Daniel Balakov

When you begin a journey of revenge, start by digging two graves: one for your enemy, and one for yourself.”― Jodi Picoult

Today, we take a look at a defensive name that has had some recent insider buying in its shares. The company also recently upwardly revised its guidance. An analysis follows below.

Company Overview:

Primo Water Corporation (NYSE:PRMW) is an Ontario-domiciled and Tampa, Florida headquartered provider of sustainable drinking water solutions in North America, Europe, and Israel. With its exit from the small-format retail water business in 2Q22, the company is essentially a pure-play large format supplier of water dispensers, purified bottled water, and self-service refill drinking water. It was formed in 1952 as Cott Beverages (Canada Ltd.) and assumed its current moniker when it purchased Primo Water Corporation for ~$775 million ($14 a share) in March 2020, which was the last significant transaction in its transition to a singularly water-focused concern. Shares of PRMW trade just over $13.00 a share, equating to a market cap of just over $2.1 billion.

Business Model

The company operates on a razor/razorblade model, with the razor consisting of water dispensers which are sold to households and offices through ~9,000 retail locations and online in 21 countries. The razorblade is water refills, which are offered through three services: Water Direct, where Primo delivers water directly to the customer’s home or business; Water Exchange, where the company provides pre-filled and reusable containers at over 14,000 sites; and Water Refill, where Primo provides water refill units at ~24,000 locations. It also sells water filtration solutions. When the company divested of its low-margin, small-format retail water bottle business in 2Q22 because it did not fit into the razor/razorblade model, it also made itself more ‘investable’ for ESG investors. The company’s operations are supported by ~61 manufacturing and production facilities and ~327 branch distribution and warehouse properties worldwide.

Revenue Disaggregation

The company recently reorganized its operations into two reporting segments and disaggregates its revenue into three units. North America includes its Primo, Crystal Springs, Mountain Valley, Crystal Rock, Vermont Pure, and Canadian Springs brands, amongst others. Sans the recently divested single-use water bottle business, it accounted for FY21 revenue of $1.42 billion, or 74% of total. Europe includes Eden Springs, Decantae Mineral Water, and Fonthill Water businesses. It was responsible for FY21 revenue of $247.6 million, or 13% of total. The other category captures Primo’s Israeli Eden Springs operations, Aimia Foods, and John Farrer & Company coffee businesses, as well as its corporate overhead. It generated FY21 revenue of $263.8 million or 14% of total.

