BorisRabtsevich/iStock via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the PIMCO Corporate & Income Strategy Fund (NYSE:PCN) as an investment option. This is a closed-end fund with a primary objective “to seek high current income, with a secondary objective of capital preservation and appreciation.”

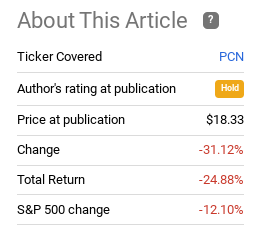

It has been one year to the day since my September 2021 review of PCN, and quite a bit has changed since then! At the time, I mentioned the fund’s income stream looked attractive, but it wasn’t enough to make me a buyer. In hindsight, this turned out to be the right call. The income stream has stayed constant, but PCN has seen a sharp loss since publication:

Fund Performance (Seeking Alpha)

Certainly the performance looks a bit scary. Even with the broader macro-climate, it is clear PCN has been performing worse than many other options. With that backdrop, I wanted to take another look at the fund to see if I should change my rating for Q4 and into 2023. After review, I do believe a buy argument is much easier to make now than it was in September last year, and I will explain my reasoning in detail below.

Credit Has Been Hit Hard, Better Times May Be Ahead

To start, I want to dig into the reasons behind PCN’s poor performance over the past year. Understanding the why can sometimes be critical when evaluating if better days do lay ahead. In the case of PCN, we should recognize that while I showed that the fund is down quite a bit since my review a year ago, the bulk of the losses has come this calendar year. After wrapping up 2021 on a fairly positive note, 2022 has been all downhill:

YTD Performance (PCN – Seeking Alpha)

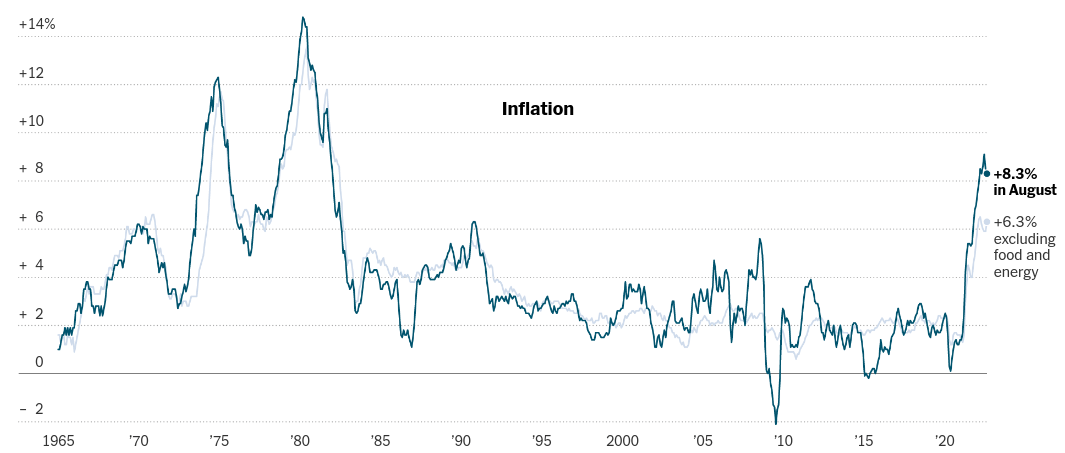

There have been a variety of reasons for this, most of which are probably well known to investors at this point. Still, it is worth running down the list. The primary reasons for the bloodbath is credit markets is two-fold. These twin factors are high levels of inflation and aggressive (relatively) Fed rate hiking. The two are going hand in hand because as long as inflation stays elevated, which August’s report shows is still the case, the Fed is very likely to keep on track with higher rates:

CPI Figures (Bureau of Labor Statistics)

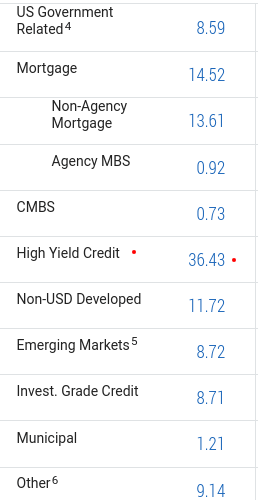

The other paramount concern impacting the high yield credit markets, and PCN by extension, is rising recession risks. This fear is not going to impact IG credit as much, since that is an area investors will often flock to when economic conditions deteriorate. But high yield credit and other riskier assets tend to fall out of favor when recession fears hit the headlines. This is critical to PCN because this CEF is a big player in the high yield credit space:

PCN’s Sector Weightings (PIMCO)

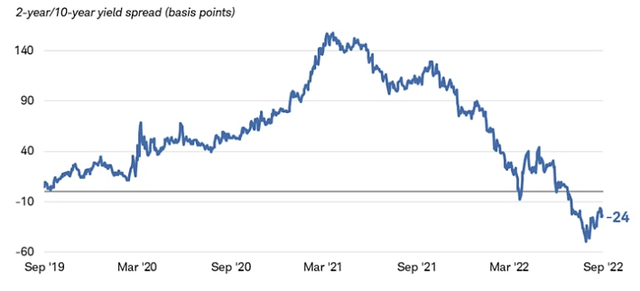

As you can see, high yield credit is by far the largest individual sector within PCN’s portfolio. This makes the outlook for this space very important when evaluating whether or not to buy this fund. Since mid-August, PCN has been dropping again very consistently, and a lot of that has to do with concerns of an impending recession. The bond markets are beginning to signal the expectation of negative growth domestically, as evidenced by the sustained yield curve inversion across the Treasury market:

Treasury Yield Curve (showing an inversion) (Charles Schwab)

What I am trying to illustrate here is that credit markets have been under fire this year for legitimate reasons. As interest rates rise bond values drop, so it is logical that PCN would see NAV pressure. Further, high yield credit can often under-perform when there are broader economic concerns that makes investors want to de-risk. With the yield curve flashing a warning signal, that is just one of many signs that investors are probably using as an excuse to bail on this fund, and others like it.

My point is not that PCN is suddenly going to shoot higher and to ignore these risks. Quite the contrary. I do believe that the U.S. is going to have a stronger 2023 than the market is predicting as of now, which makes me bullish on lower quality credit as an opportunistic play. But that does not mean I won’t be wrong and broader deterioration could result. The bond markets are often good at predicting recessions, so readers need to manage expectations and factor that into their analysis. However, we have seen the yield curve invert before and macro-news ends up exceeding expectations. If that is the case this time around as well, I expect to see some gains in equities and credit markets alike.

Where’s The Good News? Valuation Is One Spot

As my followers know, I am not a cheerleader of any stock or fund, even the ones I own. So I am not at all suggesting to avoid the risks mentioned above and “back up the truck” at these levels, or whatever other bullish phrase is the flavor of the week that we see so often. But I am suggesting that PCN offers quite a bit more value today than it did a year ago. Aside from the fact that credit markets seem too beaten down across the board, PCN in isolation is much cheaper than it was in September 2021.

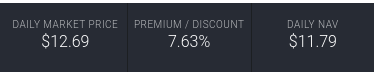

I am not referring to just the share price – obviously that is much lower than a year ago. But the share price has dropped by a wider margin than the fund’s underlying value. This is where the opportunity comes in. On this date last year, PCN had a premium to NAV of almost 27%. Today, that figure has dropped to a much more reasonable level. As I write this (on 9/19), PCN is down during market hours as well. So it is very likely we will see the 7.6% premium push below 7% at the market price tomorrow (9/20):

PCN’s Valuation (PIMCO)

The simple conclusion is not that PCN is “cheap” necessarily, but that is has moved to a level that is finally justifiable. Some investors may certainly find this too expensive still, and I wouldn’t fault them. But to see a fund that often trades in the teens or 20% premium range, this is a much more comforting spot for new positions.

Income Story Is Very Strong

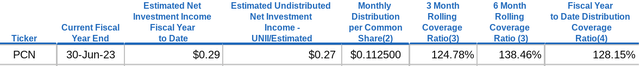

I will now expand on the point made above on why I think a slight premium is acceptable for this particular CEF. While I generally like to buy CEFs at a discount, PCN catches my eye here because it’s income story is supportive of a premium price (how much of a premium is subjective, as always!). In 2021 I discussed how I found the distribution stream attractive, but the lofty premium kept the fund on my “avoid” list. Looking back, PCN has managed to sustain its distribution and its covered has actually improved. This is impressive, especially in this environment:

What this shows us is PCN is maintaining its distribution handily. The fund’s coverage ratios are well above what I would need to see to be comfortable in a fund. Further, the UNII metric suggests PCN has roughly 2 1/2 months of distributions in reserves. Heading into the end of the year this means a special distribution is very likely. This is key to my upgrade to a “buy” rating.

