golero/E+ via Getty Images

Thesis

We are initiating coverage on Poshmark, Inc. (NASDAQ:POSH) and are recommending a “HOLD” as we believe that there are too many risks facing the business during these uncertain economic times. The company has shown mixed financial performance in its recent earnings report, but the metrics are generally positive. However, we are concerned about the continued unprofitability, and we believe that major risks such as competitive and macroeconomic risks will continue to affect the company’s bottom line.

Company Overview

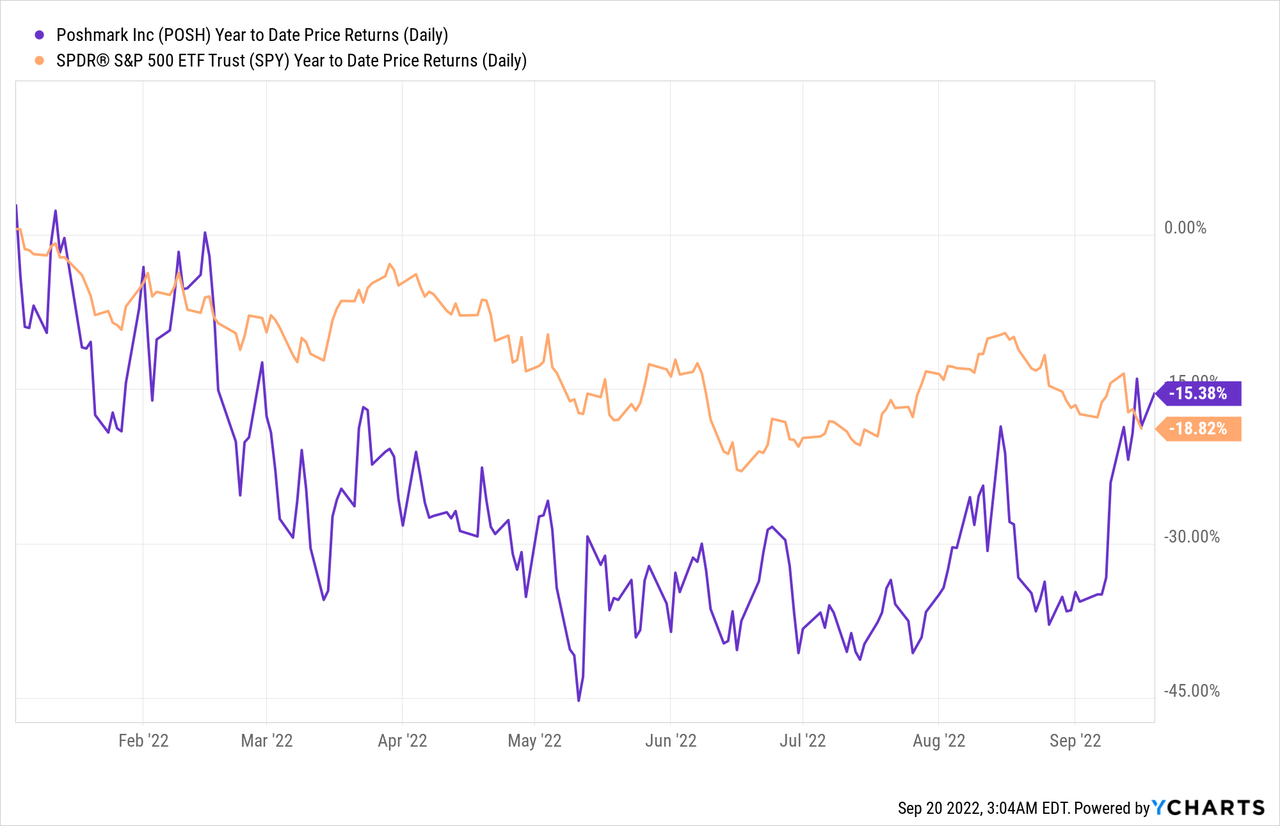

Poshmark is a social commerce marketplace where users can buy and sell new and secondhand fashion, home goods, and electronics. The company operates a platform that is the leading social marketplace for new and secondhand style for women, men, children, pets, home, and more. The platform has over 80 million users, with over 200M available listings. Poshmark completed its IPO at $42 per share, with a valuation of $3 billion. The stock price began trading after its IPO at $97.50 per share, at a valuation more than double its IPO valuation. The company’s stock performance has tracked the S&P 500 year-to-date, with Poshmark returning -15.38% compared to S&P 500’s return of -18.82%. Poshmark has a market capitalization of $1.13 billion.

Recent Earnings

Some Positives

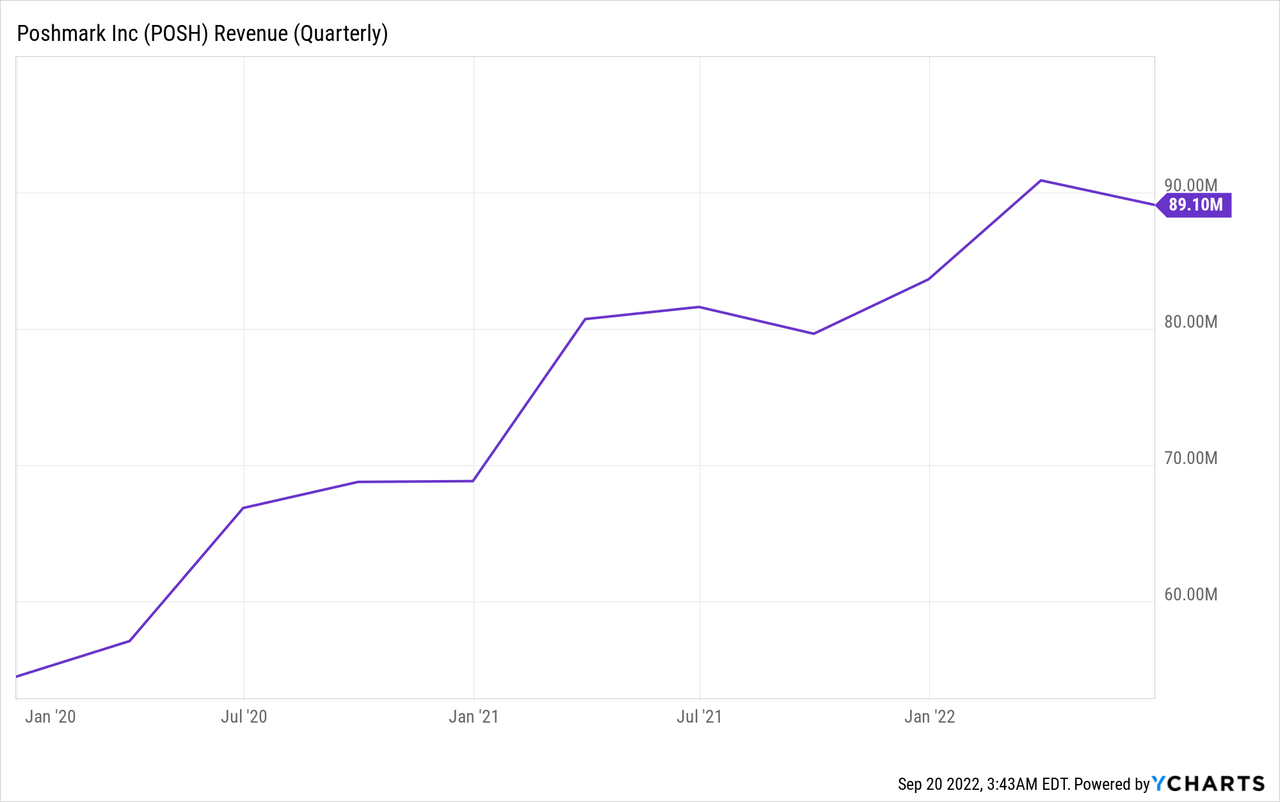

Poshmark had some solid YoY quarterly financial performance growth, mostly notably in its net revenue. The company reported a net revenue of $89.1 million in Q2 2022, which represented a 9% YoY growth compared to $81.6 million in Q2 2021. Gross Merchandise Volume (GMV) which measures the volume of the sales of goods sold in the marketplace also rose 8% YoY. Furthermore, management reported that in the last 12 months, the number of active buyers reached 8 million users, which represents a 14% YoY growth compared to the same metric in Q2 2021. We view the YoY revenue growth, GMV growth, and the increase in the number of active users as good signs that the company continues to grow and gain traction within the industry. In addition, the company has had $581.2 million in cash on the balance sheet, which is nearly half of the current market capitalization of the company. As a result, we view the balance sheet as fairly safe as well.

Some Negatives

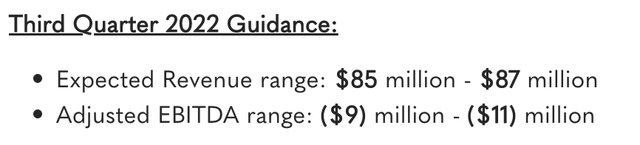

There were some poor financial metrics in the earnings announcement as well. First and foremost, the net loss per share expanded from -$0.03 per share in Q2 2021 to -$0.29 per share in Q2 2022. Similarly, the Adjusted EBITDA also turned negative on a YoY basis, with Adjusted EBITDA being -$9.8 million this past quarter compared to $6.5 million in the quarter a year ago. Guidance for this Q3 2022 remained negative, with Adjusted EBITDA range coming at a range of -$9 million to -$11 million. The declining profitability metrics are concerning, and though the company has ample liquidity as a result of the IPO, we believe that management needs to provide a better guidance of profitability metrics in the future to make us recommend the stock.

Q3 2022 Poshmark Earnings Presentation

Major Headwinds

Competitive Risks

Poshmark is one of many competitors operating in the luxury resale space, with large fashion-oriented players like Farfetch (FTCH), Grailed, TheRealReal (REAL). In addition, there are larger e-commerce players like eBay (EBAY), Etsy (ETSY), Amazon (AMZN), Walmart (WMT), and other businesses that also have a component of fashion resale in its product line. We believe that such a wide array of players in the space will make it hard for Poshmark to improve profitability metrics, as the company will need to continue to spend to attract users and remain commissions low in order to keep sellers at Poshmark.

Macroeconomic Risks

Poshmark is a marketplace for resale fashion goods, and we believe that the company’s business model is likely to be challenged in the event of a major economic recession led by a decline in U.S. consumption. Though it is likely that resellers will fare better selling used fashion goods at lower prices than retailers selling goods at retail price, we believe that consumption will nevertheless drive demand for fashion goods as a whole lower, which would translate to lower GMV for the business and subsequently lower commissions. Already, used auto prices are dropping and so are luxury fashion goods such as watches. As the economy slows down further from high inflation and interest rate hikes, we believe Poshmark will also its business model severely impacted by the economic circumstance.

Conclusion

Poshmark is a stock that needs more clarity before making a position in either direction. Though the company’s financial performance has been all-around decent, the worsening profitability metrics in the face of greater competitive risks and macroeconomic slowdown make this stock dangerous to go long on. We recommend investors to continue to keep watch on this stock and wait until economic conditions improve and/or management gives a more clear guidance on its path to profitability.

Be the first to comment