Justin Sullivan

By Valuentum Analysts

Chipotle (NYSE:CMG) is one of our favorite restaurant ideas, and while it may face more pressures from an inflationary environment than others, the wave of employees returning to work in the cities may help normalize its business in the near term, especially in urban areas. We also believe that the Chipotle customer is less price-sensitive than other customers and will continue to pay up for food quality and convenience. The long lines at locations in the cities are a frequent reminder that there is no shortage of demand for Chipotle, seemingly at any price — meaning Chipotle has further room to continue to raise prices, in our view.

In Chipotle’s third-quarter results, released October 25, the fast-casual operator’s comparable sales advanced 7.6%, and while input costs may be a headwind, the firm’s restaurant margin still expanded 180 basis points in the quarter, to 25.3% of sales. The firm continues to open new restaurants at a nice clip, with 43 new locations opening their doors in the quarter (with many having a Chipotlane drive-thru). Next year, management expects to open as many as 255-285 new restaurants, a solid pace, and one that we think CEO Brian Niccol can achieve. We’re fans of Chipotle, and let’s walk through our thesis in this note.

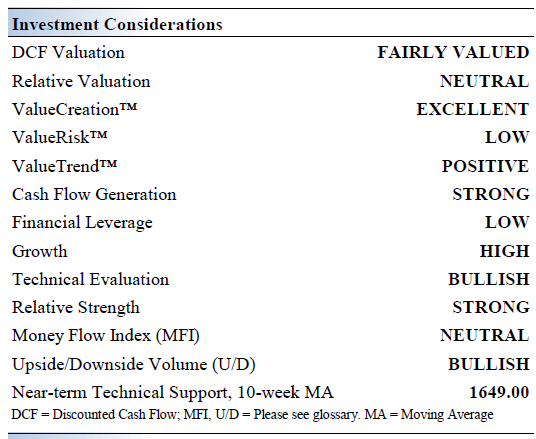

Chipotle’s Key Investment Considerations

Image Source: Valuentum

Chipotle serves a focused menu of burritos, tacos, burrito bowls (a burrito without the tortilla) and salads, made using fresh ingredients. It prides itself on trying to find the highest-quality ingredients (‘Food With Integrity’) and providing an exceptional restaurant experience. The company was founded in 1993 and is based in Denver, Colorado.

In March 2021, Chipotle announced that it was accelerating its growth strategy in Canada, with an eye towards new restaurant locations. Chipotle is leaning on productivity gains and its pricing power to offset inflationary headwinds to preserve its margins.

Chipotle sees room for ~6,000 restaurant locations in North America, more than double Chipotle’s unit restaurant count at the end of September 2021. The company is aggressively investing in its drive-thru operations, which it refers to as Chipotlanes. In December 2021, Chipotle opened its first restaurant location that caters solely to digital orders.

Chipotle’s growth story rests on its ability to continue growing its physical store count while also expanding its digital operations. The company recently signed new delivery partnerships with Uber (UBER) Eats and Grubhub, while also expanding its digital operations into Canada. Innovations on the digital front will be key.

Investors should be aware of the generosity in our assumptions in our valuation model, however. We are expecting strong annual revenue growth through 2025 and assume Chipotle significantly expands its operating margin over this period, aided by economies of scale.

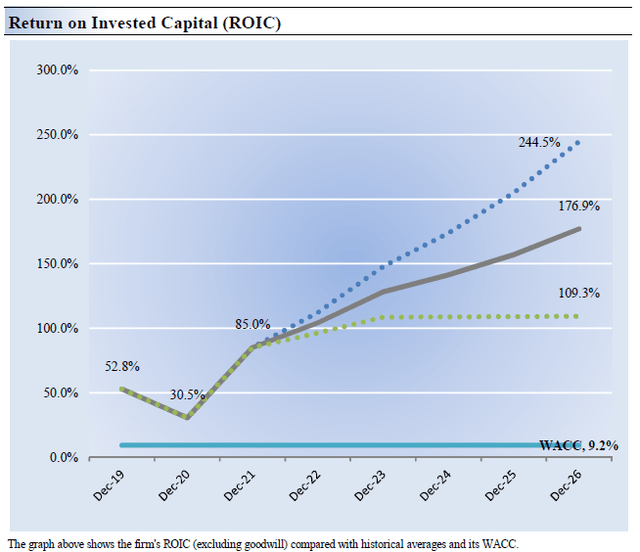

Chipotle’s Economic Profit Analysis

The best measure of a company’s ability to create value for shareholders is expressed by comparing its return on invested capital [ROIC] with its weighted average cost of capital [WACC]. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Chipotle’s 3-year historical return on invested capital (without goodwill) is 56.1%, which is above the estimate of its cost of capital of 9.2%.

As such, we assign Chipotle a ValueCreation rating of EXCELLENT. In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. Chipotle is a strong economic profit generator.

