Delpixart/iStock via Getty Images

Postal Realty (NYSE:PSTL) buys post office related properties from mostly mom-and-pop sellers and leases them to the USPS. Despite having a tiny market cap of just over $300 million, this space is so fragmented that PSTL is by far the market leader.

The Buy Thesis

Postal has quality aspects to its business that would normally cause a stock to trade at a high multiple, but a recent sell-off makes PSTL opportunistically cheap. Specifically, PSTL has:

- Reliable external growth through uncrowded pipeline

- Extremely low churn

- High visibility to future cashflows

- Minimal capex

- Reliable organic growth

- Benefits from inflation

- Benefits from recession

Such attributes would usually cause a REIT to trade at an FFO multiple in the mid 20s, but Postal’s story is still unknown to the market resulting in a 2023 FFO multiple of 15.5X and a 15% discount to net asset value (NAV).

I will begin by exploring each of these aspects of PSTL’s business and then look into what could cause the market price to more properly reflect fundamental value. I will also cover risks to an investment in PSTL.

Reliable growth through uncrowded pipeline

The infrastructure required to run the USPS is massive with last mile distribution facilities, industrial scale sorting warehouses and mid-size hubs. It is billions of dollars of real estate and most of it is owned by individuals who only own one or two facilities.

This level of fragmentation causes higher cap rates allowing PSTL to buy around 7% while other industrial properties are going for around 5%.

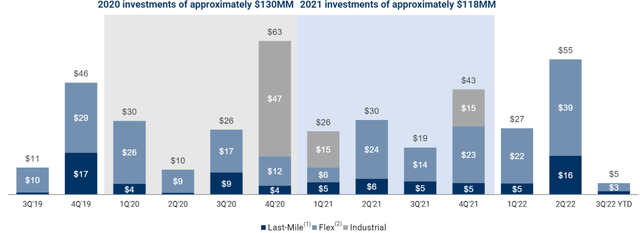

Abnormally high cap rates combined with a large total addressable market (TAM) portends years of accretive growth. So far, PSTL’s acquisition volume has been huge relative to its market cap, averaging over $100 million per year.

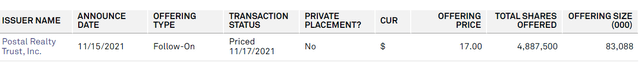

In late 2021 PSTL raised $83 million at $17.00 per share which using 2022 FFO of $0.91 is a roughly 5.4% cost of equity capital.

S&P Global Market Intelligence

With a weighted average cost of debt of 3.48% PSTL has a weighted average cost of capital (WACC) of 4.632% using their targeted 40% leverage ratio.

As of most recent quarter, debt to total capital was 33% which means the near term transactions can be levered a bit more than 40% to get to the target which further pulls down the WACC.

Thus, Postal’s spread on investment (ROIC less WACC) is about 240 basis points which is quite a comfortable margin and should directly translate to AFFO/share accretion. With continued acquisition volume approximating roughly 1/3 of market cap per year, the accretion should be quite substantial.

In most real estate sectors a 240 basis point acquisition spread is good, but I think it is particularly good for PSTL due to the nature of the assets.

Some of the spread is usually lost to things going wrong. Perhaps a tenant doesn’t pay or leases are not renewed and you can’t find a replacement tenant.

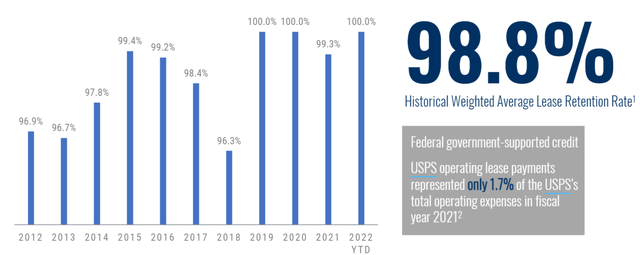

Well, PSTL’s income is about as reliable as it gets. The USPS has never failed to pay rent and they renew their leases 98.8% of the time based on the last 10 years.

The 98.8% retention rate is even more impressive considering these are 5 year leases. That means churn in any given year is about 1/5 of 1.2% or about 0.24%.

Compare that to any other real estate sector.

Apartments have annual retention rates of about 55% with 1 year leases or shorter resulting in ~55% annual churn. Industrial retention rates fluctuate between 40% and 80% with lease terms of roughly 8 years on average making for about 7.5% annual churn.

