marrio31

Investment Thesis

Plug Power Inc. (NASDAQ:PLUG) remains well poised to take advantage of the race for green energy generation, given the recent macro events in Ukraine and the record high oil/ gas prices. The company has been cementing its future capabilities through its Gigafactories in NY in 2021, Australia by 2023, and South Korea by 2024. Nonetheless, the macro headwinds have also presented temporary headwinds to PLUG’s stock performance, on top of the market fears of the potential recession due to the Fed’s continuous hike in interest prices. As a result, the stock had continued to fall by -27.78% since our previous analysis, from $25.27 on 03 March 2022 to $18.25 on 13 July 2022.

For now, we are downgrading our buy rating to hold, since it was evident that PLUG is unlikely to recover before sometime in FY2023, when the energy market stabilizes. Unfortunately, the stock may slide further to new lows in the intermediate term. Investors, take note.

PLUG Is Set To Perform Well Despite Temporary Headwinds

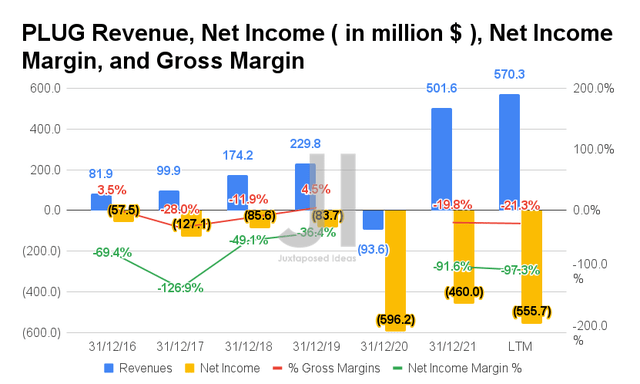

PLUG has had healthy revenue growth in the past few years, at an impressive CAGR of 54.57%, with a total of revenues of $570.3M in the LTM. Nonetheless, it is also clear that the company has yet to report profitability, given its negative margins, especially so given the elevated gas prices and material prices. By the LTM, PLUG reported a deepening net loss of -$555.7M with net income margins of -97.3%.

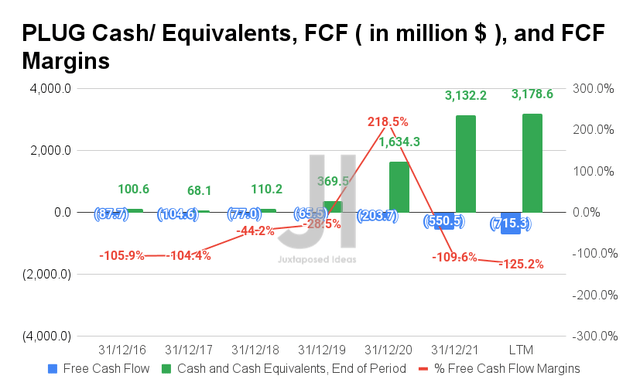

Therefore, PLUG has yet to report positive Free Cash Flow (FCF), with an FCF of -$715.3M and an FCF margin of -125.2% by the LTM. Nonetheless, we are not overly concerned for now, given its massive war chest of $3.17B of cash and equivalents on the balance sheet. These would easily last PLUG for the next two years, given its capable management thus far.

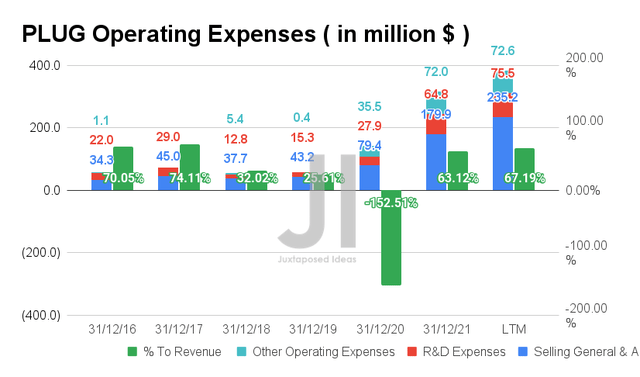

As a result of its expanding operations and projects, PLUG also increased its operating expenses over time to a total of $383.3M in the LTM, representing an increase of 268.4% from FY2020 levels. Nonetheless, we are not overly concerned since it has remained relatively stable at 67.19% to its growing revenues in the LTM and mostly attributed to its new Gigafactory, thereby revenue accretive eventually.

