JHVEPhoto/iStock Editorial via Getty Images

Thesis: In This Environment, Essential Retail Is Sexy

Phillips Edison & Company (NASDAQ:PECO) may be new to the public real estate investment trust (“REIT”) space, but the grocery-anchored shopping center landlord has been in business for over 30 years. With 289 properties under management, 268 of which are wholly owned, PECO commands the highest percentage of revenue from grocery-anchored centers of any shopping center REIT at 97%.

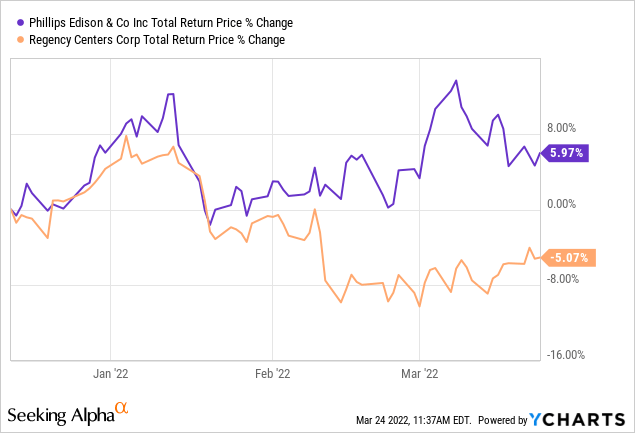

Since writing “3 Reasons To Buy Phillips Edison & Co. Instead of Regency Centers” in December 2021, PECO has outperformed its larger blue-chip peer by a significant margin.

I know, I know. This is not a long enough time period for a fair comparison. There are any number of reasons why Regency Centers (REG) might’ve underperformed PECO over the last four months. But the fundamental reasons why I argued PECO was the better buy back in December remain true today: PECO is smaller, cheaper, and better-positioned than REG for the long term.

Now, I’ll fully admit that by multiple metrics, REG’s properties are higher quality than those of PECO. But they also come with a higher price tag and lower cap rate, generally speaking.

And as we find in a recent article on Brixmor Property Group highlighting its inflation hedging qualities, it’s possible to perform well following a value investing approach in real estate as long as the right management team is in place.

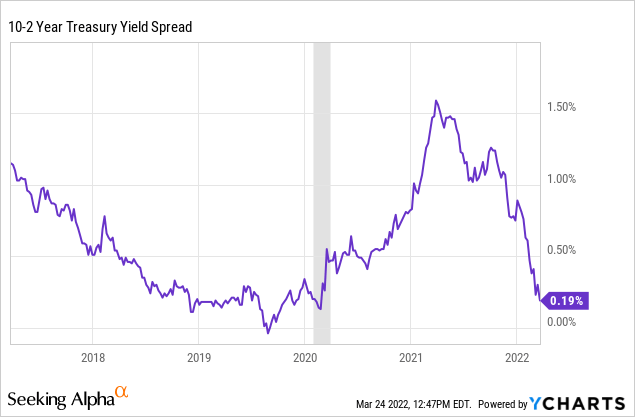

One of the primary reasons I like PECO is its defensiveness. The yield curve spread between the 10-year and 2-year Treasury rates, which has historically been one of the most reliable predictors of an oncoming recession, is rapidly declining toward zero.

That means the likelihood of a recession in the next year or so is increasing. In recessions, grocery-anchored retail centers tend to be one of the more defensive investments. That makes PECO appealing, especially since the stock is currently valued at a mere ~14.9x core FFO.

4 Reasons To Like PECO

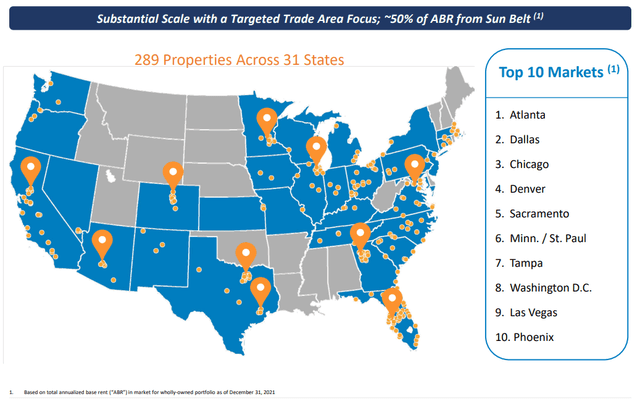

The first reason I see to like PECO concerns its geographic concentration. Now, people need to eat everywhere, so grocery-anchored centers in any population center should perform well as long as other real estate fundamentals are positive.

