adrian825

Thesis

Photronics, Inc. (NASDAQ:NASDAQ:PLAB) stock has been hammered since its FQ3 earnings release, which remains nearly 40% below its early August highs. However, we believe the battering was justified as it was overvalued while heading to its highs.

Coupled with a slowdown in the broad semi industry, we deduce that the market has adjusted its expectations on Photronics. Despite management’s confidence that its growth cadence is unlikely to be impacted materially, Photronics’ revenue growth has been relatively volatile over time. As a result, the market isn’t convinced about its forward momentum at the valuation levels in August. Therefore, the de-risking by the market has set up PLAB well for a medium-term re-rating as it laps more challenging comps from its massive growth momentum in 2022.

Our price action analysis also suggests that further downside volatility should be limited as it approaches its near-term support. Hence, we postulate investors can consider capitalizing on the capitulation move to add exposure over time.

We rate PLAB as a Buy.

Photronics’ Growth Is Expected To Moderate

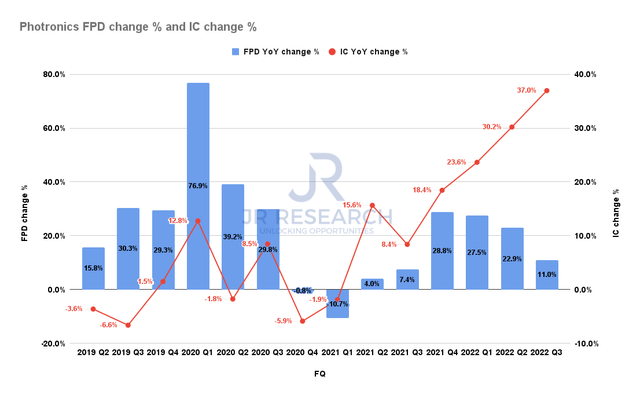

Photronics revenue by product change % (Company filings)

As seen above, the leading photomask company in the semi industry has seen tremendous growth in its IC segment since Q4’21. It continued a fourth consecutive quarter of above-trend growth, as its IC segment posted a 37% YoY increase in revenue in FQ3. However, FPD sales have continued to moderate, as the company highlighted it focused its capacity on higher-margin products while still being tight on capacity. Therefore, investors should expect its investment cadence in FPD to continue being a near-term headwind on the revenue growth trend for its FPD segment.

Investors should note that the company’s photomask products are used pervasively in mainstream and higher-end segments, as the company accentuated:

There has been some slowdown in customer new tape-out activities, more in high-end than mainstream. However, our experience has shown that megatrends in the market [will] drive [the] development of new IC and FPD designs, such as [in] of 5G telecommunications; the expansion of electronics and automotive application; and, of course, the continued expanding need for consumer electronics. As a result, we believe the negative impact of any slowdown on Photronics will be minor, as reflected in our Q4 guidance. (Photronics FQ3’22 earnings call)

Consequently, we believe its weaker-than-expected Q4 guidance relates to a slowdown in its IC segment, which should not be surprising. However, the company remains confident in its long-term model of improved profitability, which should continue to drive operating leverage higher. Therefore, we deduce that it should help mitigate the impact of a revenue slowdown, given the outsized impact of fixed costs deleveraged on slower revenue growth.

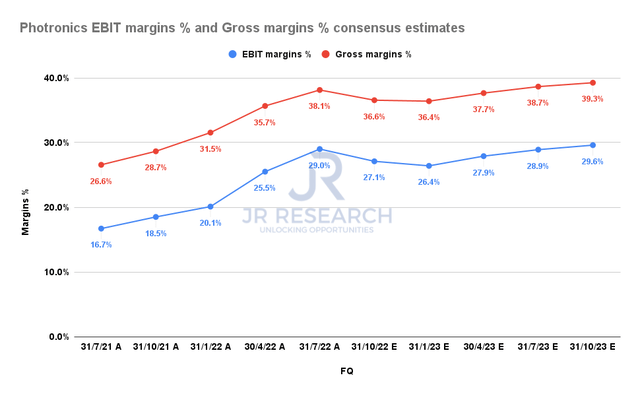

Photronics Gross margins % and EBIT margins % consensus estimates (S&P Cap IQ)

The consensus estimates (very bullish) suggest that the company’s gross and EBIT margins should continue to improve as it focuses its capacity on higher-margin segments while optimizing its current capacity.

Therefore, we believe it’s critical to provide robust support to its valuation, helping PLAB maintain investors’ confidence in its highly profitable operating model. Furthermore, the company believes it remains on track to meet the guidance on its 2024 model: gross margins (42-43%) and operating margins (32-33%). Hence, there’s still potential for margin accretion to help recover buying sentiments on PLAB.

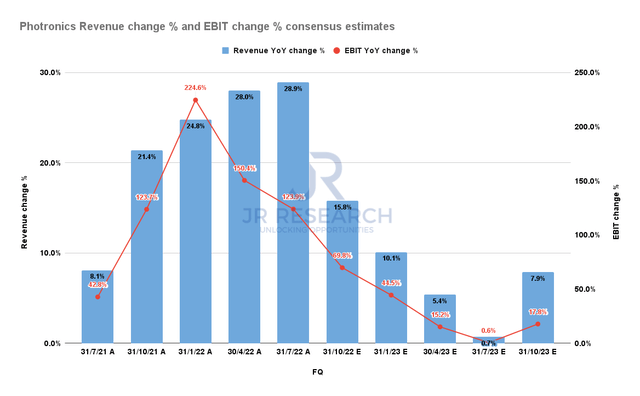

Photronics revenue change % and EBIT change % consensus estimates (S&P Cap IQ)

Despite that, PLAB’s revenue growth is projected to slow markedly through FY23, given the broad semi downturn. Therefore, it’s also expected to impact its operating leverage significantly, given the nature of its operating model.

Hence, we surmise that the battering in August/September was justified, as the market needed to de-risk for slower growth prospects, coupled with more challenging comps.

Is PLAB Stock A Buy, Sell, Or Hold?

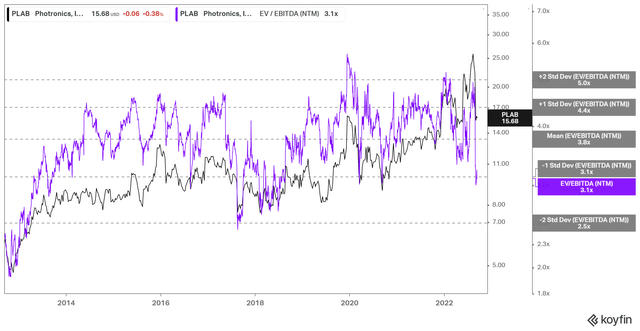

PLAB NTM EBITDA multiples valuation trend (Koyfin)

As seen above, PLAB last traded at the one standard deviation zone below its 10Y mean. That zone has underpinned its valuation multiple times over the past ten years. Of course, if a worse-than-expected semi downturn were to occur, it could send PLAB down further to the two standard deviation zone.

However, despite the near-term pessimism, we believe the reward-to-risk profile seems pretty reasonable at the current levels.

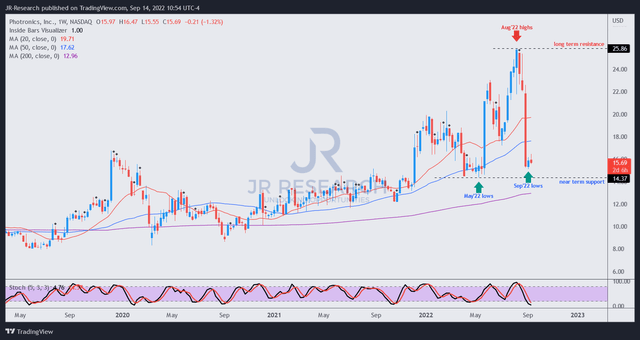

PLAB price chart (weekly) (TradingView)

We noted that the down move in August/September is emblematic of a capitulation move to shake out weak holders while de-risking PLAB substantially. Therefore, we deduce that the current levels should hold robustly, with limited downside risk to its near-term support, as seen above.

Accordingly, we urge investors to consider layering in, even though there could be further downside volatility.

We rate PLAB as a Buy.

Be the first to comment