metamorworks/iStock via Getty Images

Pitney Bowes Inc. (NYSE:PBI) reports recurrent revenue and ties with large established partners. In my view, Pitney’s technological improvements and more partnerships will likely imply a significantly higher stock valuation. Even considering the risks from regulators, I don’t see why Pitney is trading at the current price mark. Under my discount cash flow models, the fair valuation could be worth $8, and even $14 depending on several assumptions made.

Pitney’s Recurrent Revenue

Pitney is a tech company offering digital, physical, and financing solutions to help clients send mails and parcels.

Sidoti & Company – Small Cap Conference

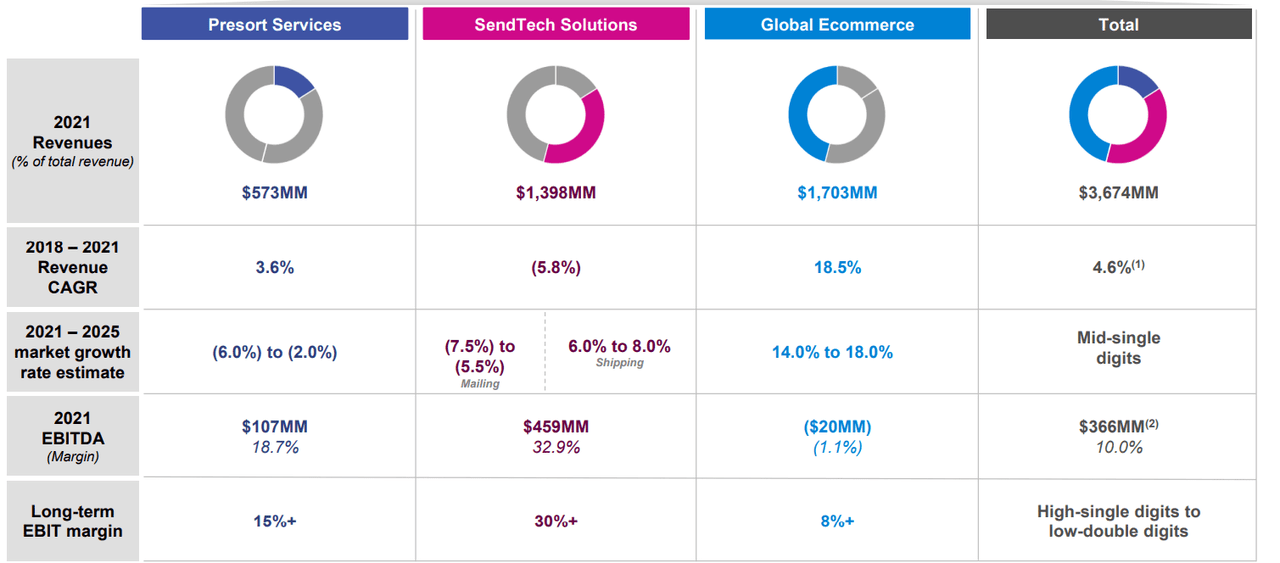

Among the company’s business divisions, I believe that the most interesting right now is the 65%-70% recurrent revenue reported from SendTech. It means that 65% of the revenue reported by SendTech’s division appears to be recurrent. With this in mind, making a DCF model appears quite convenient. Keep in mind that future EBITDA will most likely be not very volatile:

Sidoti & Company – Small Cap Conference

Analysts Are Expecting Sales Growth And Positive Free Cash Flow In 2022 And 2023

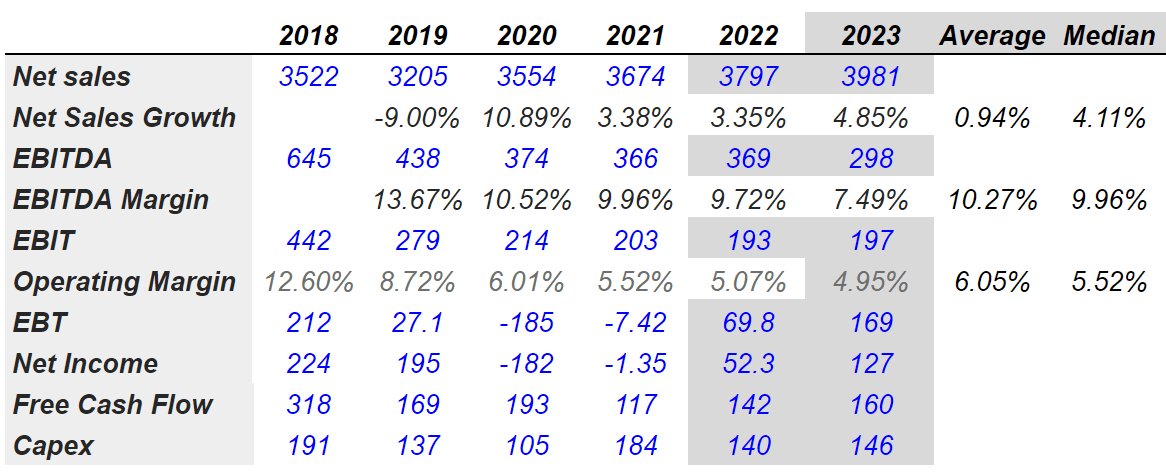

I made an assessment of previous and expected sales growth, EBITDA margin, and operating margin, which I later used in my financial modeling. Under my numbers and that of other analysts, Pitney’s sales growth would be likely close to 4.11%, the median EBITDA margin could be close to 9.96%, and the operating margin could be close to 5.52%. Finally, most investment advisors are expecting free cash flow growth close to $142-$160 million:

Marketscreener.com

The guidance given by management is also aligned to that of analysts. The company expects the target market to grow at mid-single digits, so in my view, sales growth will likely stay close to 4%-7%. Pitney’s long-term EBIT margin is also expected to be equal to high-single digits to low-double digits.

Sidoti & Company – Small Cap Conference

Assuming That More Clients Will Notice Pitney’s APIs, The Stock Price Could Be Worth $8 To $14

With the global ecommerce sector poised for profitability, under normal conditions, I believe that Pitney will most likely report sales growth. I am also optimistic about Pitney because of its shipping application programming interfaces or APIs. If clients are not reluctant to run their own coding programs, they could experience significant efficiency. As more clients learn about the company’s digital capabilities, Pitney’s sales will likely trend north:

Powered by our shipping APIs, clients can purchase postage, print shipping labels and access shipping and tracking services from multiple carriers that can be easily integrated into any web application such as online shopping carts or ecommerce sites and provide guaranteed delivery times and flexible payment options. Source: 10-K

Under this base case scenario, I would also expect more partners to use the company’s capabilities. As a result, the company will likely enjoy certain economies of scale as the volume of work will increase. In sum, I would expect the company’s free cash flow margins to enlarge:

We are a workshare partner of the USPS and national outsource provider of mail sortation services that allow clients to qualify large volumes of First-Class Mail, Marketing Mail and Marketing Mail Flats and Bound Printed Matter for postal workshare discounts. Our network of operating centers throughout the United States and fully-customized proprietary technology provides clients with end-to-end solutions from pick up to delivery into the postal system network, expedited mail delivery and optimal postage savings. Source: 10-K

Finally, in this case, I am also assuming that The Pitney Bowes Bank will operate with more and more clients. Keep in mind that the company offers revolving credit solutions, which are also quite profitable for Pitney.

Through our wholly owned subsidiary, The Pitney Bowes Bank (the Bank), we offer our clients in the United States a revolving credit solution that enables clients to make meter rental payments and purchase postage, services and supplies and an interest-bearing deposit solution to clients who prefer to prepay postage. Source: 10-K

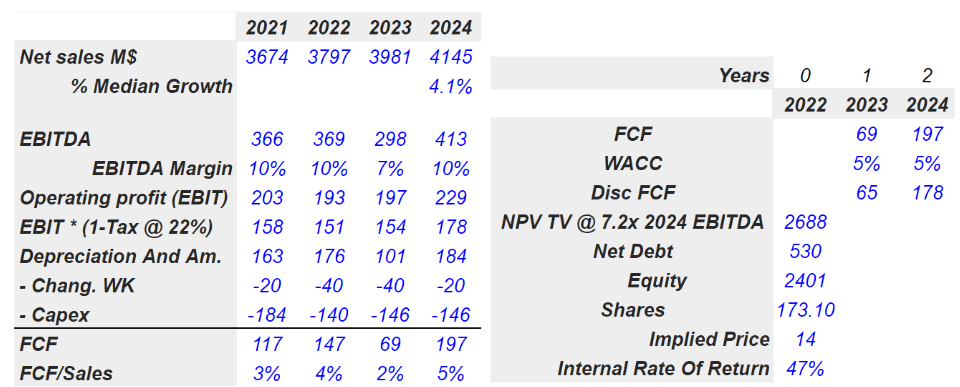

I am a bit less optimistic than other analysts, but my numbers are not far from those of other analysts. Under normal conditions, I believe that Pitney could deliver as much as $4.14 billion in sales in 2024.

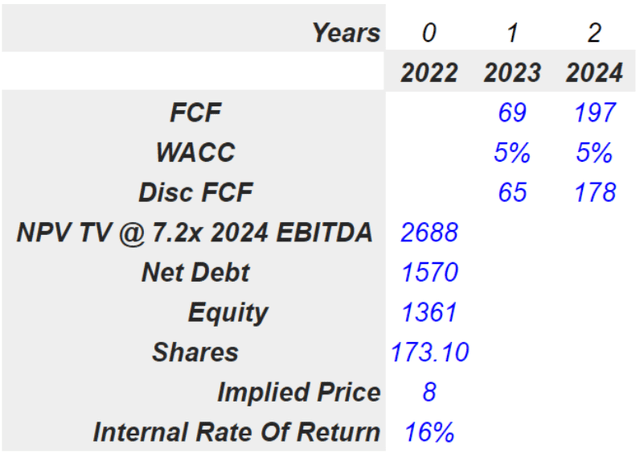

If we also use an EBITDA margin ranging from 9.9% to 7%, conservative depreciation and amortization, and capital expenses around $146 million, 2024 free cash flow would stand at $197 million. If we discount 2023 and 2024 free cash flow for 2023 and use a terminal EBITDA of 7.2x, the implied equity would be $2.4 billion. Finally, the fair price would be $14:

Author’s Compilations

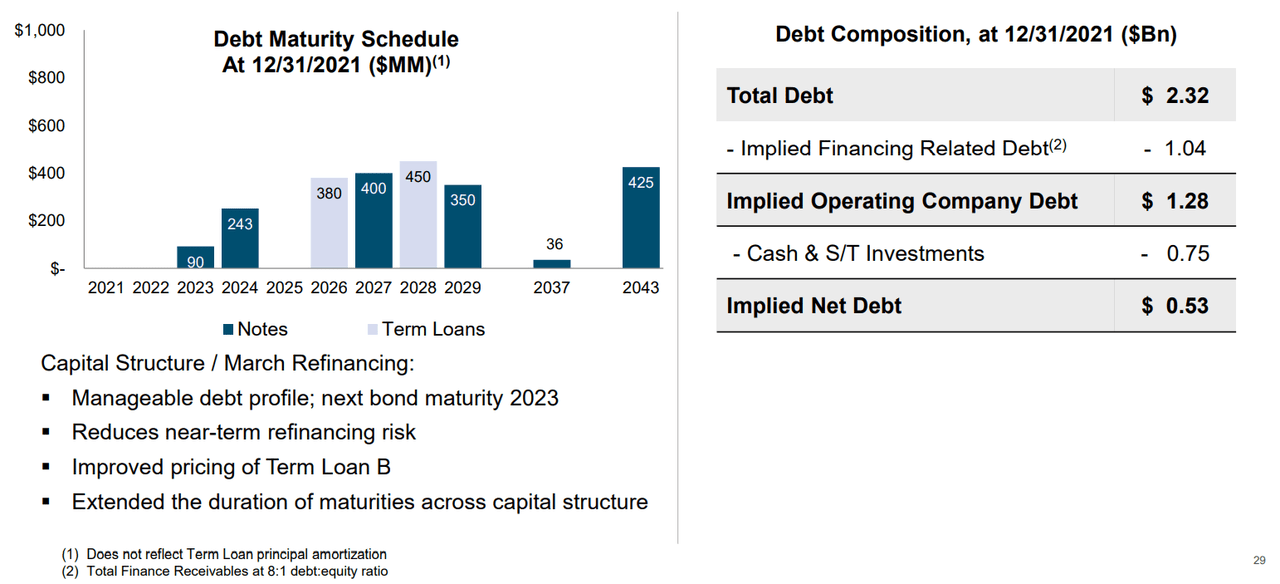

Note that I am using a net debt of $530 million, which does not include the company’s financing-related debt. If we add the implied financing related to debt, the company’s fair price would stand at $8 per share:

Strategic Update Author’s Compilations

New Regulations And Failed Partnerships Could Lead To $4.5 Per Share Or Lower

Pitney depends on several partnerships with large conglomerates that offer delivery services. If, for whatever reason, Pitney does not maintain its relationships with these large partners, future net revenue would most likely decline. As a result, if journalists note the decline, the fair valuation of Pitney and its stock price could decline:

We are dependent on financially viable national posts in the geographic markets where we operate, particularly in the United States. A significant portion of our revenue depends upon the ability of these posts, especially the USPS, to provide competitive mail and package delivery services to our clients and the quality of the services they provide. Their ability to provide high quality service at affordable rates in turn depends upon their ongoing financial strength. If the posts are unable to continue to provide these services into the future, our financial performance will be adversely affected. Source: 10-K

Pitney could suffer significantly from changes in the post-regulation in the United States. Let’s note that Pitney needs approval from regulators to launch a new product. If the company does not obtain approval from authorities, sales growth will most likely decline. As a result, the fair price may be lower than what I depicted in the previous financial model:

A significant portion of our business is subject to regulation and oversight by the USPS and posts in other major markets. These postal authorities have the power to regulate some of our current products and services. They also must approve many of our new or future product and service offerings before we can bring them to market. If our new or future product and service offerings are not approved, there are significant conditions to approval, regulations on our existing products or services are changed or, we fall out of compliance with those regulations, our financial performance could be adversely affected. Source: 10-K

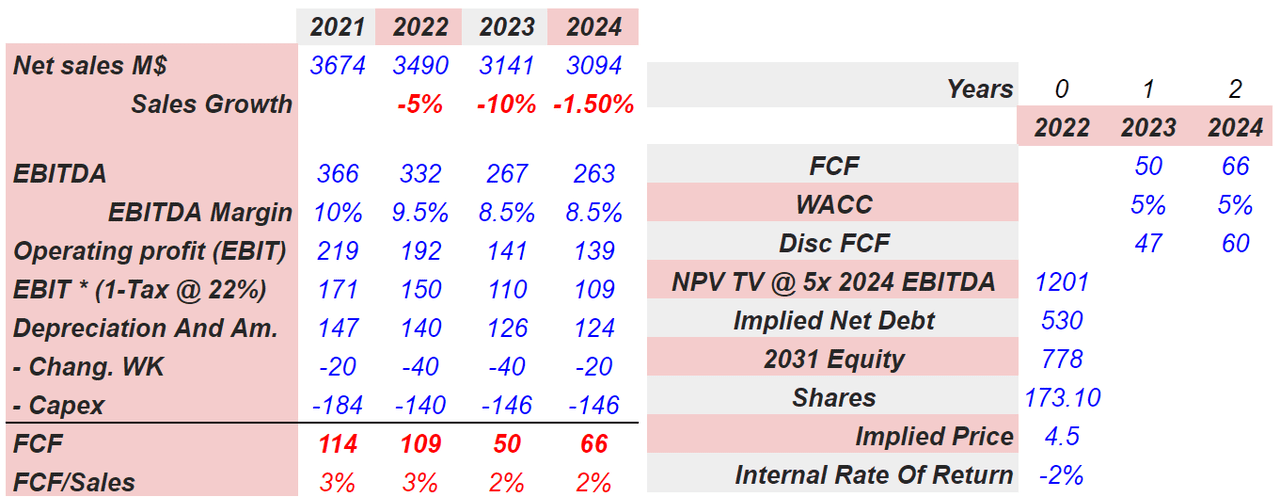

I also modeled a pessimistic free cash flow model with sales growth of -10%, 5%, and -1.5% as well as an EBITDA margin close to 8.5%. My results include a decline in free cash flow from around $115 million in 2021 to almost $65 million in 2024. If we sum everything with a weighted average cost of capital of 5% and EV/EBITDA multiple of 5x, the implied equity would be almost $775 million. Finally, the implied price would be $4.5. If we also assume the implied financing related to debt, the implied stock price would be much lower than $1.

Author’s Compilations

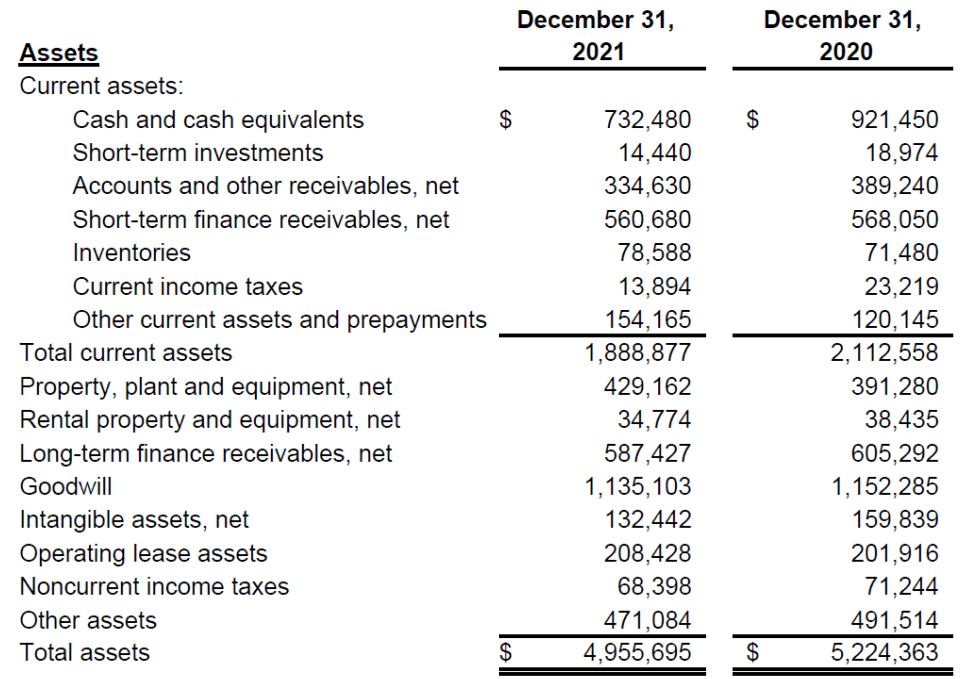

Pitney’s Balance Sheet

As of December 31, 2021, the balance sheet includes $732 million in cash, $4.95 billion in total assets, and goodwill worth $1.13 billion. Given the total amount of goodwill, it is very relevant that investors will need to be aware of potential goodwill impairment risks.

10-K

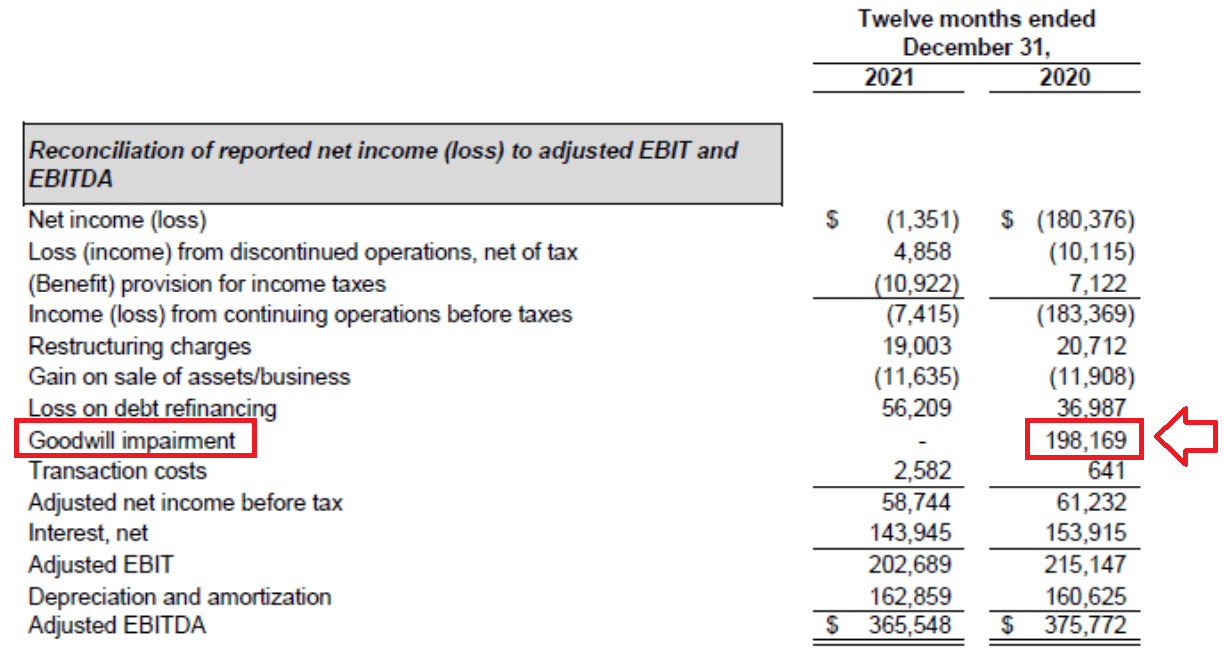

In 2020, the company reported an impairment of $198 million. As a result, the adjusted EBITDA was equal to $375 million whereas it may have been much lower. Without the impairment, the EBITDA would look equal to $177 million.

10-K

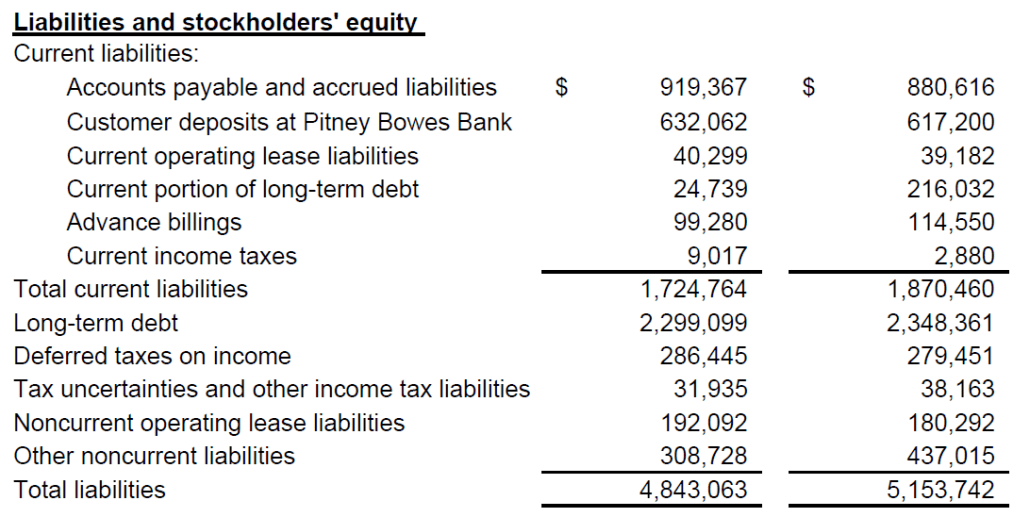

As of December 31, 2021, the total amount of liabilities is equal to $4.8 billion, so the asset/liability ratio is equal to 1x. While investors will most likely study carefully the company’s contractual obligations, as of today, the balance sheet looks healthy.

10-K

Conclusion

With recurrent revenue, partnerships signed with large conglomerates, and a digital strategy, Pitney is quite interesting right now. In my view, if management keeps delivering the same EBITDA margin, we will most likely see further stock demand in the market. I do believe that there are some risks related to the total amount of debt and some regulatory risks. With that, in my view, the current stock price fails to represent the true value of the stock. I believe that there is significant upside potential in Pitney’s valuation.

Be the first to comment