Chun han/iStock via Getty Images

Introduction

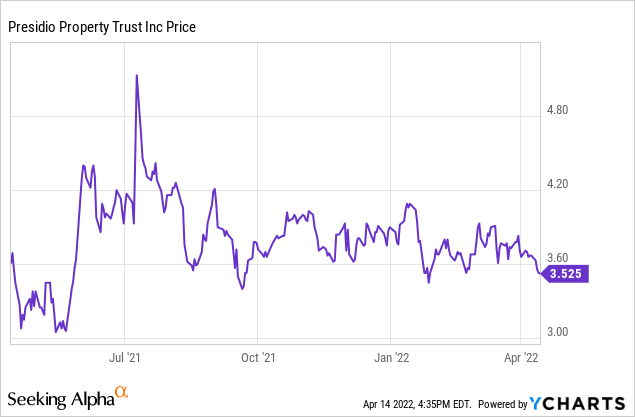

While I generally like my preferred share positions to be low risk as the low possibility of generating capital gains reduces my risk appetite, meaning I mainly care about the income, some preferred shares are riskier than others. I have a long position in the preferred shares of Presidio Property Trust (NASDAQ:SQFT), and although I’m bearish on the common shares of this REIT due to dividend coverage concerns, I think the margin of safety on the preferred shares is still good enough to remain long. The preferred shares are trading with (NASDAQ:SQFTP) as their ticker symbol

I Warned In August For A Rapidly Deteriorating Result, And Common Shareholders Should Be Worrying

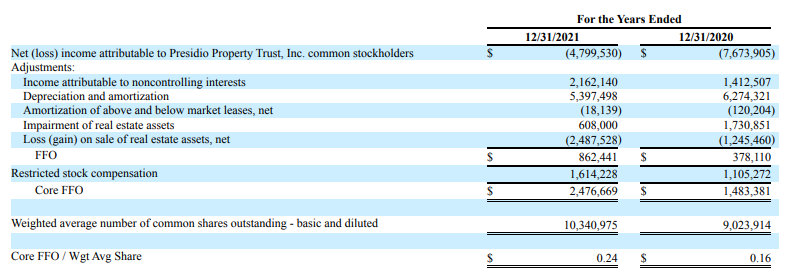

In my August 2021 article, I warned for a massive decrease in the reported FFO of Presidio Property Trust as the REIT had been issuing preferred shares. While this boosted the balance sheet size, it took time to deploy the cash while the preferred dividend payments immediately started to weigh on the underlying FFO result. According to my calculations, the FFO would fall to just 3 cents per quarter.

Unfortunately, I was right. While the reported core FFO in the first half of 2021 was approximately $1.67M, the full-year core FFO fell to just $2.48M. This means that despite the enlarged balance sheet, the H2 core FFO was just $800,000 or just under $0.08 per share. This also means the current distribution of $0.105 per quarter is nowhere near fully covered by the FFO.

SQFT Investor Relations

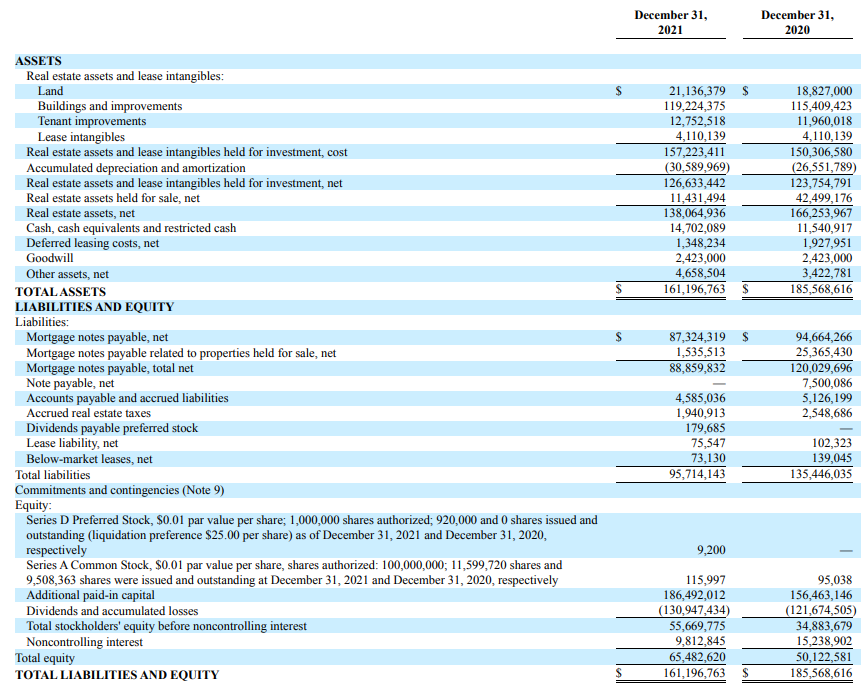

As of the end of 2021, the total balance sheet contained just over $161M in assets. That’s a decrease of about $23M compared to the previous year as the REIT sold off some of the assets that were previously already classified as “held for sale.” While the model homes were sold at a profit, three other assets (Waterman Plaza, Garden Gateway and Highland Court) were sold at a combined loss of $3.2M based on the book value. Fortunately, the gain on the sale of other assets (including the model homes) allowed Presidio to report a total gain of $2.5M which helped to keep the net loss relatively limited.

Although it’s too early to tell, I hope the recently sold assets indicate the REIT has turned a corner and the current book value of the properties is more realistic.

SQFT Investor Relations

The book value of the real estate assets is approximately $138M while the net debt position is roughly $75M. With an LTV of 54% based on the book value of the assets and just under 45% based on the acquisition value, the leverage on the balance sheet appears to be quite reasonable.

I’m Sticking With My Preferred Shares

I have no intention to initiate a long position in the common shares of Presidio, so I’m looking at the REIT from the perspective of a preferred share investor. I am always focusing on two elements: Asset coverage and dividend coverage.

There were 920,000 preferred shares outstanding as of the end of 2021, for a total value of $23M. This means that of the almost $55.7M in equity on the balance sheet approximately 41% consists of preferred shares. Or in other words, the asset coverage ratio is almost 250%. That’s not very high but good enough at this point. Even if the book value of the assets decreases by an additional 20%, there would still be enough value left to make the preferred shareholders whole.

In order to determine the dividend coverage ratio, we need to look back at the reported FFO, which was just around $0.8M in the second half of the year. That’s fine as the FFO calculation already includes the preferred share dividends. The total amount of preferred share dividends in the second half of the year was approximately $1.08M which means the adjusted FFO before making the preferred share dividends was $1.9M, of which almost $1.1M was needed to pay the preferred share dividends. Or in other words, based on the H2 2021 performance of Presidio, the preferred dividend coverage ratio was 173%.

Investment Thesis

I would be very nervous if I would be a common shareholder of Presidio Property Trust. Based on the H2 2021 FFO, the dividend payout ratio exceeds 200% and this situation may not be sustainable for much longer. While I appreciate the SQFT management team is working on increasing and improving the FFO performance, I’m for sure sticking with the preferred shares for now and I’m avoiding the common shares.

Although an asset coverage ratio of less than 250% and a dividend coverage ratio of less than 175% is on the lower end of the spectrum, the risk/reward ratio is still acceptable considering the preferred shares are paying $2.34375 per year (in monthly tranches), and based on the most recent share price of the preferred shares of $22.83, the yield is 10.27%. Although the high yield is a sufficient compensation for the higher risk profile of Presidio, I’m still keeping the size of my position in SQFTP limited.

Be the first to comment