whyframestudio/iStock via Getty Images

Introduction

The fortunes of the oil and gas industry have seen a day and night difference as demand recovers from the Covid-19 pandemic and exposes a lack of supply following years of minimal investment, even before the Russia-Ukraine war turbocharged prices. This now sees Pioneer Natural Resources Company (NYSE:PXD) sending a tidal wave of cash to the pockets of their shareholders, although this is very desirable right now, fears of a recession linger in the minds of investors but thankfully, their shares appear to have not priced triple-digit oil prices and thus investors can grab a very high 10%+ yield with little downside risk should the bullish outlook for oil prices fall flat.

Background

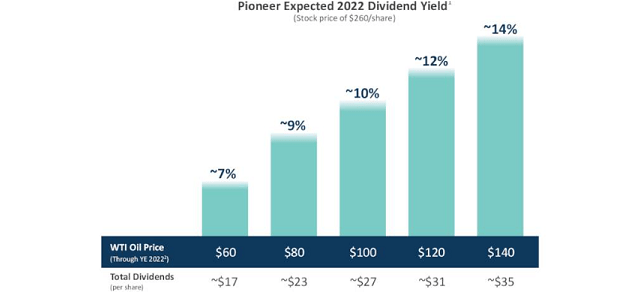

Unlike past oil and gas booms, most companies are wary of rapidly increasing production and instead prefer to focus on rewarding their shareholders. This saw a wave of refreshed shareholder returns policies rolled out across 2021 and 2022, some are heavily weighted towards dividends whereas others are heavily weighted towards share buybacks. Each investor is entitled to their own preferences but it remains mine that dividends are preferable to share buybacks, which thankfully in this situation, take center stage given their variable dividend policy, as the graph included below displays.

Pioneer Natural Resources June 2022 Investor Presentation

It can be seen that as Western Texas Intermediate oil prices increase, their dividends follow in tandem with them aiming to return 75% of their free cash flow, as per slide five of their June 2022 investor presentation. This also shows that they aim to top up their shareholder returns with relatively smaller share buybacks funded from the last portion of their free cash flow. In some situations, returning the vast majority of free cash flow would leave the company vulnerable to a downturn but thanks to their very healthy financial position, this is not the case. When the first quarter of 2022 ended, their net debt stood at $3.305b, as per their Q1 2022 10-Q, which even compared to their downturn-stricken operating cash flow of $2.083b during 2020 would only see a low net debt-to-operating cash flow of 1.59, as per their 2021 10-K. This means that even with much weaker financial performance, their leverage would still only be low and thus as a result, they can safely return as much free cash flow as they want to their shareholders.

The rewards are obvious if oil prices remain strong with Western Texas Intermediate prices of $100 per barrel providing annual dividends of $27 per share, which on their current share price of $209.80 would see a very high near 13% yield. Due to the lack of investment in oil and gas production throughout the last half-decade, the world is finding it difficult to meet demand, which in theory should provide a solid degree of support even in the face of recession fears with the International Energy Agency warning of further market tightness still to come regardless of these economic risks. Despite this bullish outlook for oil prices that should see investors able to grab a double-digit dividend yield in the short-term, risk management is always important and thus this analysis considers what happens if this bullish oil price outlook falls flat.

Discounted Cash Flow Valuations

The type of investor attracted to oil and gas companies can vary with some more likely to attract speculative traders, whilst in this situation, given their heavy focus on dividends, they are more likely to attract income investors. This means that their intrinsic value is heavily dependent upon the future income they can provide their shareholders and thus can be estimated by utilizing discounted cash flow valuations that replace their free cash flow with their dividend payments. If interested, further details regarding the inputs utilized for these valuations can be found in the relevant subsequent section.

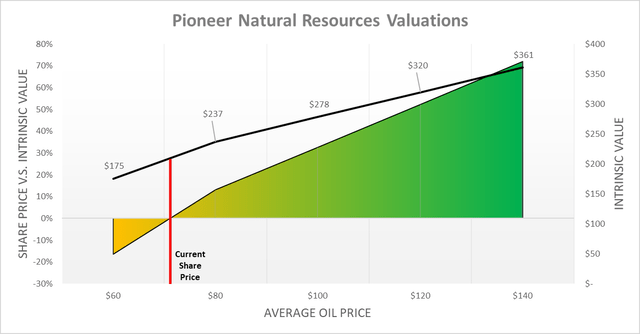

Whilst there are numerous ways to approach valuations, thankfully management made the choice rather easy by laying out their forecast dividends at various average Western Texas Intermediate oil prices ranging from $60 per barrel to $140 per barrel. In my view, these are suitable to provide a basis for the bearish through to bullish scenarios, which respectively see dividends of $17 per share to $35 per share at the lower and upper limits with the other three steps sitting between the two, as per the previously included graph.

Notwithstanding the growth that the oil and gas industry enjoyed recently as demand recovers coming out of the Covid-19 pandemic, it remains a fact that eventually in the long-term they face a decline as the world transitions to clean energy. The supermajor oil and gas companies, such as BP (BP) are already investing in these new areas, although it remains uncertain whether independent oil and gas companies, such as Pioneer Natural Resources, eventually follow suit and find themselves a new place in the world. To account for this long-term uncertainty and provide a margin of safety, it was assumed that in each scenario, their dividends would remain unchanged heading into the future before ceasing after 30 years. Considering their accompanying share buybacks, this effectively assumes their total dividend payments at the company level decline slightly each year, thereby seeing a gradual wind down across the decades.

Very interestingly, reviewing these results show that their current share of $209.80 sits between the intrinsic value for the $60 per barrel and $80 per barrel scenarios, which indicates that their shares are seemingly priced for only circa $70 per barrel oil despite prices having spent most of 2022 around $100 per barrel. Even under the bearish $60 per barrel scenario, their intrinsic value of $175 is only 16% lower than their current share price, thereby indicating only a little downside risk in the medium to long-term. Whilst oil prices may one day plunge even lower, since the world is finding supply difficult, this should not be for a prolonged time and conversely should be matched with periods of comparably high oil prices because once again, it is important to remember that these scenarios are averages given the month-to-month unpredictably of oil prices.

In my eyes, this is a desirable set of results because investors can grab a very high double-digit yield right now whilst only facing a little downside risk if the bullish oil price outlook falls flat. This is not to say that their share price would not budge if oil and gas prices plunge in the short-term, which is always a risk given the inherent volatility in markets. More so, this means that in the medium to long-term, investors should still fare well because the intrinsic value of their dividends under this situation is still near their current share price. By providing a variety of results, readers can cross-reference their own views with these valuations as they may vary from my own.

Valuation Inputs

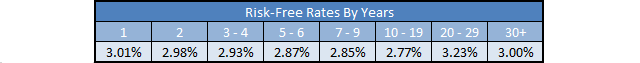

When conducting these discounted cash flow valuations, they utilized a cost of equity as determined by the Capital Asset Pricing Model. The inputs were a Beta of 1.32 (as per Barron’s), an expected market return of 7.50% and risk-free rates per year that track the United States Treasury yield curve on July 22th 2022, as the table included below displays.

Author

Conclusion

If chasing yield, it remains important to not allow yourself to be blinded simply by the headline yield on the ticker quote page, as in many cases, it can mask medium to long-term fundamental issues or alternatively, see investors nursing heavy losses if the tide turns. Thankfully in this situation, their share price is seemingly only pricing a scenario whereby Western Texas Intermediate oil prices only average circa $70 per barrel and thus even if the bullish outlook falls flat, investors only face a little downside risk in the medium to long-term. Since this means they can grab a very high 10%+ yield right now and still sleep easy at night, I believe that a buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Pioneer Natural Resources’ SEC filings, all calculated figures were performed by the author.

Be the first to comment