anyaberkut

A Quick Take On PowerSchool Holdings

PowerSchool Holdings (NYSE:PWSC) went public in July 2021, raising approximately $711 million in gross proceeds from an IPO that priced at $18.00 per share.

The firm provides cloud-based software solutions for K-12 education schools and districts in North America.

While the company has promise as its busiest quarter of the year is underway, I’m on Hold for PWSC due to macro slowdown concerns.

PowerSchool Holdings Overview

Folsom, California-based PowerSchool was founded to create a unified platform of software technology spanning all administrative functions for K-12 school use cases.

Management is headed by Chief Executive Officer Hardeep Gulati, who has been with the firm since August 2015 and was previously general manager of SumTotal Systems, a talent management system.

The company’s primary software module offerings include:

-

Administrative

-

Classroom

-

Talent

-

Communications

-

Home

-

Portals

-

Absence management

-

Finance | HR | Payroll

-

Insights & analytics

-

Predictive early warning

The firm pursues new school clients via direct sales and marketing efforts in its core geographic areas as well as through resellers in other areas.

PWSC also licenses APIs to vendor partners for them to create ‘plug-ins’ to enable data flows and embedded capabilities within their software offerings.

PowerSchool’s Market & Competition

According to a 2020 market research report by Apps Run The World, the top 10 K-12 software vendors represented 37.5% of the global K-12 applications system delivery in 2019.

This represented a 4.5% growth over the previous year, to almost $3.7 billion in total revenue.

The report forecasts the K-12 applications market will reach $4.8 billion by 2024, a CAGR of 5.2% from 2019 to 2024.

Also, the COVID-19 pandemic increased the need and usage for cloud-based systems that can operate whether a school employee is at the office or remotely.

Major competitive or other industry participants include:

-

Microsoft (MSFT)

-

Blackboard

-

Blackbaud

-

Follett School Solutions

-

Oracle (ORCL)

-

SAP (SAP)

-

Frontline Education

-

Capita Software

-

Instructure

-

Tyler Technologies (TYL)

-

Others

PowerSchool Holdings’ Recent Financial Performance

-

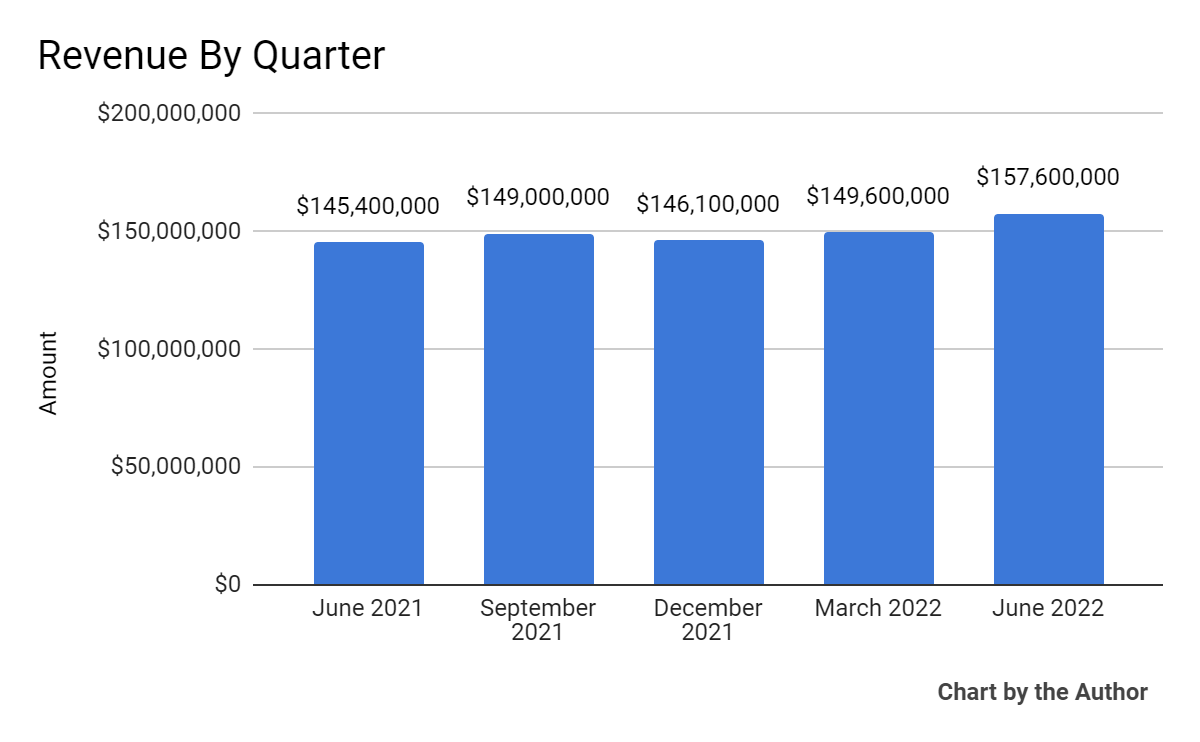

Total revenue by quarter has largely plateaued in recent quarters with a bump in Q2 2022:

5 Quarter Total Revenue (Seeking Alpha)

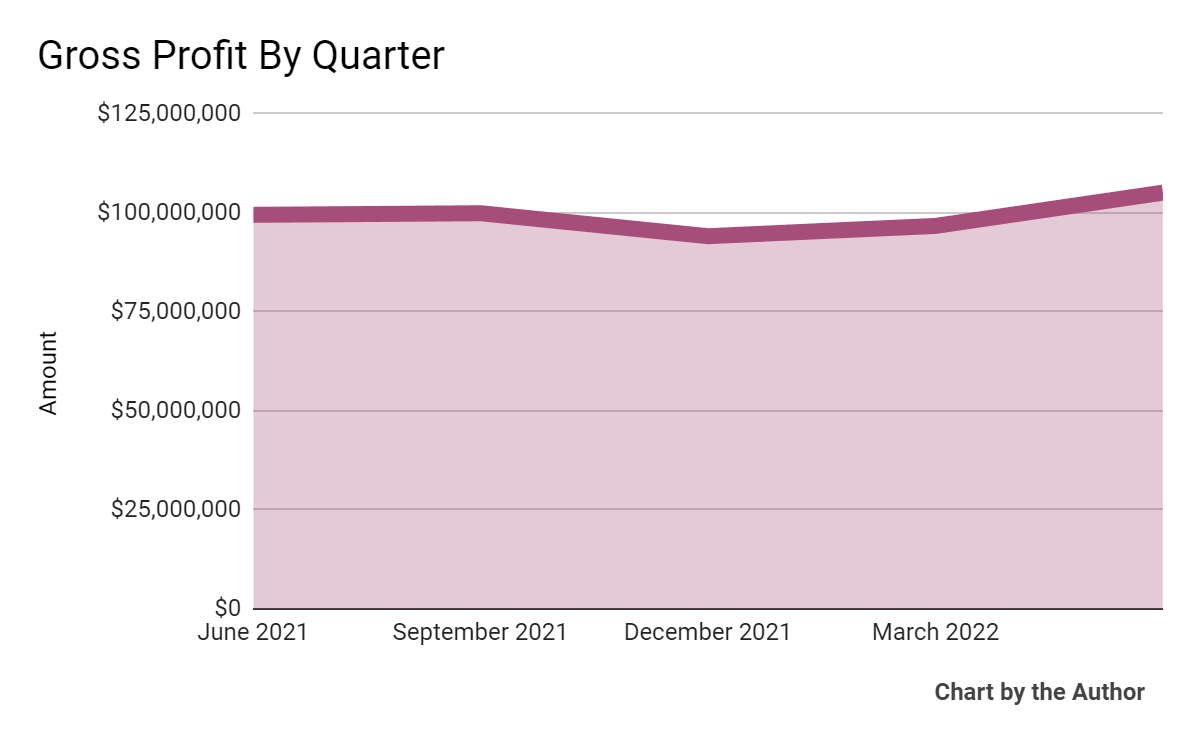

5 Quarter Gross Profit (Seeking Alpha)

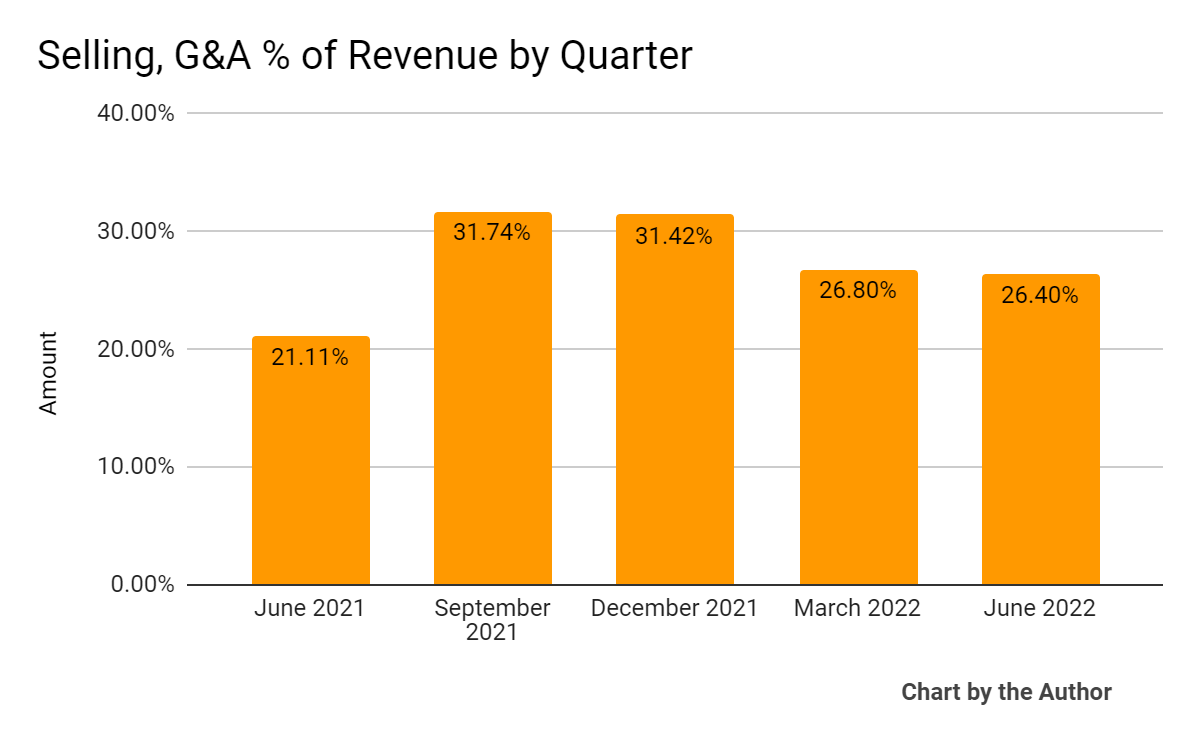

- Selling, G&A expenses as a percentage of total revenue by quarter have fallen somewhat in recent periods:

5 Quarter SG&A % Of Revenue (Seeking Alpha)

-

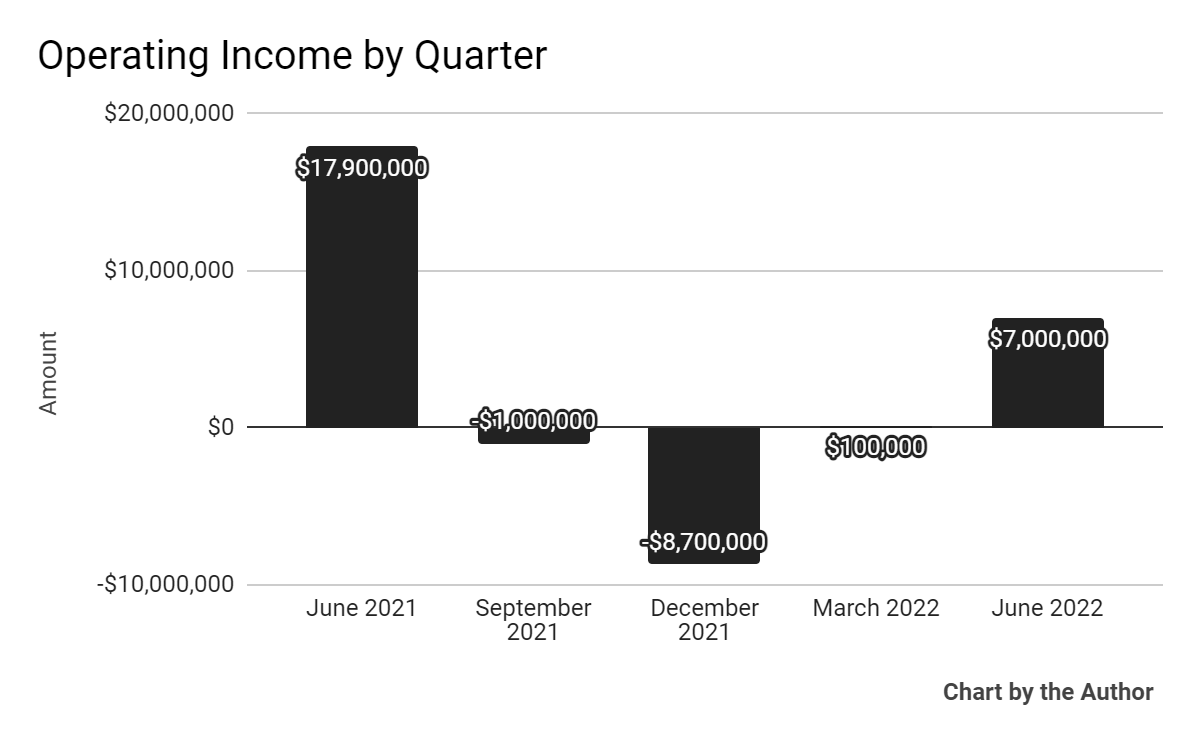

Operating income by quarter returned to positive territory in Q2 2022:

5 Quarter Operating Income (Seeking Alpha)

-

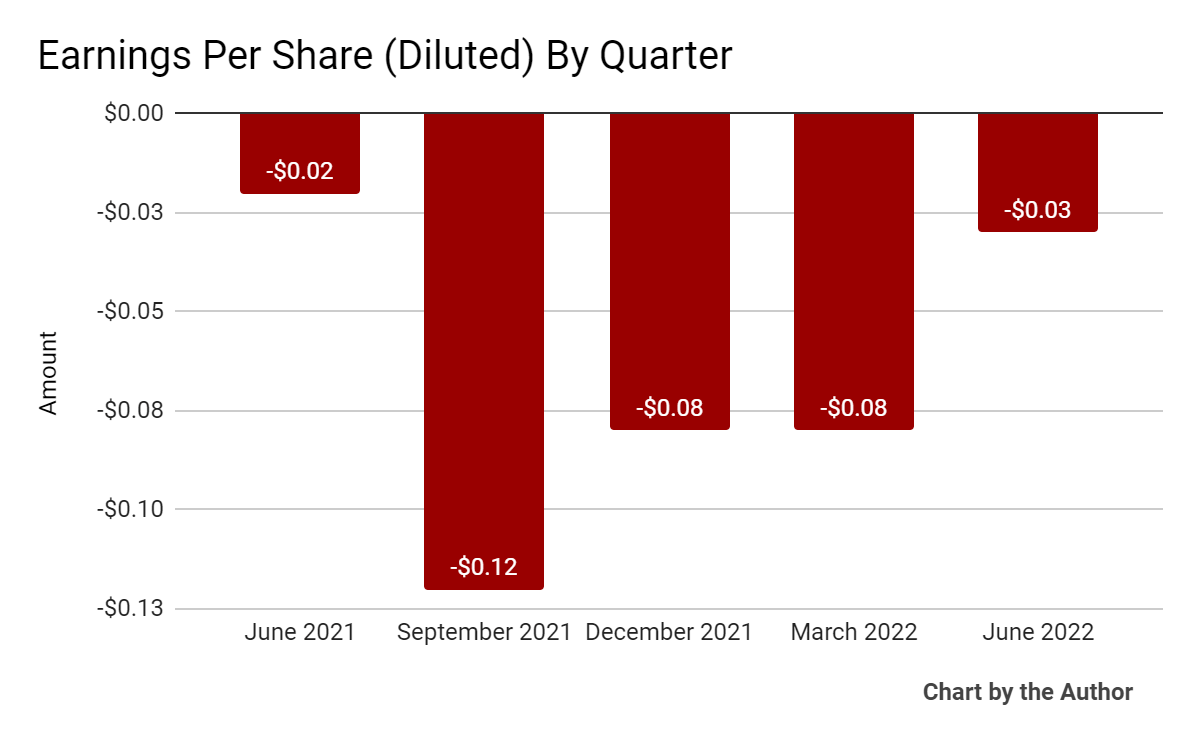

Earnings per share (Diluted) have remained negative in each of the past five quarters:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

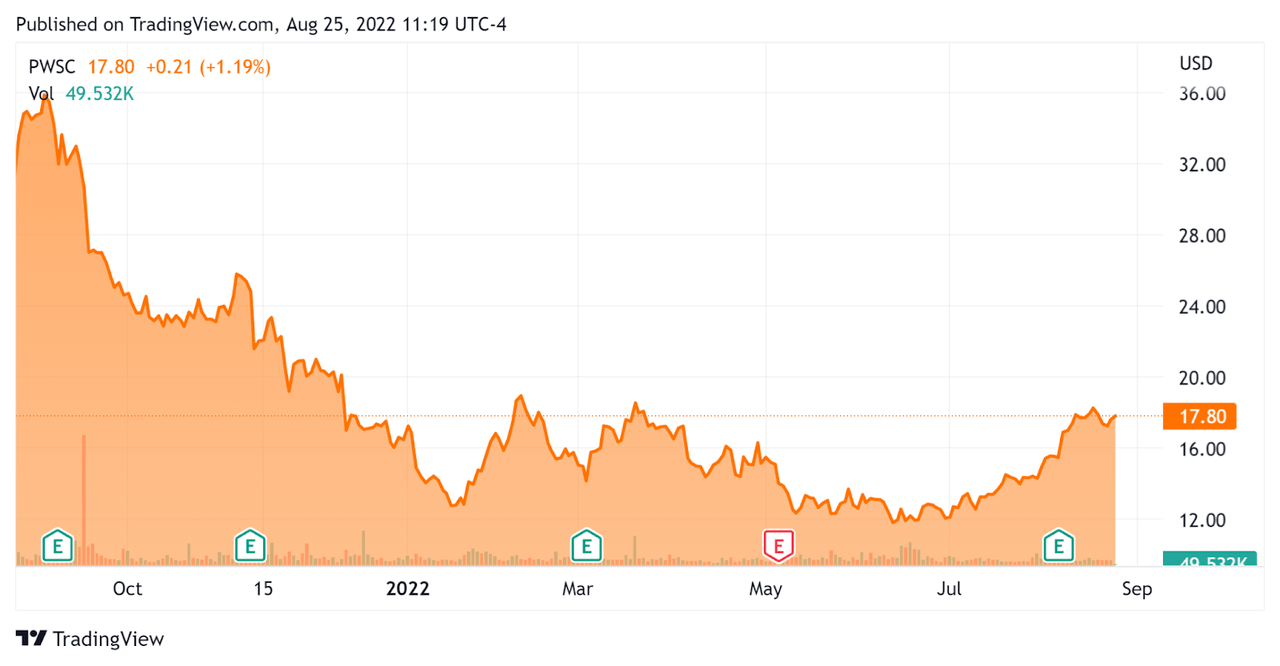

In the past 12 months, PWSC’s stock price has dropped 42.9% vs. the U.S. S&P 500 index’ fall of around 7.2%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For PowerSchool Holdings

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

6.69 |

|

Revenue Growth Rate |

21.6% |

|

Net Income Margin |

-8.0% |

|

GAAP EBITDA % |

9.5% |

|

Market Capitalization |

$3,420,000,000 |

|

Enterprise Value |

$4,030,000,000 |

|

Operating Cash Flow |

$113,720,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.31 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Blackbaud (BLKB); shown below is a comparison of their primary valuation metrics:

|

Metric |

Blackbaud |

PowerSchool |

Variance |

|

Enterprise Value / Sales |

3.83 |

6.69 |

74.7% |

|

Revenue Growth Rate |

10.5% |

21.6% |

106.4% |

|

Net Income Margin |

-1.5% |

-8.0% |

446.3% |

|

Operating Cash Flow |

$195,520,000 |

$113,720,000 |

-41.8% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

PWSC’s most recent GAAP Rule of 40 calculation was 31.1% as of Q2 2022, so the firm needs some improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

21.6% |

|

GAAP EBITDA % |

9.5% |

|

Total |

31.1% |

(Source – Seeking Alpha)

Commentary On PowerSchool

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted its cross-selling strategy success as well as new logo wins to grow its customer base to over 15,000.

The company also introduced new products such as MTSS (Multi-Tiered System of Support) to connect data ‘to create actionable whole child views and align personalized intervention plans across all levels and types of support required for students.’

Since its IPO, the company has expanded its platform from 14 products to 19, providing the firm with new opportunities to cross-sell within its customer base.

As to its financial results, topline revenue rose by 11% year-over-year and adjusted EBITDA margin was 31%, the highest margin since its IPO.

Subscription and service revenue accounted for 85.7% of the company’s total revenue for the quarter.

The firm’s net dollar retention rate was 107.3%, 60 basis points higher than the previous quarter, indicating cross-sell success and higher sales & marketing efficiency.

R&D expense as a percentage of total revenue dropped slightly year-over-year, while adjusted EBITDA margin was 30.9%, higher than its previous guidance range.

For the balance sheet, the company finished the quarter with $15.4 million in cash and equivalents, but that was after drawing $40 million from its revolving line of credit for seasonal requirements.

The firm has subsequently repaid that amount, and management expects to pay off the remaining $30 million balance by the end of Q3.

Looking ahead, for the full year of 2022, management raised revenue and adjusted EBITDA guidance ranges to grow revenue by 13.1% and to produce adjusted EBITDA margin of 30% at the midpoint.

Notably, management expects to pay $58 million in share-based compensation for the year, at the midpoint of the range.

Regarding valuation, the market is valuing PWSC at an EV/Sales multiple of around 6.7x.

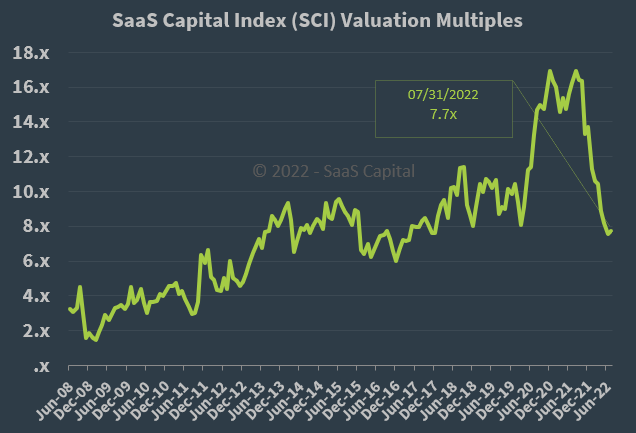

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.7x on July 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, PWSC is currently valued by the market at a slight discount to the SaaS Capital Index, at least as of July 31, 2022.

The primary risk to the company’s outlook is a potential macroeconomic slowdown or recession, which may slow sales cycles and reduce its revenue growth trajectory.

Also, continued inflationary pressures on labor costs may push costs up.

Although the stock has recently received positive comments by Goldman Sachs and has risen as part of a general valuation bump among technology stocks in recent weeks, I wonder how much further it can rise in the near term, given slowing macroeconomic conditions.

The company still hasn’t reached earnings breakeven, and management continues to hand out share-based compensation at a high rate, while PWSC has already pushed through Goldman Sachs’ price target of $16 and has recently traded as high as $18.

While the firm has promise as its busiest quarter of the year is underway, I’m on Hold for PWSC due to macro concerns.

Be the first to comment