For instance, the San Francisco Bay Area experienced some of the highest net population outflows during the pandemic, with many of those folks moving to the Sunbelt. But there are still a lot of people in the Bay Area, and they still buy groceries and other essential retail items.

That said, I like to see that PECO’s portfolio is concentrated largely in regions of the country that have either experienced strong population growth (Sunbelt) or at least have had stable populations (Mid-Atlantic/Midwest).

PECO Q4 2021 Presentation

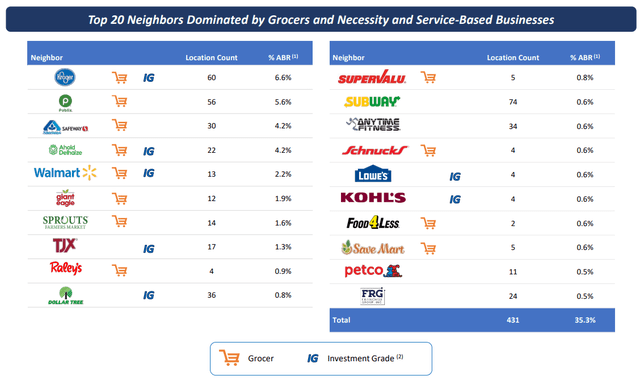

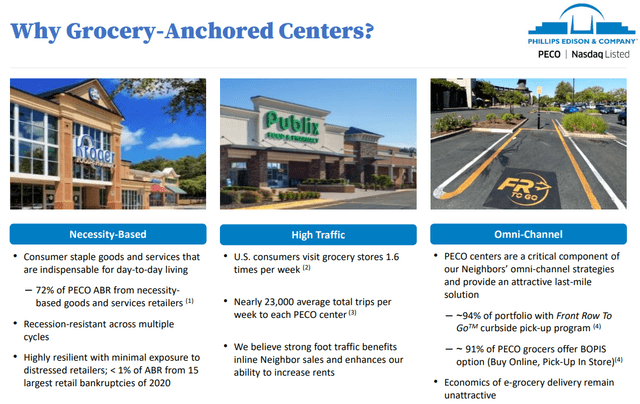

The second reason to like PECO is the REIT’s nearly exclusive focus on grocery-anchored centers, which account for 97% of total rent.

Perusing PECO’s top 20 tenants, we find that 12 of them are grocers.

PECO Q4 2021 Presentation

And the REIT doesn’t just buy any grocery-anchored center. PECO targets properties wherein the anchor is the #1 or #2 grocer by sales in its respective market. This alone ensures a certain quality to PECO’s real estate.

In an increasingly omnichannel retail world, PECO has done a good job of retrofitting its portfolio to suit customers’ evolving desires. Most of its grocers now offer curbside pickup and buy online, pick-up in store (“BOPIS”) services.

What’s more, the majority (72%) of PECO’s rent is derived from “necessity-based” retailers, which makes its portfolio far more recession-resistant than the average REITs.

PECO Q4 2021 Presentation

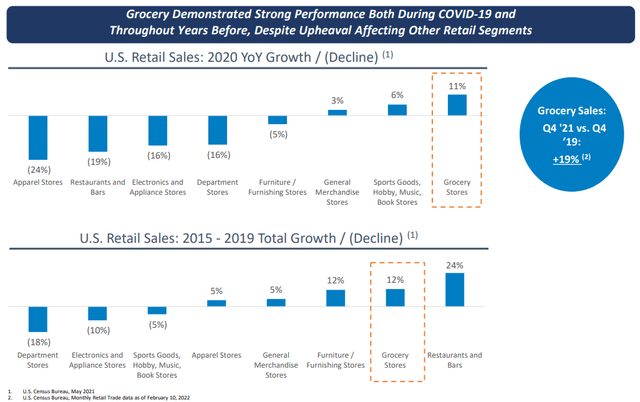

In 2020, for instance, grocery stores exhibited impressive growth even while the rest of the retail landscape suffered. But, of course, 2020 was a unique year. Even going back to the five-year period of 2015 to 2019, however, grocery stores still boasted some of the highest sales growth.

