Scott Olson

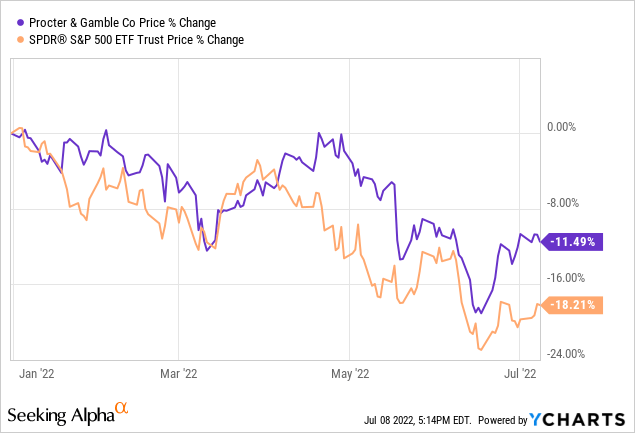

Procter & Gamble (NYSE:PG) has lost about 11% of its market cap year to date, outperforming the broader market, which has declined by as much as 18%.

In our opinion, this outperformance is likely to last in the near term, and in this article, we will highlight the key reasons why.

1) Performance during times of low consumer confidence

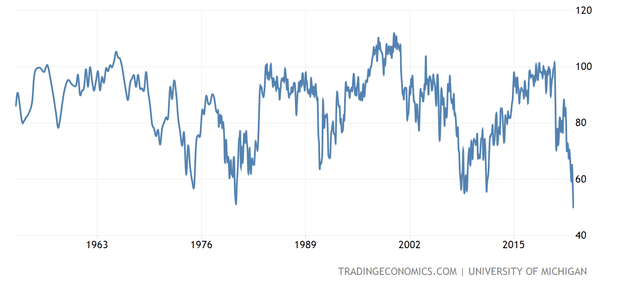

Consumer confidence is often treated as a leading economic indicator, used to gauge the sentiment of the consumer. A decline in consumer confidence can potentially forecast a changing trend in the spending behavior of the consumer.

U.S. Consumer confidence (Tradingeconomics.com)

The consumer confidence in the United States has been sharply declining in the past months. By July, we have fallen below levels that have been recorded during the financial crisis in 2008-2009. Although consumer spending has remained strong in the first half of the year, we believe that the trend is likely to change in the near future.

During times of low confidence, people are likely to cut or delay their purchases on durable, discretionary, non-essential goods. This tendency could have a substantial negative influence on firms’ financial performance, which operating in these sectors. On the other hand, companies that are selling household products, like P&G, are likely to be significantly less impacted.

Let us take a look now, how P&G’s stock has actually performed during times of low consumer confidence.

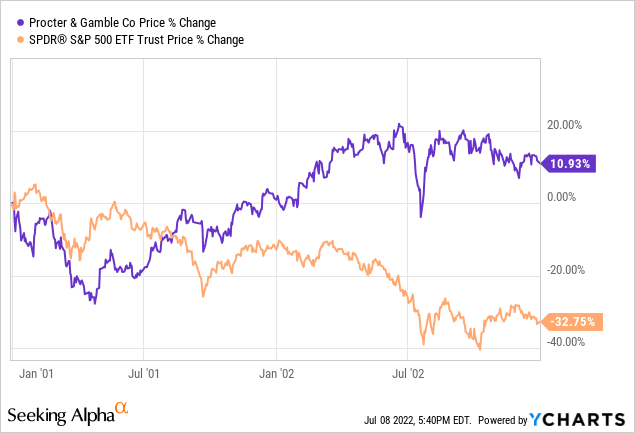

2001-2003

In this time period, P&G has substantially outperformed the broader market, as its stock price has increased by almost 11%, while the S&P500 (SPY) has declined by more than 32%.