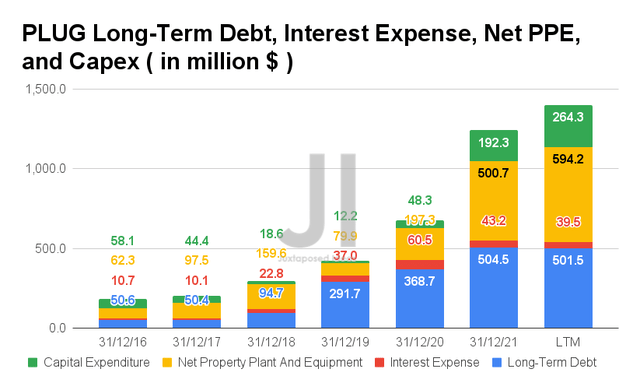

Nonetheless, given its lack of profitability, it is evident that PLUG had relied on long-term debts to sustain its operations and expansions. By the LTM, the company reported long-term debts of $501.5M and interest expenses of $39.5M, representing a massive increase of 36% though a favorable decline of 34.7% from FY2020 levels, respectively. Therefore, we are rather satisfied with its capital deployment thus far.

In the meantime, PLUG continues to grow its capabilities with net PPE assets of $594.2M and capital expenditure of $264.3M in the LTM, representing massive increases of 301.1% and 547.2% from FY2020 levels, respectively. As a result of its investments in the new Gigafactory in Rochester, N.Y, we expect the company to continue improving its operating efficiencies in the highly competitive fuel cell and electrolyzer market moving forward. Though these expenses seem relatively extensive given PLUG’s lack of profitability now, we are not concerned, since these investments would eventually be top and bottom lines accretive upon hitting the inflection point. Patience my dears, since green energy technologies need time (and a lot of capital) to scale up.

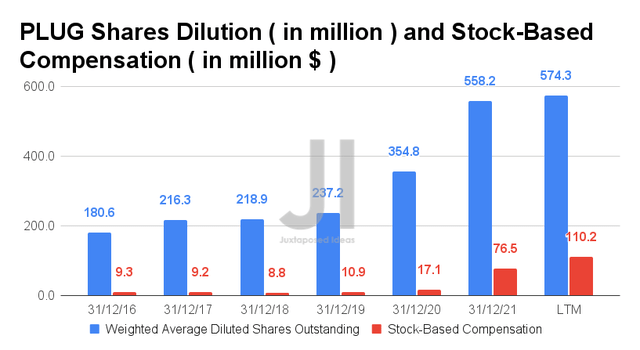

For now, PLUG will continue relying on stock-based compensation (SBC) with the eventual impact of more share dilution for the next two or three years. In November 2020 and February 2021, the company also raised capital through a public offering of its common stock, effectively diluting its long-term investors by 218% from FY2019 levels. At that time, PLUG managed to raise over $3B for its working capital.

By the LTM, PLUG had also reported SBC expenses of $110.2M with total diluted shares outstanding of 574.3M, representing a tremendous increase of 644.4% and 61.8% from FY2020 levels, respectively. Assuming that the rate continues as it had in the past quarter, we expect to see the company report up to $211.3M of SBC expenses and total diluted shares outstanding of 622.6M for FY2022. A relatively modest increase for now. We shall see.

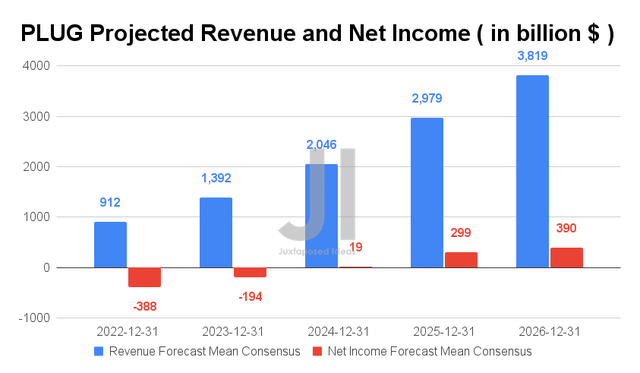

Over the next five years, PLUG is expected to report revenue growth at an excellent CAGR of 50.05%, while also finally reporting a net income break even in FY2024. The management continues to affirm its financial target of achieving $3B in revenues, 30% gross margins, and 17% operating margins by 2025. In the meantime, consensus estimates that the company will report revenues of $912M and net incomes of -$388 in FY2022, representing YoY improvement of 81.8% and 15.6%, respectively.

Analysts will also be closely watching PLUG’s FQ2’22 performance, with consensus revenue estimates of $165.54M and EPS of -$0.20, representing an increase of 32.9% though a decline of -9.76% YoY, respectively. Nonetheless, it is also evident that the company has been broadly missing consensus estimates for the past seven consecutive quarters, potentially contributing to its weaker stock performance thus far. As a result, we are uncertain of its short-term stock recovery, barring a positive catalyst. Highly unlikely in this economic climate.

In the meantime, we encourage you to read our previous article on PLUG, which would help you better understand its position and market opportunities.

- Plug Power: Buy The ‘Meme’ Stock With Robust Fundamentals

So, Is PLUG Stock A Buy, Sell, or Hold?

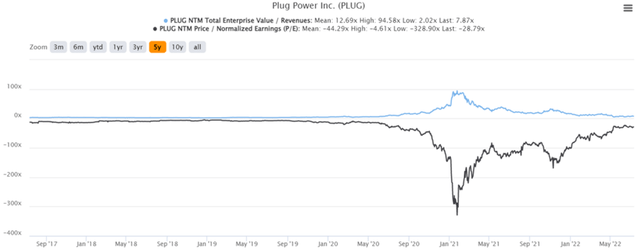

PLUG 5Y EV/Revenue and P/E Valuations

PLUG is currently trading at an EV/NTM Revenue of 7.87x and NTM P/E of -28.79x, lower than its 5Y EV/Revenue mean of 12.69x though improved from its 5Y P/E mean of -44.29x. The stock is also trading at $18.25, down 60.7% from its 52 weeks high of $46.50, though still at a premium of 43.7% from its 52 weeks low of $12.70. It is evident that PLUG had continued to fall since our previous analysis in March 2022, given the macro headwinds and its yet profitable business.

PLUG 5Y Stock Price

Despite the strong buy rating with the consensus estimates’ price target of $45 with a 146.58% upside, we are more skeptical now, since the stock has been on a continuous downwards trajectory since hitting the peak in early 2021. In addition, given the bearish market situation and the elevated gas prices, we expect more temporary headwinds to PLUG’s operations and profitability in the intermediate term. We believe that these will continue to exert pressure on its stock price ahead, before recovering some time in FY2023 once the energy market stabilizes.

In the meantime, we encourage interested investors some patience first, before adding more exposure to PLUG, since we may continue seeing a moderate retracement post FQ2’22 earnings call. Existing investors with lesser tolerance for volatility may choose to cash out some capital first, before adding at the lows. However, in the long term, we remain hopeful of PLUG’s potential to be one of the leaders in the green energy market, given its aggressive expansion and competent capital deployment thus far.

Nonetheless, we rate PLUG stock as a Hold for now.

Be the first to comment