Ksenia Sandulyak/iStock via Getty Images

A Quick Take On PishPosh

PishPosh, Inc. (BABY) has filed to raise $8.7 million in an IPO of its common stock, according to an S-1/A registration statement.

The firm operates an ecommerce destination site for premium baby products.

Given the company’s largely undifferentiated offerings, fierce competition among online retailers and growing heavy losses, I’ll pass on the BABY IPO.

PishPosh Overview

Lakewood, New Jersey-based PishPosh, Inc. was founded to develop an online presence and offline showroom boutique for the sale of baby products.

Management is headed by Chief Executive Officer Chaim (Charlie) Birnbaum, who has been with the firm since 2022 and was previously involved in various roles in online business-to-consumer [B2C] companies.

The company also sells products through third-party marketplaces such as Amazon.

As of September 30, 2022, PishPosh has booked fair market value investment of $9.3 million in equity and debt from investors, including Alpha Capital Anstalt, Palladium Holdings, The Hewlett Fund, L1 Capital and individuals.

PishPosh – Customer Acquisition

The firm uses social media, digital advertising and traditional media to market to potential customers.

The company’s website has attracted over 800,000 prospects, 1.35% of which converted into paying customers, as of September 30, 2022.

PishPosh outsources its fulfillment operations.

Sales and Marketing expenses as a percentage of total revenue have risen as revenues have varied, as the figures below indicate:

|

Sales and Marketing |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Nine Mos. Ended September 30, 2022 |

29.1% |

|

2021 |

25.5% |

|

2020 |

21.6% |

(Source – SEC)

The Sales and Marketing efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Sales and Marketing spend, rose to 1.7x in the most recent reporting period, as shown in the table below:

|

Sales and Marketing |

Efficiency Rate |

|

Period |

Multiple |

|

Nine Mos. Ended September 30, 2022 |

1.7 |

|

2021 |

-0.3 |

(Source – SEC)

PishPosh’s Market & Competition

According to a 2022 market research report by Grand View Research, the global market for baby products was an estimated $214 billion in 2021 and is forecast to reach $352 billion by 2030.

This represents a forecast CAGR of 5.7% from 2022 to 2030.

The main drivers for this expected growth are a shift in consumer preferences for ‘high-quality, utility-driven, and premium baby products.’

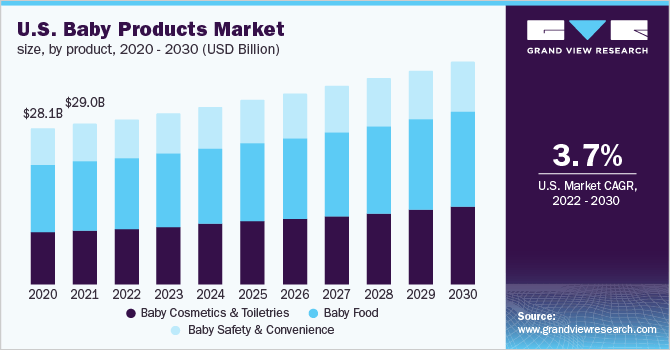

Also, below is a historical and projected future trajectory forecast for the U.S. baby products market:

U.S. Baby Products Market (Grand View Research)

Major competitive or other industry participants include:

-

Buy Buy Baby

-

Albee Baby

-

Others

PishPosh, Inc. Financial Performance

The company’s recent financial results can be summarized as follows:

-

Uneven topline revenue

-

Variable gross profit

-

Growing gross margin

-

Sharply higher operating loss

-

High cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Nine Mos. Ended September 30, 2022 |

$ 16,858,484 |

95.1% |

|

2021 |

$ 13,331,398 |

-8.2% |

|

2020 |

$ 14,518,025 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Nine Mos. Ended September 30, 2022 |

$ 5,753,025 |

135.0% |

|

2021 |

$ 4,439,136 |

-8.7% |

|

2020 |

$ 4,862,149 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Nine Mos. Ended September 30, 2022 |

34.13% |

|

|

2021 |

33.30% |

|

|

2020 |

33.49% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Nine Mos. Ended September 30, 2022 |

$ (4,197,434) |

-24.9% |

|

2021 |

$ (1,047,006) |

-7.9% |

|

2020 |

$ (153,517) |

-1.1% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Nine Mos. Ended September 30, 2022 |

$ (4,153,966) |

-24.6% |

|

2021 |

$ (1,179,163) |

-7.0% |

|

2020 |

$ (189,526) |

-1.1% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Nine Mos. Ended September 30, 2022 |

$ (4,122,487) |

|

|

2021 |

$ (1,173,098) |

|

|

2020 |

$ (105,641) |

|

(Source – SEC)

As of September 30, 2022, PishPosh had $528,235 in cash and $8.0 million in total liabilities.

Free cash flow during the twelve months ended September 30, 2022, was negative ($5.3 million).

PishPosh, Inc. IPO Details

PishPosh intends to raise $8.7 million in gross proceeds from an IPO of its common stock, offering approximately 1.74 million shares at a proposed price of $5.00 per share.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

The company has also registered for sale in a separate prospectus 1.34 million shares of certain interested selling shareholders.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $29.4 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 26.1%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Management says it will use the net proceeds from the IPO as follows:

We plan to use the net proceeds of this offering for general corporate purposes, such as working capital. We may also elect to use proceeds from this offering to acquire complementary technologies, products, or businesses, although we are not a party to any letters of intent or definitive agreements for any such acquisition.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says it is unaware of any legal action that would have a material adverse effect on its operations or financial condition.

The listed bookrunners of the IPO are Boustead Securities and Sutter Securities.

Valuation Metrics For PishPosh

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$33,409,815 |

|

Enterprise Value |

$29,363,672 |

|

Price / Sales |

1.55 |

|

EV / Revenue |

1.36 |

|

EV / EBITDA |

-7.42 |

|

Earnings Per Share |

-$0.96 |

|

Operating Margin |

-18.37% |

|

Net Margin |

-30.93% |

|

Float To Outstanding Shares Ratio |

26.08% |

|

Proposed IPO Midpoint Price per Share |

$5.00 |

|

Net Free Cash Flow |

-$5,349,681 |

|

Free Cash Flow Yield Per Share |

-16.01% |

|

Debt / EBITDA Multiple |

-1.07 |

|

CapEx Ratio |

-165.35 |

|

Revenue Growth Rate |

95.05% |

(Source – SEC)

Commentary About PishPosh’s IPO

BABY is seeking U.S. public capital market funding for its general growth initiatives.

The firm’s financials have produced variable topline revenue, fluctuating gross profit but increasing gross margin, sharply higher operating loss and growing cash used in operations.

Free cash flow for the twelve months ended September 30, 2022, was negative ($5.3 million).

Sales and Marketing expenses as a percentage of total revenue have risen as revenue has fluctuated; its Sales and Marketing efficiency multiple rose to 1.7x in the most recent reporting period.

The firm currently plans to pay no dividends and to retain any future earnings for reinvestment back into the company’s growth plans.

BABY’s trailing twelve-month CapEx Ratio indicates it has spent lightly on capital expenditures as a percentage of its operating cash use.

The market opportunity for selling baby products is large and expected to grow at a moderate rate of growth through the end of the decade.

Boustead Securities is the lead underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (73.9%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

Risks to the company’s outlook as a public company include its tiny size, uneven revenue history and high losses as it has sought to grow revenue.

As for valuation, management is asking investors to pay an Enterprise Value/Revenue multiple of approximately 1.36x at IPO.

Given the firm’s largely undifferentiated offerings, heavy competition among online retailers and growing heavy losses, I’ll pass on the BABY IPO.

Expected IPO Pricing Date: To be announced.

Be the first to comment