peshkov

Investment Thesis

Phillips 66 (NYSE:PSX) is about to report Q3 2022 results next Tuesday, November 1, premarket.

I argue that investors’ outlook toward the risk-reward of oil is too negatively skewed. Investors are too quick to price in negative elements weighing down oil prices, and not giving enough consideration to the oil demand likely to keep oil prices high in 2023.

PSX’s dividend will probably increase further in 2023.

Altogether, paying approximately 8x to 9x next year’s free cash flow is still very attractive.

What’s Happening Right Now?

Investors have increasingly come to terms with the prospects of a slowing global economic outlook. Perhaps, the biggest headwind facing oil prices right now is China’s strict lockdown.

Comments made by Xi Jinping over the weekend, that China will continue to embrace Covid lockdowns irrespective of the economic implications, are likely to continue to have near-term implications on oil prices.

Furthermore, the widely reported belief that China is entering a period of slowing economic outlook in 2023 is not helping matters.

Meanwhile, in the US, even with the speculation that the Fed is going to stop raising interest rates sooner rather than later, this doesn’t detract from the potential economic slowdown that the US is now likely to see in 2023.

Simply put, there are clear-cut reasons to be bearish on oil. However, I believe that investors are being too quick to price in the negative considerations and not giving enough consideration to the positive upside drivers.

For my part, I believe that the underlying driver for oil is that we are an oil economy. And despite all these worries about the demand for oil falling in 2023, the facts don’t appear to echo that sentiment.

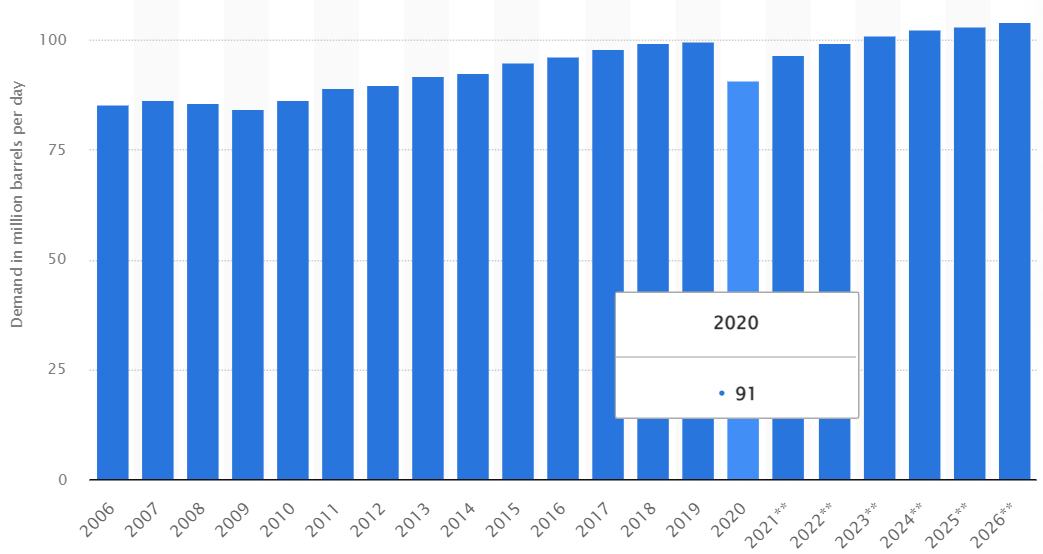

statista.com

Demand for oil is very sticky and continues to slowly trickle higher over time. Essentially, despite near-term vicissitudes, I suspect that in 2023, oil prices are likely to stay range bound around $80 to $90 WTI, or possibly higher.

But I strongly believe that we are unlikely to see oil prices retracing below $70 WTI.

Phillips 66’s Near-Term Prospects

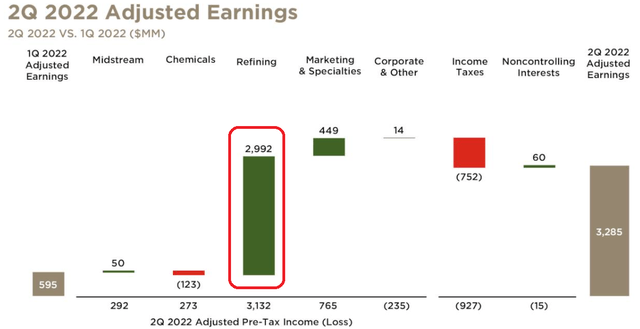

PSX has 4 segments, midstream, oil refining, chemicals (50% of CPChem), and marketing and specialties.

Right now, by far, the biggest driver of its bottom line pretax income is its refining segment.

PSX’s refining segment makes up close to 75% of its total pretax income as of Q2. So, what happens to its refining segment has an overwhelming impact on the stock price.

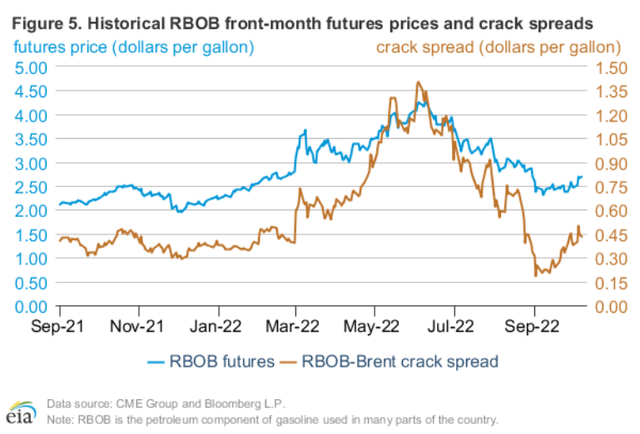

PSX’s refining business is driven by crack spreads. That’s the difference between Brent oil (or WTI) and the value of refined products, such as diesel.

As you can see above, crack spread margins have remained wide throughout Q3 2022, thus we should expect Q3 results to be strong.

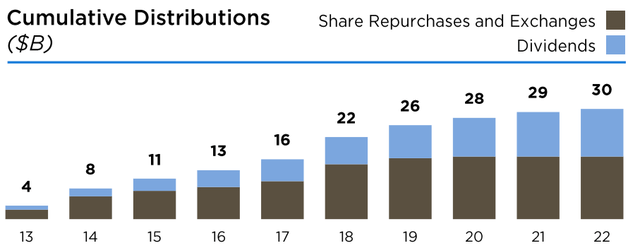

That being said, the real driver of PSX’s stock price is its capital return program.

Capital Return Program

PSX has an investment-grade balance sheet with a net debt position of approximately $10 billion. Its balance sheet today is the strongest it’s been since 2019, with a debt-to-capital ratio of below 30%.

This strong balance sheet provides PSX with the flexibility it requires to both invest in the business, as well as return capital to shareholders. PSX declares that it aims to reinvest 60% of its cash flows from operations and to return 40% of its cash flows from operations to shareholders.

But the real bullish argument here is shown in the graphic that follows.

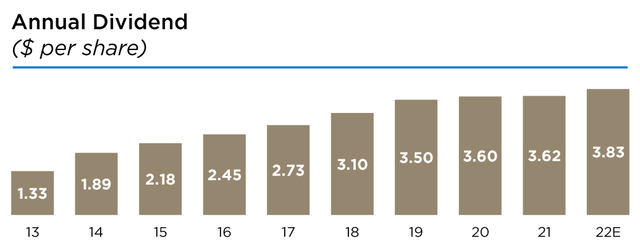

Presently, PSX offers investors a relatively safe 3.9% yield. Even if things in the oil market were to sour up, I would argue that given PSX’s strong balance sheet, PSX would continue to raise its dividend further in 2023.

For example, in 2021, when oil prices were hovering around $65-$70, PSX only raised its dividend by less than 1%. Thus showing that PSX is eager to keep moving its dividend higher.

Meanwhile, keep in mind that the other half of the capital return program is PSX’s share repurchases, which support strong increases in EPS figures.

PSX Stock Valuation — $6 to $7 Billion Mid-Cycle

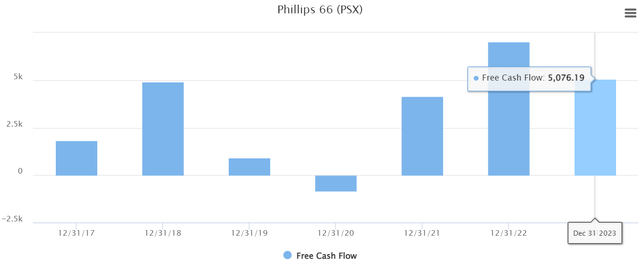

PSX believes that throughout the cycle, it has approximately $1 billion of sustainable capex requirements, thus allowing the business to deliver around $6 billion of free cash flow.

This leaves PSX priced around 8x through the cycle free cash flow. Objectively, this is a little higher than some smaller marginal oil players. But there again, smaller players are significantly more likely to have extreme volatility.

When the market is favorable, they’ll ooze free cash flow, but when oil prices inevitably turn south, those smaller, less diversified players are likely to embrace substantial losses.

Back on PSX, you can see that analysts expect that in 2023 PSX’s free cash flow retraces lower.

That’s the theme that is seen across the board with countless cyclical commodities. Analysts’ financial models are expecting that 2022 was an anomaly and that PSX’s free cash flow will revert to around $5 billion in 2023.

I believe that’s too bearish. But in an attempt to meet halfway with analysts’ estimates, I end up expecting that PSX will make approximately $6 billion of free cash flow in 2023. That would put the stock at around 8x next year’s free cash flows. A bargain. Particularly compared with what’s available in other pockets of the market, outside of energy.

The Bottom Line

For investors that are bullish on oil, and simply don’t want to have the headache that their investment could one morning be down 40% to 50%, PSX makes a lot of sense in my opinion.

Not only does it carry a 3.9% dividend yield, but perhaps more importantly, it has a strong and flexible balance sheet that allows PSX to continue raising its dividend.

Investors would do well to ignore a lot of the near-term noise hitting the oil market, and remain constructive towards oil stocks.

Be the first to comment