AsiaVision/E+ via Getty Images

Investment thesis

PLAID Inc (OTCPK:PLDIF) is failing to compete successfully in the CX market, highlighted by negative trends in SaaS metrics for ARR growth and NRR. Management does not appear to have any solutions in place to address these challenges, and consensus estimates point to a dramatic slowdown in growth. Despite the major correction in price, we rate these shares as a sell.

Quick primer

Established in 2011 as a consulting and app development business aimed at the Japanese e-commerce industry, PLAID Inc developed and released its own CX (customer experience) platform SaaS called KARTE in 2015. The company has 699 customers in Q2 FY9/2022 in multiple sectors ranging from financial services, recruitment, apparel, real estate, media, travel, and consumer goods. Notable clients include MonotaRO (OTCPK:MONOY), ZOZO Inc (OTCPK:SRTTY), and Ajinomoto (OTCPK:AJINY). Founder and CEO Kenta Kurahashi previously worked at e-commerce group Rakuten (OTCPK:RKUNY). In September 2021 the company raised its stake in group company Emotion Tech to 65% from 4.5% for JPY1.6 billion/USD12 million; this newly consolidated subsidiary provides an NPS (net promoter score, like customer feedback) platform called EmotionTech CX, and an employee experience platform called EmotionTech EX. PLAID Inc IPOed in December 2020. CX platform peers include NICE (NICE), Oracle Japan (OTCPK:OCLCF), NTT (OTCPK:NTTYY), Hitachi (OTCPK:HTHIY), and Zendesk (ZEN).

PLAID Inc has no relationship with Plaid, the privately-owned San Francisco-based fintech company specializing in data transfer networks for unified banking.

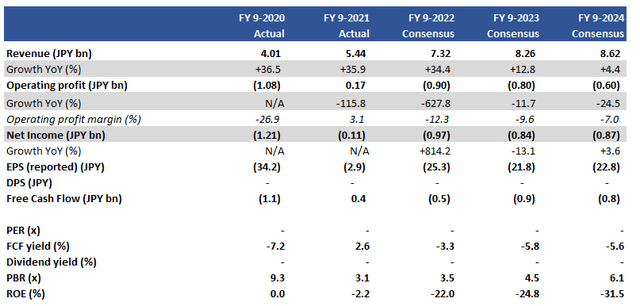

Key financials including consensus estimates

Key financials including consensus estimates (Company, Refinitiv)

Our objectives

PLAID Inc’s shares have corrected by over 80% YTD, experiencing a significantly larger sell-off compared to its other SaaS peers both domestic and abroad. We want to assess recent trading trends to see whether this share price correction is warranted and whether it is currently an opportunity to buy.

Recent trading not encouraging

Q2 FY9/2022 results were mixed, with the company showing 40.3% sales growth YoY. The pace of underlying growth appears more to be in the 20%-25% YoY range, given the acquisitive impact of Emotion Tech. Using a simple ‘Rule of 40’ (sales growth YoY and profit margin figures combined) as a guide, we see that PLAID Inc is not getting the trade-off between growth and profitability right with an operating margin of -8.4%.

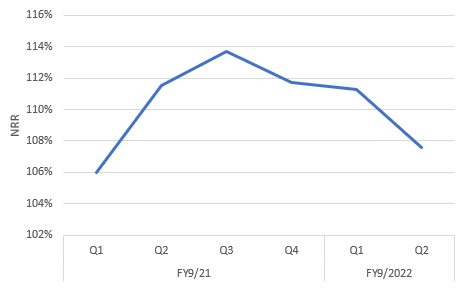

A closer look at disclosed SaaS metrics presents a troublesome picture. Annual Recurring Revenue (or ARR) grew 22.6% YoY, down from 27.6% YoY in Q1 FY9/2022 and 32.3% YoY in Q4 FY9/2021. This downward trend shows that despite a steady increase in customer numbers, there are negative factors in play that is dampening growth. What is a major concern is the trend in Net Revenue Retention (or NRR), which has fallen for three consecutive quarters. As a general indication of customer success, the latest NRR rate of 107.6% is not great, particularly when sales & marketing costs still made up 44.9% of sales.

Quarterly NRR trend

Quarterly NRR trend (Company)

There appear to be three fundamental problems facing the business. Firstly, acquiring as well as retaining customers is becoming more difficult due to increasing competition, and a lack of sufficient resources to perform operational support sufficiently to keep customers happy. Secondly, the company benefitted from the pandemic lockdowns which resulted in escalating online activity, but with user trends normalizing PLAID Inc is finding it harder to expand with existing customers. Thirdly, churn is a serious problem occurring at both large and small accounts, highlighting the low level of dissatisfaction with the service. These issues will be challenging to resolve outright in the short to medium term.

Management believes that its competitors are targeting its existing customer base (page 18) offering cheaper pricing and a wider array of services. Some customers are also bringing their in-house CX systems online. What this means to us is that switching costs for CX solutions are very low, and if you do not provide high customer satisfaction, your business is under threat.

Next, we look at consensus estimates (in Key financials above) to see how the growth outlook is viewed by the sell-side.

No growth, no profits

The company issued a relatively mild downward revision for FY9/2022 at Q2 reporting, with sales guidance range cut by 3% to 8% from the previous. However, management has warned that trading conditions will remain difficult into H2 FY9/2022. New FY guidance implies that H2 sales volume will be flat HoH indicating no growth – the key issue appears to be the lack of contract renewals that seasonally concentrate at the end of March/April.

Whilst consensus estimates remain slightly above revised company guidance for FY9/2022, there is little to be positive about FY9/2022 and FY9/2023. With sales growth expected to decline dramatically in the next two years, we can only surmise that expectations are that ARR growth tails off in H2 FY9/2022 and earnings visibility drops. Our impression is that consensus is being too negative as sales growth is unlikely to decline to low single digits YoY, but the direction of travel looks correct. Currently, PLAID Inc does not appear to have a competitive product to beat off its competition, and its own service levels are not adequate enough to meet customer needs.

Valuations

On consensus estimates the shares are trading on Price to sales FY9/2023 1.8x. This would usually be a bargain multiple for a SaaS-model business with tangible growth prospects. With fundamental weaknesses such as cash burn, loss-making operations, and a slowing growth profile, we believe the shares are unattractive.

Risks

Upside risk comes from management beginning to execute well with KARTE and improve ARR and NRR metrics, effectively increasing customer success.

There is a potential for PLAID to be acquired by a software peer who may want a bolt-on CX to its own offering.

Downside risk comes from deteriorating SaaS metrics as KARTE’s market position is undermined by its competitors.

It is also plausible that the company will require re-financing in the medium term with its cash burn profile.

Conclusion

PLAID Inc is failing to compete successfully in the Japanese CX market, through a combination of low customer success and high competition. Management has tried to bolster growth via M&A, but the core issues appear unresolved. Despite the major correction in the price, we believe the shares remain unattractive and rate the shares as a sell.

Be the first to comment