ablokhin/iStock Editorial via Getty Images

Investment Thesis

With current macro conditions favoring the banking sector and recent rapid expansion, The PNC Financial Services Group (NYSE:PNC) is certainly a business to watch. Despite industry factors, an above-average dividend yield, and PNC’s acquisition-fueled growth potential, I still recommend a Hold in PNC. In this article, I’ll go through the buy argument and discuss why I don’t find it compelling.

The Buy Argument

Industry Tailwind

Interest rates have recently hit multi-year highs, a hindrance to the wider market. However, banking is one of the few sectors that stand to improve their performance. Because banks profit from the difference between the yield they generate with cash they invest in short-term notes and the interest they return to customers, rising rates essentially is a free earnings boost for the banking sector. Further, rate hikes improve a bank’s profitability on loans, due to a similar increase in the spread between the federal funds rate and the rate the bank itself charges.

Other less obvious benefits can be seen from differences in long-term and short-term rates. Since the foundation of the Fed, long-term rates have risen faster than short-term rates during periods of rate hikes. This benefits banks, since they borrow on a short-term basis, and lend on a long-term basis.

Therefore, due to current interest rate levels (with no signs of rates dropping in the immediate future), I suspect banks (and thus PNC’s) earnings will improve.

I also find it promising that since rates began increasing in recent years, PNC’s stock has not moved to reflect the margin growth which should be concurrent (and has been, according to Q3 earnings), remaining fairly static throughout 2022 into 2023.

Acquisitions and Firm Growth/Stability

So, the banking industry can exploit current macro conditions. What sets PNC apart?

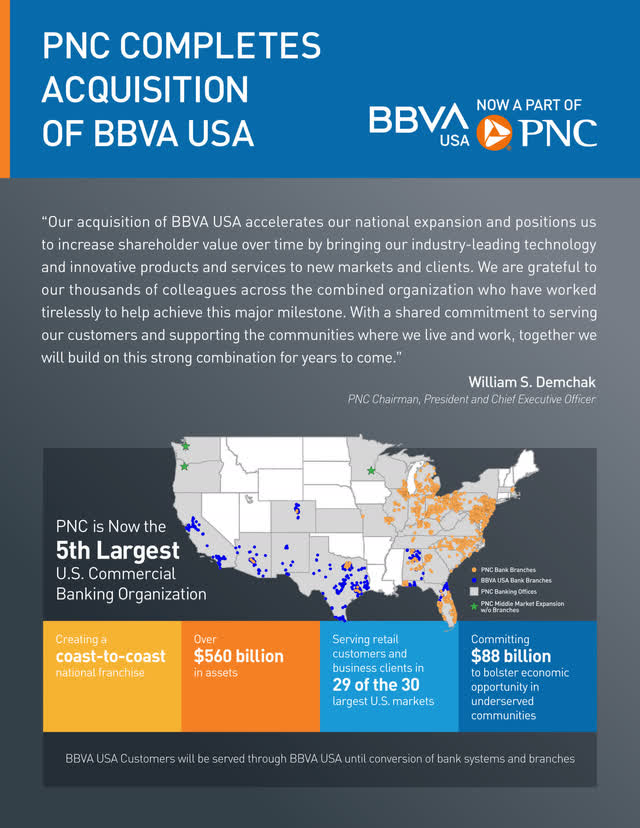

PNC recently acquired the US subsidiary of BBVA (NYSE:BBVA), a move that has improved PNC’s market share and scale. The deal positioned PNC as the nation’s 5th largest bank in terms of total assets and helped expand PNC’s network into states where it previously had little presence.

This acquisition has exposed PNC to new markets and given them the opportunity to expand its retail banking base, a significant portion of its revenue. PNC has had successful large-scale acquisitions in the past, such as portions of RBC (NYSE:RY) or National City, and I see no reason why their acquisition of BBVA would go any differently. Thus, I anticipate the integration of these new branches and customers to go relatively smoothly (more on this later), which accelerates PNC’s national expansion and should provide them with a sizable number of new customers.