I See Oil And Gas Prices Rebounding

I now want to dig a little deeper into PCN’s portfolio. As mentioned above, the high yield credit sector dominates this fund. But this can mean a lot of things. High yield credit comes in a variety of types, asset classes, maturity dates, etc. So while there is plenty of risk associated with securities that fall below investment grade, how much risk really depends on each individual holding.

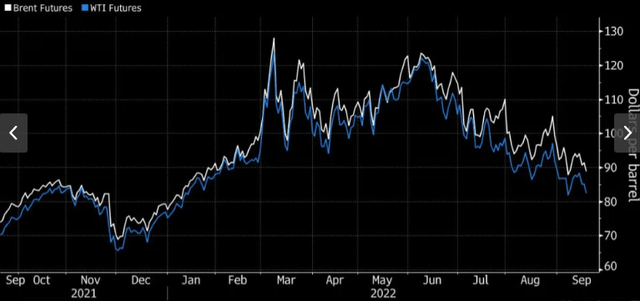

One area in particular that is getting some negative press right now is the Oil and Gas sector. Prices for both commodities are on decline, after generally having an astounding year. The reasons are complex, but both primarily stem from broader economic concerns on a global level. As China continues to take a strict approach to COVID-19, war in Europe rattles sentiment on that continent, and the U.S. on the verge of or already in a recession, demand is expected to decline for both these commodities. This has been reflected in current prices, as shown below:

Gas Futures (priced in Euros) (Yahoo Finance) Oil Futures (priced in Dollars) (Yahoo Finance)

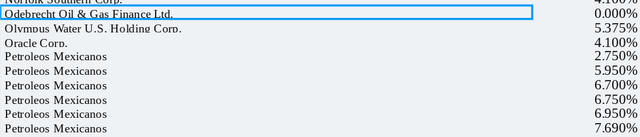

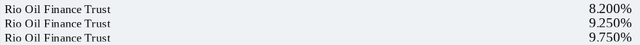

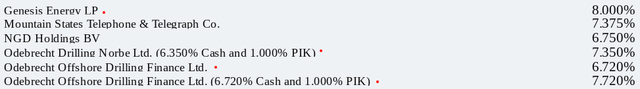

This is something all high yield investors should be monitoring because many debt issuers within the oil and gas sector are below investment grade. Further, the energy sector led in defaults when the pandemic sent oil prices tumbling. This is relevant because PCN does indeed have some exposure to this space. Holdings include issues from Petróleos Mexicanos, a government-owned oil and gas company in Mexico, Odebrecht Oil & Gas Finance Ltd., Rio Oil, Genesis Energy, among other issues, including some individual stocks in the energy sector, as listed below:

PCN Holdings (PIMCO) PCN Holdings (PIMCO) PCN Holdings (PIMCO) PCN Stock Holdings (Energy Sector) (PIMCO)

I am hoping to illustrate here that PCN is indeed exposed to this sector. This has almost certainly had some impact as commodity prices have been falling. Some may see this as much needed relief – in terms of prices at the pump or in household energy bills – but the companies in the sector who issued debt do not view this positively.

However, I view this opportunistically. I think buying up the commodities, energy stocks, or funds that hold debt from issuers exposed to this sector are all smart moves right now. Simply, this is not Q1 or Q2 2020. Sure, the market is starting to predict declining economic growth. Supply-chain issues are also starting to ease a little bit. This is bearish for commodity prices like oil and gas.

But I personally see this as short-sighted. The supply-demand imbalance, especially within oil markets, is not going away. Demand may decline going forward if world economies see recessions. But demand is still very elevated to supply, which supports prices even if demand does wane a bit temporarily. A similar story plays out in the gas sector. Russia has weaponized its supplies, and Europe does not have an easy alternative. I see the dips in these commodities as buy opportunities, and I imagine revenues and profits will continue to be strong in this space going into 2023. This means the underlying debt should perform well, a positive sign for PCN.

Bottom-line

This has been a year to forget in credit markets. PCN, along with most options investors would have considered, is down very heavily. To be fair, more downside could be in the cards. Inflation is still high, the Fed is likely to keep raising rates, and concerns of recessions (here and abroad) are pressuring high yield valuations. All of these factors cloud the outlook for this fund.

However, I believe the U.S. in particular will perform better than anticipated in 2023. I see the Fed pausing before it hits the 4% mark, probably when it nears 3.5% as it will want to assess the impact before moving much higher. In addition, PCN’s valuation story is no longer as scary as it was last year and its income metrics are very impressive. These factors make me willing to place a “buy” rating on PCN, and I encourage readers to give this fund some consideration at this time.

Be the first to comment