Chipotle’s Cash Flow Valuation Analysis

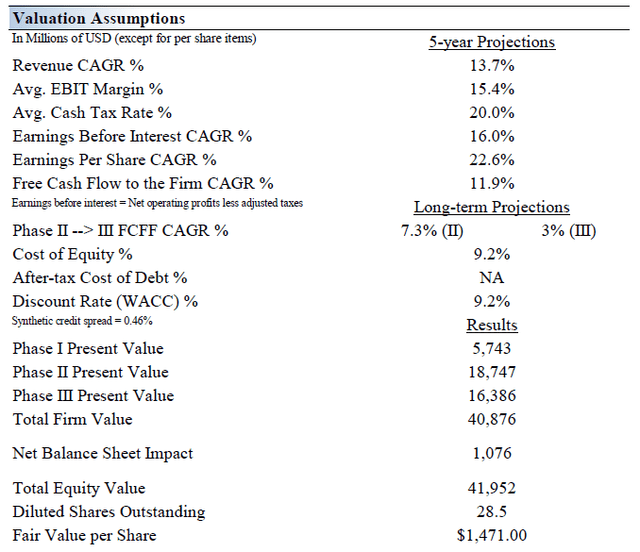

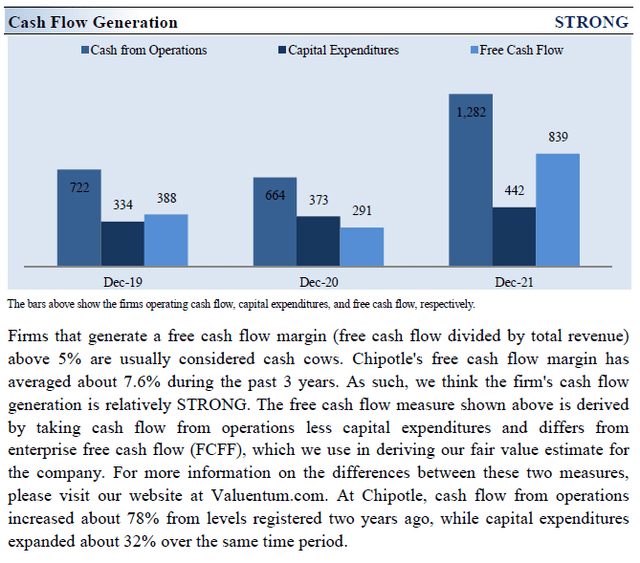

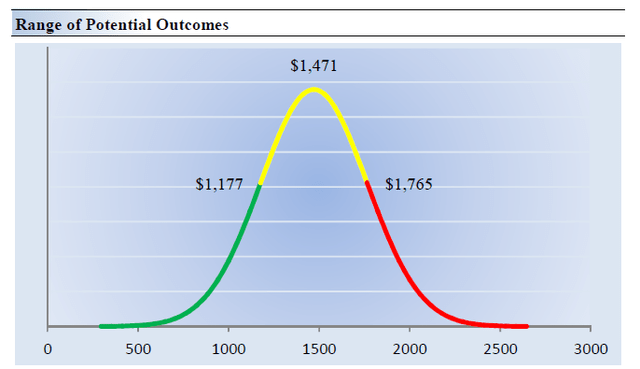

We think Chipotle is worth $1,471 per share with a fair value range of $1,177- $1,765. The margin of safety around our fair value estimate is driven by the firm’s LOW ValueRisk rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them.

Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 13.7% during the next five years, a pace that is lower than the firm’s 3- year historical compound annual growth rate of 15.8%.

Our model reflects a 5-year projected average operating margin of 15.4%, which is above Chipotle’s trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 7.3% for the next 15 years and 3% in perpetuity. For Chipotle, we use a 9.2% weighted average cost of capital to discount future free cash flows.

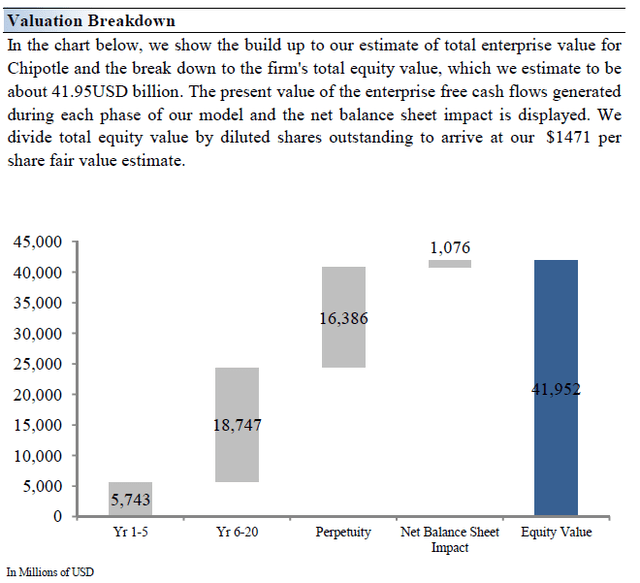

Image Source: Valuentum Image Source: Valuentum

Chipotle’s Margin of Safety Analysis

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate the firm’s fair value at about $1,471 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

Our ValueRisk rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for Chipotle. We think the firm is attractive below $1,177 per share (the green line), but quite expensive above $1,765 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Concluding Thoughts

There are a number of restaurant bellwethers, including Starbucks (SBUX), McDonald’s (MCD) and Yum! Brands (YUM), that offer impressive dividend yields and that may be great for dividend growth investors to consider, but Chipotle is cut from a different cloth.

Its fast-casual focus and premium food offerings coupled with its Chipotlane rollouts–and a long-term breakfast “call option” for the company to add the daypart–are a few things that give the company a runway for continued strength that may be unprecedented by an established brand, particularly considering its unit development potential in North America.

We’re reiterating our fair value estimate of ~$1,471 per share, about where shares are currently trading at the time of this writing, but a more optimistic take on Chipotle could see shares reach the higher end of our fair value estimate range of ~$1,765 per share. We’re not ruling out the upside potential.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment