rvlsoft

Thesis

In the current market environment investors are arguably well advised to overweight quality and underweight growth. Moreover, I would focus on value propositions and/or business models that show little exposure to economic cycles, e.g., consumer staples or utilities. One name that I particularly like is Procter & Gamble (NYSE:PG). And apparently I am not alone in this assessment: Ray Dalio’s 13F SEC filing reveals that Procter & Gamble is Bridgewater’s largest single stock holding, with an equity valuation of $970 million.

Amidst a turbulent market environment PG stock has shown strength. For reference, PG stock is up more than 3% for the past 12 months, versus a loss of about 4% for the S&P 500 (SPY). In addition to the 7 percentage point outperformance, PG stock has been less volatile than the broad market.

About P&G

Procter & Gamble is one of the world’s largest consumer-focused conglomerates in the world. The company researches, develops, manufactures, and markets an extensive portfolio of personal care and hygiene products. The company was founded in 1837 and has since then proven a history of steady revenue growth and value accumulation. P&G’s portfolio includes recognizable brands such as Charmin, Tide, Crest Oral-B, Bounty, Febreze, Downy, Gain. In January 2005, P&G took over Gillette in a $57 billion deal and has claimed, and since then retained, the crown of the world’s largest house of personal-care brands. Notably, in 2014 P&G exited around 100 of its brands to focus on the remaining portfolio that accounts for about 95% of the company’s profits. As of today, P&G operates 5 key segments: Beauty with about 18% of total sales, Grooming with approximately 8%, Health-Care with about 13%, Fabric & Home Care with some 35% and Baby, Feminine & Family Care accounting for the remainder, ca. 25%.

Steady Value Accumulation

Given the nature of P&G’s personal-care and hygiene focus, the company is less exposed to cyclical fluctuations, which should be especially valuable to investors in the context of the current macro-environment. But apart from this defensive profile, I would also like to highlight that P&G has proven a history of steady revenue growth and value accumulation.

From 2017 to TTM 2022, P&G’s revenues grew at a 5-year CAGR of about 5%, which is almost double nominal GDP growth. Over the same period, earnings from continuous operations jumped from $10 billion to $14 billion, a CAGR of about 7%.

P&G closed the June quarter with $7.2 billion of cash and cash equivalents, including short term investments, and total debt of $32.3 billion. Given annual cash from operations of more than $16 billion (TTM reference), P&G’s $25 billion net-debt should not concern investors at this point.

With respect to P&G’s most recent quarter: despite a challenging macro-environment that needs no explanation, P&G’s organic sales increased by about 7% year over year and EPS grew 7%, respectively. CEO Jon Moeller commented:

Fiscal year 2022 was another strong year … The P&G team’s execution of our integrated strategies delivered strong top-line growth, earnings growth, and significant cash return to shareowners in the face of severe cost and operational headwinds.

Going into fiscal year 2023 the company expects ‘another year of significant headwinds’, but remains confident to ‘deliver balanced growth and value creation’.

Residual Earnings Valuation

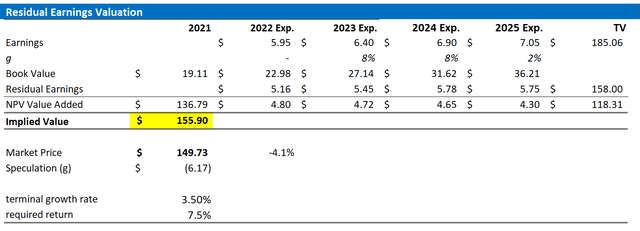

Let us now look at the valuation. What could be a fair per-share value for P&G’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the capital charge, I anchor on P&G’s cost of equity at 8%.

- To derive P&G’s tax rate, I extrapolate the 3-year average effective tax rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply 3.5%, which I argue is in line with nominal GDP growth expectations, but below PG historical growth track record as I like to be conservative in my assumptions.

Based on the above assumptions, my calculation returns a base-case target price for P&G of $155.90/share, implying that PG is currently fairly valued as compared to accounting fundamentals.

Analyst consensus EPS; Author’s calculation

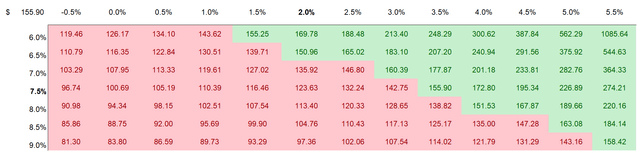

I understand that investors might have different assumptions with regards to P&G’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst consensus EPS; Author’s calculation

Risks

P&G is arguably quite low risk given the company’s non-cyclical exposure and strong brand equity. Moreover, the company has proven earnings resiliency even in challenging macro-environments, which is anchored on the company’s strong global presence, scale and brand portfolio provide a solid competitive moat. That said, short-term downside risks could be currency exposure and an inflation-driven compression of profit margins. As potentially long-term risks I have identified non-strategic/non-economic M&A activity and structurally changing market trends–such as changing demographics and consumer preferences.

Conclusion

Ray Dalio has voiced concerns about the state/valuation of the market multiple times. Accordingly, he prefers to hold defensive consumer-centric stocks such as P&G, J&J (JNJ) and Coca-Cola (KO). P&G is his largest single-stock holding as of June 30th and I argue investors should consider adding this company to their portfolio as well.

Based on a residual earnings valuation model, anchored on analyst EPS consensus, I calculate a $150.90/share target price. While this implies not much upside, I would like to highlight that as the economy is likely to enter a recession, it is prudent to play it conservatively. In my opinion, P&G is solid investment and should likely outperform both inflation and the broad market.

Be the first to comment