Pgiam/iStock via Getty Images

We begin again with our coverage of financial advisory names. The next on the list is Piper Sandler (NYSE:PIPR). As opposed to the pure-play investment banks that we cover, Piper Sandler has several other businesses that are mixing the picture. Sequentially, things are flat, which is remarkable. The weakness is in their M&A franchise, but their specialty businesses in municipal bonds are doing good, and the volatility is supporting their equity brokerage business. The resilience from sponsors offered in the last quarter is now over as the credit and equity environments have turned off private equity. Shockingly, they’ve had sequential growth in equity capital markets, IPOs and the like, which no one would have expected. Piper Sandler is a mid-market exposure as well, and does lots of smaller transactions below $1 billion. This could be a point of strength as opportunistic M&A in the smaller cap space offers a backstop. Overall, with their brokerage facing businesses, but also their growing restructuring franchise, Piper is not a bad bet on volatility.

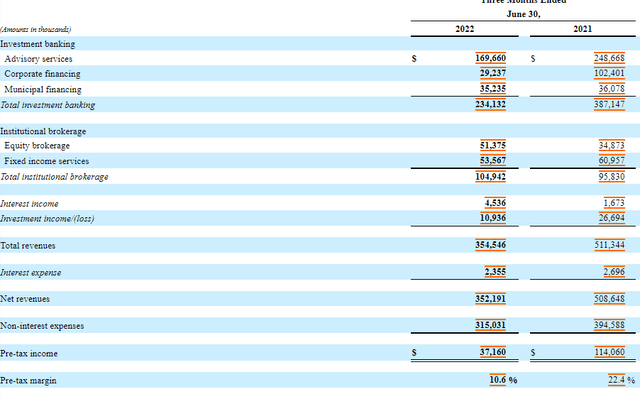

Q2 Results

The Q2 results were really quite peculiar. Broadly, PIPR’s segments are investment banking and institutional brokerage. Institutional brokerage was less surprising. The volatility has been good for those businesses. Equity brokerage saw meaningful YoY growth of over 60%, while fixed income saw some declines, but only by 10%, saved by specialty exposures to the municipal bond market. Overall, institutional brokerage, about 30-40% of PIPR’s revenue, saw decent growth of around 10% YoY.

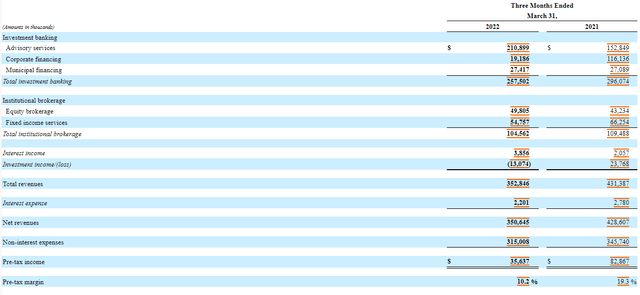

Investment banking saw major declines YoY of around 30%. No surprise there. However, there have been some pretty standout performances within. While YoY declines have been bad, the sequential performance reveals some pretty remarkable action. Sequentially, corporate financing, which includes ECM, actually went up. And this was driven by healthcare ECM and a bounce-back of biotech. FIG was weirdly strong as well, even though environments like this typically put everything on hold for those sorts of companies. A big surprise, since IPO markets have been closed, and ECM activity virtually dead since June. Sequentially those are up about 50%. Municipal financing is also up sequentially by about 20%, and YoY the change has been flat, owing to PIPR’s niche here in municipal bonds. Not bad at all. Advisory services fell about 20% sequentially and tanked YoY. No major surprise there, and not as good as some of the other companies in our coverage like Perella Weinberg (PWP) which managed to go flat on advisory. PIPR is not the same pedigree there.

IS Q2 from 10-Q (sec.gov)

IS Q1 from 10-Q (sec.gov)

The poorer performance in advisory is because of the let-down from sponsors. Because leveraged finance markets are effectively closed, and sellers are adjusting expectations in a new risk-off environment, PE has taken a massive pause. This was a source of major resilience last quarter, and has kept the H1 figures actually pretty close to prior year’s, with only a 5% YoY decline in advisory services.

Conclusions

At some point, the hold off in financing that has happened during the industry will have to release, especially if things get worse macroeconomically with balance sheets being the way they are. It will begin to hurt businesses to wait there, which is what they’ve been doing so far. Moreover, PIPR has been adding partners to its restructuring business for several quarters now in preparation of a worse environment. ‘Dialogue’ around restructuring has started, and to our understanding about 10% of partners are now in restructuring, with overlap from other segments. This could surprise to the upside, especially since there’s no precedent of PIPR having a restructuring franchise to protect in a downturn. Also, PE activity will have to resume because there is so much dry powder. These are backstops. Still, with the latent issues in the economy stemming from a quite logical decline in consumer confidence, there is certainly some more downside for the investment banking business.

But on top of the backstops in advisory, there is also the institutional brokerage business which offers explicit countercyclicality. Volatility is a trader’s friend, and the bet on more market troubles in our opinion is a sure one, and one that can be made without paying any premium for that security. Moreover, PIPR has repurchased about 10% of its shares. We certainly like that sort of capital allocation too, in addition to their acquisitions of DBO (a tech focused M&A group) and Stamford, hopefully at good prices in the current environment, which added to their headcount. The space might not be the best, but PIPR has some major backstops. We don’t hate it at all, but note there’s a lot of operating leverage in the model, and having to fire people is akin to a fire-sale of assets. The good companies hire when things look bleak, like Moelis (MC).

We think there’s merit to the thesis here, and IB isn’t doomed. But we don’t take these kinds of risks when there are sure things on the market, or speculative bets like this that are cheaper. Pass for now.

Be the first to comment