Chinnapong/iStock via Getty Images

A Quick Take On Privia Health Group

Privia Health Group (NASDAQ:PRVA) went public in April 2021, raising approximately $449 million in gross proceeds for the company and its majority stockholder in an IPO.

The firm has developed a physician enablement platform for value-based care in the U.S.

I’m on Hold for PRVA in the near term until progress toward operating breakeven can be demonstrated.

Privia Health Overview

Arlington, Virginia-based Privia was founded to provide enablement solutions for healthcare providers and patients based on the value care payment model rather than the fee-for-service model.

Management is headed by Chief Executive Officer, Shawn Morris, who has been with the firm since 2018 and was previously President of Cigna-HealthSpring.

The company currently counts among its constituents:

-

3,370 care providers

-

More than 3.8 million patients

-

870+ care center locations

The company pursues relationships with physician groups by providing a range of services, including:

-

Practice Management

-

Value-based Care

-

Technology & Analytics

Market & Competition

According to a 2020 market research report by Grand View Research, the market for health management services in the United States was an estimated $13.9 billion in 2019 and is expected to reach $62 billion by 2027.

This represents a forecast of 20.5% from 2020 to 2027.

The main drivers for this expected growth are a growing demand from physician groups for ‘healthcare IT services and solutions that support value-based healthcare delivery, resulting in a transition from Fee-For-Service (FFS) to a Value-Based Payment (VBP) model.’

Also, there’s an ongoing need to reduce healthcare costs across the full range of the healthcare system in the U.S.

Major competitive or other industry participants include:

-

Oak Street Health

-

One Medical

-

Aledade

-

Agilon Health

-

VillageMD

- Optum

-

Episodic point solutions, such as telemedicine providers

Privia’s Recent Financial Performance

-

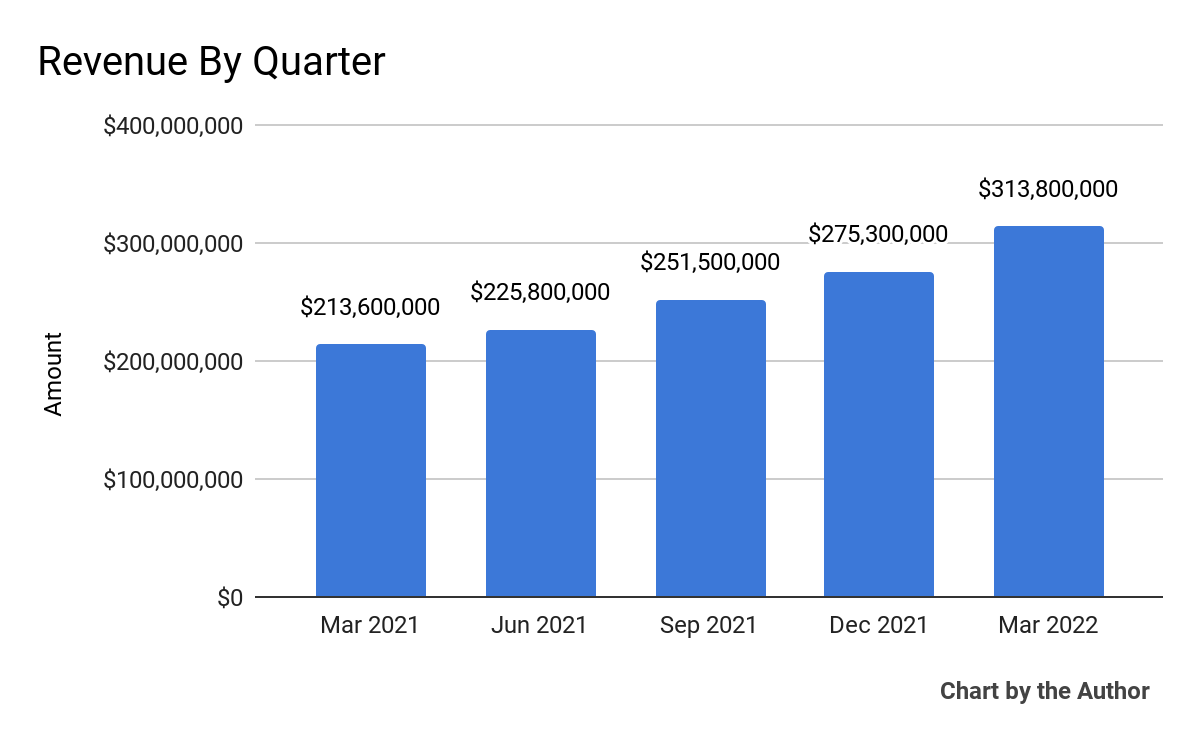

Total revenue by quarter has risen significantly over the past 5-quarter period:

5 Quarter Total Revenue (Seeking Alpha and The Author)

-

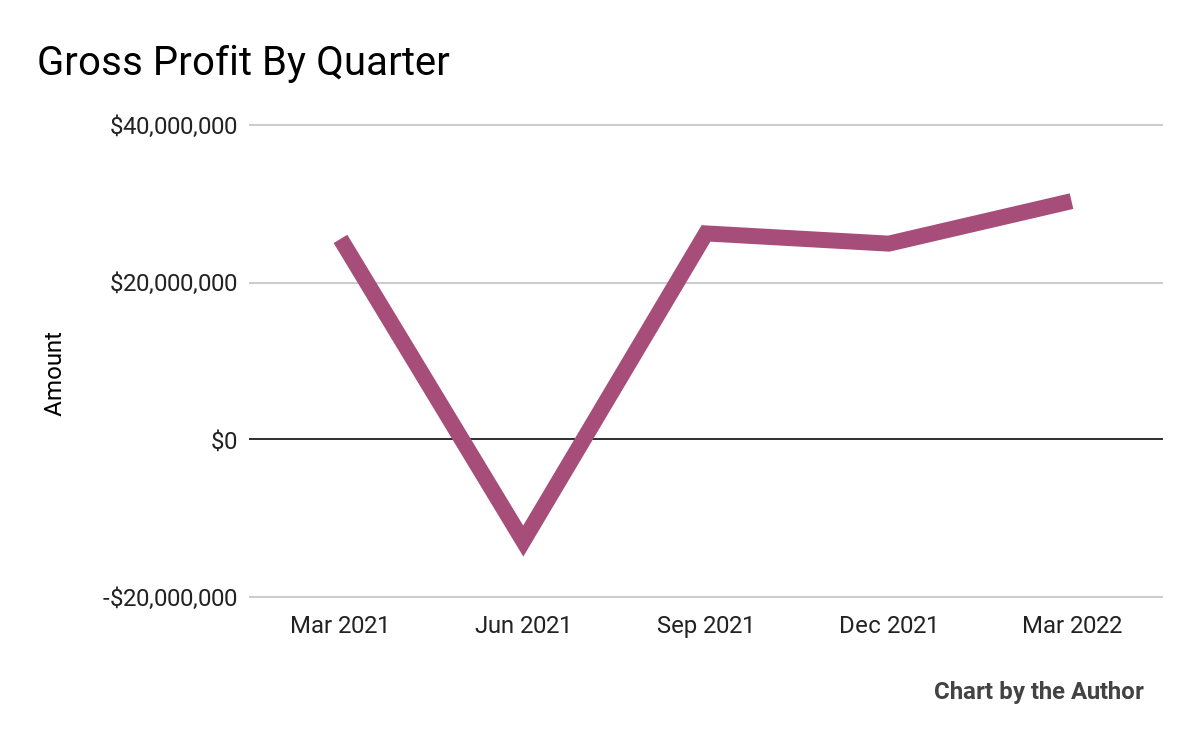

Gross profit by quarter has been uneven and has notably not followed the same trajectory as topline revenue:

5 Quarter Gross Profit (Seeking Alpha and The Author)

-

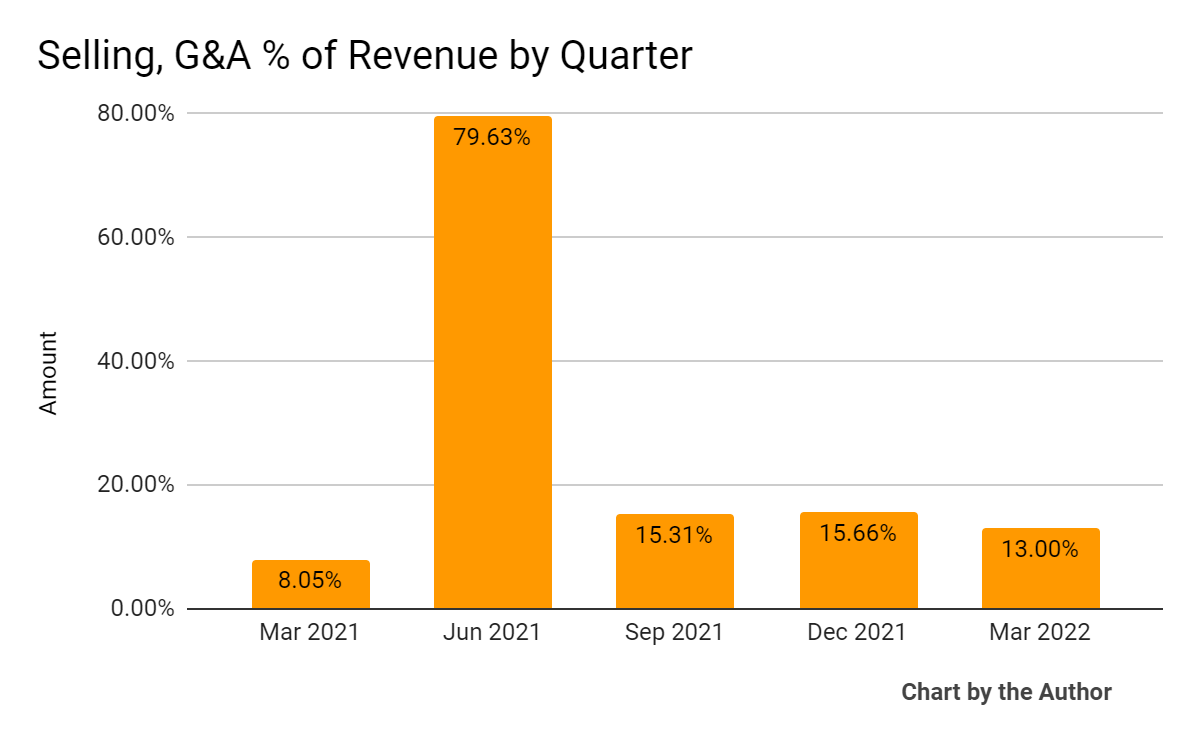

Selling, G&A expenses as a percentage of total revenue by quarter have dropped to 13% in the most recently reported quarter:

5 Quarter Selling, G&A % of Revenue (Seeking Alpha and The Author)

-

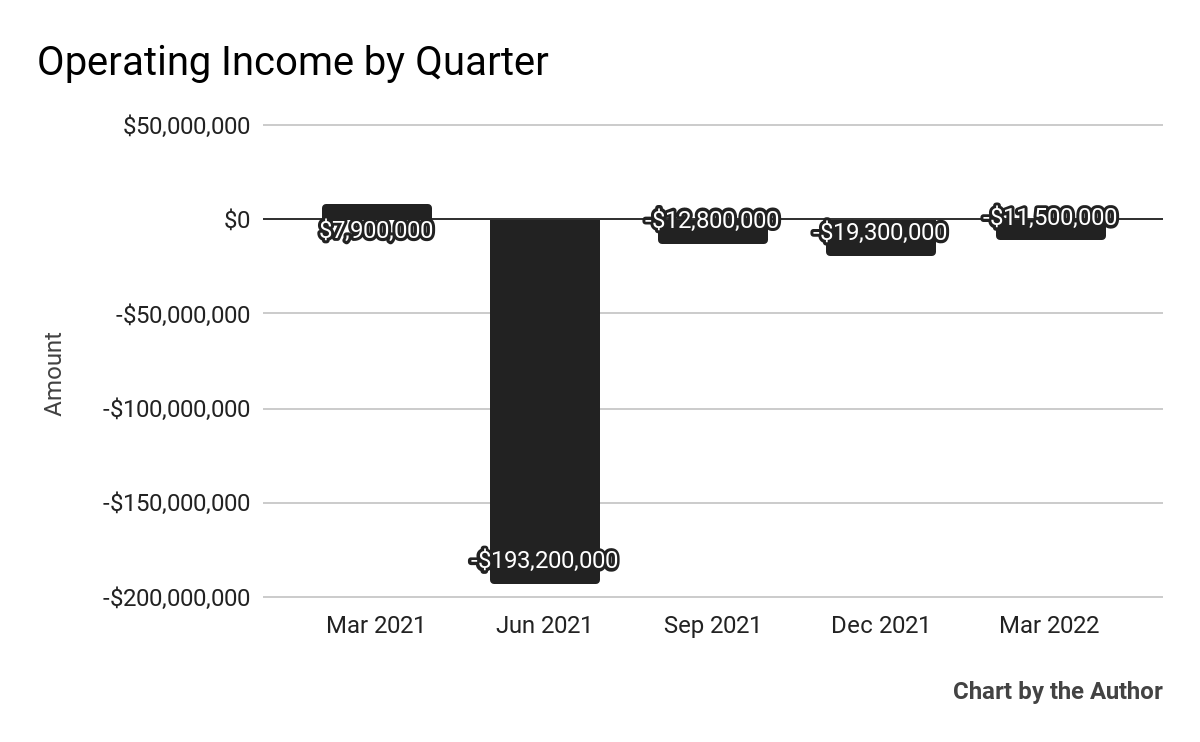

Operating income by quarter has remained negative for the past 4 quarters:

5 Quarter Operating Income (Seeking Alpha and The Author)

-

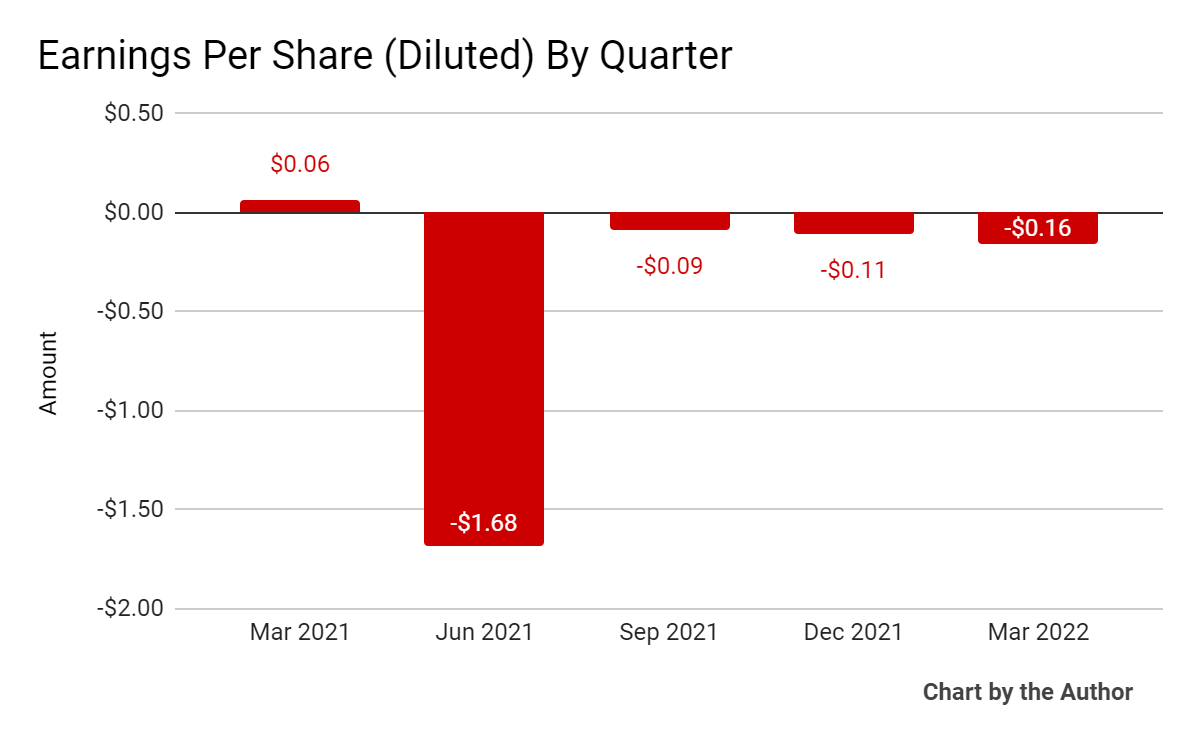

Earnings per share (Diluted) have also remained negative in the past year:

5 Quarter Earnings Per Share (Seeking Alpha and The Author)

(Source data for above GAAP financial charts)

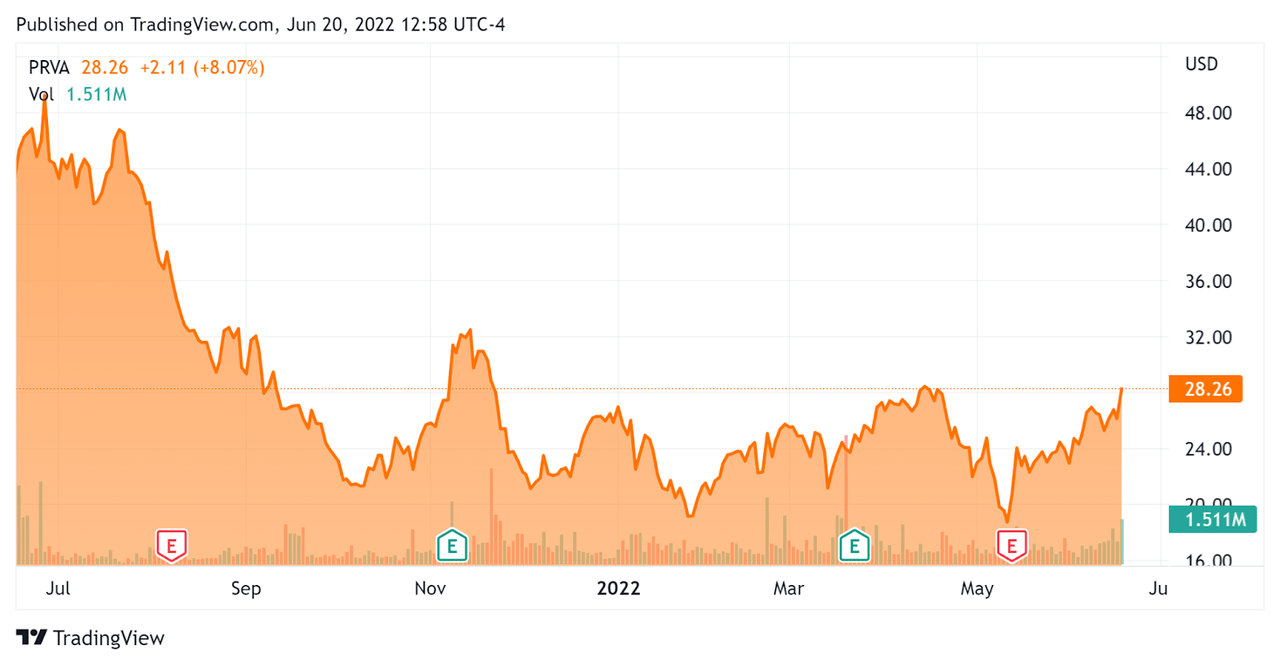

In the past 12 months, PRVA’s stock price has fallen 34.6 percent vs. the U.S. S&P 500 Index’s drop of around 13 percent, as the chart below indicates:

52 Week Stock Chart (Seeking Alpha)

Valuation Metrics For Privia

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Market Capitalization |

$3,070,000,000 |

|

Enterprise Value |

$2,820,000,000 |

|

Price/Sales (TTM) |

2.81 |

|

Enterprise Value/Sales (TTM) |

2.65 |

|

Operating Cash Flow (TTM) |

$52,210,000 |

|

Revenue Growth Rate (TTM) |

30.41% |

|

CapEx Ratio |

87.00 |

|

Earnings Per Share |

-$2.04 |

(Source)

Commentary On Privia

In its last earnings call (transcript), covering Q1 2022’s results, management highlighted its broad care network, which it has continued to build out, covering more than 50 specialty care types.

The company has over 80 at-risk payer contracts that cover more than 848,000 patients, which is an increase of 17.6% from the previous year.

Notably, the company is taking on upside and downside risk with these payer contracts, which it believes will provide ‘significant opportunities for topline and EBITDA growth,’ with the potential for increased variability in coming periods.

As to its financial results, its practice collections grew substantially, but GAAP results below the line continue to be a cause for concern.

Looking ahead, management reconfirmed 2022 guidance toward the high end of the previously guided range.

Regarding valuation, the market is valuing the company at an EV/Revenue multiple of around 2.8x.

Management’s strategy is to create large-scale medical groups of primary care providers and then ‘surround them with the right specialists.’

By seeking to partner with lower-cost health systems, the firm believes it can add value in the ambulatory care segment and share in the cost savings and revenue gains as the healthcare model in the U.S. transitions to value-based care.

PRVA may be a stock to watch for its revenue growth trajectory, but for the near term, its below-the-line performance hasn’t been impressive.

While the stock has pushed up since its Q1 results announcement, how much more room it has to grow is an open question.

In my view, management will need to make better operating progress before the market will further reward the stock.

I’m on Hold for PRVA in the near term until progress toward operating breakeven can be demonstrated.

Be the first to comment