kentoh/iStock via Getty Images

Investment Thesis

Pinterest, Inc. (NYSE:PINS) was one of the first social media companies to embrace the new environment and change its leadership. The time for investing for growth is now in the rearview mirror.

Now is the time to prove to investors the viability of Pinterest’s platform. More specifically, investors want to know that Pinterest can cut back on expenses and still grow its topline.

Also, investors really want to see Pinterest’s user numbers slowing down their attrition. Put simply, investors are keen to buy into Pinterest if they believe that this is more than just a Covid-winner.

With the stock down so significantly, I’m inclined to believe that there is some upside here.

What’s Happening Right Now?

As headed into Q3 2023, I wrote a bullish article about Pinterest here. I said:

[…] even though Pinterest hasn’t got the financial wherewithal to substantially make inroads, investors simply need to believe that it’s “possible.”

Along this theme, I now continue.

Recall, other bullish investors are interested in Pinterest too. For instance, activist shareholder Elliott took a 9% position in Pinterest because they believed that there was low-hanging fruit available to right this ship.

Furthermore, as I’ve made the case previously, the goal for Pinterest is how to move beyond just advertising to making eCommerce a bigger part of its opportunity.

How to make Pinterest shift its users beyond just seeking inspiration to overlapping with Stitch Fix’s (SFIX) personalization business model?

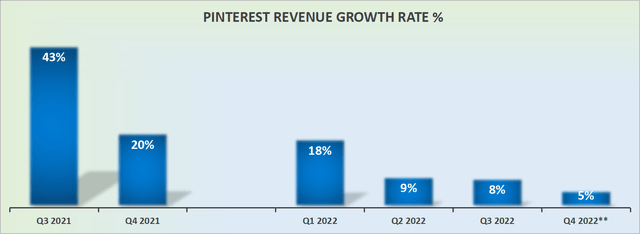

Revenue Growth Rates, Over the Worst

Undoubtedly, the guidance ahead is the most pertinent consideration for bulls. There’s no ambiguity here. With at least mid-single digits CAGR, including FX, investors are going to be very pleased with this.

This means that there’s Q1 of next year that is going to be slightly tough, but after that, the comps for 2023 become materially easier.

Put another way, with Pinterest down more than 80% from the highs, this is a company that appears to be priced as if it’s going to go bankrupt.

Again, that’s not to say that there are not plenty of issues, which we’ve already discussed above. But one way or another, this company has been left for dead, with expectations so low, that anything that wasn’t utterly disastrous was probably already priced in.

Profitability Profile

This is where the battleground now lies for tech companies. They went through this period of excess, but can they now dramatically reduce their investment and show investors that they can translate some of that revenue into clean GAAP profitability?

I believe that Pinterest is demonstrating just that. For example, total operating costs and expenses were up 41% y/y in Q3. However, looking ahead to Q4, Pinterest states that operating expenses will be dialed back considerably and are only expected to be up in the low double digits.

I believe this is a reflection that Pinterest’s new CEO Bill Ready is very much attuned to what investors are now looking for. This is something that other top executives have recently been accused of being unwilling or incapable of doing.

PINS Stock Valuation – What’s Fair Value?

Difficult to argue that Pinterest is dramatically undervalued. What makes me say so? Well, for one, the business saw its bottom line go from reporting a small GAAP profit last year to a loss this time around.

One significant culprit for this is that while revenues were up 8% y/y, share-based compensation (“SBC”) was up 41% y/y. And that’s a theme that I’ve highlighted on many occasions. With companies’ stock selling at really low points, management’s SBC has to be dramatically increased to top up any shortfalls in executive compensation.

In a further effort to drive my point home, we can see that since the start of 2022, even though Pinterest has more revenues to spread its cost basis over, its GAAP losses have been increasing each quarter.

So, PINS is down a lot. But it isn’t exactly the best bargain around.

The Bottom Line

There’s much to be hopeful about Pinterest. For one, the share price has clearly already taken a lot of medicine in the past twelve months. The share price has already come down more than 80% from its highs.

Also, there’s already been a change of management. Bill Ready is a highly reputable CEO, and he has come in with the mission to right this ship. And with the stock down so much, there’s bound to be a change in the underlying strategy.

It’s far from guaranteed that Pinterest is now fully out of the woods. But for now, the market is giving this stock a pass.

Be the first to comment