Ignatiev/E+ via Getty Images

Koninklijke Philips N.V. (NYSE:PHG) recently announced significant accounting charges related to some of its products and the current macroeconomic outlook is significantly affecting the company’s results. In fact, things apparently are so bad for Philips that the company announced a thorough reorganization with layoffs. In this report, I discuss the pains for Philips and demonstrate that this most definitely is not the first time the company seems to be hitting rock bottom since its foundation in 1891.

Sleepless Nights for Philips

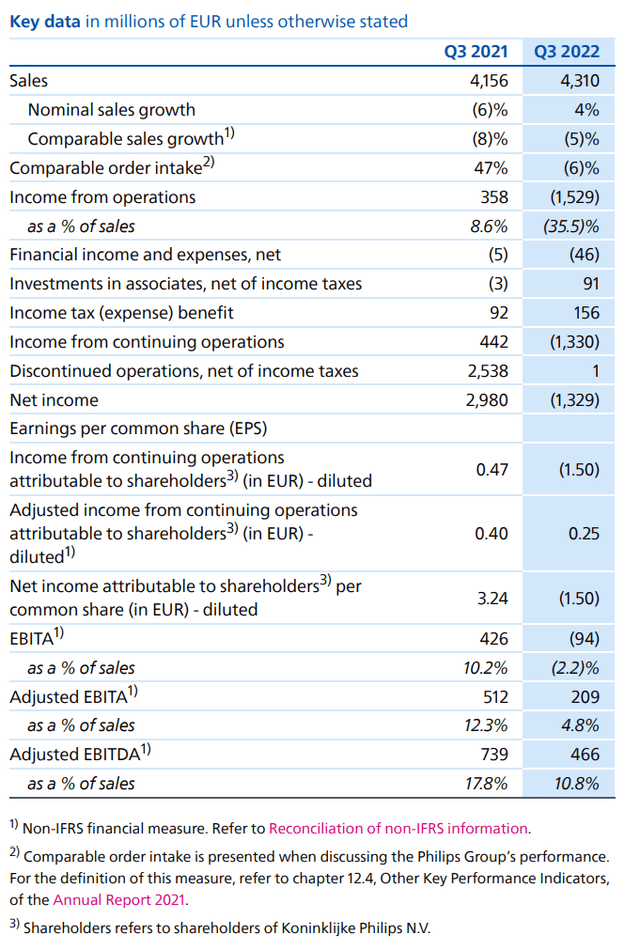

Philips Q3 2022 results (Philips)

Looking at the year-over-year results, we already see that things are challenging for Philips. Comparable sales growth was -5% and in the same quarter last year it was negative 8%. This year Covid-19 restrictions in China, supply chain challenges and the situation in Ukraine pressured sales. In the comparable quarter last year, Philips booked a €3 billion profit which was driven by the sale of its Domestic Appliances business compared to a €1.3 billion loss this quarter. On the basis of continued operations Philips swung from a €442 million profit to a €1.3 billion loss. On adjusted EBITDA basis margins declined from 17.8% to 10.8%, significantly lower than the ~20% the company should be able to generate.

The €1.3 billion loss was driven by the problems that Philips continues to face with its CPAP/apnea devices. The devices have become problematic since the isolating foam used can crumble and end up in the respiratory tract. The devices also became a cost drag on the company as Philips is falling short in informing and advising customers on a path forward. As a result, Philips impaired its goodwill on the Sleep & Respiratory Care division by €1.3 billion while cost growth related to provisions, remediation and quality provisions brought another €378 million in costs, but as the adjusted EBITDA already showed even when adjusting for the cost debacle at the Sleep & Respiratory Care division margins are way too low driven by inflationary costs pressures and negative currency impacts.

A Tale of Decline: Big Reorganization Is Coming, Dividend Unsustainable

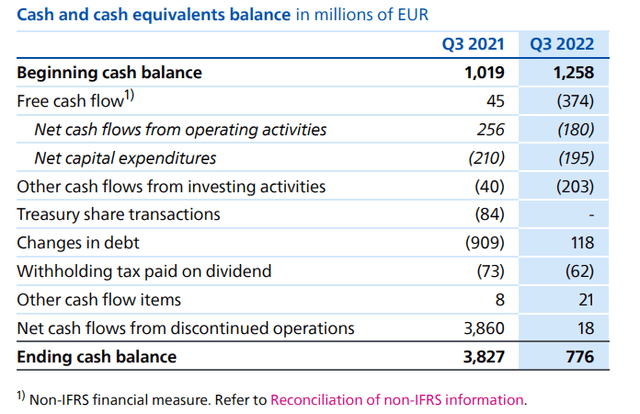

Cash and cash equivalents (Philips)

For Philips, the results mark the fifth consecutive quarter of declining revenues and profits and that is reason enough to announce a reorganization that will shed 4,000 jobs from the company and the fourth quarter will show year-over-year comparable sales decline as well. So, the third quarter results are fitting in a trend of decline.

If we look at the cash balance it might be somewhat clear why Philips is taking action now. In one year, the cash pile declined by over €3 billion with no sparkle of hope becoming visible for the company. The company is shoring up its cash position by cutting 5% of its staff, securing a €1 billion credit facility and postponing share repurchases. With its debt increasing and results declining, the debt-to-EBITDA is rising as well. Combined with the weak cash position I do fear that the €0.85 per share dividend is not sustainable. The twelve-month trailing adjusted net income is €651 million or €0.74 per share, and I am expecting Q4 numbers to be under pressure as well. So, in the most positive scenario, with the dividend policy in mind there would be a €0.37 dividend costing Philips roughly €325 million. Normally investors can opt for a cash or stock dividend. Philips might choose to keep a dividend in place but with a €776 million cash position this might not be the wisest thing to do, and the dividend is expected to come down significantly. I believe that with the current financial situation and Philips, the company should scrap the dividend altogether.

Hitting Rock Bottom Again

What is somewhat unfortunate is that Philips is not new to hitting rock bottom. The company started in 1891 as a light bulb factory and expanded to household devices and more. However, at some point the company had so many products that it lacked focus, excellence and margins. A major mistake from the company was relying on its cash cow CRT TVs while the competition was switching to LCD displays. Eventually Philips had to follow suit, but in order to become competitive again it had to spin off its Lighting business (now Signify) and sold its TV business as the company focused on Healthcare. Last year the company sold its Domestic Appliances business, but what we are seeing is that while Philips has shed its business to improve its focus, it is not paying off as much as it should.

On lower revenues, earnings are more or less stable, but we are not seeing Philips excelling. They have a vision, but they also have a hard time executing that vision. Philips was once one of the largest electronics companies in the world standing at the cradle of semiconductor giants such as ASML and TSM, but over time it seems that the size of the company rendered it inflexible to innovate and even with a thorough refocus on Healthcare, Philips is now met with failures in its focus segment. While I don’t believe that Philips will face bankruptcy as a result of the issues in its Sleep & Respiratory Care division and there is significant upside for Connected Care, the company’s current state and prior execution make it prone to being passed by competitors left and right.

Conclusion: Philips Is Not A Stock You Should Own

If you look at Philip’s past, the current problems sound a lot like “same problem, different day”, the company even after refocusing its business is not able to deliver excellence and it makes one wonder whether Philips has wat it takes to provide products that benefit consumers and enable the company to deliver value to shareholders. I believe that the company will have to cut its dividend or even scrap it altogether, which provides for further downside for the stock after already shedding over 70% of its value in the past year.

While I majored in Aerospace Engineering, I pursued a minor in MedTech Based Entrepeneurship which introduced me to the concept of smart and remote monitoring equivalent to the Connected Care business of Philips which I believe is the future. I do believe that Connected Care as a vision is a solution for how healthcare will evolve, but Philips really has to prove itself again.

Be the first to comment