peshkov

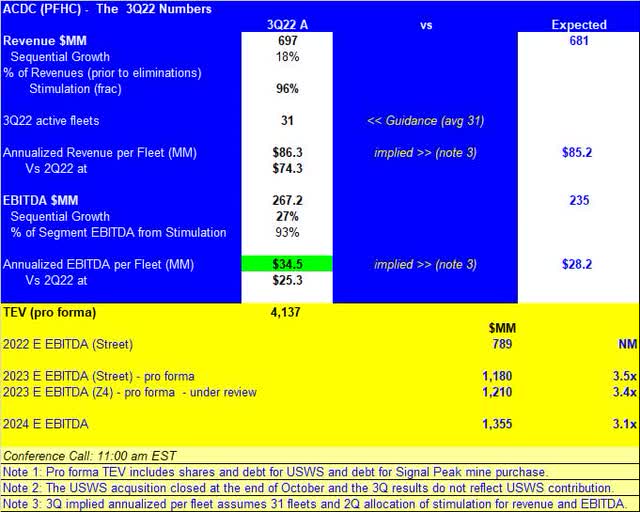

This is a Z4 Energy Research pre call note. ProFrac, now trading under NASDAQ:ACDC, reported better than expected revenue and EBITDA on an as expected fleet count. Unlike some others in the well completion space, this quarter they did so without a surprise increase in active fleets and as such posted peer leading per fleet metrics. For our backgrounder piece on ProFrac and their acquisition of U.S. Well Services, which closed after the quarter ended, click here. Here’s our quick table for the quarter.

Z4 Energy Research

Fleet Count & Capex Guidance: Essentially as expected. The company previously guided 3Q22 to an average of 31 active fleets, with an expectation that they would exit the quarter with 32 fleets as they commissioned their first efleet. In reality, they averaged 31 in the quarter and deployed their 32nd fleet early in the fourth quarter. So far, so good. Previously they had planned to add 2 more efleets in the fourth quarter and had stated their intention to activate no further conventional fleets (however they are continuing to upgrade Tier II fleets to cleaner Tier IV DGB engines).

With the US Well Services acquisition they picked up 7 completed efleets and with the 3Q press release have guided to a combined company 2022 exit rate of 39 fleets. They expect to complete construction of 3 additional fleets near term which will be placed into service in the first quarter of 2023, and we understand another 3 fleets (from US Well Services) should be in service at some point in 2023. US Well Service at one point expects to be running 10 fleets around year end 2022, but we don’t know if the cadence of new fleet rollouts has been altered since we last spoke to them, USWS, which was prior to the announcement of the acquisition. To sum up, this should translate to 44 fleets, 12 of which will be efleets.

Our estimates for 2023 are under review for improvement after the call. We were at $1.2 B mm EBITDA for 2023 as of our last modeling update at the end of August. This estimate assumed a pro forma frac fleet count of 44 and roughly implied a $27.5 mm per fleet annualized EBITDA metric. Note in the quick table above, they sported a best-in-show $34.5 mm annualized per fleet EBITDA figure this quarter. While it’s natural to assume the new fleets will take some time to be, “ProFrac-ized”, for lack of a better term, they have shown themselves to be capable of rapid integration with previous acquisitions. We expect to be modeling for between 42 and 46 fleets as an annual average for 2023 and should have a better idea as to which end of this range we’ll be at after the call.

Given the continued tight frac market conditions we expect for next year and given their history of rapidly improving upon prior operator results, our sense going into the call is that we will be moving our numbers up post call. It’s likely that we move to at least $1.3 B for EBITDA, which would put them at a forward multiple of 3.3x. Street consensus is just below us at present at $1.18 B for 2023 EBITDA. Our sense is that the Street is still in the “getting to know you” phase, and that big EBITDA per fleet beats will provide confidence to move consensus higher as well.

Other Items:

- In light of their vertically integrated nature, we’d like to hear more on the call about their power generation thoughts.

- Also on the call, we’d like to hear about the “second proposed” transaction noted in a recent filing – Is it a large private frac player or some other ancillary service name, or it’s related to the generation comment above? Or is it off the table entirely? Inquiring minds want to know.

Nutshell: This was another strong quarterly result from this newly public and now much bigger frac player. They are on a path to be #2 in terms of overall NAM frac horsepower and #1 in NAM efrac at a time when customers want efrac not just for its ESG merits but for the improved economics and reliability it offers over diesel. We view the name as overly cheap among their frac peers given their per fleet metrics and increased scale, which should better leverage fixed costs. The efleet angle should also help bring down per fleet maintenance costs at a time when maintenance inflation is making itself felt in capital budgets. Some of this cheapness is newness to market. Some of it may be tied to their modest debt levels. Our sense is that as the quarters roll by, and they continue to perform, their forward multiple will move away from the discount zone. Competitor NEX (who we’ve owned for some time now and is our number 5 holding) trades at 3.5x 2023 Street consensus, but turned in a $21.7 mm annualized per fleet number in the quarter. And other names in the group who offer a little less transparency but slightly greater scale trade at considerably higher multiples. We own ProFrac as the 4th largest position in the ZLT.

Be the first to comment