JayLazarin

For precious metals investors, JPMorgan Chase & Co. (JPM) goes with market manipulation. For example, the bank holds the largest stake of gold at the COMEX. Another thing, it is common knowledge that JPMorgan is a very active trader in gold futures, usually on the short side of this trade.

As a result, over the years, the bank has gained a bad reputation as a market manipulator.

Investment thesis

In this article, I am trying to prove that things have changed. In my opinion, the available data shows that the market manipulator thesis has lost its credibility. If I am correct, the precious metals market may be at the beginning of a new, strong bull market that should drive the price of gold much higher than the latest top established in mid-2020.

COMEX

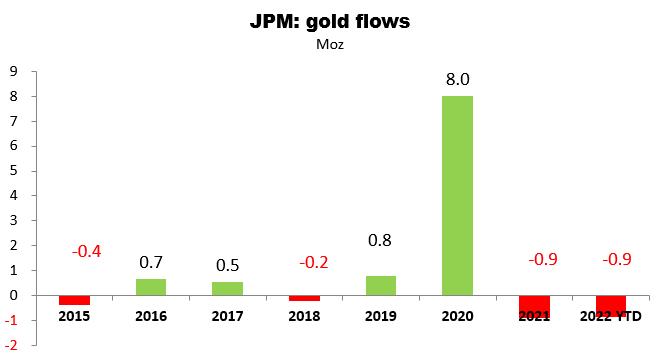

According to the COMEX data, between 2016 and 2019, JPMorgan was accumulating gold at a relatively steady pace of 0.5-0.8 million ounces a year (excluding 2018):

Simple Digressions

Then, in 2020, the bank increased its COMEX stake by as many as 8.0 million ounces. Finally, over the last two years it has cut its holdings by 1.8 million ounces.

Unfortunately, these figures do not paint the whole picture. For example, they do not cover what happens within a single year. And here is the point – in the beginning of May 2022 JPMorgan held 11.0 million ounces of gold, the largest gold stake ever. Since then, the bank has cut its holdings by 2.6 million ounces (a decrease of 23.9%). In other words, over the last 3.5 months, the bank was selling out its gold as if being in a panic mode.

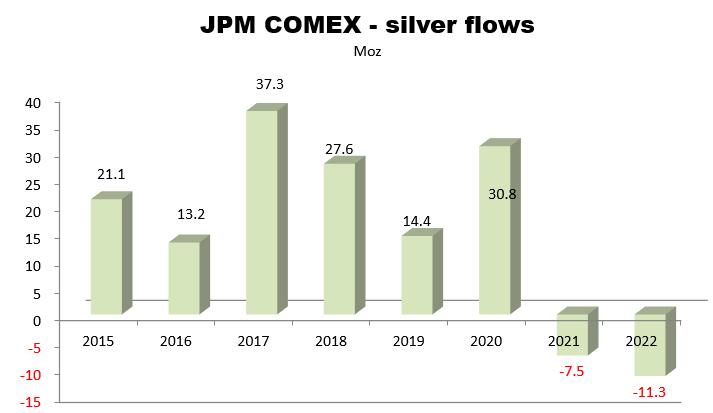

The same happened with silver. As the chart below shows, over the last two years, JPMorgan has cut its COMEX silver stake by 18.8 million ounces:

Simple Digressions

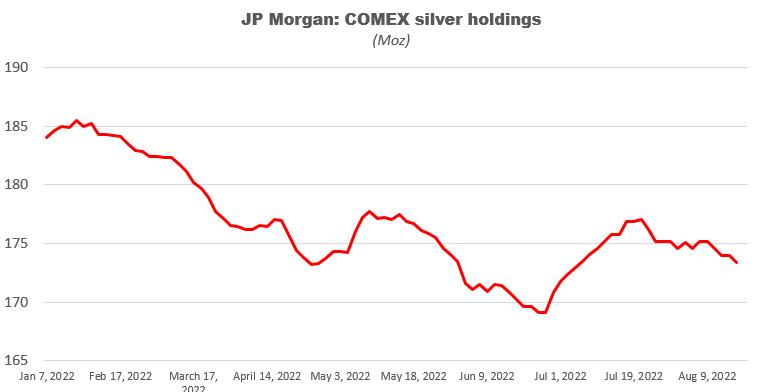

What is more, similarly to its gold holdings, this year the bank, excluding a few short episodes, was generally selling out its silver:

Simple Digressions

COT data

Now the best point. It is also common knowledge that JPMorgan was actively trading gold futures on the COMEX. More, I assume that the bank was the largest trader there.

The chart below depicts a net short position held by the four largest players trading gold futures on the COMEX:

Simple Digressions

I think it is easy to spot that over the years this position has dropped significantly. For example, between 2008 and 2009 the four largest traders (with JPMorgan being the largest one) were “responsible” for 50% – 55% of the total gross short position held by all the shorts. Now they hold a mere 25% of the total gross short position.

Note: according to “Explanatory notes” delivered by the Commodity Futures Trading Commission: “The report shows the percents of open interest held by the largest four and eight reportable traders, without regard to whether they are classified as commercial or non-commercial”

What does it mean? In my opinion, it means that JPMorgan has significantly reduced its involvement in gold futures trading. Or, better said, it is no longer a large short seller of gold.

Summary

I think that the above discussion proves that JPMorgan is retreating from the precious metals market. If I am correct, the thesis that this market is manipulated by this bank is no longer valid. I think it is the excellent news for precious metals investors. After years of manipulation, there is a good chance that very soon the main forces driving the prices of precious metals will be the free market forces.

My view on the gold market in the short term

Money Managers

The fact that JPMorgan withdraws from the precious metals market nicely coincides with my short-term bullish opinion on gold. Please look at the graph below:

Simple Digressions

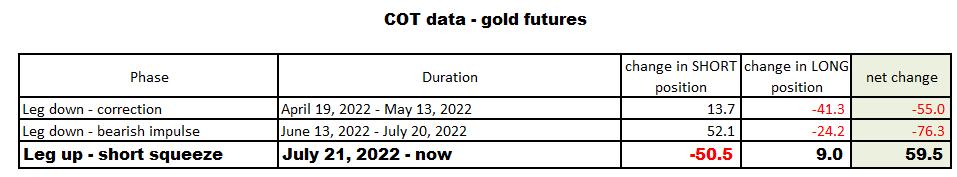

The graph shows the changes in gross and net positions held in gold futures by big speculators called Money Managers.

The first two rows depict the latest two phases of a bear market in gold. It has to be noted that the first phase (April 19 – May 13) was a typical correction where the dominating party were the bulls, cutting their bullish bet by 41.3 thousand contracts. Then, on June 13, the second phase started. During this stage, the most active party were the bears, increasing their bearish bet by 52.1 thousand contracts. Hence, it was a typical bearish impulse during a bear market. Of course, as during each bear market, a net position held by Money Managers went down in both cases though the dominating parties were different, as explained above.

The third row (July 21 – now) indicates that now the gold futures market is in the phase called “Short squeeze.” At this stage, the most active players are the bears, leaving the market in panic. Note that these traders have cut their bearish bet by as many as 50.5 thousand contracts so far. Another fact confirming my thesis on the short squeeze – during a classic short squeeze, the total open interest should go down significantly. And indeed, since July 21 the total open interest has dropped by 71.2 thousand contracts (or 13.6%).

Now, in my opinion, the fact that the gold futures market is in the short squeeze phase is an extremely bullish indication. Generally, most bear markets end with a short squeeze so…I am bullish.

Small Traders

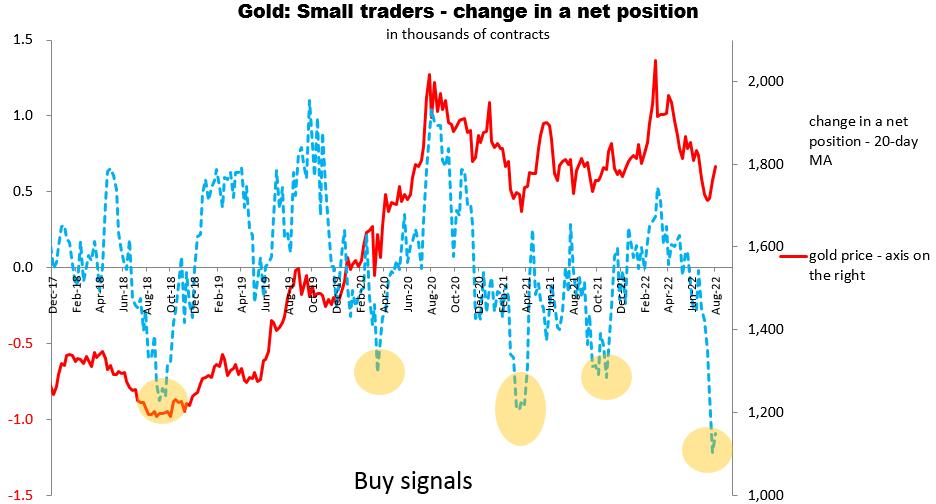

Another bullish indication – the so-called Small Traders are extremely bearish about gold.

Note: Small Traders are those players that do not qualify, according to the Commodity Futures Trading Commission definition, as Commercial or Non-commercial traders.

Without going too deeply into definitions – in general, these traders are always wrong about the market. In other words, it makes sense to take an opposite (to Small Traders) position. And, as the chart below shows, every time Small Traders were extremely bearish about gold, a new leg up was in the making (look at the yellow circles below):

Simple Digressions

Summary

In my opinion, JPMorgan, one of the world’s largest speculators in gold, is withdrawing from the precious metals market. If I am correct, there is a good chance that the main forces driving the prices of precious metals will be the free market forces. This thesis nicely coincides with the current bullish setup printed by the COT data. In other words, I think that we are ahead of a new, big bull market in gold.

Be the first to comment