Galeanu Mihai/iStock via Getty Images

It’s coming on six months since I wrote my bullish article on Mueller Water Products Inc. (NYSE:MWA), and in that time, the shares have produced a loss of about 14.3% against a loss of around 17.4% for the S&P 500. I thought I’d check in on the company yet again for obvious reasons. I considered the valuation to be reasonable when the shares were changing hands at $14, which opens the possibility that they’re very cheap at the moment. I’ll determine whether these shares are a good place to invest by looking at the most recent financial history here, and by looking at the stock as a thing distinct from the underlying business. I also recommended selling some puts previously, and I feel obliged to write about that trade, so I’m going to write about that trade.

As I type this, the weekend is upon us, and I imagine that you are planning a great vacation to an exotic location with the person of your dreams. Whatever you’re doing, and however busy you are, I assume that you’ve allocated only a finite amount of time reading my thoughts about Mueller Water Products, so I’ll try to make your reading experience as efficient as possible. The capital structure remains rock solid, and the company exceeded expectations yet again, which is perhaps one reason why the shares have outperformed over the past six months. The shares are now objectively cheap, and so I’ll be buying a few hundred more of them. At the same time, I’m remaining short the puts I wrote earlier, as I’d be happy to be exercised at an adjusted price of $11.95. That said, I don’t see the point in selling puts at the current prices. This is one of those rare circumstances when it makes more sense to simply buy the shares than to write puts.

Management Conservatism

In the most recent “Management Discussion and Analysis” portion of the company’s latest 10-Q, after breaking down the proportion of sales from each element of the business (55-60% from repair and replacement, 30-35% from residential construction, and 10% related to natural gas activity), management stated that:

We expect the operating environment in fiscal year 2022 to be very challenging as a result of the uncertainty around the depth and duration of the pandemic which has accelerated and may continue to accelerate, inflation, labour availability, and global supply chain disruptions. We anticipate that growth in the residential construction end market will help offset anticipated challenges in the project-related portion of the municipal market.

To summarize, the company anticipates operational problems which will be offset by improved housing demand. In my view, investors who pin their hopes on housing at the moment may be disappointed in the second half of 2022.

That said, it may be the case that management is displaying an excess of conservatism, a view that’s supported by a quick review of the recent financial history here. Additionally, I remain optimistic about the company’s ability to benefit from ongoing municipal repair work, and, eventually, higher water infrastructure spending.

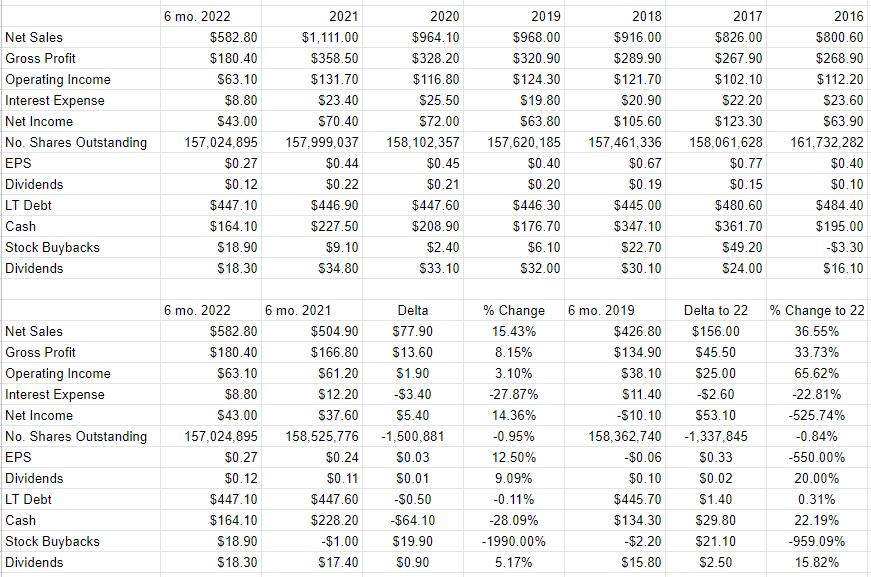

Financial Snapshot

The first six months of 2022 were quite good relative to the same period a year ago. Specifically, the top line and bottom lines were up by 15.4%, and 14.4% respectively. So far at least, any fears about the environment being “very challenging” are overblown. In addition, the company has increased the dividend, which is a very positive development in my view. Less positive is the fact that the level of debt persists, currently sitting at about $447 million. On the bright side, these notes aren’t due until 2029, so there’s no imminent threat in my view. Also, the company is sitting on cash and equivalents of about $164 million. So, cash represents about 37% of long term debt, which suggests to me that the capital structure is quite strong.

All of this suggests to me that I’d be happy to add to my position if the price is right.

Mueller Water Financials (Mueller Water investor relations)

The Stock

As my regulars know, I consider the “business” and the “stock” to be quite different things. In case you’re new here, I’ll tell you also. I consider the “business” and the “stock” to be quite different things. Every business buys a number of inputs, performs value-adding activities on them and sells the results at a profit. In the final analysis, that’s what every business is. The stock, on the other hand, is an ownership stake in the business that gets traded around in a market that aggregates the crowd’s rapidly changing views about the future health of the business. It’s also possible that the stock’s movements relate to the crowd’s view about “the market” in general, and have very little to do with what’s going on at the company. So, in some sense, the stock is “doubly buffeted” by the crowds’ rapidly changing views about a given company, and the crowd’s rapidly changing views about the overall stock market.

This is troublesome, but it’s a potential source of profit because these price movements have the potential to create a disconnect between market expectations and subsequent reality. In my experience, this is the only way to generate profits trading stocks: by determining the crowd’s expectations about a given company’s performance, spotting discrepancies between those assumptions and stock price, and placing a trade accordingly. I’ve also found it’s the case that investors do better/less badly when they buy shares that are relatively cheap, because cheap shares correlate with low expectations.

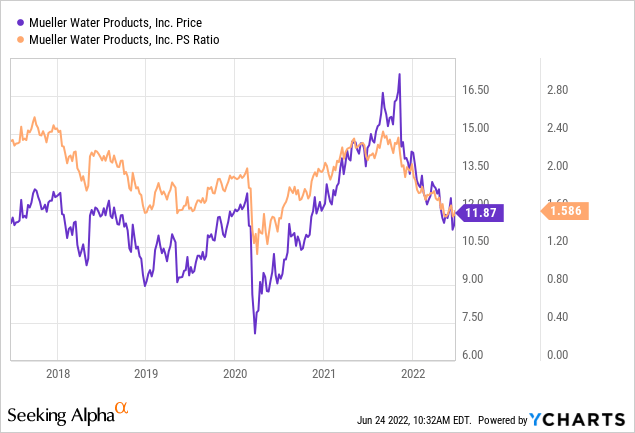

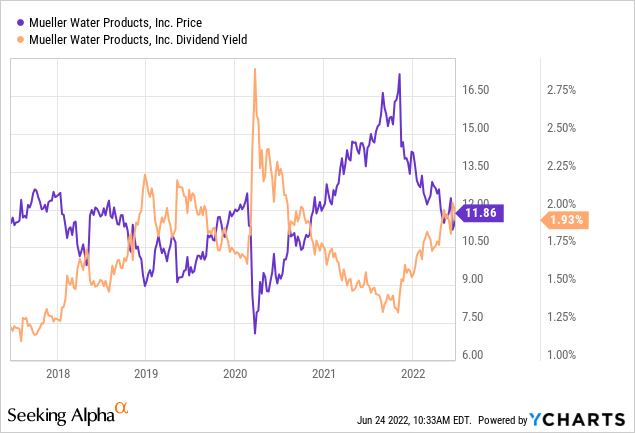

As my regulars know, I measure the relative cheapness of a stock in a few ways. For example, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. Previously, I decided to buy because the shares were trading at a respectable price to sales ratio of just over 2.0, and sported a dividend yield of 1.55%.

Fast forward nearly six months and the shares are 26% cheaper on a price to sales basis, and the dividend yield has jumped about 24%, per the following:

Source: YCharts

Source: YCharts

Given the business performance and the fact that the shares are even cheaper now, I’ll be buying a few hundred more shares. Normally, I’d also sell some puts, but I’m already short a number of them, as I describe below.

Options Update

In my previous missive, I wrote that in addition to buying some of the stock, I sold 10 of the August puts with a strike of $12.50 for $0.55 each because I considered these to be “win-win” trades at the time. I reasoned that if the shares remained above $12.50 until the third Friday of August, I’d have pocketed a 4.4% return for tying up capital for eight months. If the shares dropped below $12.50, I’d be obliged to buy, but would do so at a much cheaper adjusted price than the then stock price. Now that the shares have fallen in price, and time value has dropped away, these last traded hands at $1.50, and are currently priced at $0.85-$1.55. So far my trade is very much under water.

Normally I’d recommend selling more puts, but it doesn’t make sense to do so in this circumstance in my estimation. For instance, my August puts with a strike of $12.50 are currently about $0.70 in the money. So selling these results in approximately the same entry price as buying the stock today, assuming you get exercised. The risk of not being exercised is too great in my view, so the investor may as well buy the stock.

If we review lower strike prices and further months, a similar story emerges: the premia are either too thin to make the trade worthwhile (for example the November puts with a strike of $10 are bid at $0), or the strikes are too close to the current market price to justify the effort. For that reason, and I can’t believe I’m writing this, it makes much more sense to buy the stock than to sell puts in my view. Shocking, I know.

Conclusion

I came to feel that Mueller Water was reasonably priced in January of 2022 and I’m now of the view that the shares are trading at a very nice valuation. In spite of the fact that the company managed to boost the top and bottom lines in the mid teens, the shares are much cheaper on a price to sales basis. In addition, since the shares have dropped in price, the dividend yield is even more attractive now. Given the strength of the capital structure here, I see no need for the firm to return to the well to either sell more capital or take on any more debt, so I think the risk is reasonably low. Finally, while I normally like selling put options to boost returns and reduce risk, I don’t see the point of doing so in this circumstance. The premia is too thin, and the shares are already at “screaming buy” levels in my view.

Be the first to comment