Justin Paget

Underfollowed small-cap REITs are a great way to get higher income and growth at a value price. That’s because, naturally, it doesn’t take as many deals to move the needle as it does for real estate behemoths such as Prologis (PLD), Simon Property Group (SPG), or Realty Income Corp. (O).

This brings me to the much smaller and under the radar Plymouth Industrial REIT (NYSE:PLYM), which remains attractively priced with a healthy dividend yield. This article highlights why income investors searching for growth ought to give PLYM a hard look.

Why PLYM?

Plymouth Industrial REIT owns and operates warehouses and distribution centers across primary and secondary markets in the U.S. It currently owns 207 buildings totaling 34 million square feet in the main industrial, distribution, and logistics corridors of the U.S., with a track record of purchasing properties well below replacement cost.

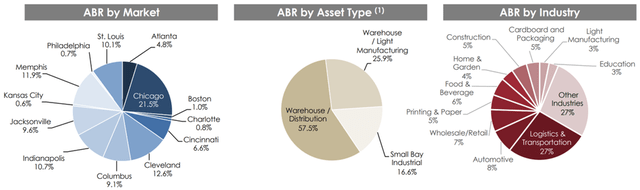

PLYM is well-diversified, with top 10 tenants, including FedEx (FDX), representing just 15.7% of its total portfolio annual base rent. As shown below, 26% of PLYM’s ABR stems from the primary markets of Atlanta and Chicago, with the remaining 74% coming from well-known secondary markets such as Cincinnati, Indianapolis, Cleveland, Jacksonville, and St. Louis.

PLYM Portfolio Mix (Investor Presentation)

Meanwhile, PLYM is demonstrating strong portfolio fundamentals, with ending occupancy of 99% and saw 99.7% rent collection as of the end of Q3. It also saw robust same store NOI growth of 8.4% on a GAAP basis and 11% on a cash basis, excluding early lease termination income.

PLYM is also seeing very strong demand in its key markets, driven by low vacancy levels. This is reflected by the 17.6% increase in rental rates on a cash basis on new leases. The growth in portfolio EBITDA has resulted in a decline in PLYM’s net debt to EBITDA ratio to 7.3x, and over time, I’d like to see the ratio trend down below 7x.

Also encouraging, PLYM has a large amount of developable land totaling 192 acres, which could be translated to 2.3 million gross rentable square feet of space. Some of this land is currently being developed, with Phase 1 construction on 70K square feet of space in Portland, Maine, 417K square feet in Atlanta, Georgia, and 156K square feet in Cincinnati, Ohio.

Notably, growth could slow down in the medium term, as general real estate market volatility brought upon by high interest rates could remain for the foreseeable future. This was noted by management during the recent conference call:

Our pipeline remains robust, but we’re still working through a period of price discovery among both buyers and sellers. We’ve seen a significant number of deals come back to us due to retreading or buyers walking on refundable contracts or sellers just deciding to pull properties from the market for the time being, which further reinforces our decision to stay on the sidelines until we see some additional clarity among various sized transactions.

Deals are still closing, though not at the same velocity as the first half of this year. We continue to see portfolios of assets that are similar to ours traded at premium to the one-off or smaller portfolio transactions. These types of industrial assets with diversified tenants and exposure to the same markets where we have a presence are hard to find at scale.

Nonetheless, I see plenty of value in PLYM at the current price of $19.63 with a forward P/FFO of just 10.7, based on the FFO per share midpoint guidance of $1.83. The respectable 4.5% dividend yield is also well-covered by a low 48% payout ratio, setting up the stock for dividend bumps down the line towards the pre-pandemic rate of $0.375 per share per quarter.

At the current valuation, PLYM also trades at a significant discount to Prologis, which currently carries a forward P/FFO of 21.4 at the current price of $109.75. Even the closer peer, STAG Industrial (STAG), which like Plymouth, also invests in secondary markets trades at a far more expensive valuation with a forward P/FFO of 14.4.

Investor Takeaway

In conclusion, I believe that PLYM is an attractive investment at the current price. It offers a compelling value proposition with a well-diversified portfolio of properties, strong portfolio fundamentals, and potential for future growth. While near-term growth could be tempered by real estate market volatility, I believe that the long-term outlook remains favorable for PLYM. As such, I believe that it is a good addition to any portfolio seeking exposure to the industrial real estate sector.

Be the first to comment