bhofack2/iStock via Getty Images

Having grown up in suburban Chicago, I’ve been eating Portillo’s (NASDAQ:PTLO) since I was a kid. As I became interested in business and investing, I’d always wanted to be a part-owner of Portillo’s which has an iconic brand, loyal customer base, and large crowds for lunch and dinner. With shares off 50% over the past year, I thought now might finally be my chance to own a piece of the action.

Despite the significant fall in the share price, Portillo’s continues to trade at lofty multiples of EBITDA and earnings. Further the company faces meaningful near-term headwinds as inflationary forces drive up expenses and a potentially weakening consumer environment as the economy slows. In addition, insiders recently dumped 8 million shares (less than a week after the company’s Investor Day in November). Lastly while I expect that Portillo’s will continue to expand its restaurant base in the years to come, unit economics in new markets have less attractive economics than its home Chicagoland market.

Overview

Founded in 1963 by Dick Portillo, Portillo’s is an iconic fast food restaurant featuring Italian beef sandwiches, hot dogs, hamburgers and salads with an average ticket of ~$10 per guest. In 2014, private equity firm Berkshire Partners acquired Portillo’s (which had 38 restaurants at the time) for a reported $1 billion price tag.

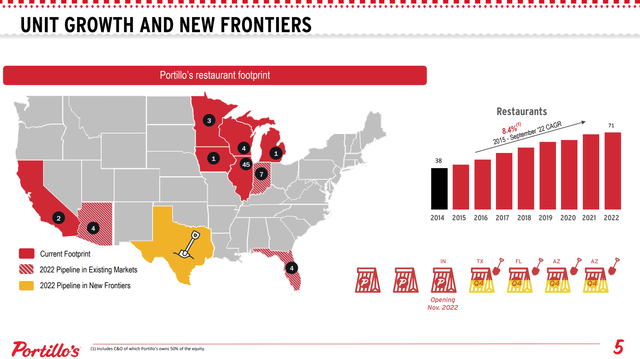

Under Berkshire Partners ownership the focus has been unit expansion. In the past 8 years, Portillo’s has nearly doubled its footprint to 71 locations of which 47 are in greater Chicago (another 17 restaurants are located in adjacent Midwestern states). The company came public in 2021 – while the IPO was priced at $20 per share the stock soared to a price of $50 before falling to a current price of $19.30. In November Berkshire Partners sold a meaningful portion of its stake.

Geographic Footprint (Investor Presentation)

In recent years the company has expanded beyond its core Midwestern footprint to fast growing sunbelt states Florida and Arizona (with plans for Texas). While these restaurants have been successful – as discussed in the next section, average unit sales and profitability are well below the exceptional results achieved in Chicagoland.

Lower Unit Volumes & Lower Margins Outside Chicagoland

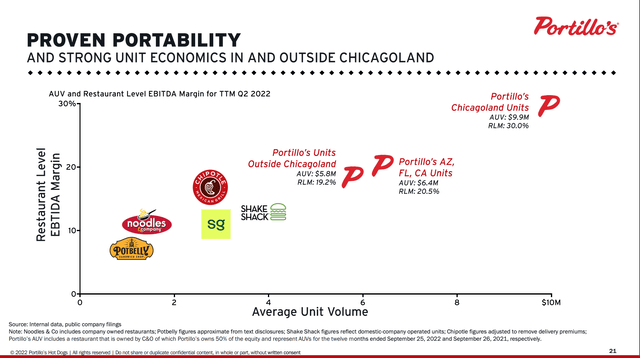

Portillo’s has fantastic unit economics in its home market of Chicago. As shown below Chicagoland restaurants generate nearly $10 million in annual revenue at a 30% restaurant level (excluding corporate) EBITDA margins. Within the Chicagoland market Portillo’s generates industry leading sale and profitability, well in excess of peers like Shake Shack (SHAK) and Chipotle (CMG).

Average Unit Volume and Restaurant Level Margins (Investor Presentation)

However, Chicagoland is a mature market for Portillo’s with limited opportunity for continued restaurant growth. As Portillo’s has moved beyond its home market, unit economics, while good, are well below levels achieved in Chicagoland. Portillo’s Chicagoland restaurants generate an astounding $3 million in EBITDA per location – to put this in context, Portillo’s EBITDA per Chicagoland location is roughly equal to McDonald’s revenue per location! However, restaurants outside Chicago produce a fraction of this ($1.1-$1.2 million in EBITDA per location).

Restaurant sales and profitability per location outside of Chicago are unlikely to reach the otherworldly results achieved in Chicago given differing tastes in local cuisine, lower brand awareness, and different competitive dynamics (for instance in California and Arizona, Portillo’s competes with local favorites such as In N Out Burger).

Current Results

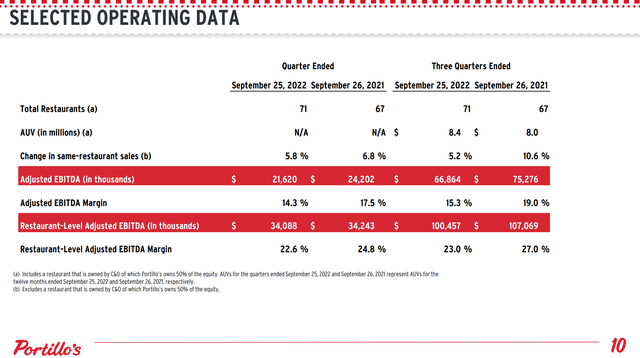

Current Results (Investor Presentation)

Despite having a larger store base in 2022 than 2021, Portillo’s has seen EBITDA decline 11% year-over-year as inflationary pressures have increased food and labor costs while transactions declined 3% year-over-year. Notably traffic has been weak despite the company deliberately increasing prices less than competitors (and seemingly below the rate of inflation which has run 6-8% for food and labor).

3Q22 Management commentary (Seeking Alpha Transcripts)

Valuation

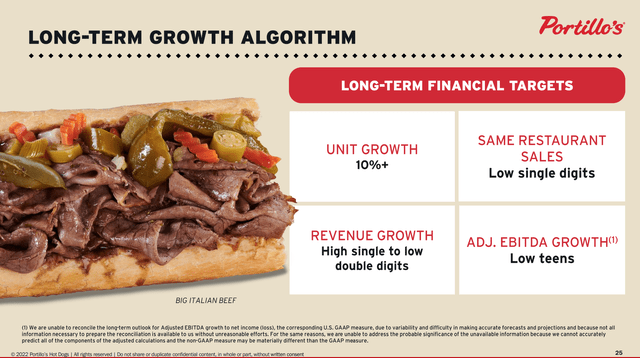

Despite the decline in the share price, Portillo’s trades at 18x my estimated 2023e EBITDA and 31x 2023e EPS. For 2023, I assume that EBITDA recovers to 2021 levels as the company continues to expand its store count. Over the medium term, Portillo’s financial objectives are shown below:

Financial Targets (Investor Day Presentation)

I think a fair value for the business is somewhere in the neighborhood of 12-13x EBITDA which credits Portillo’s for its strong brand, fantastic home-market unit economics and long-term growth potential while being cognizant of risks to its expansion strategy (and less attractive economics) and the competitive nature of the fast food industry. Applying a 12-13x EBITDA multiple to estimated 2023e EBITDA gets me to a price target of $11-13 per share.

Conclusion

While I plan to visit Portillo’s on my next trip to Chicago, this is not a stock I’m interested in owning at the current price. As a value investor, I look to buy stocks at a minimum 30% discount to my estimate of fair value. As such, I’d be a buyer in the $9-10 range.

Be the first to comment