August Company Presentation

Water Market

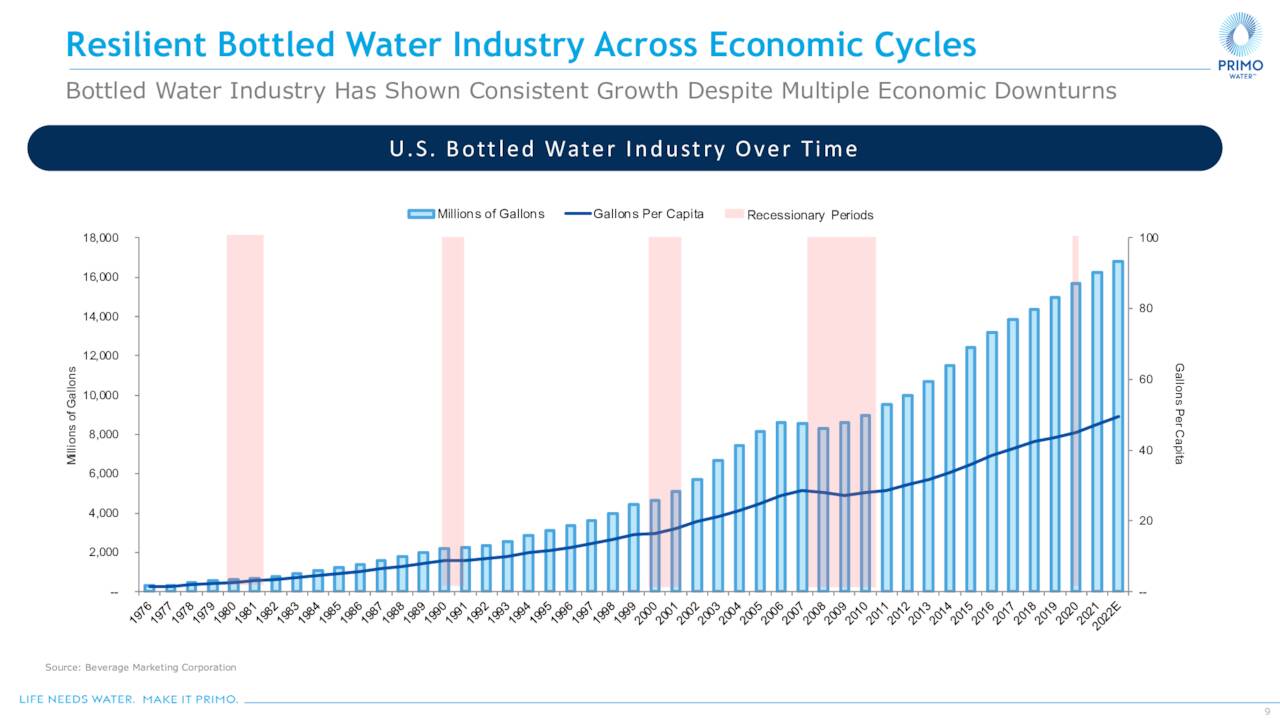

With approximately seven million U.S. households currently employing large format water solutions and a company estimate of 29 million households comprising the total domestic home market opportunity, management is confident in its ability to grow dispenser sales. Furthermore, gallons of bottled water consumed per capita in the U.S. have risen almost every year since 1976 to ~50 gallons annually, underscoring Americans’ pivot away from tap water consumption. Primo’s largest competitor in the three and five gallon home and office bottled water market is Nestle (OTCPK:NSRGY).

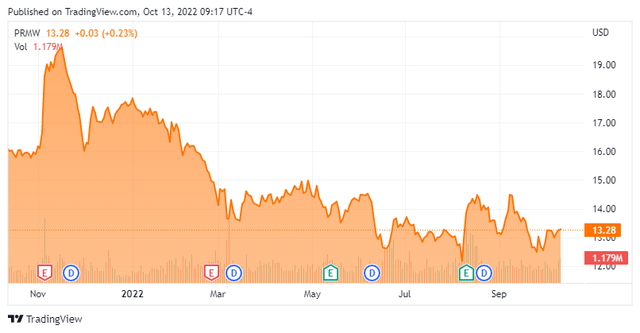

Transformation & Stock Price Performance

From 2014-2020, Primo (then Cott) acquired seven water companies for a total consideration of $2.7 billion, while offloading its carbonated soft drink and juice business to Refresco for $1.3 billion in 2018 and the bulk of its coffee operations to Westrock Coffee for $405 million almost concurrent to its purchase of Primo in 1Q20. The current goal of this razor/razorblade enterprise is to generate earnings of $1.15 a share (non-GAAP) and Adj. EBITDA of $525 million on revenue of $2.4-$2.5 billion by FY24, aided by some tuck-in acquisitions.

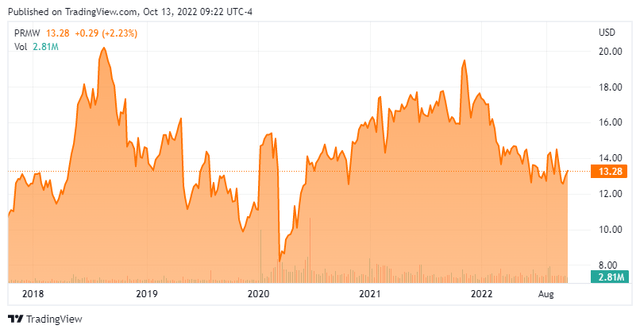

During this transformation, the company’s stock has been rangebound between $10 and $20 a share since 2015, save a brief detour below $7 during the pandemic-induced selloff. After it rebounded back into its long-term range, the market looked at Primo as a loser in the pandemic with everyone staying away from the office, making Cott’s moniker-changing acquisition look quite ill-timed. This dynamic kept its stock in the lower end of its multi-year range. As people returned to the office, shares of PRMW began to catch a bid, and with the announcement that it was exiting the low-margin, small water bottle business concurrent to its 3Q21 earnings report in early November 2021, they surged to a 16-year high, briefly trading above $20 a share.

However, with inflationary headwinds, supply chain concerns, and high Chinese tariffs still on the books from the Trump administration – its dispensers are manufactured in China – creating a challenging operating environment, its stock drifted back towards the lower end of its multi-year range, trading near $12 a share just before the company’s 2Q22 earnings announcement on August 11th.

