easy access to finances; along with that the company could manage its asset quality through advanced data-based operations.

Risk factors

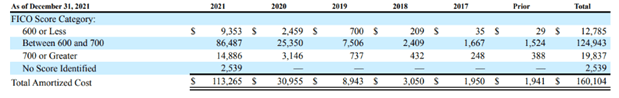

customer credit score (annual report)

Having a business model which serves low credit customers gives an edge to the business, but also puts a substantial risk on the company during adverse economic conditions, where these customers are most likely to default on the lease payments. As we can see, currently the delinquency rate has risen significantly and might take longer to recover, which will further affect the profitability.

In the last 2 years, the buy now, pay later system has grown, and as a result, the company has enjoyed the rally of the BNPL system; but, as the government has recognized the growing market of buy now, pay later, it is planning to bring new laws and regulation to those services. In such a case the company might get hit on the revenue front.

In 2021, the company raised significantly high debt for share repurchase, but the stocks are repurchased at significantly higher prices, which resulted in lower-than-expected outstanding share reduction. But a substantial rise in debt will bring significant interest costs, which will further affect the company’s profitability.

Recent development

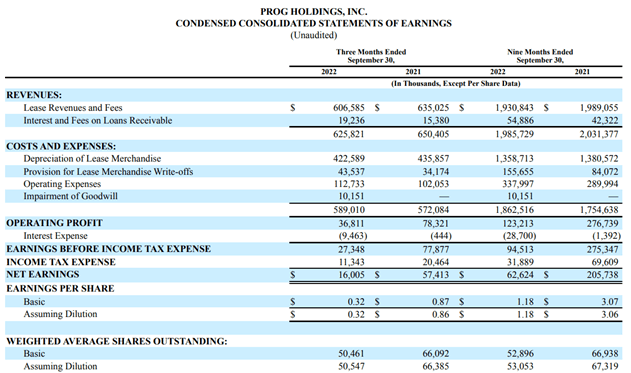

Quarterly earnings (Quarterly report)

In the latest quarter, revenue declined slightly but the net profit margins dropped significantly.

Due to the adverse economic pressure that the customers have been facing, write-offs increased to 9.8%, significantly higher than the expected range of 6% to 8%. and as a result of increased write-offs EBITDA margins declined to 8.1%.

Also, due to the substantial rise in delinquencies, the stock price dropped more than 72%, despite the strong historical performance, but as the investors are realising the value of the business the stock price started appreciating.

Currently, the market capitalization of the company is about $963 million, down significantly in the last few months, despite a strong business model which produced over $245 million last year. which shows that the company is currently trading at nearly 4 times its 2021 CFO. whereas historically it had been trading for more than 10 times its CFO.

From this price, PRG provides huge upside potential but the risk is substantial. The current increase in debt, rising delinquencies and the risk of the government implementing new regulations might affect the stock price, therefore I believe PRG is a hold.

Be the first to comment