I find PNC’s improvement in scale to be complemented by its stable finances. Here are a few key metrics. (All measures in thousands of $.)

| TTM Sep 2022 | FY 2021 | FY 2020 | FY 2019 | FY 2018 | FY 2017 | |

| Total Revenue | 20,475,000 | 19,135,000 | 16,798,000 | 16,839,000 | 16,190,000 | 16,329,000 |

| Total Diluted EPS | 13.25 | 12.70 | 16.96 | 11.39 | 10.71 | 10.36 |

| Dividend per Share | 5.50 | 4.80 | 4.60 | 4.20 | 3.40 | 2.60 |

| Normalized Net Income | 5,903,000 | 6,040,000 | 2,873,990 | 4,739,970 | 5,009,670 | 4,138,350 |

| Net Profit Margin | 28.67% | 29.92% | 17.88% | 27.26% | 28.15% | 33.00% |

| Earnings Retention Rate | 58.52% | 62.20% | 27.67% | 56.11% | 62.47% | 74.90% |

Data sourced from 10-K and 10-Q filings.

There are a few key trends that this data suggests to me. The first is stability — while growth has not been as impressive as many other firms, steady EPS, revenue, and margins all suggest to me that PNC’s revenue base is stable. Further, as previously stated, current macro trends and improvements to scale should improve short-term earnings, and due to their solid earnings retention, their high dividend appears sustainable — potentially even having more room to grow (even better, the quarterly dividend has recently improved to $1.50 per share).

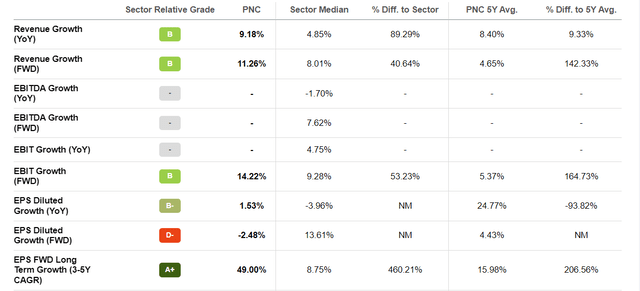

Analyst projections are equally promising, as PNC also has organic growth opportunities that it is taking advantage of according to Morningstar, and Seeking Alpha gives PNC a sector-relative growth grade of A+ (below).

This combination of PNC’s newfound scale, favorable macro conditions, and PNC’s financial stability gives me confidence that PNC’s growth will be stable, though modest.

Dividend

PNC is sweetened by its above-average dividend. Their TTM dividend yield outpaced the sector by nearly 20%, and that advantage is only going to be compounded by the recent improvement to $1.50 per share per quarter.

As I established during my discussion of PNC’s finances, I find PNC to be a stable investment for its sector. Check out its Moody report or ESG risk rating if you’re curious about specifics. Given that banking is a relatively secure industry, having below-average risk in that sector implies a fairly high level of stability, which is a necessity for a dividend-yielding stock.

The Hold Argument

First, I want to clarify something. PNC appeals to investors seeking a stable, dividend-based return (or perhaps exposure to the banking industry, or both) – and for those investors, I find PNC to be a reasonable buy. However, for everyone else, there are a few key issues.

Put most simply, PNC has a few major problems. First: while PNC has somewhat promising near-term prospects for its sector, I still find it likely to underperform the broader index. Second: PNC’s dividend, while above average for the sector, still falls short of being worth the buy. Third: PNC has had to reinvest much of its recent earnings growth, which has muted the effect of BBVA’s integration. If this trend continues to hamper margin growth, PNC’s already lackluster growth would be further impeded.

