Win McNamee

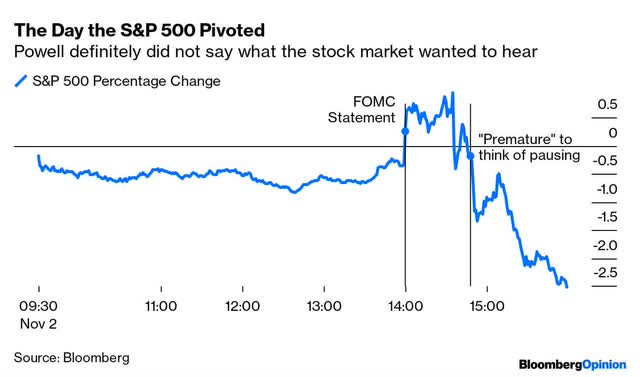

As expected, the Fed raised short-term rates by 75 basis points yesterday. What was not expected was the dovish tilt in the FOMC policy statement that accompanied the increase. It stated that the Committee would “take into account the cumulative tightening of monetary policy” and “the lags with which monetary policy affects economic activity and inflation.” That was music to my ears, and it sent bond yields falling and stocks soaring upon release. While this was not the pivot everyone has been talking about, it was an acknowledgment that we have yet to see the full impact of the rate hikes to date, which take time to work through the economy, and that smaller rate increases are prudent moving forward.

I indicated yesterday that Powell’s rhetoric was bound to stay hawkish to manage inflation expectations and limit further enthusiasm for risk assets. He did not disappoint on that front during his press conference that followed by stating that “the ultimate level of interest rates will be higher than previously expected.” That was all it took to send stocks reeling from their highs of the day to close sharply lower. Understand that the policy statement is a carefully crafted document, while Chairman Powell’s off-the-cuff commentary during his press conference is not. I am not placing a lot of importance in that comment, because he said a lot of things that ran counter to one another. I think he was more focused on diffusing the market rally after the statement’s release, which came after one of the best monthly performances on record. Ultimately, he will be data dependent.

I still see the peak in the Fed funds rate, otherwise known as the terminal rate, being 4.5% with a final 50- basis-point rate increase in December. I recognize that I am in an extreme minority, but I expect the Fed will pause then because the incoming data will show that a downtrend in inflation is taking shape. As the rate of economic growth is bound to continue slowing, Fed officials should realize that the lagged impact of 450 basis points of rate increases will bring them close to target by the summer or fall of 2023. I think this is why the stock market had such a strong performance in October, which should continue to a lesser degree in November. The market looks forward, while its participants are typically looking over their shoulders. The bears on Wall Street are focused on the weakening rate of economic growth, the deceleration in earnings growth, and rising unemployment.

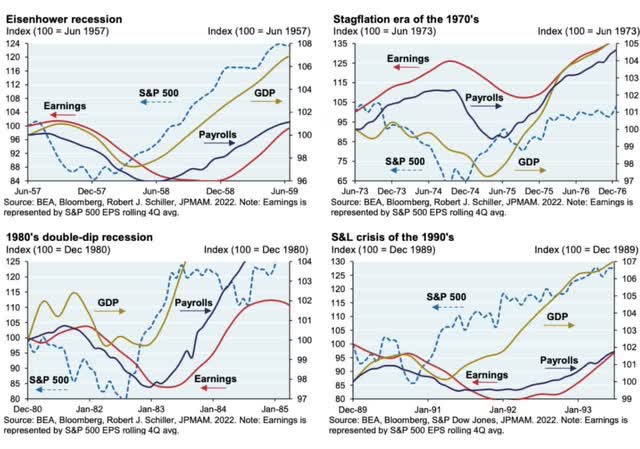

That’s why Bank of America’s Sell Side Indicator, which measures Wall Street sentiment, has fallen to its lowest level since 2017 in the most recent survey. Historically, this has resulted in the S&P 500 being higher 12 months later 94% of the time, according to the bank’s strategists. I like those odds, and it falls in line with my more optimistic market outlook. While we may very well see weakening GDP growth, a rising unemployment rate, and a decline in corporate profits, the market typically bottoms before the other three data points. That has more often than not been the pattern, as can be seen below during previous cycles.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment