Darren415

This article was first released to Systematic Income subscribers and free trials on Aug. 14.

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferreds and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the second week of August.

Be sure to check out our other weekly updates covering the BDC as well as the CEF markets for perspectives across the broader income space.

Market Action

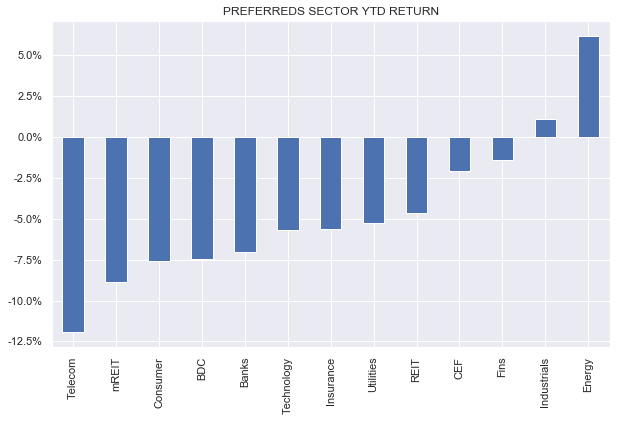

Preferreds continued to rally in line with the broader income space with a 0.4% weekly return. All sectors are up in August, with BDC (single-member sector with PSEC.PA) and Tech in the lead.

Year-to-date, Industrials have moved into the green to join Energy preferreds. Only the Telecom sector features a double-digit loss at this point.

Systematic Income

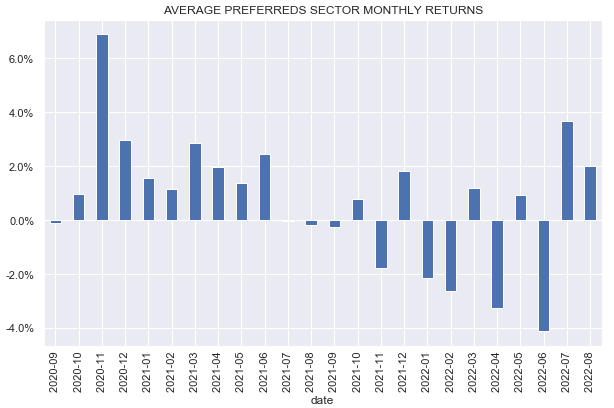

August is shaping up to be the second positive month in a row, something preferreds have not been able to achieve since May and June of 2021.

Systematic Income

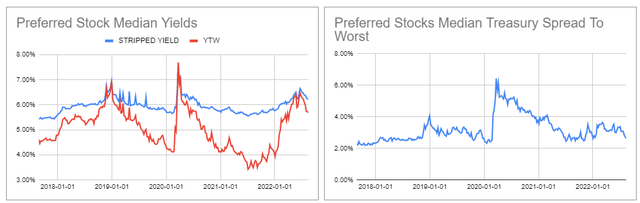

Both preferreds yields and credit spreads have rallied over the last couple of months. Yields are now about 1% off their recent peak in June.

Systematic Income Preferreds Tool

Market Themes

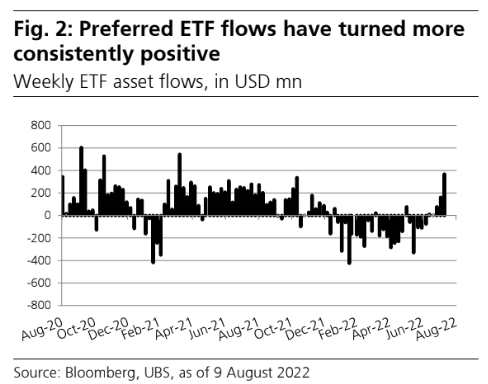

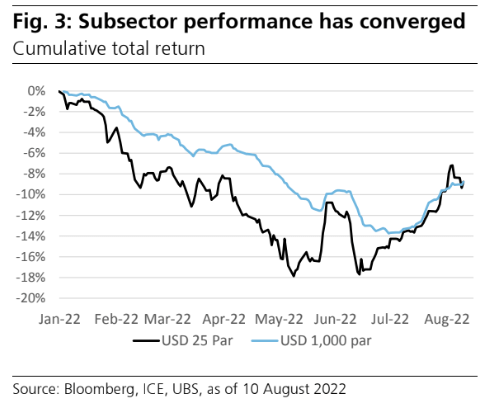

The retail preferreds sector has bounced back hard. Recall that retail preferreds underperformed their institutional counterparts in the first half of the year due to their longer-duration profile as well as sharp outflows from passive ETFs, which tend to primarily hold retail preferreds.

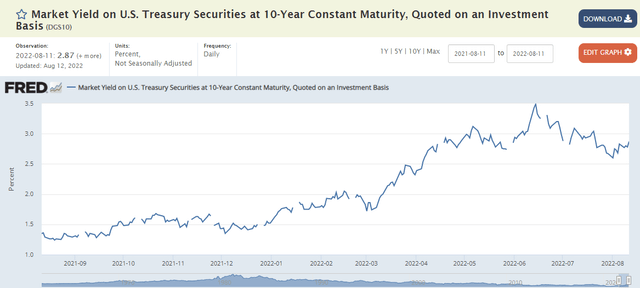

This pattern has now reversed. First, the 10Y Treasury yield has fallen by 0.65% from its peak, supporting the longer-duration profile of retail preferreds.

And two, preferred ETF flows have turned positive, providing a significant tailwind to retail preferreds.

UBS

This has allowed retail preferreds to do a roundtrip and recover all the lost ground versus institutional preferreds. The two sub-sectors boast pretty similar returns year-to-date.

UBS

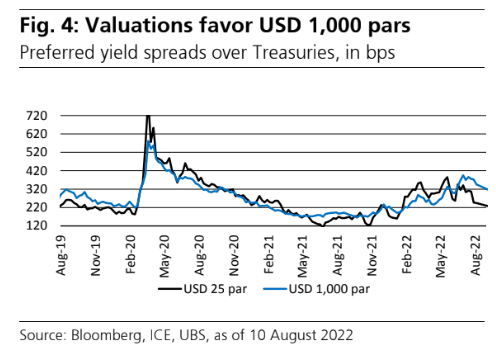

We continue to favor some exposure to institutional preferreds via CEFs or actively managed ETFs given institutional preferreds valuations look more attractive as the following chart shows.

UBS

Market Commentary

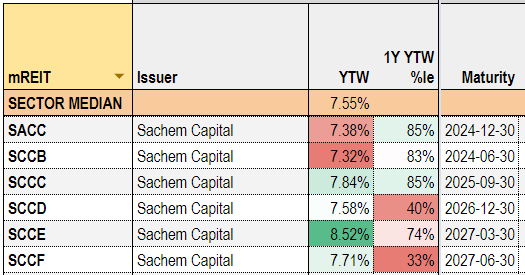

Mortgage REIT Sachem Capital 7.125% 2027 bond (SCCB) was added to the Baby Bond Tool. Sachem has a ton of bonds outstanding – the highest-yielding one is the Mar-2027 SCCE with an 8.5% YTM and looks much more attractive than the rest of the suite. It does have the second longest maturity in the suite, however, with the credit yield curve as flat as it is, there is not much additional compensation it requires. Investors who really want to keep their duration exposure minimal may want to go with the 7.4% yielding (SACC). Sachem Capital asset coverage of the bonds after its secured facilities are taken into account is about 1.9x, which is not particularly strong but not terrible either.

Systematic Income Preferreds Tool

Sachem bonds that have been trading since the start of the year are up 1% on average. Modest maturity, not-too-horrible securities like these are worth a look once again now that credit spreads have rallied from 6% to 4%. The moves have been hard and fast as everyone, including the Fed, has now moved to overweighting the latest bit of data. Market volatility will probably remain elevated for this reason, causing investors to be more tactical than they may want to be otherwise.

Stance & Takeaways

The market’s attention has now turned from peak inflation, which seems to be finally here, to where inflation will settle over the next year or so. The consensus is pricing in a very optimistic scenario that either inflation will move sharply lower in the near-term or macro indicators will cool sufficiently to allow the Fed to bring the Fed Funds rate lower. The Fed itself has been pushing back hard on this view. Neel Kashkari, the Minnesota Fed President, who used to be the most dovish Fed governor, now expects the policy rate to close at 4.4% by the end of 2023 – fully 1% above the market consensus peak.

What this suggests is that there is a significant risk that short-term rates move well above what the market expects, which can then result in a greater macro downturn that the now buoyant stock market is pricing in. For this reason, we continue to have focus on both floating-rate (or soon-to-float) higher-quality preferreds like NLY.PF and PNC.PP which can take advantage of rising short-term rates. We also keep an eye on higher-quality fixed-rate preferreds, which can hold in relatively well in a typical recessionary scenario of widening credit spreads and falling longer-term rates such as HBANM trading at a 5.72% yield and WFC.PL trading at a 5.8% yield.

Be the first to comment