PECO Q4 2021 Presentation

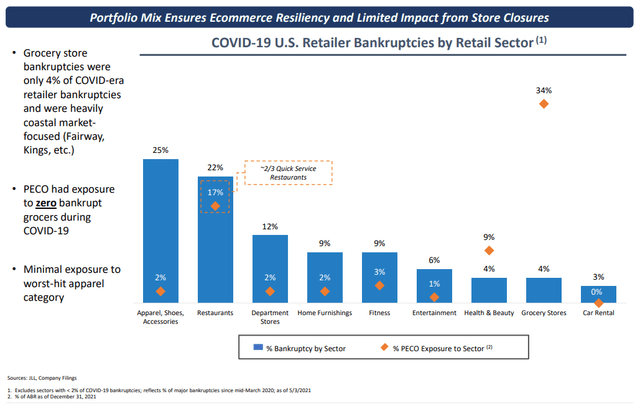

Moreover, PECO’s in-place tenant base mostly proved to be resilient during the pandemic, as the REIT had very little exposure to the retail sectors worst hurt by COVID-19. Notably, unlike many other shopping center landlords, PECO has very little exposure to apparel retail or department stores.

PECO Q4 2021 Presentation

Moreover, unlike many other types of retail, the economics of home delivery simply don’t make sense for groceries right now. It isn’t profitable for retailers. Grocery stores already operate with very thin profit margins of 2-4%. It becomes very difficult to make a profit on any kind of delivery services without charging hefty fees that turn off most customers.

So, PECO is Internet-resistant in addition to being recession-resistant.

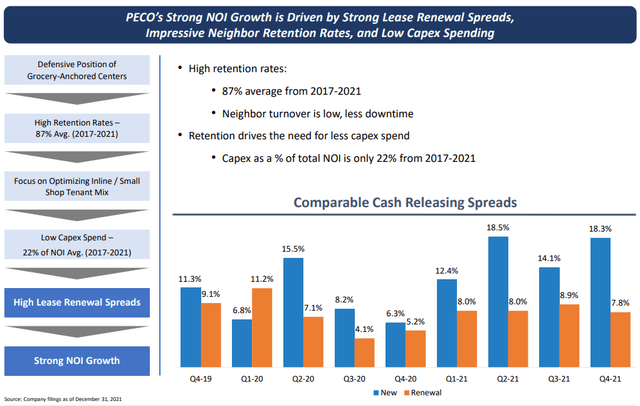

But does this mean that rent growth is limited? After all, stable businesses rarely also enjoy high growth rates. That hasn’t been the case for PECO in the last year. In each quarter of 2021, rent rates on new leases increased by double-digits over previous rates, and renewal rates consistently rose around 8%. Blended rent growth for the full year came in at 10.1%.

PECO Q4 2021 Presentation

Moreover, notice that PECO’s tenant retention from 2017 to 2021 has been 87%. This is a remarkably high rate that speaks to tenants’ success at PECO’s properties.

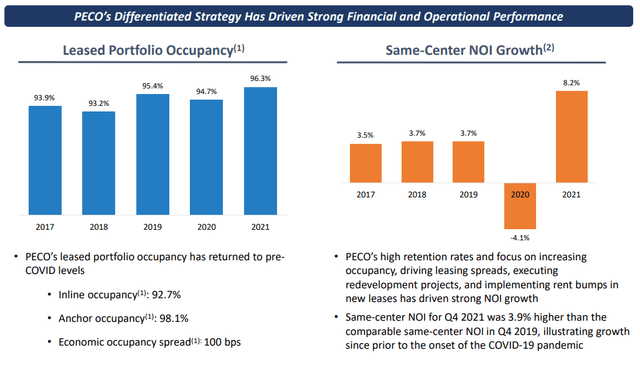

Hence we find that PECO’s occupancy is also quite high at 96.3% in 2021, with nearly 100% anchor space occupancy. This occupancy is well above 2019 levels and indicates strong demand for PECO’s space from retailers. Inline (small shop) occupancy is the real stand-out, rising from 88.9% at the end of 2020 to 92.7% at the end of 2021.

PECO Q4 2021 Presentation

After a difficult year in 2020, same-property NOI growth of 8.2% is exactly the rebound that investors needed to see in 2021. In the fourth quarter, same-property NOI grew at 15.2% year-over-year and 3.9% over the same quarter of 2019.

For 2022, management expects same-property NOI growth to come in at 3-4%, which is in-line with its pre-pandemic growth rate.

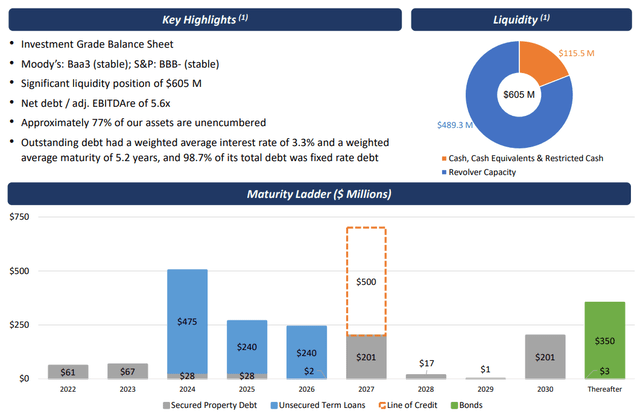

The third reason to like PECO is its fairly strong, investment grade-rated (BBB-) balance sheet. Net debt to EBITDA ended 2021 at 5.6x, down considerably from 7.3x at the end of 2020. Also, debt maturities appear to be well-laddered over the next decade.

PECO Q4 2021 Presentation

The weighted average interest rate of 3.3% is pretty low, especially considering virtually all debt (98.7%) is fixed rate. In Q4 2021, PECO issued $350 million of 10-year bonds with an interest rate of 2.625%.

Let that soak in. If that doesn’t communicate the bond market’s view of PECO’s defensiveness and conservatism, especially at a time when inflation is running hot, I don’t know what does.

The fourth reason to like PECO is its skilled and shareholder-aligned management team, led by company co-founder Jeffrey Edison (after whom the company is half-eponymously named). Around 7% of PECO is owned by management, which represents about $288 million of PECO’s current ~$4.1 billion market cap.

Moreover, the six-month, post-IPO lockup period ended January 18th with no recorded insider stock sales.

In fact, it appears that the IPO price of $28 per share may have been priced intentionally or at least knowingly too low, giving insiders a chance to buy more shares below fair value. CEO Jeffrey Edison bought 50,000 shares at the IPO for $28 apiece, totaling a $1.4 million purchase.

Summary Points

In 2021, core FFO per share of $2.19 rose 10.6% from 2020’s $1.98. Unfortunately, PECO has guided for basically flat core FFO growth in 2022 with a range of $2.16 to $2.24 (midpoint of $2.20). Interestingly, total core FFO is expected to increase by ~11%, but on a per-share basis, it’s expected to come in flat. This implies PECO is going to rely heavily on equity issuance this year for growth, perhaps in pursuit of a credit rating upgrade.

On the plus side, that gives the current annualized dividend of $1.08 a payout ratio of 49%, leaving lots of room for dividend increases.

Given that PECO asserts there are at least 5,800 grocery-anchored shopping centers in the nation that meet its investment criteria, PECO owns about 5% of its investable universe. On the surface, that would seem to leave plenty of room for growth, but in a post-COVID world grocery-anchored properties are in high demand.

In 2022, PECO expects to acquire $300-400 million of new properties (net of dispositions), and as of February 9th the REIT was already off to a good start with two closed acquisitions totaling $82.9 million in property value. For these acquisitions, PECO expects to achieve 8% unlevered total returns based on initial cap rates of 5.75% to 6.75%. In 2021, PECO’s acquisitions featured a weighted average initial cap rate of 6.4%.

With compressing cap rates, it’s more likely that PECO will acquire properties this year in a range of 5.75% to 6.25% cap rates. But these feature strong and stable organic growth.

Bottom Line

We might look at 2022 as a year of consolidation for PECO. Dispositions were elevated in 2021 as the REIT repositioned its portfolio. Net investment volume was only $91.5 million, compared to planned net investment volume of $300-400 million for this year. This should set PECO up for solid growth into the future.

With the likelihood of an impending recession increasing, PECO looks like a solid and defensive dividend growth stock to weather whatever storms lie ahead.

Be the first to comment