Robert vt Hoenderdaal/iStock Editorial via Getty Images

Koninklijke Philips N.V. (NYSE:PHG) is a leader in healthcare technology across diagnostic imaging tools and specialized medical devices. There is also an important personal care segment that covers consumer items like power toothbrushes. The company just reported its latest quarterly results highlighted by soft operating trends amid ongoing supply chain challenges and the difficult macro backdrop.

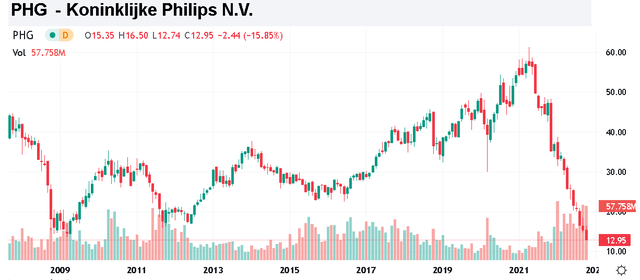

This is a stock that has been crushed all year, losing more than two-thirds of its value in 2022 amid several operational headwinds. To address these issues, management has announced a restructuring initiative including cost cuts aimed at improving profitability. While Philips still has work to do, we sense the effort to focus on efficiency is a step in the right direction. Recognizing the near-term uncertainties, we like the stock following the selloff considering overall solid fundamentals.

PHG Earnings Recap

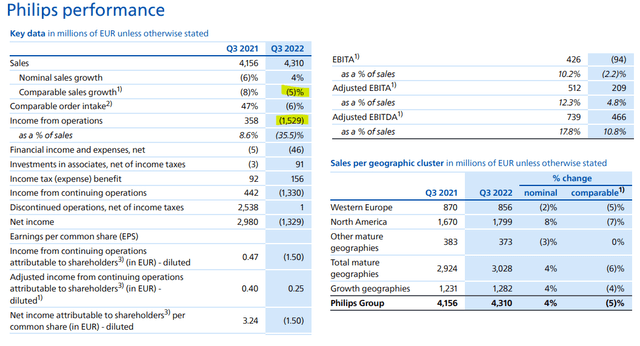

Philips reached EUR 4.3 billion in Q3 sales, up 4% year over year. On the other hand, this level was down by -5% on a comparable basis. The order flow also declined by -6%, although this is in the context of a particularly strong 47% increase in the period last year during the early stages of the pandemic recovery. Margins have been hit based on higher costs amid global inflationary trends.

source: company IR

The story here was a EUR 1.5 billion non-cash charge addressing the financial impact of an ongoing safety recall related to the Respironics group ventilators and airway pressure machines. Excluding this amount, the adjusted income from continuing operations per share at EUR 0.25 was down from EUR 0.40 in the period last year.

The FDA identified an issue where the foam used in the equipment breaks down back in 2021. The update now is simply that Philips is moving toward a consent decree as it remains subject to an investigation with the potential for further lawsuits. The uncertainty here helps explain much of the share price weakness this year, with a thought that the discount on the company’s market value has likely already priced in some of the worst-case outcomes in terms of financial liabilities.

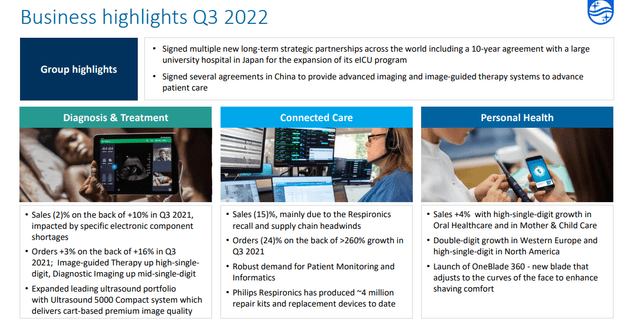

Operationally, the sales have been weaker, affected by shortages of key components including electronics. Covid lockdowns in China have also impacted the manufacturing of parts that further limited some sales. Revenue from the Diagnosis & Treatment segment was down -2% y/y, compared to a 10% increase last year.

In the Connected Care group, sales fell by -15% including the drag from the Respironics recall. On the other hand, the Personal Health segment was a strong point with sales climbing by 4%, with momentum in Western Europe and North America in particular.

source: company IR

Philips Group Restructuring

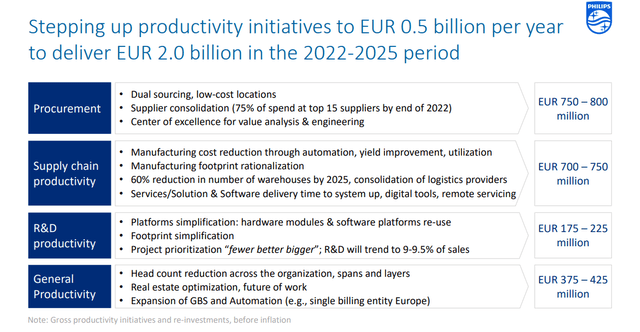

As mentioned, a key development from this earnings report was the restructuring announcement resulting in a non-cash charge of EUR 168 million in Q3. The plan is to simplify the organization starting with a cut to around 4,000 positions globally, representing around 5% of the total headcount. While termination and severance-related costs are expected to reach EUR 300 million in the coming quarters, the effort is also expected to generate annualized savings of 300 million going forward.

Furthermore, actions such as consolidating global logistics and prioritizing R&D into fewer high-impact projects are intended to kickstart a turnaround as the effort goes into effect. Overall, the goal is to deliver EUR 2.0 billion in savings through 2025. Ultimately, we believe the plan was necessary and can work to support margins going forward.

source: company IR

In terms of guidance, management sees Q4 sales declining in the “mid-single digits” as a continuation of Q3 trends. An expectation for the adjusted EBITDA margin in the “high-single-to-double-digit” also compares to the metric of 10.8% in Q3 but is still down from a more normalized level closer to 20% from 2021. Again, the setup is prolonged operational challenges and a worsening macro environment only partially offset by productivity initiatives and efforts towards higher pricing. That said, 2023 should capture more of the recently implemented savings measures.

Finally, we note that the company ended the quarter with EUR 780 million in cash against EUR 8.3 billion in total debt. Considering approximately EUR 2.3 billion in adjusted EBITDA over the past year, the net leverage ratio of around 3x is elevated but otherwise stable.

PHG Dividend

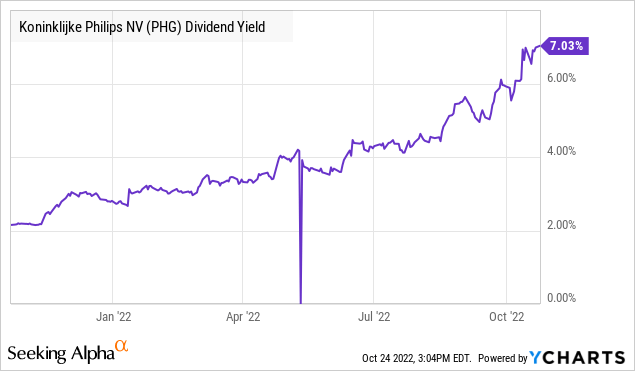

PHG’s current dividend yield is listed above 7%. Technically, the company’s policy is to distribute an annual payout of 40% to 50% of adjusted income from continuing operations. Historically, the annual amount is declared in conjunction with the Q4 earnings report.

Notably, the annual dividend of EUR 0.85 per share, has been held steady since 2018, representing a payout of approximately EUR 480 million. In 2020, the company issued the dividend in shares only during the depths of the pandemic uncertainty. By this measure, we won’t be surprised to see a similar action this year into 2023 in support of cash flows recognizing the ongoing financial challenges.

While nothing has been confirmed, investors should be prepared for either a smaller cash distribution or another stock payment. The point here is to say that the 7% yield is not what it seems, also considering the payout is declared in Euros which has lost value against the Dollar over the past year.

PHG Stock Price Forecast

The collapse in PHG’s stock price since hitting a high above $61.00 back in early 2021 has been a spectacular fall from grace. In this case, beyond the slowing global economy, company-specific factors between the impact of the Respironics recall and unique supply chain shortages have translated into poor sentiment. The question becomes if there is any value at the current level. We’re on the side of optimism noting the company’s strong points.

Seeking Alpha

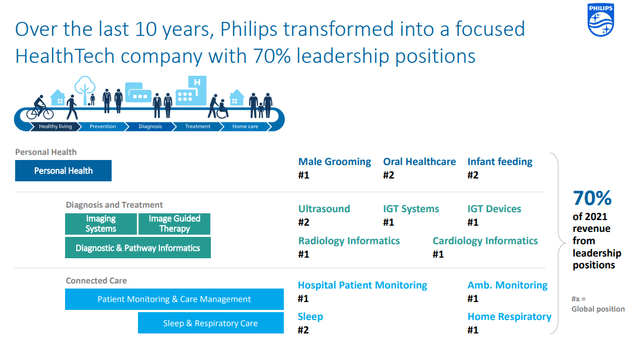

PHG continues to generate underlying profitability in a market segment that is supported by a positive long-term outlook. Taking a step back, keep in mind that Philips remains the global leader across several product categories from “male grooming” devices in Personal Health to the core diagnostics equipment in Radiology and Cardiology Informatics. In the Connected Care segment, the high-level tailwind is the global trend of increased spending on medical care with an aging population.

According to Philips, the company’s addressable market within Health Tech of around EUR 155 billion is expected to grow between 3-5% per year through 2025. The bullish case for the stock is that through the restructuring effort, a more streamlined operation will be able to drive earnings high from value-added segments. Getting past the near-term volatility, the company is well-positioned to reclaim a growth trajectory.

source: company IR

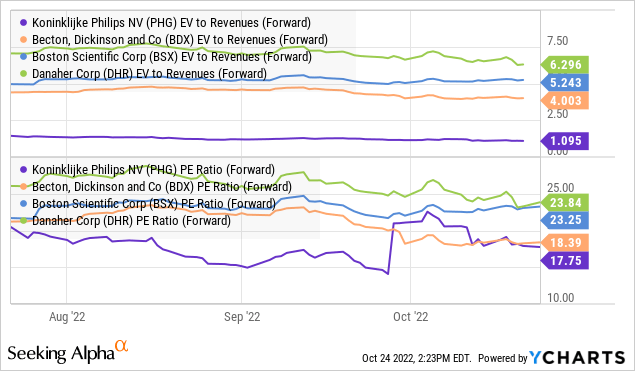

In terms of valuation, we’re looking at some Healthcare comparables like Becton, Dickinson, and Co. (BDX), Boston Scientific Corp. (BSX), and Danaher Corp. (DHR). Philips also competes with more diversified players like General Electric (GE) and Johnson & Johnson Corp. (JNJ) in key segments.

Recognizing these companies have their differences, Philips stands out as trading at a discount to the group with its EV to Revenue multiple at just 1X compared to an average for the group closer to 5x. A large part of that spread considers the weaker trends this year and largely the balance sheet debt position, which is justifiable. PHS with trading at a forward P/E ratio of 18x is also below DHR at 24x and BSX at 23x.

In our view, PHG under more normalized conditions deserves a structurally higher premium given its more high-tech focus. With some conviction that the company can drive earnings higher over the long run, the stock could be considered the value-pick in the group.

Final Thoughts

The next few quarters will be critical for Philips to demonstrate it can stabilize the business and move forward from its regulatory uncertainty. While the stock has been a disaster, this is a case where we believe a turnaround will eventually take hold. Expect volatility to continue but we also see room for shares to rebound going forward.

Be the first to comment