2Q22 Earnings & Revised Outlook

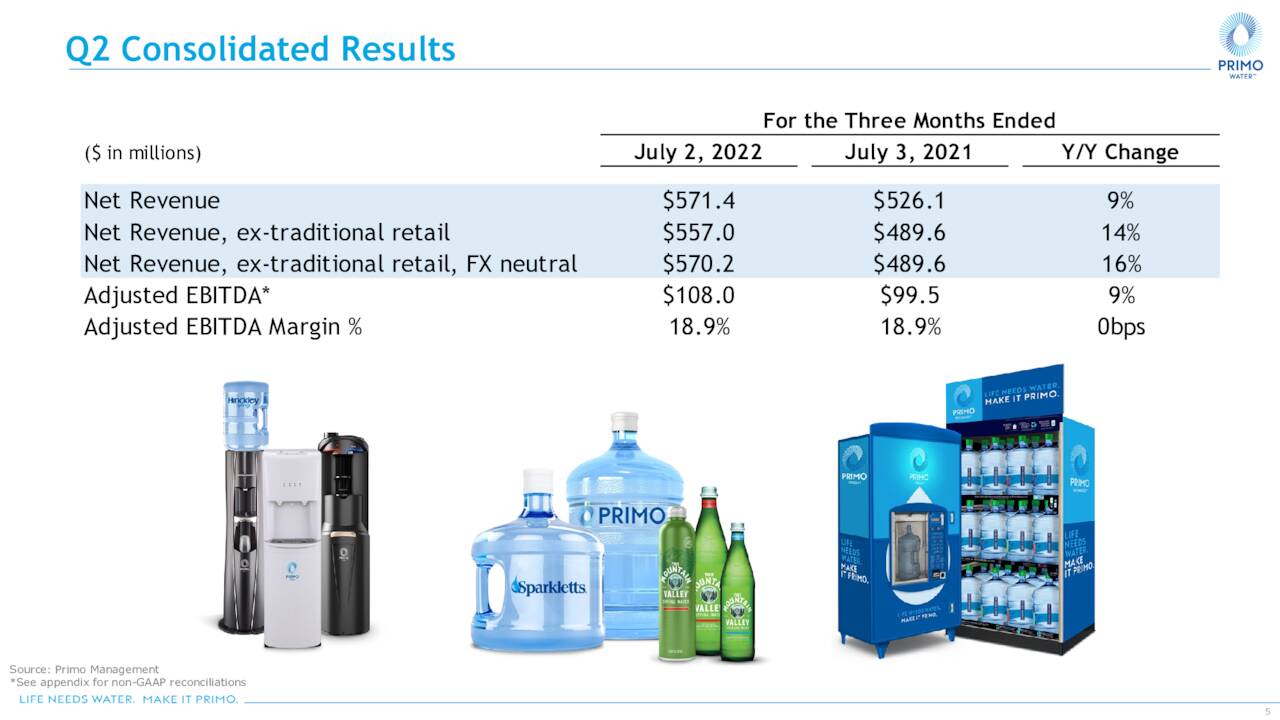

Despite these handicaps, its 2Q22 financial report was solid, with Primo earning $0.21 a share (non-GAAP) and Adj. EBITDA of $108.0 million on revenue of $571.4 million versus $0.17 a share (non-GAAP) and Adj. EBITDA of $99.5 million on revenue of $526.1 million in 2Q21. The 9% improvement at the top line was actually 16% if the small water bottle business and the impact of currency translation are eliminated from the results, as price increases were successfully passed on to counter inflationary impacts. Furthermore, the bottom line beat Street expectations by $0.04 a share while the top line bested consensus by $22.3 million.

August Company Presentation

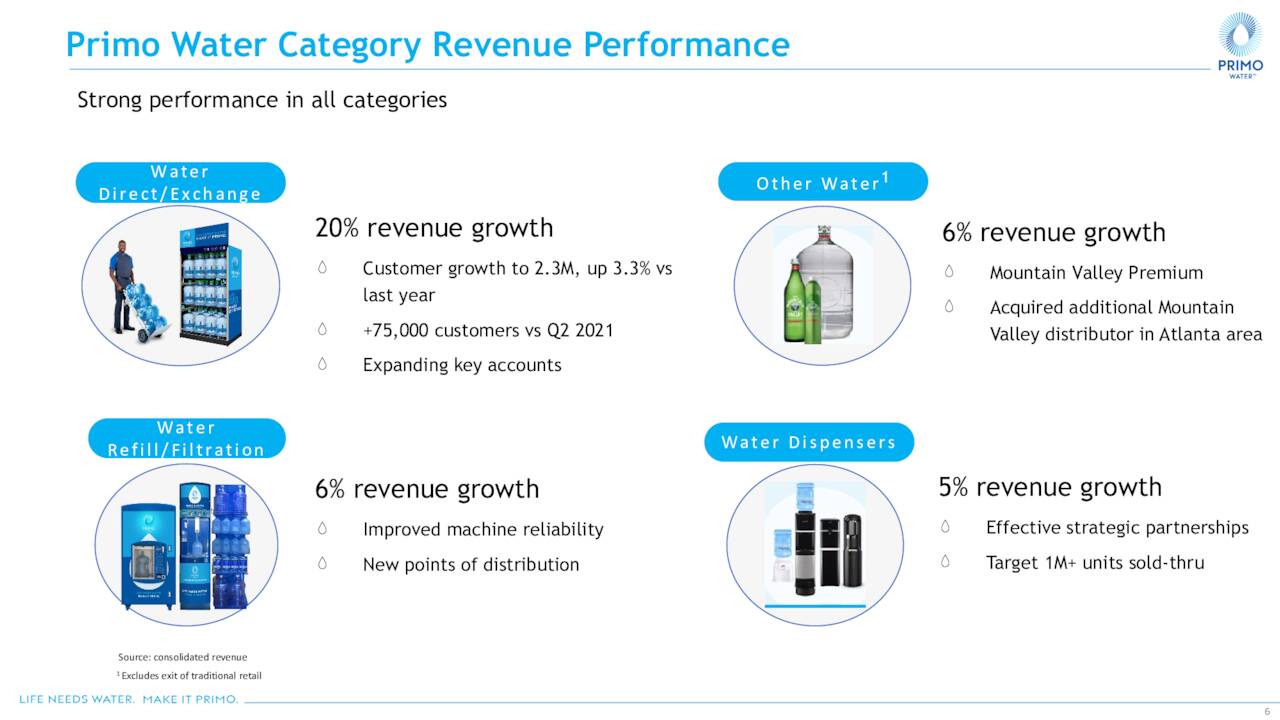

The strength was across all geographies and products with dispenser revenue up 5% year-over-year, water refill/filtration up 6%, and water direct/exchange up 20%, as the final category reached 2.3 million customers after adding 75,000+ new ones in 2Q22. Primo sold over 225,000 dispensers (razors) in the quarter and still expects to achieve its goal of one million plus sold in FY22.

