nrqemi/iStock via Getty Images

A friend of mine just came back from a trip to Zurich and asked me about my opinion on Polestar Automotive Holding UK PLC (NASDAQ:PSNY). Despite my aspiration to become the knowledge center in the electric vehicle (“EV”) field, I did not know how to answer. You can imagine my shame. A couple of days later, another friend from Germany asked me about Polestar too. Again, I was ignorant. Determined not to feel shame again, I decided to educate myself and conduct research on the company.

Polestar started its EV production as Volvo’s (OTCPK:VOLAF, VLVLY, VOLVF) and Geely’s (OTCPK:GELYF) subsidiary in 2017, but later developed into an autonomous enterprise. It became an emerging EV baby with ambitious plans in the premium segment and a strong support from its parents. In 2021, Volvo announced plans to list Polestar via SPAC in combination with the investment group Gores Guggenheim. In June 2022, a listing occurred, and since then the share price decreased from $13 to $5 per share. Actually, I have never seen an increased price after the SPAC listing. Please share in the comments if you know any.

The key question that investors ask in such a situation is if the bottom remains in the rearview mirror. I will be frank with you, my team and I do not know. But we believe that the August / September share price decline was mainly caused by temporary COVID deterioration in China affecting the production premises and recent broad market turmoil. From a long-term perspective, Polestar achieved a solid production track record and started gaining recognition across consumers all over the world. Additionally, we challenged the sales forecast provided in the SPAC presentation and it seems achievable. The company’s valuation is also attractive. What stops us from issuing a Buy signal is the profitability development. Let us share our conclusions and investment strategy with you.

Product range and its recognition

Polestar 1

Polestar is Volvo’s baby, and Volvo is perceived as a safe car for the family that wants to enjoy Scandinavian stability. Does such a family sound like a typical buyer of an innovative electric vehicle? Apparently not. Especially keeping in mind all the issues with charging infrastructure. Therefore, Polestar did its best to cut its umbilical cord from Volvo and make a name for itself.

Its first vehicle, Polestar 1, launched in 2017, was nothing like Volvo. Retailing at $160,000, it was elegant, pricey, and limited— not your typical family car. In 2017, pure battery technology was still in the infant phase, which is why Polestar 1 was built on a plug-in-hybrid base. The technology turned out to be an interim one. The vehicle’s 470 miles range was impressive, but its peers can do better now. For instance, Lucid Air has 520 miles of range on batteries alone. In terms of sales, the model remained a niche product.

Originally, a three-year production was planned with a capacity of 500 units per annum. However, only 65 vehicles were delivered to the European market. Although the production of the model was stopped in 2022, Polestar 1 played a prominent role in launching and establishing Polestar as an electric performance brand in the premium segment.

Polestar 2

In 2019, Polestar2 was launched. Its price starts at $49,000 and the car is positioned as a premium one in the EV segment. After a test drive over the last weekend, I would say it is a good Volvo-like electric model. Is it premium? I do not think so. Does it matter? I do not think so. What matters is that the car started gaining traction across the globe. While only 10,000 vehicles were sold in 2020, 21,200 were sold in the first half of 2022 alone. Polestar leveraged Volvo’s established network to sell its vehicles worldwide. The share of U.S. sales increased from 1% to 12% in 2020, and the share of sales in Asia and Rest of the World reached almost 20%. Additionally, Polestar continues to expand its presence in Europe. For instance, it signed several contracts with leasing companies, such as Arval in Spain and in Italy.

Polestar does not publish its exact pre-order data, but we know that one of the biggest renting companies, Hertz (HTZ), placed an order for 65,000 vehicles over the next 5 years. Knowing that it is a five-year order, Hertz likely expects to purchase 13,000 cars by Polestar annually. Given that Hertz has a total fleet of 430k vehicles, the annual purchase corresponds to 3% of Hertz’s fleet. It means that the order is still marginal and provides a potential upside in case the delivery succeeds.

By the way, Hertz was also planning to buy from Tesla (TSLA). I guess it is a good argument that Polestar can compete with Tesla. Clearly, it does not have as advanced road assistance and auto-pilot capabilities, but it could be a good choice for more conservative drivers. Additionally, when advanced autopilot software is developed, it could be installed at Polestar which relies on Google in terms of software.

If you read all this and are astonished that Hertz is still alive, then you have the same ‘wow’ effect as I did when I started my analysis. Despite initial trouble during COVID-19, Hertz survived. You can read the magnificent story of Hertz’s recovery after the COVID-20 hit there. In summary, the retail investors saved Hertz.

Polestar 3 and beyond

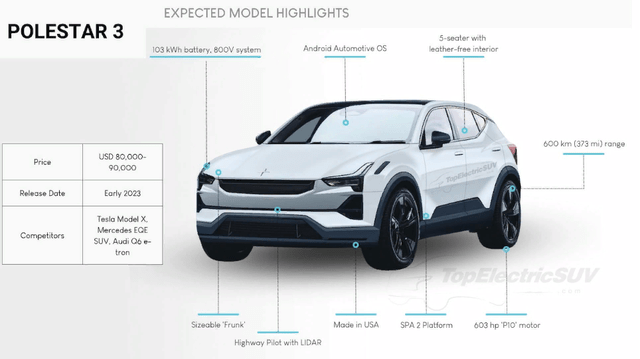

As for the premium segment, let’s take a look at Polestar’s third child and its similar, iconic name— Polestar 3.

The model’s production plans were initially announced in June 2021. Now the vehicle’s release date has finally been revealed, scheduled for October 2022. What is notable is that the SUV will be delivered to the markets in 2023, an entire year later. Nevertheless, the U.S. is said to receive vehicles after Europe due to the later production start with a starting price at around 90k. Polestar positions itself as a competitor to the Porsche Cayenne. But what about price and U.S. funding eligibility? In contrast to Polestar 2, Polestar 3 will be produced in China and the U.S. Unfortunately, according The Inflation Reduction Act (“IRA“), only sedans under $55,000 and SUVs and vans under $80,000 will be subsidized. That leads to the conclusion that even though Polestar is not a Chinese company, it won’t get any U.S. federal subsidies.

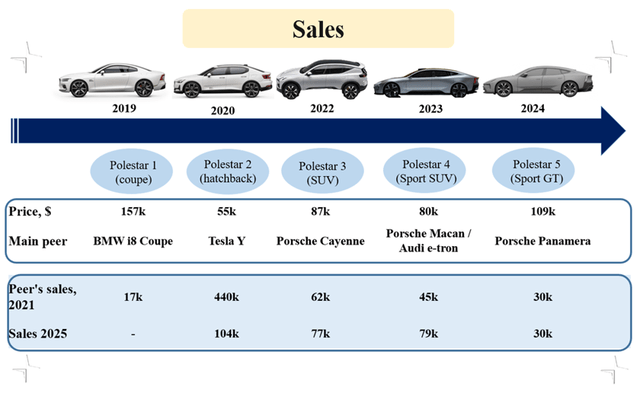

Prepared by author based on annual reports

In the future, Polestar plans to enlarge its presence in the premium segment by launching further models. The company does not disclose the exact prices, but mentions the main model’s peers. Based on that claim, we estimated vehicle prices and checked if sales mentioned in the SPAC presentation could be achieved. Sales of Polestar are expected to achieve 104k in 2025, only ¼ of Tesla Y sales in 2021. Evidently, the former has a much stronger brand, so one-fourth seems a reasonable estimate. Conversely, sales of Polestar’s EV models are anticipated to be higher than Porsche internal-combustion models.

I deem this estimate reasonable, as the competition is tougher in the traditional car segment compared with the emerging EV market. On top of this, given recent software problems by Porsche (OTCPK:POAHY) and Audi (OTC:AUDVF), Polestar may outpace them in the EV segment and secure their premium niche. Polestar’s reliance on Google (GOOG, GOOGL) helps in terms of roll-out speed, but cuts the business marginality due to royalty fees. While Volkswagen (VWAGY, VLKAF, VWAPY) relies on internal software development, it could help reach higher profitability but continues to have execution issues.

Production

Recent setbacks

Polestar is uniquely positioned compared to its peers. It started its production in 2020 before going public, and since then has managed to increase it significantly. In 1H-22, Polestar doubled production compared with 1H-21. Initially it planned to manufacture 65k over the entire year in 2022, but then the forecast was decreased to 50k.

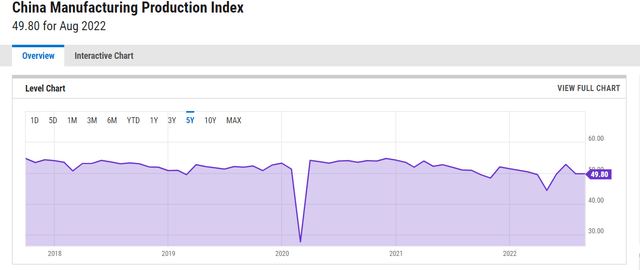

The company explained the decrease as a result of protracted lockdowns in China. And although Zhejiang province, where the Polestar 2 factory is located, is not the most affected, I believe this explanation. The supply chains depend on the entire Chinese region. As we see from the China Manufacturing Production index, in the 1st half of 2022 it decreased, pretty much evidencing difficulties in the overall Chinese economy.

Polestar 2 is produced at a Chinese factory in Taizhou, Zhejiang province, a region located near Shanghai. Polestar 3 will be produced in Chengdu and in the U.S. at Charleston. The key question for successful roll-out this year is if the provinces are affected by COVID. So far, the authorities have extended COVID restrictions, and it is known that at least 68 of Chinese cities are currently in lockdown. The fact is that while Zhejiang, where Polestar 2 is produced, is slightly affected, Chengdu, the Polestar 3 producer, is affected heavily. Lin Hancheng, the authority of China’s production hub, Shenzhen, stated in early September:

The city’s COVID situation is severe and complex. The number of new infections remains relatively high and community transmission risk still exists.

Nevertheless, even in Zhejiang’s capital there are tight requirements around testing (tests have to be done every 72 hours instead of once a week). It is reported that several factories in China arranged their workers to live in the “closed-loop” systems, where they spend all the 24 hours near the manufacturer in order to continue functioning. As the last two years showed, it is challenging to forecast COVID-19 development. Still, I believe that COVID-19 headwinds will be temporary. Additionally, Polestar 3 will also be produced in Charleston, U.S. Therefore, the Chinese zero-tolerance policy to COVID-19 is unlikely to harm the company at full pace.

Long-term positioning

Compared with other start-ups, Polestar does not need to build production factories from scratch. It does not have such roll-out problems as Rivian Automotive (NASDAQ:RIVN) and Lucid Group (NASDAQ:LCID) face. When comparing Polestar, Lucid, and Rivian, it turns out that while Lucid’s half-year production was 1,405 units and Rivian’s 6,954, Polestar’s roll-out equaled 21,000 vehicles.

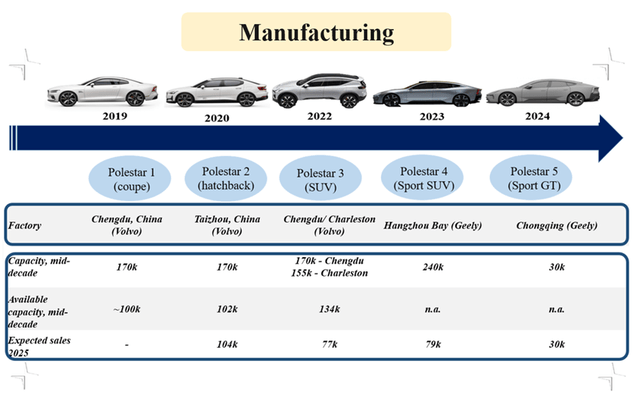

As for manufacturing potential, the company leverages the free capacity available from Geely and Volvo in China. We can conclude that there is enough capacity by Volvo’s plant to produce the targeted Polestar 2 and Polestar 3 vehicles. Geely does not disclose such detailed information for its plants, but we understand that plants for Polestar 5 will be built by Geely (Chongqing factory) specifically for the model. Additionally, Polestar plans to build production capacity in Europe; the Capex for these premises is not included in its projections. It would be critical to have European premises given worldwide logistics inefficiencies. Plus, the absence of European factories would lead to lower profitability in Europe compared with competitors.

Prepared by author based on annual reports

Projections, profitability, equity dilution

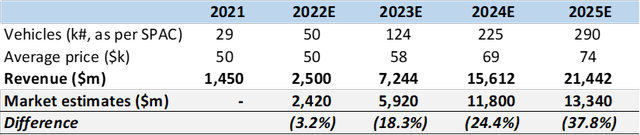

Based on the vehicle roll-out plans shown in the SPAC presentation, we forecast revenue development by 2025 and compared it with the market estimates. Although the market expects Polestar to meet its guidance in 2022, it expects about 25% underperformance over the next few years. Given an established production base, I believe that Polestar has solid chances to meet its forecast if COVID restrictions fade away in China. However, I will use market estimates for the projections to be on the conservative side.

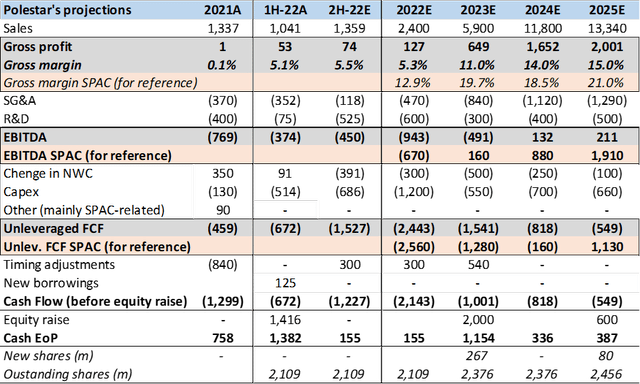

Prepared by author based on SPAC projections

Recently, Polestar published its 1H-22 results, which will allow us to better forecast the 2022 full year outlook. Unfortunately, its first half figures are worrisome in terms of profitability and expenses. Polestar achieved only 5.1% gross margin, making it almost impossible to reach SPAC margin of 13% over the entire year. The company explained its low profitability as a result of “product and market mix.”

I wonder what “product mix” the company is referring to. The only company product in 2022 is Polestar 2 that costs about $50,000 in its initial version. I would not think that the lower factory utilization had a strong effect on the margin decline. The underperformance compared with the initial outlook was about 20% and does not seem significant enough to lower the gross margin by seven percentage points. Could higher energy prices affect profitability? For our analysis, we took the price index in Beijing as a proxy due to the fact that the info about all the Chinese regions is not available online. After analyzing the chosen data, we came to the conclusion that the price increase was about 8% and would not influence the cost of production.

Therefore, I would like to understand what really drives Polestar’s profitability. In initial SPAC projections, Polestar achieved over 20% gross margin by 2025 and was indispensable for positive cash generation in the long-term. Decreasing gross margin to 15% would result in negative cash generation. Therefore, it is key to understand the reasoning behind the profitability.

The second thing that puzzled me in the latest reporting is the split between SG&A and R&D costs. It differs completely from SPAC projections. In the first year and a half, Polestar spent about $75m on R&D (subtracting depreciation and amortization) compared with $600m anticipated in the projections over the entire year. Does that mean that Polestar will delay its vehicle pipeline? On the contrary, SG&A reached $350m in 1H-22, while the full-year costs should be about $470m. Did the company do some unplanned marketing campaigns to support sales? Does it mean that Polestar’s vehicles do not get enough traction among consumers? I would like to know the answers to the questions before I invest in the company.

On the positive side, working capital usage looked quite efficient in the first half. If such efficiency is also achieved in the second half, it could help Polestar finish the year with positive cash. Polestar raised only about $1.4 billion at SPAC listing due to the limited free float. Therefore the company would already need to raise about 10% of its current market cap next year. It does not look problematic, especially compared with cash requirements of competitors like Lucid.

Note: the updated SPAC presentation from May is not available on the Internet anymore, therefore I based my benchmarking on the March presentation. I understand that profitability differences are only two percentage points in 2022 across the different presentation versions. But the profitability is assumed to be the same over the following years.

Prepared by author based on SPAC presentation

Valuation

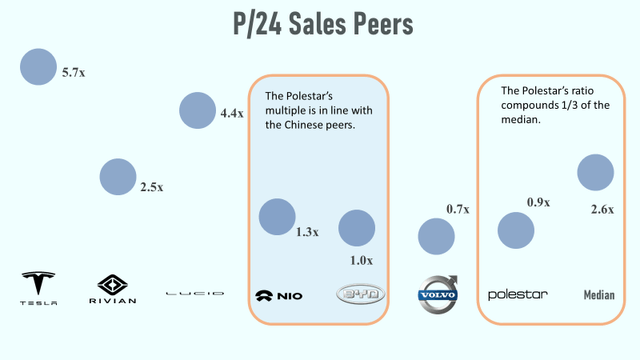

For valuation of an EV start-up, I prefer using the EV/2024 Sales multiple. I believe such metrics are more insightful than any profitability related multiples, given the high uncertainty around business perspectives.

Prepared by author based on SA

Although the Polestar’s 1.4x multiple is much lower than the 2.7x median of the peer group, it is in line with the Chinese peers. For example, Nio has P/24 Sales of 1.5x and BYD – 1.3x. The Chinese companies have lower valuations because they can be delisted from the American stock exchange, and it would be problematic for investors to have access to their Chinese stocks. The delisting risks exist due to the impossibility of evaluating the company in China by an American auditor. The reason for this is the Chinese government policy that the audit must be done by a local company.

Although the market values Polestar as a Chinese entity, it does not have delisting risks. Let me elaborate on this.

If we look at the ownership structure, we see that Geely has a certain controlling power over the company but does not own the majority of voting rights. Geely owns in total 47% of Polestar, 8% indirectly via Volvo, and 39% directly. What we know about the Chinese investment part is the following:

Chongqing Chengxing Equity Investment Fund Partnership, Zibo Financial Holding, and Zibo Hightech Industrial Investment, Chinese state asset managers, are minority shareholders that participated in the $550m private placement announced in early 2021 alongside a range of other investors.

Unfortunately, the share of Chinese investors is not fully disclosed. Could it be above 3% giving above 50% ownership to the Chinese investors? Yes, it could, but the SEC does not perceive Polestar as a Chinese company. Moreover, the latter does not mention any delisting risks in the annual report. Compared with Nio (NYSE:NIO), for instance, that does mention it. The regulator had an extensive exchange on the issue in the pre-IPO phase and got the following answer.

We are a Swedish premium electric performance car brand, headquartered in Sweden, with a global presence. […] Our Holding Company will be in the UK and we are applying to be listed on the Nasdaq in the United States with strong support from top tier institutional investors. Over the past four years, we have made great progress separating the Polestar brand from Volvo Cars. Our business and contracting relationships with Volvo Cars and Geely are conducted on an arm’s-length basis

This means that China-USA relationships may have an effect on the company, especially given the production premises in China. But the company is perceived as European by regulators.

Risks

Since listing, Polestar has a very limited track record, which I see as the main risk. Companies frequently struggle with successful performance after an IPO, even despite a strong track record as a private company.

When analyzing Polestar, some may take a note that the company might have been in a heavy burden trap given a high share of long-term liabilities (1/3 of total assets) and current liabilities (2/3 of total assets). However, long-term liabilities mainly consist of earn-outs that will be gradually converted into shares with the share price increase. For example, 20% of earn-out liabilities will be converted into equity when the share price reaches $13 (almost 100% upside from current levels). Current liabilities largely consist of payables to related parties that may be repaid via further equity issuances (it was already partially done at listing). This means that credit risks are low despite high liabilities, but dilution risks increase in case of successful performance.

A further risk may lie in manufacturing agreements that Polestar concluded with Geely’s and Volvo’s factories. We do not know the conditionals and pitfalls of these contracts. It obviously remains uncertain if the contract can be instantly canceled, when is its ending point. Besides, it is unknown what is the maximum production provided in terms of the policy.

Conclusion

Polestar is definitely a promising company that has multiple opportunities of development in the global arena. However, the profitability issues and a limited track record as a public entity remain main concerns for me. I would wait a couple of quarters before making an investment decision, even despite an attractive current valuation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment