ThitareeSarmkasat/iStock via Getty Images

Phillips Edison & Company (NASDAQ:PECO) is no newcomer to the real estate business but will face new challenges in proving its worth in the industry. The company is based in Ohio but has offices in Utah, New York, and Georgia. Prior to the company’s public listing, it was able to show consistent growth as it invested in community and neighborhood shopping centers. The company was listed as the 14th largest retail owner by square footage in 2016 and today manages a portfolio of millions of square feet of property.

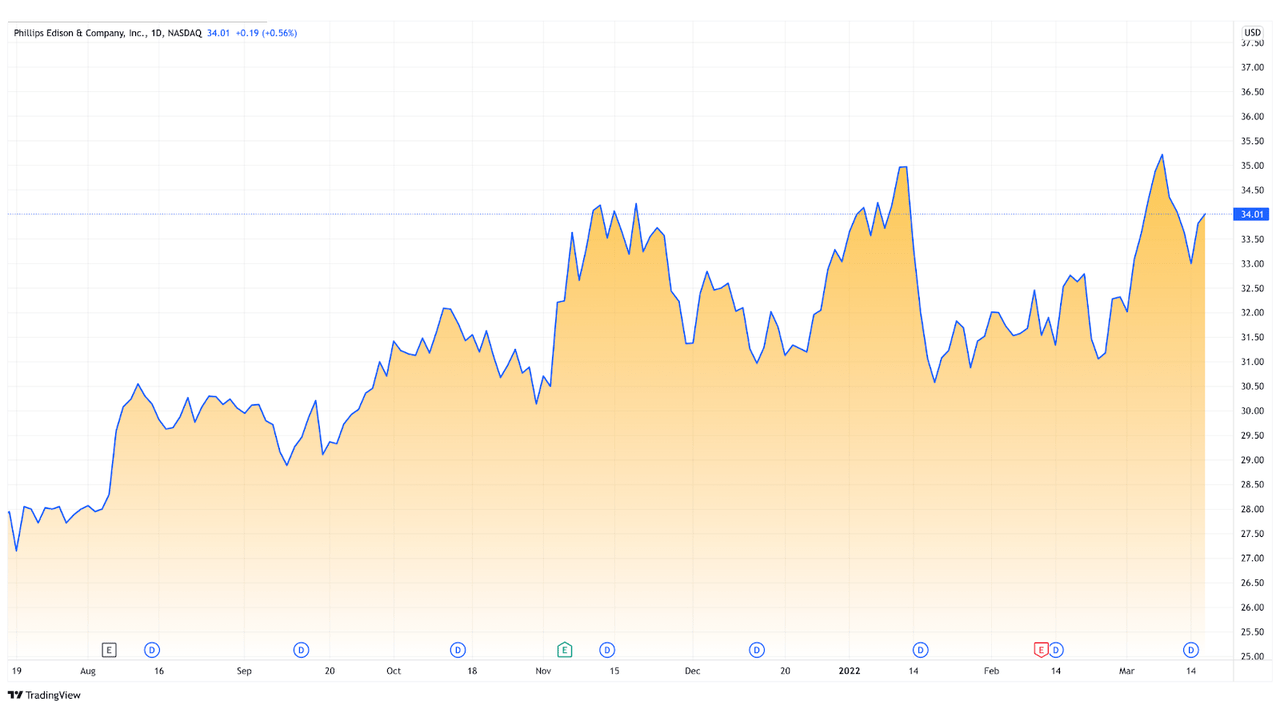

tradingview.com

Since its IPO, PECO has seen both optimistic analyses on its profitability and been a source of scrutiny compared to its peers in the industry. We will look at the company’s performance in its first public year, the extraordinary growth of the REIT industry, and why a cautiously bullish stance on the company could provide great returns in the long term.

Company Profile

Phillips Edison & Company was founded in 1991 and is today one of the largest owners and operators of omnichannel grocery-anchored neighborhood shopping centers in the United States. PECO has generated strong results through its vertically-integrated operating platform and national footprint of well-occupied shopping centers. The company owns a number of retailers that operate on both a regional and national level, though they all have the common attribute of selling goods where their shopping centers, which all include well-occupied neighborhoods.

The company went public for the first time in 2021, raising a total of $57.4 million from gross proceeds as it began trading on the NASDAQ. PECO is classified as a real estate investment trust, or REIT, as an entity that holds a portfolio of commercial real estate or real estate loans. As per last year, the company went from being a private non-traded REIT to a publicly-traded REIT. These companies usually attract investors due to the above-average dividend yield paid compared to other stocks. Diversification is another big plus for investors, along with greater liquidity and high transparency. Of course, there are some drawbacks, such as high sensitivity to changes in interest rates, higher tax liabilities, and the unlikely but costly possibility of industry headwinds and technology disruption.

The REIT industry could not have hoped for a better year than 2021, which saw the sector outperform the broader market by a substantial margin, finalizing the year with the best performance since 1976. The FTSE NAREIT Composite, a free-float adjusted market capitalization-weighted index of U.S. Equity and Mortgage REITs, delivered a total return of slightly more than 40% for the year, compared to the 29% total return the S&P 500 delivered in the same period.

