JillianCain/iStock Editorial via Getty Images

Postal Realty Trust, Inc (NYSE:PSTL) operates a very simple business of owning and leasing properties to one primary tenant, the United States Postal Service (“USPS”). The company is not only the largest owner of properties leased to the USPS, but they are also the first and only real estate investment trust (“REIT”) primarily focused on serving the USPS.

The advantages of this business model are numerous. Revenue streams are stable and predictable and effectively backed by the Federal Government. And for those concerned about government finances, it’s worth noting that the USPS’ operating lease payments in 2021 represented less than 2% of their total operating expenses. So, if there are significant cuts, it’s likely to be elsewhere first.

The logistical network is also irreplaceable, as the USPS has the largest retail distribution network in the U.S., with over 160M unique delivery points. As such, regardless of the state of its operations, it’s unlikely to come under existential threat anytime soon.

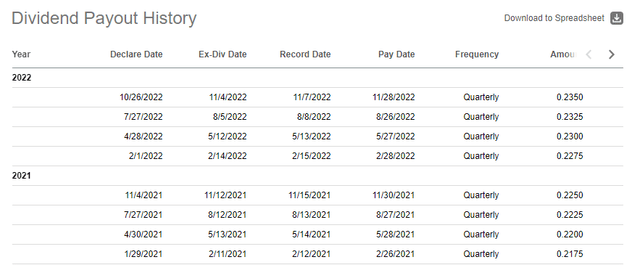

For income investors, the steady stream of revenues to PSTL has translated to bond-like dividend checks. In fact, it’s better than a bond since the quarterly payments have now been increased for seven straight quarters. The payout, as a result, is currently yielding about 6% at current pricing.

While the stock is down 20% YTD, shares trade at a very narrow 52-week range, with less than $6 separating their highs and lows. Following a positive earnings release, shares have remained little changed. For those seeking above average dividend yields from a reliable company with a wide moat, PSTL is one that could deliver on demand.

Exceeding Acquisition Targets

In the current quarter ended September 30, 2022, PSTL reported total rental revenues of +$13.2M. This was up 29% from the same period last year due primarily to contributions from newly acquired properties.

Through the first nine months of the year, the company acquired 266 properties for a total purchase price of +$102.8M. And subsequent to quarter end, they purchased another seven properties totaling +$5.9M. In total, they have already surpassed the +$100M acquisition mark guided for at the end of 2021, continuing a trend of exceeding expectations of their acquisition targets.

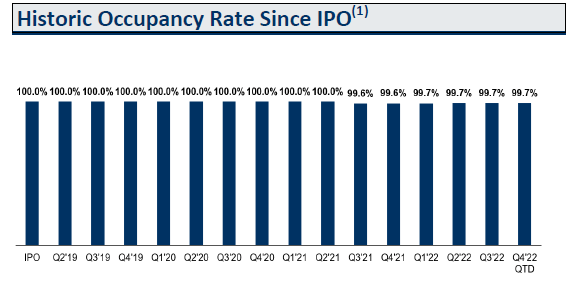

Continuing to add properties to their portfolio is important due to existing occupancy levels in their same-property portfolio that are essentially full at 99.7%. In addition, cash collection rates are also at 100%. While this is positive, it also limits improvement opportunities accretive to earnings.

Q3FY22 Investor Supplement – Historical Occupancy Levels By Year

In addition, most of PSTL’s leases are structured as fixed annual rental payments without annual escalations. This is problematic in inflationary environments, as there is a greater likelihood that variable operating expenses will exceed their fixed rental income.

Opportunities For Internal Growth

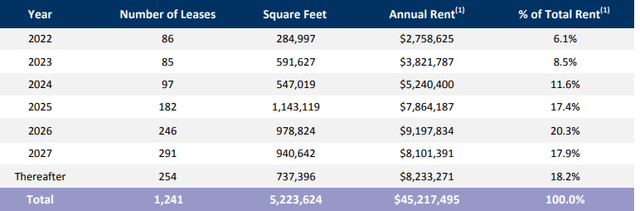

They do, however, benefit from shorter duration leases with average remaining lease terms of approximately four years. This provides them with more readily available opportunities to markup rents to market value.

Q3FY22 Investor Supplement – Lease Expiration Schedule

In addition, the company is evaluating whether to introduce inflationary adjustment charges on future renewals. For the remainder of 2022, there are 68 leases with the USPS that are set to expire. According to management, these would be the first potential candidates for the adjustment charges. Moving forward, if they can incorporate the adjustments to most of the expiring leases, that could provide an adequate runway of achieving annual organic NOI growth of between 2 to 3%.

A Slowing Acquisition Market Is One Risk To Consider

While headline NOI is up about 35% from last year, this is primarily driven by their non-same-store pool of acquisitions. There isn’t anything wrong with this per se, but the company does run the risk of facing a slowdown in the external market.

Management did note that on recent acquisitions, they are going in at higher cap rates. But many sellers are unwilling to change their expectations on pricing. PSTL appears to be adequately overcoming these challenges at present, given current activity levels, but that could change in the months ahead if the uncertainty persists.

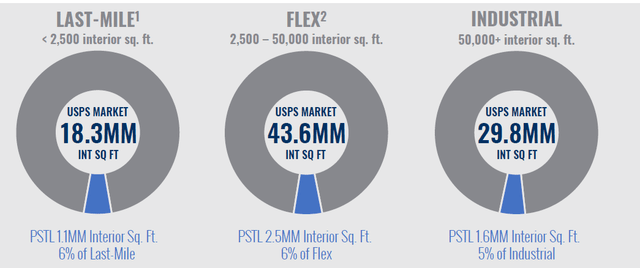

One area where the acquisition environment appears to be cut off is in industrials. In 2021, PSTL acquired five industrial properties but none so far in the current year. This makes sense, given the high likelihood of earnings dilution due to probable negative leverage associated with any debt-financed purchase in the current interest rate environment.

The lack of activity in this sector, nevertheless, is a setback, especially considering the growth potential. Currently, the USPS market in the industrial sector is about +$30M interior square feet. PSTL commands just 5% of that total share.

Similarly, they also have 6% of the share in both last-mile and flex. While this sounds low, it is still significant, considering the next top twenty owners combined own just 11% of the market.

With a grand total market size of 286M square feet, there is no shortage of opportunity for external growth. It’s just that the market must be open to transaction. This not only requires a narrowing in bid/ask spreads, but lenders, too, must be open to extending credit.

November 2022 Investor Presentation – Market Share Opportunity In PSTL’s Last-Mile, Flex, and Industrial Property Classes

Debt Position And Dividend Coverage Remain Adequate

On this, PSTL is well positioned to continue accessing the capital markets for financing. At the end of the third quarter, the company had over +$100M in liquidity and no notable debt maturities through 2026. In addition, their net debt multiple stood at 5.3x adjusted EBITDA, which is well below target levels of 7x.

PSTL also pays a quarterly dividend of $0.235/share, which represents an annualized yield of about 6% at current pricing. Furthermore, the quarterly payment has now grown for seven consecutive quarters since the beginning of 2021.

Seeking Alpha – PSTL Dividend Payout History In 2021 and 2022

From a safety perspective, the current payout equates to 90% of third quarter adjusted FFO. While this is on the high side, it is still fully covered. Share issuances via their ATM could negatively impact coverage levels, but usage is unlikely, given the current share price.

Reliable Deliverer Of Growing Dividend Checks

PSTL turned in a solid quarter overall in Q3. Continuing activity in the external acquisition market, taking their total investments for the year above initially projected levels was one highlight from the report, as was management’s further commentary regarding their intentions on incorporating an inflation adjustment on future lease renewals.

With effectively full occupancy rates and cash collections, the company is heavily dependent on the external market for growth. Shorter duration leases do provide some markup opportunity, but their primary driver of growth will continue to be portfolio expansion.

Though the company has exceeded expectations on this, there is a risk of a slowdown, considering widening spreads between buyers and sellers and lender hesitancy. PSTL has proved capable in overcoming these challenges, however.

And access to capital markets is supported by confidence in the credit and staying power of their sole reportable tenant, the USPS. As long as rents are being paid and leases are being renewed, PSTL should have no issues raising funds for future acquisitions.

Income investors could also rest easy knowing their quarterly payouts are backed by a durable stream of cash flows. Continuous quarterly increases further sweeten the deal. At about 16.9 forward FFO, the stock isn’t heavily discounted at the surface level.

But usage of a dividend discount model with similar inputs from a prior analysis does impute an estimated share price of about $18.50/share, assuming a 7.5% discount rate and a long-term dividend growth rate of 2%. This would represent over 15% upside in the shares. And on top of that, investors would receive a quarter payout yielding about 6%. For many, that is a package worth holding onto.

Be the first to comment