George Frey

The stock of Phillips 66 (NYSE:PSX) is currently trading down ~3% today (Thursday) after news that Putin restarted the Nord Stream 1 natural gas pipeline to Europe prompted a wide ranging sell-off in the energy sector. However, a restart of Russian nat gas deliveries to Europe will have little to no effect on US refiners other than perhaps to – in the short term – lower their costs for natural gas feedstock a bit. Meantime, I expect PSX to report record or near record refining profits in its upcoming Q2 EPS report scheduled to be released on July 29. That’s because PSX is the largest importer of Canadian oil sands heavy crude and, as a result, has one of the highest distillate yields in its peer group. That, combined with very strong ULSD (ultra-low sulfur diesel) crack margins, should enable PSX to post very strong refining results in Q2.

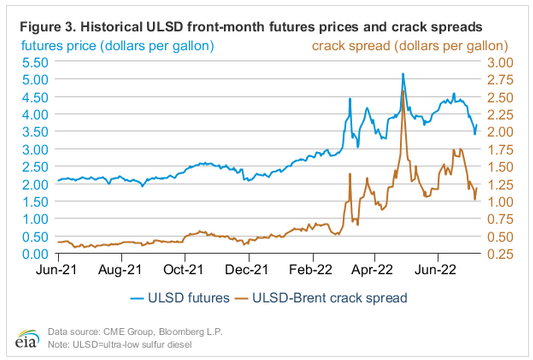

EIA

As can be seen above, the ULSD crack spread was (and still is) very strong during PSX’s Q2 (April-May-June).

Investment Thesis

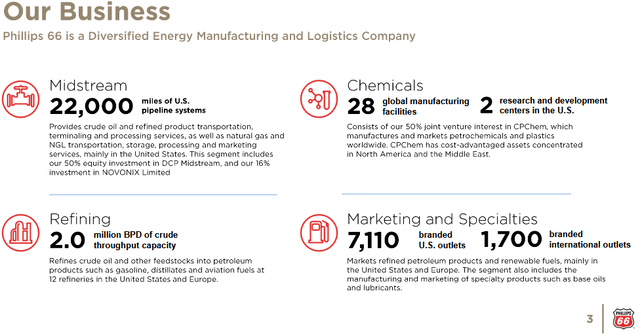

As shown in the May investor update presentation, PSX operates an integrated energy and logistics company:

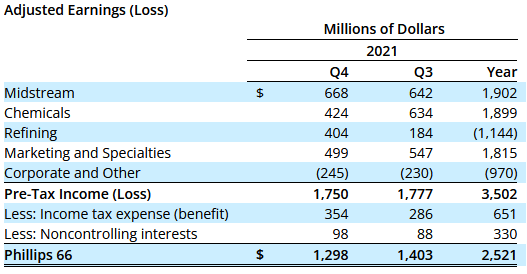

Most investors likely think of PSX as a refiner, and it certainly is. That said, many investors likely don’t realize that PSX also has large interests in Midstream (including several long-haul pipelines and a 50% stake in DCP Midstream (DCP), one of the largest nat gas processors in the country) and Chemicals via its 50/50 JV with Chevron (CVX) in the CPChem partnership. Both the Midstream & Chemicals Segments reported record earnings in FY21 and, in aggregate, generated ~$3.8 billion in adjusted earnings for the company:

Phillips 66 Q4 EPS Report

It’s not much of a stretch to say that PSX’s Midstream & Chemicals Segments saved the company from what otherwise would have been an abysmal COVID-19 stretch of 2020-2021 for its Refining Segment.

However, there’s no doubt that for the upcoming Q2 report – due out July 29th – all eyes will be focused squarely on a big recovery in PSX’s refining earnings.

What To Expect For Q2

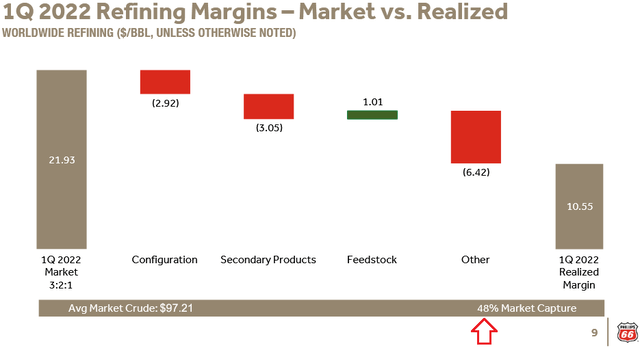

Phillips 66’s overall global market capture in Q1 was a very poor 48%:

What the graphic above means is that given the 3:2:1 market crack spread for Q1 ($21.93/bbl), PSX was only able to generate a realized margin of $10.55/bbl (or 48% of $21.93/bbl). Obviously, that was a terrible quarter for PSX’s refining segment. The results were explained by CFO Kevin Mitchell on the Q1 conference call:

Market capture in the previous quarter was 65%. Market capture is impacted by the configuration of our refineries. Our refineries are more heavily weighted toward distillate production than the market indicator. The configuration impact was relatively flat quarter-on-quarter as lower clean product yield offset higher distillate cracks.

However, looking at the graphic above we see that the “configuration” category was only responsible for $2.92/bbl of PSX’s overall reduction in realized margins while the “other” category was a whopping $6.42/bbl. Later on the conference call then CEO Greg Garland touched on what the “other” factors were:

Yeah. I think the focus is going to be on operating well and being in the market and able to take advantage of the margins that are available. I think we have talked about some of the exposures that we have on diesel on heavy sour dips on prem cokes and all of those environments look favorable as we look into the summer months.

I think there’s some moving parts. We were hindered this quarter on timing issues in the Gulf Coast on product timing and in the Central Corridor on crude purchasing and timing issues there. So I think those will normalize out and we will see that profitability show up in later periods.

Note that PSX’s Central Corridor region (40% market capture in Q1) is composed of refineries that receive a large percentage of crude feedstock from discounted Canadian oil sands crude. This region typically delivers some of the company’s strongest refining margin. That being the case, I believe that much of the profitability sucked out of the Q1 results by the “other” category will show up in the upcoming Q2 results.

Meantime, note the EIA’s weekly status report indicated that distillate fuel inventories decreased by 1.3 million barrels last week and are ~23% below the five year average. This is another bullish short- and mid-term indicator for PSX considering its greater exposure to distillate yields as compared to its peers.

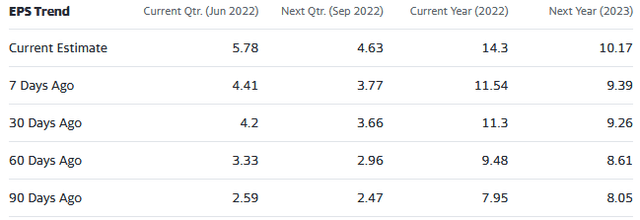

Bottom line is that Q1 EPS estimates have been significantly rising for PSX:

Indeed, over just the past 30 days, while the stock price dropped ~12%, consensus earnings estimates for PSX increased by a whopping $1.58/share to $5.78. That brings the current full-year 2022 estimate for PSX to $14.30. With a stock price currently at only $84.60 at pixel time, that implies a forward P/E of only 5.9x.

Shareholder Returns

In Q1, PSX generated operating cash flow of $1.1 billion and returned $404 million to shareholders via the dividend – which is currently $3.88/share on an annual basis, for a yield of 4.5%.

In April, PSX paid off $1.45 billion of debt (a remnant of the COVID-19 induced impact). The improvement in the company’s overall net-debt-to-capital ratio led the company to announce that it restarted share repurchases under its existing $2.5 billion authorization and that it planned to “resume our cadence of annual dividend increases.” Indeed, in May, PSX announced a 5% increase in the quarterly dividend to $0.97/share. Prior to COVID-19, PSX had established a record as one of the best dividend growth companies in the S&P 500 and I fully expect PSX to return to that level of performance.

Sustainability Going Forward

PSX has been investing in several important sustainability initiatives going forward:

- Conversion of the Rodeo Refinery in California to Renewable diesel.

- In chemical waste and recycling, PSX joined Operation Clean Sweep Blue, invested in the Circulate Capital Ocean Fund, and CPChem is now recycling polyethylene.

- This week, PSX announced it closed a JV in to create a European network of hydrogen refueling stations.

- Also in the category of “Emerging Energy,” PSX already is a leading global manufacturer of specialty coke, a precursor to the synthetic graphite used in battery production. Earlier this year, PSX announced it signed a technology development agreement with NOVONIX Limited (OTCQX:NVNXF) to advance production and commercialization of next-generation anode materials for lithium-ion batteries.

Clearly, the transition to clean-energy is not being overlooked by PSX and the company will not be caught flat-footed like a deer in the headlights.

Summary and Conclusion

PSX’s refining segment had a horrible Q1. However, looking under the hood there were several short-term timing related factors that should enable the company to move much of the missed profit in Q1 into Q2 – boosting the upcoming EPS report. Meantime, the stock has been moving lower despite the fact that consensus Q2 EPS estimates have moved up sharply. As a result, PSX appears significantly undervalued and I advise investors to take advantage of the current dip and buy the stock. While you wait for the Q2 EPS report, you can enjoy the current 4.5% yield – which is very attractive considering, despite all the market worries about rising interest rates, the current yield on the 10-year Treasury is only 2.91%.

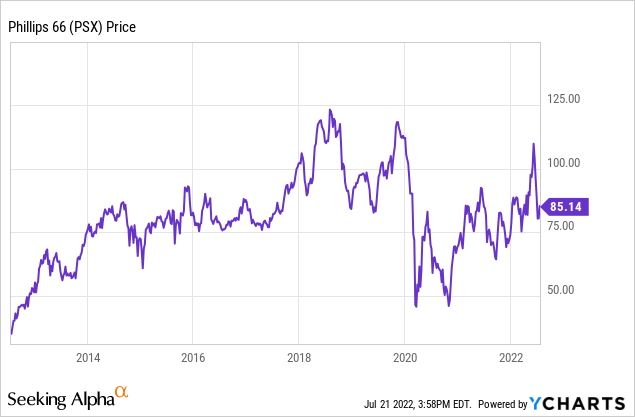

I’ll end with a 10-year price chart of PSX stock and note that despite the addition of significant midstream & chemicals assets over the past few years, PSX is currently trading at the same price level it was back in 2015:

Be the first to comment