The likelihood that this phenomenal performance will continue into 2022 is low, given that the main driver for this was the global pandemic, which proved to be a tailwind in helping drive outsized gains in rental rates and property values.

While some of this will continue in the current year, it cannot be realistically expected to return to March 2021 figures, especially since it is not being compared to 2020, which saw a total return of –6% and proved to be fairly easy to bounce back from. REITs soared in 2021, and while the altitude of the sector is slowly going down, it should see itself drifting for a while as the benefits of pandemic-related tailwinds continue to drive demand.

Company Portfolio

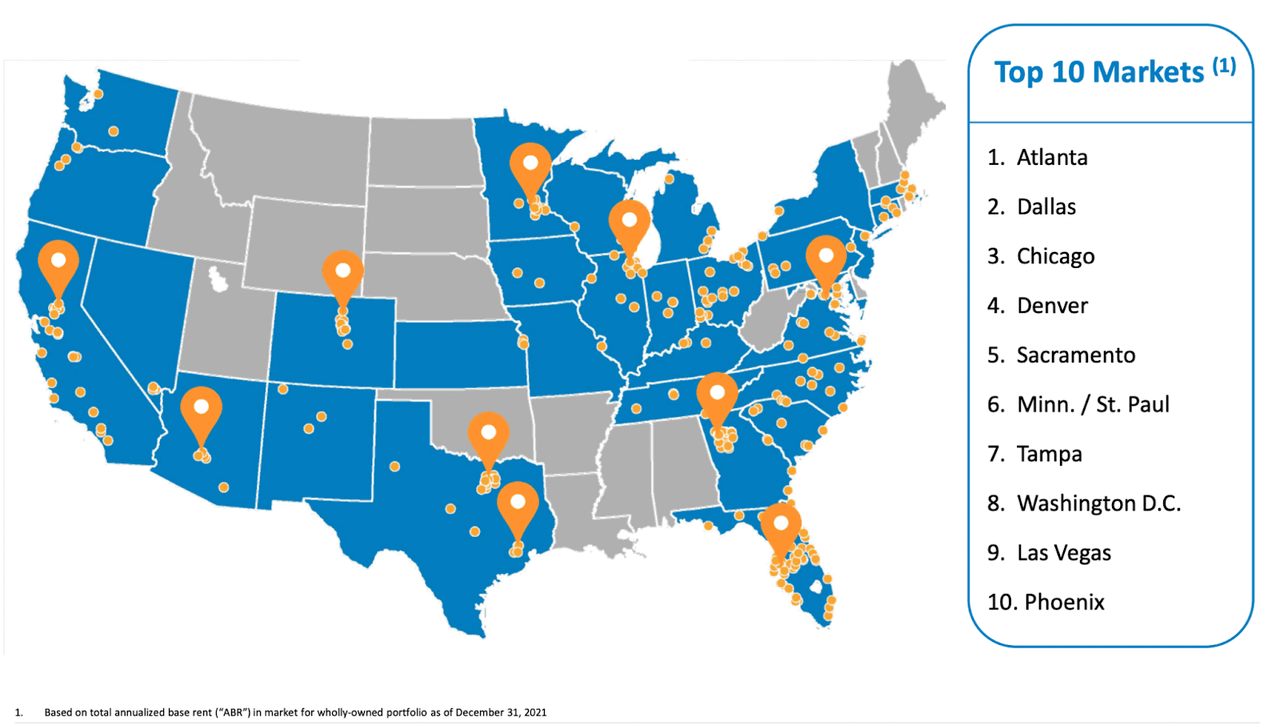

investors.phillipsedison.com

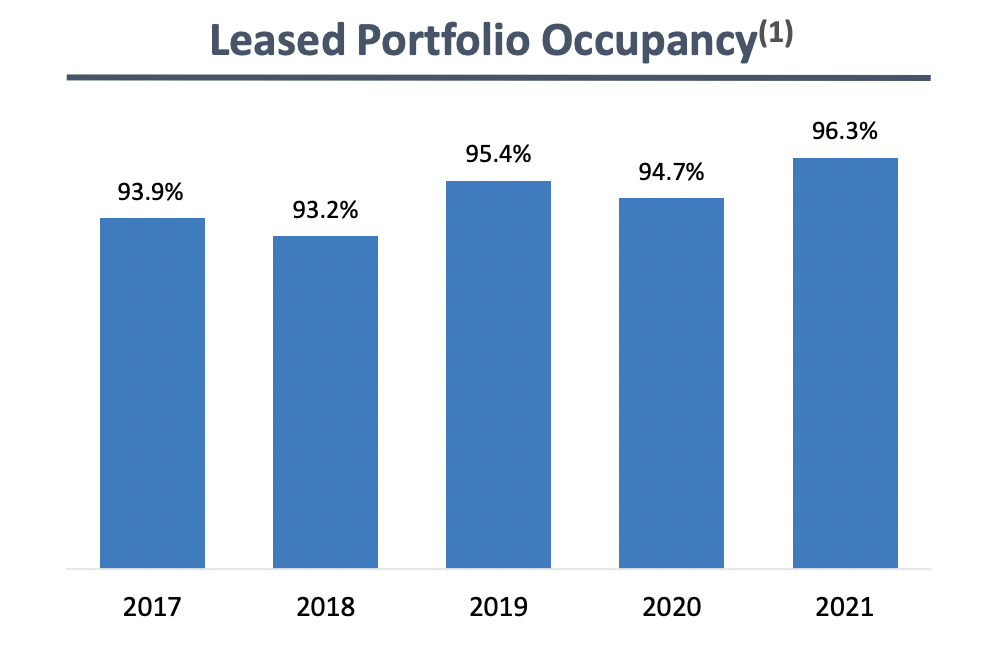

PECO owned a total of 268 properties by the end of 2021, or a total of approximately 30.7 million square feet of land, located across 31 states throughout the US. The previous year saw the company lose a total of 15 properties compared to 2020, or a total of 1 million square feet. However, leased portfolio occupancy increased from 94.7% at the end of 2020 to 96.3% by the end of 2021. This represented a subtle increase, but a rise nonetheless, maintaining high occupancy levels. Anchor occupancy also increased from 97.6% in December 2020 to 98.1% at the end of 2021. Maintaining this increase also saw an in-line occupancy rise, which saw a 3.8% increase for a total of 92.7%.

investors.phillipsedison.com

The final quarter of the year saw positive deals and renewals as 253 leases worth 1.4 million square feet were executed during the last three months of the year. This was just slightly more when compared to the previous year’s final quarter, which saw 300,000 square feet less in new deals, renewals, and options. PECO went on to acquire an additional five grocery-anchored shopping centers and two outparcels totaling over 750,000 square feet for $219.1 million. The company also sold four properties and one outparcel for $27.8 million.

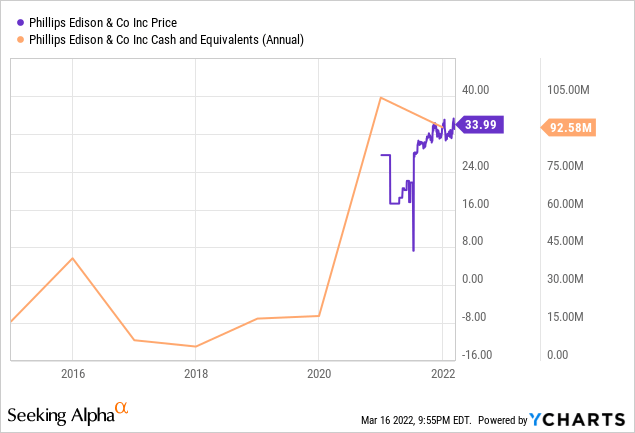

First Public Annual Report

In 2021, PECO completed its initial public offering, worth $547 million as well as a $980 million unsecured credit facility, as well as a debut investment grade debt offering worth $350 million. As the company continues to look for growth through the expansion of its portfolio, continued acquisitions will result in growing cash flow generated by the unique position of its centers. The company’s 2021 year ended with $115.529 million in cash and cash equivalents, which resulted in a decline from nearly $132 million reported by the end of 2020, the company’s record high. Closing off the year with $4.669 billion was not too far from the $4.678 billion reported the year before. This should keep the company afloat for a while as they navigate new ways to manage their finances as a public company.

ycharts.com

The fourth quarter of the year reported a net loss attributable to stockholders of $5.2 million, which was much better than the $11.2 million loss reported in 2020, half the amount lost. Losses of $0.05 per diluted share were also a significant improvement from the $0.12 per diluted share reported in the final quarter of 2020. An increase in earn-out liability directly resulted in an increase in rental income and marked an improvement in collections. Outstanding debt achieved a weighted-average maturity of just over five years, at an interest rate of 3.3% and approximately 98.7% fixed-rate debt. Overall, PECO saw its net debt to annualized adjusted EBITDA go down from 7.3x at the end of 2020 to 5.6x by the end of 2021.

Outlook and Takeaways

On February 9, 2022, PECO’s Board of Directors authorized a new at-the-market (ATM) stock offering program worth $250 million. While the company intends to wait out ideal market conditions before using the program, this will eventually improve the company’s access to equity capital markets. In the meantime, the company is expected to see continued growth in net income, as it is currently experiencing a higher-than-average industry growth of 9.3%.

There are certainly measures that might be off-putting when considering taking a bullish stance on PECO, giving some credence to skeptical analysis by some experts. Still, there is often more to a company’s future than mere ratios and numbers on a balance sheet. PECO will see itself through these misguided figures, and while it may take some time, there is little doubt about the company’s long-term profitability. While investors may want to wait on the sidelines for either more news or a correction to occur, longer-term, it is clear that there is value to be captured here.

Be the first to comment