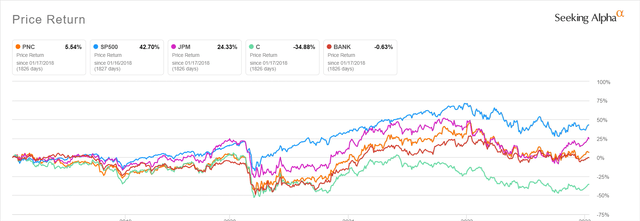

It is no secret that PNC’s growth has historically fallen behind the broader market. While this is true of the banking sector at large as well, PNC is somewhat middle-of-the-pack even within the industry.

PNC’s above-sector-average dividend, coupled with their solid, although unexceptional, performance, makes them a decent option to gain exposure to banking. However, it makes little sense to me to buy PNC now, given that it is highly likely to underperform the market.

For one, PNC has a lack of redeeming qualities to balance out its historically suboptimal returns. Yes, its dividend is above the sector average, but there are other dividend options out there: for example, IBM (IBM) or AT&T (T) each have respectable stability and a higher dividend yield, which would make them a more attractive option for a dividend-based return.

Also, while current interest rates bode well for PNC, those rates are subject to change. With inflation numbers improving, rate increases are likely to slow down. Further, in the event of a recession, the Fed has historically lowered rates, and with a potential 2023 recession looming, industry tailwinds could quickly falter. I don’t find this advantage sustainable outside of the near-term.

PNC also doesn’t present as the most low-volatility option — its beta is actually 1.16, so it is unattractive as a beta hedge.

Simply put, PNC doesn’t present a single factor — not its dividend, not its growth, and not its industry tailwind — that could not be accomplished better by another security. I don’t find PNC’s growth prospects to be attractive enough to justify a buy when there are so many more promising investments out there. I do think PNC is still worth the hold, though, since they do possess some growth potential, and depending on market conditions/future earnings retention the stock may appreciate in the near term.

Valuation

PNC’s valuation is more than fair, so for an interested investor, now would be the time to buy. PNC missed expectations on their Q4 earnings on Wednesday, which has caused a somewhat unwarranted decline in price. PNC’s PEG Non-GAAP ratio is very impressive, as is their near-4% dividend yield and FWD P/E GAAP of 9.38. Price/Book and Price/Cash Flow of 1.31 and 7.16, respectively, are other metrics that I find suggest a fair valuation for PNC.

FactSet composites set a fair price for PNC at $176.00 per share, a sentiment that I share given its impressive PEG and forward-looking earnings improvements. However, I don’t find that market sentiment will change on a dime for PNC — there are too many factors that obfuscate price movements such as potential recessional headwinds or a reversal in interest rates for me to suggest a buy. However, if PNC would help diversify your portfolio and add a stable, fair dividend, I find the current price to be very attractive.

DCF analysis is difficult to conduct given the limited availability of cash flow figures, but comps analysis, as shown above, suggests that even at its current, lower price, PNC may not be the best long investment in the sector.

Risks and Other Considerations

As with all investments, PNC is not without risks.

While their previous acquisitions have gone smoothly, and the BBVA transition has had no major hiccups so far (though integration costs have been unideal), the nature of their BBVA acquisition (new markets and the sheer size of the deal) increases the chance for future integration issues. This could stunt the growth that the acquisition offers. Furthermore, if the Fed begins reducing rates, PNC’s performance could suffer as the benefits of high rates would be reversed. While I don’t anticipate this happening in the near term, it cannot be ruled out for the later parts of 2023 and beyond.

Lastly, PNC has had its non-interest expenses increase recently, and with current rates of inflation, this trend may continue, eating into earnings.

I don’t find PNC’s risk level to be exceptional.

The Bottom Line

Whether or not to invest in PNC should depend on your investment goals. As I’ve said previously: PNC should appeal to an investor seeking stable returns from dividends. If this isn’t you, there are better options out there. The potentially fleeting nature of favorable macro trends, somewhat worrying expense increases (integration & non-interest, most notably), and a lack of a single, compelling element that invites investment lead me to recommend a Hold in PNC.

Be the first to comment