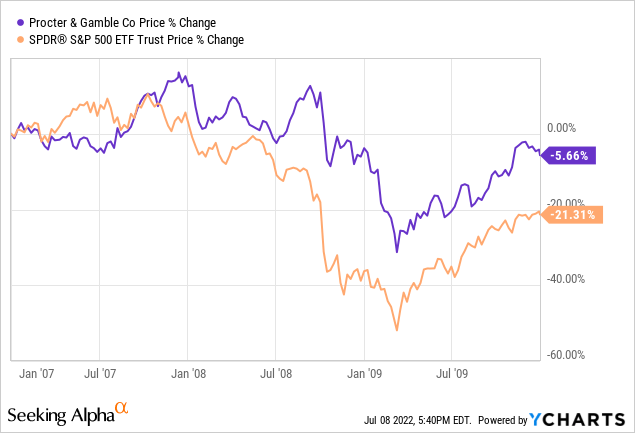

2007-2010

Between 2007 and 2010, the firm once again outperformed the broader market. Although both P&G and SPY have ended the period in the negative territory, P&G has lost only 6% of its market cap, while the SPY has declined by more than 20%.

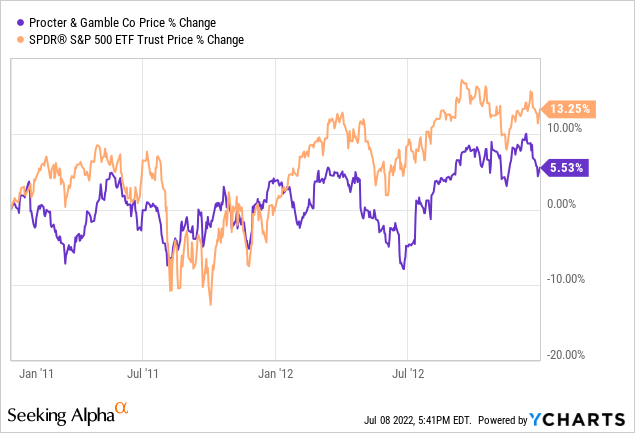

2011-2013

In this time frame, the firm has actually underperformed. While both P&G and SPY have closed in the positive territory this time, P&G has only gained about 5%, while the SPY increased by more than 13%.

Now, the question is: Is P&G well-positioned now to outperform once again? To answer this question, let us take a look at the first quarter financial results.

2) First quarter financial performance

Our previous thesis is essentially supported by the firm’s first quarter performance. The reported financial figures in Q1 were solid. Organic sales have increased by 10%, with each of the ten product categories contributing to this growth. The firm has also managed to increase its aggregate market by 50 basis points. Based on these results, P&G also decided to increase its guidance for the top-line growth figures, while maintaining the EPS outlook, even in light of the potential temporary headwinds arising from increasing costs.

In order to offset the negative impact of increased raw material and freight costs, P&G has started to increase its prices. The demand for Procter & Gamble’s products in the first quarter remained high, despite the increased pricing, resulting in organic sales growth across four segments. In three out of the five segments, the firm has also achieved net earnings growth. We believe that P&G has many well-recognized brands with a loyal customer base, which allow the firm to increase prices and grow organic revenue at the same time. In our opinion, P&G could be a safe choice even, when overall customer confidence declines.

3) Dividends

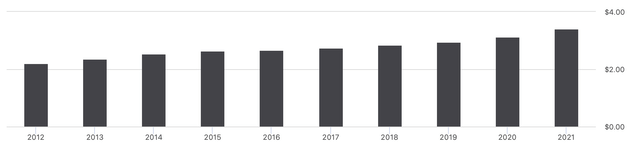

P&G has not only exhibited dividend growth in the last ten years, but in the last 65 years. This is an extraordinary dividend growth history.

Dividend history (Seekingalpha.com)

The current quarterly dividend has been declared to be $0.91 per share.

Important to note that P&G has a dividend payout ratio of more than 60%, which is significantly higher than the sector median of about 46%. Higher payout ratios can normally signal how safe and sustainable the dividend is. In our opinion, 60% is on the high end, however P&G has a strong track record of paying dividends and staying committed to returning value to their shareholders in this form, therefore we expect these dividend payments to continue and continue to grow.

Although this point is not particularly about why P&G may keep outperforming, but it more indicates that in a volatile market environment, reliable dividend stocks could be a safe haven for investors.

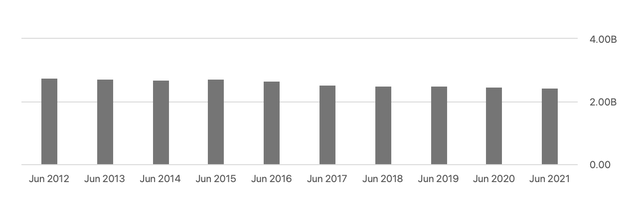

4) Share buybacks

P&G has also been consistently creating value for its shareholders through repurchase programs. They have reduced the number of share outstanding by approximately 13%.

Shares outstanding (Seekingalpha.com)

Further, P&G plans to repurchase shares in 2022 for approximately $10 billion.

5) Valuation

The decreasing stock price and the increasing earnings have been leading to multiple contractions in the last few months, leading to a more appealing entry point. Let us take a look how P&G’s traditional price multiples compared with its own 5-year historic average and with the sector medians.

Price multiples

P&G’s TTM price-to-earnings ratio is 24.75, which is significantly above the sector median of 18.5, and also slightly above its own 5-yr historic average of 24. Both in terms of EV/EBITDA and P/CF, the same trend can be observed.

Further, analysts estimate the earnings growth to continue this year despite the headwinds. The growth estimates for the next quarters are in the range of 2-6%, while for the 2023 quarters the earnings are forecasted to accelerate to the range of 8-10%.

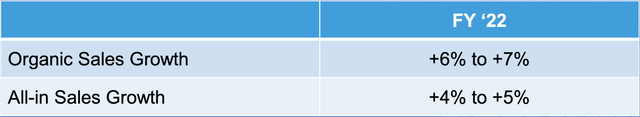

The firm has also maintained its guidance for 2022, expecting both sales and earnings to grow in the mid single digits.

Sales forecast (P&G)

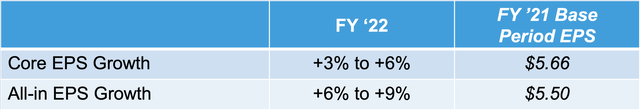

EPS forecast (P&G)

In our opinion, P&G has an excellent business with a loyal customer base, significant pricing power, which can be very valuable in an inflationary environment, and last, but not least, the firm also has been showing earnings growth across most of their segments. We believe, however that the near term macroeconomic headwinds may result in further decline in the stock price. Therefore, investors with a short time horizon, should potentially wait for a better entry point, while investors with a long term investing focus could potentially start a new position or add to their addition holdings.

Risks

Before concluding our overview, we have to highlight some go P&G’s key risks. Although it is expected that EPS growth will continue, there are a few macroeconomic factors that may create headwinds in the near term.

A comprehensive list of risks can be found in P&G’s annual report.

1) Commodity and freight cost increases

In our view, this risk is the most likely to have a material impact in the near term. Already in the first quarter, several segments have experienced a decline in net earnings due to the increased freight and input costs.

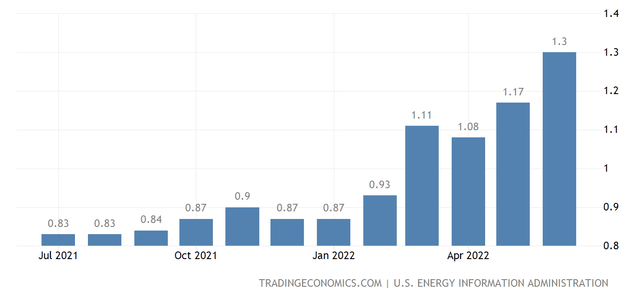

The following chart shows how the gasoline prices (USD/Liter) have been changing through the first quarter. Prices have remained elevated in throughout the first half of the year, despite OPEC+ signaling a higher than planned oil output increase in July and August.

Gasoline prices (USD/L) (Tradingeconomics.com)

Although oil prices have sharply declined in the last few days, in our view, we are not likely to get back to the February levels in 2022. Therefore, we believe that the headwinds are likely to remain in the next quarters.

2) Geopolitical disruptions

The ongoing conflict in the Eastern European region can also negatively impact P&G’s business in the short term. Depending on the duration of the conflict, the impact can get more severe.

3.) Increasing competition and COVID outbreaks Greater China

We believe, the increasing competition along with the COVID impacts in Greater China has been already visible in some of P&G’s segments. The COVID outbreak do not only impact the demand in the region, but can also lead to supply chain issues and shortages.

Key takeaways

In the last 20 years, P&G’s stock has performed well during times of low consumer confidence. Due to the strong first quarter results, P&G’s pricing power and its attractive valuation, we believe that the firm is likely to outperform again in the near term.

The firm has a strong track record of paying dividends and buying back shares, returning significant value to its shareholders.

Be aware of the macroeconomic risks before starting a position.

We currently rate P&G as “buy”.

Be the first to comment