August Company Presentation

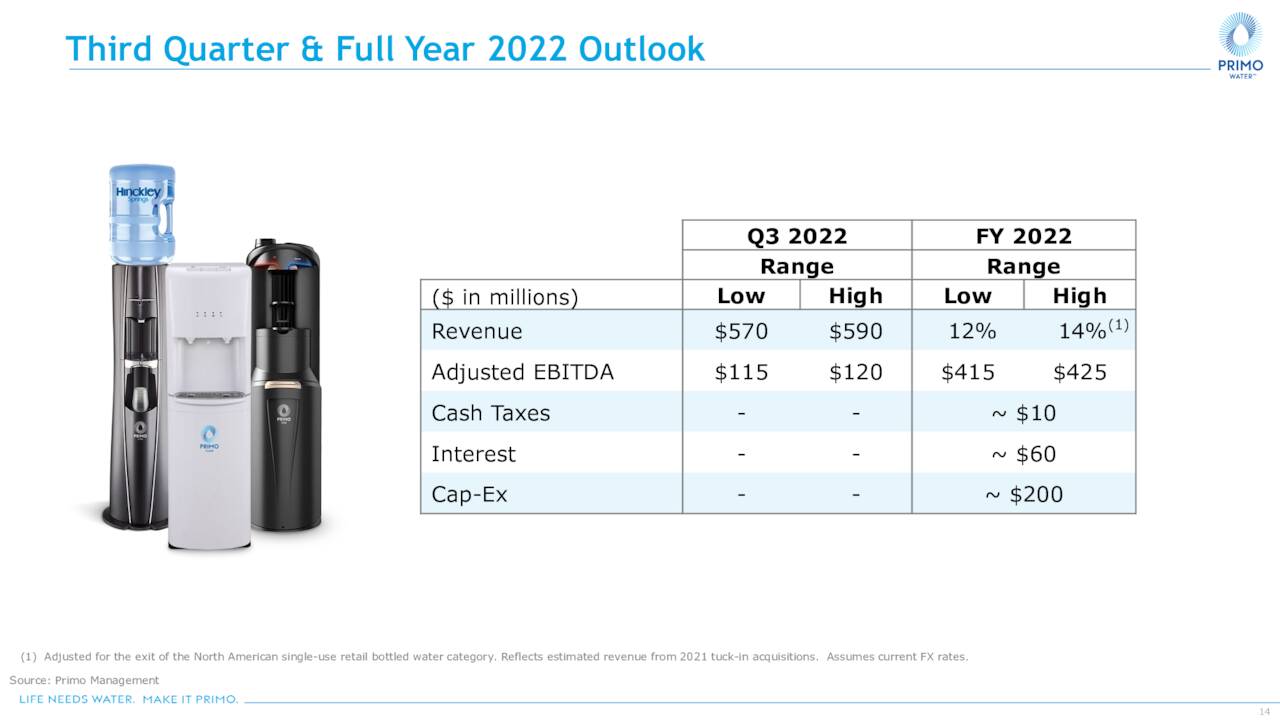

On the back of its strong quarter and a strong start to 3Q22, management bumped its FY22 outlook from Adj. EBITDA of $415 million to $420 million and revenue from $2.11 billion to $2.18 billion (based on range midpoints). Additionally, it signaled confidence that it would see a 90% reduction in tariffs in the near future, which would be passed on to customers to accelerate dispenser sales.

August Company Presentation

Balance Sheet & Analyst Commentary:

Primo’s debt level is a bit concerning with net leverage at 3.6, although with its outlook, that metric should drop to 3.4 by YE22 and below 2.5 by YE24. It held cash and equivalents of $98.5 million and debt of $1.5 billion as of June 30, 2022. It returns capital to shareholders both through dividends and share repurchases. It has paid 37 consecutive quarterly disbursements – its latest being a $0.07 per share dividend for a current yield of 2.0%. Management offered that it expects to increase the quarterly dividend by a penny in each FY23 and FY24. The board recently authorized a new $100 million share repurchase program on August 10, 2022 after purchasing 2.65 million shares in the twelve-month period starting May 10, 2021. This buyback will be funded by some property sales in California grossing ~$125 million.

Regarding analysts who have proffered commentary over the past twelve months, the Street is a mixed bag on Primo’s prospects, featuring one outperform and two buy ratings against one hold and one sell. Their median twelve-month price target is $18 a share. Jefferies reissued their Buy rating and $19 price target earlier this week. On average, they expect the company to earn $0.66 a share (non-GAAP) on revenue of $2.22 billion in FY22, followed by $0.81 a share on revenue of $2.32 billion in FY23.

In addition to authorizing the company to repurchase its own shares, board member Steven Stanbrook has been buying stock for his own account, acquiring 13,358 shares on September 6, 2022. He was actually following the lead of CEO Thomas Harrington, who purchased 39,000 shares on September 1st. Both buys were just north of $13 a share.

Verdict:

At just over $13.00 a share, Primo is trading at a price-to-FY23E sales of just over .9, a P/E ratio just north of 16 on FY23E EPS, and an EV/FY22E Adj. EBITDA of 8.5. All three metrics are fairly valued for a relatively unsexy razor/razorblade model. For management to achieve its goals of FY24 Adj. EBITDA of $525 million on revenue of ~$2.5 billion, margins will need to improve from the 19%+ projected for FY22 to 21.5% in FY24 (assuming no more acquisitions). If successfully attained (assuming net leverage of 2.5 at YE24 and $100 million of share repurchases at an average price of $13.84), it tabulates to a value of $20.53 a share if the current EV/Adj. EBITDA valuation of 8.5 still applies, resulting in approximate 50% price appreciation and ~55% total return with the dividend factored into the algebra over the next 27 months.

That represents an over 20% CAGR of for a defensive company in an uncertain economic environment and a reason for purchasing Primo for a trade to the top end of its multi-year range near $20. Furthermore, shares of PRMW will likely see a bump when tariff relief officially arrives. Not exciting enough for consideration for a large stake but a small trade idea as the stock is trading near the bottom of its recent range.

Revenge proves its own executioner.”― John Ford

Be the first to comment