Each time tenants are churned, the REIT must incur expenses to get the property re-leased. Tenant improvement costs and leasing commissions take as much as 20% out of office REIT revenues and roughly 10% out of industrial revenues. Apartments are less expensive on leasing costs because the tenants usually come to the landlord looking for space, but maintenance expense is rather substantial.

PSTL’s extremely high tenant retention rate avoids just about all of these expenses.

The leases with the USPS are double net and re-leasing to the USPS usually does not incur TI, LC or free rent.

Thus, the rental income is quite reliable and flows cleanly through to the bottom line. This makes the 7% cap rates all the more lucrative. Postal’s renewals are often better than just maintaining income.

Organic Growth – inflation beneficiary

Each renewal has a rate adjustment and these adjustments are calculated to account for inflation and other market conditions. Since the 5 year leases are flat during the term, ordinary 2% inflation would result in roughly 10% roll-ups on renewal.

As you know, inflation is far higher than 2% today. A couple years of 8% inflation and a few more of more normal inflation results in rollups on upcoming leases that are likely 20%+.

The upcoming leases were discussed on the 2Q22 conference call in which PSTL’s President, Jeremy Garber, fielded questions from analysts:

Robert Chapman Stevenson

“Okay. And then I guess the other question for me, what are the conversations like with the Postal Service and their representatives these days in terms of terms? Given it’s a government entity and a little — probably a little slower to react than other people. How much are they acknowledging the level of inflation and all the other stuff that’s inherent in the market real estate leases for your typical Taco Bells and other sort of stuff? How much of that are they recognizing as you try to negotiate lease terms going forward here? Are they still sticking to where they’ve been in the past? Are they acknowledging that today is a different day than it’s been for the last 10 years, et cetera? How are those conversations these days with the tenant?

Jeremy Garber

Yes. Rob, there’s no real change in structure. They’re still negotiating 5-year term, which, as you know, gives us the opportunity to mark our rents to market on an ongoing basis. And they’re very much aware of inflation. It is a dialogue that we are having and a solve that we’re all looking to work through as we work through the 2022 and 2023 lease renewals.

Operator

We have next question from the line of Jon Petersen with Jefferies.

Jonathan Michael Petersen

Okay. Yes, maybe I could pick up on that last question on kind of lease renewals and inflation. I mean, can you give us any indication of how successful you have been in pushing higher rents? And I guess, just for modeling purposes, as we think through the balance of this year and into next year, like should we assume higher leasing spreads than what you’ve achieved historically?

Jeremy Garber

Yes. Again, Jon, our goal is to make sure that we capture the current environment in our releasing spreads. As you know, we’ve been successful in the past in negotiations with the Postal Service around lease renewals. And as I stated, they’re well aware of the current environment. We’re in constant dialogue with them and we’re confident that we’ll be able to achieve something that captures the current environment”

88% of PSTL’s debt is fixed rate. This makes them a clear beneficiary of inflation. Their rental income rolls up with inflation, but their expenses stay largely flat.

Recession resistant and maybe even beneficiary

In good times it is nice to have a reliable tenant, but when the recession rolls around PSTL will stand above the crowd as the REIT with the tenant that is almost certainly going to pay.

The USPS rent is not subject to government budget appropriations. Whether there is a recession or not, they still need to deliver mail and packages throughout the U.S. It is considered akin to a public utility. Just as it would not be okay for municipalities to shut off water supply to poor areas in times of recession, it would equally frown upon to cut off mail service.

The USPS is much like their couriers. Neither snow nor rain, nor heat, nor gloom of night keeps the USPS from paying rent.

The above makes PSTL more resilient than most in recession, but how are they a beneficiary?

Since most of the properties are owned by mom-and-pop owners, a recession will tend to cause 2 things to happen:

- More properties available for PSTL to buy

- Higher cap rates as sellers are more motivated to sell.

Valuation

During market sell-offs it is fairly common for small caps to be punished a bit harder than the rest of the market. When someone sells there might not be buyers around to scoop up the shares so the market price has to drop to the point where there is a bid waiting. It isn’t rational or “efficient market”, but that is what happens in the real world.

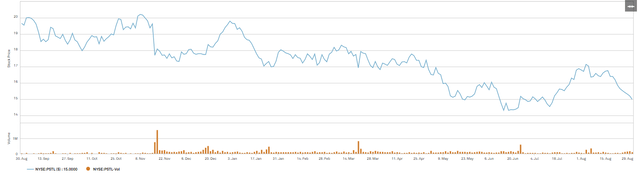

The dearth of buyers has led to a precipitous decline in Postal’s market price.

S&P Global Market Intelligence

At this new lower price, I find Postal to be deeply undervalued.

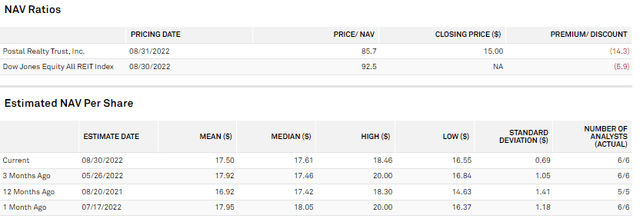

On a NAV basis, it is about 15% discounted to its asset value.

S&P Global Market Intelligence

It is even cheaper on an FFO and AFFO basis with the stock trading at 15.5X forward FFO and 14.6X forward AFFO.

Postal exists on a plane somewhere between triple net and industrial.

- Triple net REITs trade around 17X-19X AFFO.

- Industrial REITs trade at a median 25X AFFO

Fundamentally PSTL is arguably the best of both worlds. Its revenues have the reliability and visibility of triple net REITs, but it has the rapid growth of an industrial REIT.

Thus, its natural multiple is somewhere around 25X.

However, there is and probably should be a small cap discount. At just over $300 million market cap, PSTL is arguably still subscale. As such, I would put a 3 turn discount on it and view the fair multiple as 22X AFFO.

So, how could Postal’s market price close the gap between today’s $14.67 and its fair value of ~$21.50?

Catalysts

Both of these are fairly long term as they will take a couple years to play out:

- Getting added to the Vanguard Real Estate ETF (VNQ)

- Beating consensus estimates

The minimum size for inclusion in the index underlying the VNQ fluctuates, but right now it is about $550 million. At current pace of growth, PSTL should get there in about 2 years.

Index inclusion is a big thing because the VNQ alone will buy up as much as 8%-13% of outstanding shares. Other indices and passive ETFs have similar thresholds for inclusion with the total passive ownership often surpassing 30% of outstanding shares.

That is massive buying volume and the removal of shares from float tends to buoy the price up long term.

Growth versus consensus estimated growth

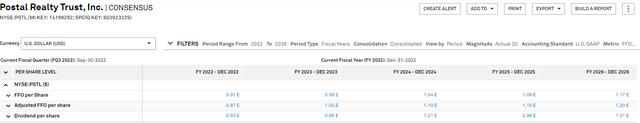

Current consensus estimates are calling for PSTL to grow its FFO/share from $0.91 in 2022 to $1.17 in 2026.

S&P Global Market Intelligence

28% growth over the next 4 years is solid, but I think these estimates undershoot the potential.

Over that period most of PSTL’s leases will roll over giving full effect to inflation. The rental rate bump alone would cause FFO growth of greater than 20% (margins increase when revenues roll up).

A large external pipeline of acquisitions at 240 basis points of spread over cost of capital should add more than a few pennies. My estimates suggest 2026 FFO would be closer to $1.30.

If and when PSTL’s growth exceeds the consensus estimate, the analysts will have to revise their estimates up which usually comes with fresh buy ratings and freshly higher price targets which tends to pull market price up.

Risks to investment in PSTL

There is a lot of doom and gloom rhetoric out there about the post office due to its minimal profitability. I don’t see it as a real threat because the U.S. government is quite accustomed to operating at a deficit. It takes quite a bit to break hundreds of years of stability and I don’t see any threats on the horizon to the USPS.

Instead, I would focus on the more real and more likely risks to PSTL:

- Equity issuance need

- Getting outscaled by a new peer

In order to fund its acquisition pipeline, Postal will need to continuously issue equity. The risk here is that if market prices are not cooperating equity cost of capital is higher and spreads over WACC would be lower. PSTL can only control the timing of its issuance and if market prices remain depressed for a long time they may not have much choice.

Although PSTL is currently the clear market leader in Postal real estate, a well-capitalized entity could swiftly surpass them in size by bidding on every property that comes to market. Such a move would not harm PSTL’s current cashflows, but it might take cap rates down. I have been worried about such a move for a couple years now and have so far been wrong, (fortunately for PSTL). Perhaps the individual property size is too small for big institutions to care about the space, but it is a threat I will keep an eye on.

The bottom line

Postal has a great niche business model that provides above economic returns. A low market price provides opportunistic entry into a great company.

Be the first to comment