Earnings of The PNC Financial Services Group (PNC) plunged in the first quarter due to a hit from provisions expenses. Although PNC appears to have booked most of COVID-19’s impact on credit quality in the first quarter, I’m expecting some remaining impact to hit earnings in the remainder of 2020. Moreover, the net interest margin will likely continue to decline in the second quarter as the full quarter’s impact of interest rate cuts was not visible in the first quarter. The margin compression will likely further drag earnings this year. On the other hand, loan growth is likely to remain high in the coming quarters, which will support the bottom-line. Overall, I’m expecting PNC’s earnings per share to decline by 34% year-over-year in 2020 to $7.86. The December 2020 target price suggests that PNC is offering a good opportunity for capital appreciation. However, the impact of COVID-19 on provision expenses in the coming quarters is still uncertain, which raises the risk of a negative earnings surprise. Due to the risks and uncertainties, I’m adopting a neutral rating on PNC.

Exposure to Hard-Hit Industries to Drive Provision Expenses

PNC’s provision expenses surged in the first quarter to $914 million from $221 million in the fourth quarter of 2020. The surge was attributable to PNC’s significant exposure to hard-hit industries. As mentioned in the first quarter’s investor presentation, around 7.3% of total loans were to high-impact industries like recreation, non-essential retail, leisure travel, consumer services, restaurants, and hotels. Moreover, around 1.7% of total loans were to the oil and gas sector. As PNC has already booked most of the lockdown’s impact in the first quarter, I’m expecting provision expenses to decline in the remainder of the year compared to the first quarter. However, the provision expenses in the remainder of 2020 will still be higher than the expenses for last year because of the continuation of the lockdown. As mentioned in the first quarter’s conference call, the reserves and allowances booked at the end of March did not fully reflect the economic crisis because the troubling unemployment data was released in April. The management is likely to add to allowances for credit losses as the situation becomes clearer. Based on these factors, I’m expecting provision expenses to clock in at $2 billion in 2020, or 78bps of net loans, compared to 33bps of net loans in 2019.

Strong Demand for Relief Credit to Partially Counter Rate-Sensitivity

As evident from the performance in the last three quarters, PNC’s net interest margin (NIM) is quite sensitive to interest rate movements. The interest rate decline has a greater impact on the average yield than on the average funding cost. After decreasing by 17bps in the first quarter, I’m expecting the NIM to decline even further in the second quarter because the full quarter’s impact was not visible in the first quarter. Additionally, PNC increased its FHLB borrowing in the first quarter due to the high loan demand. The proportion of high-costing FHLB borrowing increased to 6.2% of total funds by the end of March 2020, from 4.7% at the end of December 2019. The shift in mix towards higher-costing funds will likely further pressurize NIM in the coming quarters. Consequently, I’m expecting NIM to decline by 19bps in the second quarter and then by 15bps in the third quarter of 2020, on a linked quarter basis. The following table shows my estimates for yield, cost, and NIM.

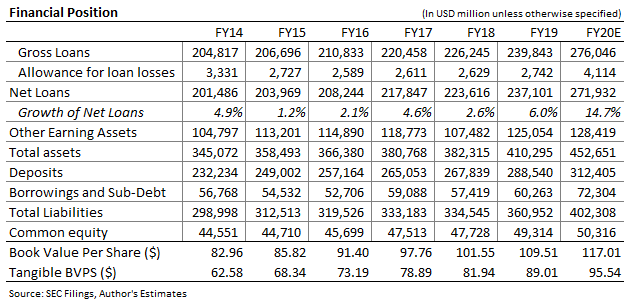

Continued loan growth will likely offset the impact of NIM compression on net interest income. Low interest rates are likely to continue to drive credit demand in the coming quarters. Moreover, the high demand for relief loans and high utilization of credit lines will likely continue till the lockdown ends, probably by the mid of the third quarter. Based on these factors, I’m expecting net loans to grow by 14.7% year-over-year in 2020, as shown in the table below. The table also shows estimates for other balance sheet items.

Considering the impact of NIM compression and strong loan growth, I’m expecting net interest income to decline by 3% year-over-year in 2020.

Expecting Earnings per Share to Decline by 31%

I’m expecting non-interest income to decline in the remainder of this year, which will further drag earnings. The normalization of income from mortgage servicing rights (MSR) will likely reduce non-interest income in the remainder of the year after the MSR income remained unusually high in the first quarter. Moreover, asset management revenues are likely to be lower in 2020 compared to 2019 because of the stock market turmoil. As a result, I’m expecting non-interest income to decline by 13% year-over-year in 2020.

I’m expecting non-interest expenses to also decline this year, which will support the bottom-line. The management is looking to control costs in a challenging operating environment, which will likely lead to a fall in non-interest expenses. As mentioned in the investor presentation, the management expects non-interest expenses to decline by 5% to 10% in 2020 compared to 2019. I’m expecting non-interest expenses to decline by 5.2% year-over-year in 2020, which is at the lower end of management’s guidance because reduction greater than around 5% appears too ambitious.

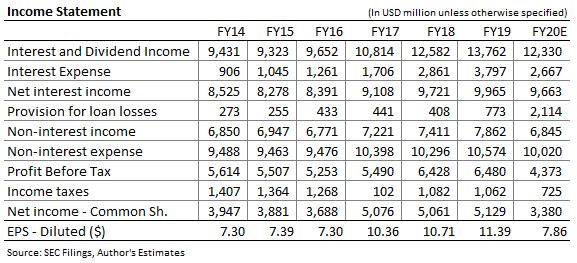

The expected increase in provision expenses, NIM compression, and decline in non-interest income will likely drag earnings in 2020. On the other hand, the strong loan growth and decline in non-interest expenses will likely support earnings this year. Overall, I’m expecting earnings per share to decrease by 31% year-over-year in 2020 to $7.86. The following table shows my income statement estimates.

The impact of COVID-19 on provisions in the coming quarters is still uncertain because the duration of the lockdown is unknown. Moreover, we don’t know if a need may arise for another lockdown sometime in the future after the current lockdown ends. These uncertainties have raised the chances of a negative earnings surprise this year.

I’m expecting PNC to maintain its quarterly dividend at the current level of $1.15 per share in the remainder of 2020. Chances of a dividend cut are low because the earnings and dividend estimates suggest a payout ratio of 59%, which is sustainable. The dividend estimate implies a dividend yield of 4.5%.

Targeting Price of $132 by Year-end

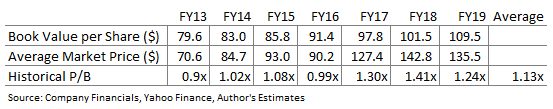

I’m using the historical price-to-book value multiple (P/B) to value PNC. The stock has traded at an average P/B multiple of 1.13 in the past, as shown below.

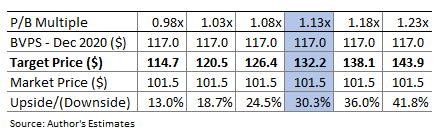

Multiplying this P/B ratio with the forecast book value per share of $117 gives a target price of $132.2 for December 2020. This target price implies an upside of 30% from PNC’s April 17 closing price. The following table shows the sensitivity of the target price to the P/B multiple.

The 43% potential price upside shows that PNC is providing a good opportunity for capital appreciation. However, the COVID-19 pandemic poses risks to earnings and valuation. Due to the risks and uncertainties, I’m adopting a neutral rating on PNC.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: This article is not financial advice. Investors are expected to conduct their own due diligence, and consider their investment objectives and constraints before investing in the stock(s) mentioned in the article.

Be the first to comment