Patrik Stollarz/Getty Images News

Philips (NYSE:PHG) stock got pummeled over the last months as a result of the poorly handled problems at the Respironics division. Communication was sub-par and after issuing a profit warning mid-October, the 3Q22 earnings call did not appeal to investors either. To top this off, supply challenges, a worsening macro-economic environment and continued uncertainty related to COVID-19 measures in China further affect performance.

Over the course of 2022 net debt increased by 60% to a level of EUR 7.5Bn and the company needs to get a handle on cash outflows. As the company has difficulty generating sufficient free cash flow to cover the dividend and buybacks, my thesis is dividend payments will be suspended.

Profit warning and Q3 earnings

In spite of the earnings warning preceding the third quarter update, management maintained an upbeat tone during the 3Q22 earnings call. The earnings call presentation highlighted a record order-book and the estimated growth of the healthcare market, yet these positives were overshadowed by persistent supply chain headwinds and a poor outlook.

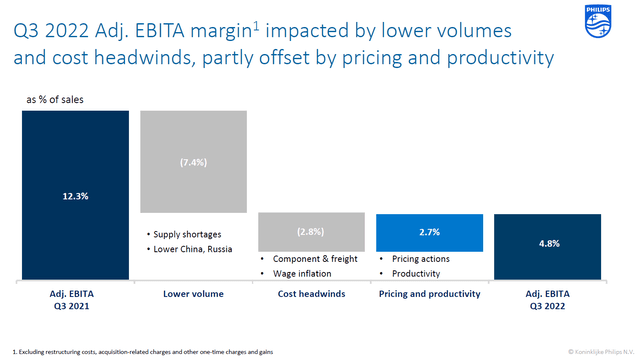

Figure 1 shows the impact of supply chain disruptions and cost headwinds on the EBITA margin. With a combined reduction of 10.2% the impact is massive and the company simply does not have the pricing power to offset such a decline. Unfortunately, due to a deteriorating macro-economic environment, it is unlikely this trend will reverse in the short term.

Figure 1 – 3Q22 Adjusted EBITA margin (philips.com)

The profit warning, issued three days before the new CEO would take-over, was unpleasant but not unexpected. Actually, given all headwinds the company is currently facing it would have been logic if more of the pain had been taken at either the warning or earnings call. After all, a goodwill impairment and a lay-off of about 5% of the workforce is peanuts compared to the problems the company faces.

The installation of a new CEO would have been a perfect moment to take the bull by the horns, but it seems the company is saving more bad news to be shared at a later date.

Turnaround initiatives

In spite of all the bad news, Philips did highlight several initiatives to improve performance. Basically, the company intends to increase prices to counter inflation and will focus on productivity initiatives.

Regarding the first item, price action, the idea is to increase prices by mid-single digits. As it became clear the company has little pricing power, it remains to be seen how this will influence sales volumes. After all, the previous two quarters supply chain issues and cost headwinds have impacted Adjusted EBITA by more than 10 percent which the company couldn’t offset by price increases. On top of this, the world is now entering a recession meaning the absorption capacity of customers will deteriorate.

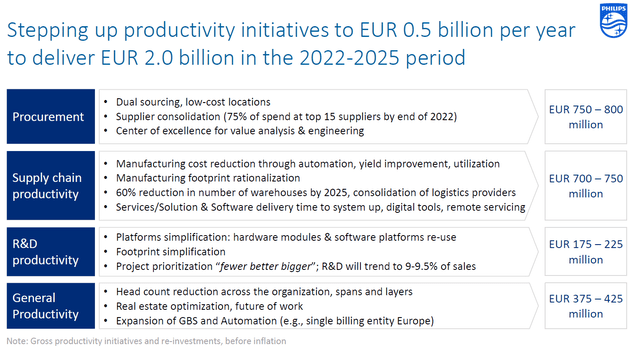

An overview of the second item, productivity initiatives, is shown in figure 2. These initiatives are expected to deliver EUR 0.5Bn per year, yet before inflation. Next to this, not all initiatives may turn out to be beneficial in the long run. For example, Philips intends to consolidate the amount of suppliers with the aim to have 75% of spend at the top 15 suppliers. From a cost optimization perspective this may be desirable, but for a company facing supply chain disruptions, a diversified base of suppliers may have its upside as well. After all, who doesn’t remember the dependence on China producing COVID tests and mouth masks during the early stages of the pandemic?

Figure 2 – Productivity initiatives (philips.com)

Shareholder returns

A lot has been said and done about the stock price development of Philips over the last year. Little more digital ink needs to be spilled on this subject as figure 3 says it all.

Figure 3 – Philips stock price development over the last decade (seekingalpha.com; chart by author)

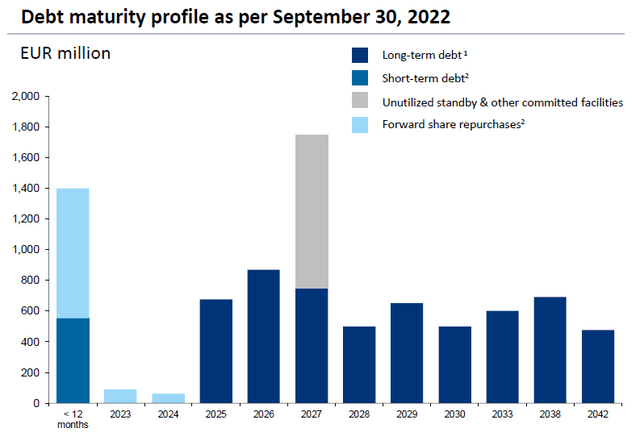

In absence of stock price appreciation, investor losses are cushioned by dividends and buybacks. The company has committed itself to share buybacks as became clear during the current and previous investor updates, see figure 4.

Figure 4 – Debt maturity and forward share repurchases (philips.com)

Given the performance this year, it appeared odd the company decided to bring forward the share repurchases as announced in April 2022 and as shown in figure 4. During the 3Q22 earnings call this decision was revoked, to wit:

Executing the settlement of the forward contracts – entered into as part of the share repurchase program announced on July 26, 2021 – at the original settlement dates in 2023 and 2024, instead of in 2022 as earlier announced

On top of this, the company secured a EUR 1Bn credit facility. Long story short, the company is postponing cash outflows and securing credit to maintain a healthy balance sheet. This becomes especially clear if the development of net debt is assessed.

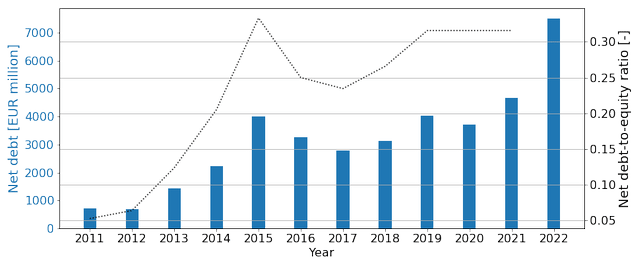

In figure 5 an updated version of the debt graph is shown, the original version is given in this article which warned about the deteriorating risk profile. After some relative constant years up to 2020, net debt surpassed the EUR 4Bn mark in 2021 and continued the uptrend in this year. Currently, net debt stands at EUR 7.5Bn, an increase of 60% over the course of nine months.

Figure 5 – Debt development and net-debt-to-equity ratio, 2022 number excludes 4Q22 (philips.com; chart by author)

The past years the company used the net-debt-to-equity ratio as a measure to avoid excessive debt. Based on the data in figure 5, I have no doubt the company will surpass the self-imposed net-debt-to-equity ratio which it had managed to keep constant since 2019. So, with the company in need of cash it would have been logic to suspend the share buybacks, but this is not a possibility. What is a possibility however is to forego the EUR 0.85 per share dividend.

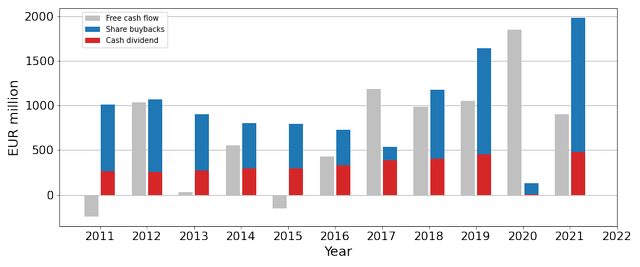

In figure 6 the amount spend on share buybacks and cash dividend has been depicted next to the free cash flow. In aggregate free cash flow hasn’t covered the shareholder returns apart from a few occasions. Moreover, the company distributes dividend both in cash and stock. In the figure below the stock dividend has not been included as it does not generate an outflow of cash. Yet, even with the stock dividend excluded, it’s evident to me that the company spends more than it can afford.

Figure 6 – Free cash flow versus cash dividends and buybacks. Buyback amounts based on the line item ‘purchase of treasury shares’ from the cash flow statements in the annual reports (philips.com; chart by author)

I believe the data in figure 6 leaves no doubt the company has difficulty to consistently generate sufficient free cash flow to cover the cash dividend and buybacks. Add to that a deterioration in performance and one can understand my thesis the company has no other choice but to suspend dividend payments.

Risk dominates outlook

The fourth quarter outlook shared by Philips did little to sooth the nerves of investors. The comparable sales are expected to show a mid-single-digit decline as sales continue to suffer. From the outlook of the 3Q22 presentation:

Sales impacted by prolonged operational and supply challenges, a worsening macro-economic environment and continued uncertainty related to COVID-19 measures in China

Moreover, the Adjusted EBITA margin will be impacted by lower volumes and inflation, but this is not my main concern. My main concern is management has lost grip on the company and the new CEO may not be able to turn the tide.

First of all, the EUR 1.3Bn non-cash charge the company announced in the aforementioned profit warning only concerned the goodwill of the Respironics business. Additionally, two settlements were made with the US Department of Justice for alleged false claims and unlawful kickbacks prior the third quarter presentation. In spite of this, the company hinted there may be more to come, from the 3Q22 update:

Given the uncertain nature and timing of the relevant events, and of their potential financial and operational impact and associated obligations, if any, the company has not made any provisions in the accounts for these matters

For example, the company can’t yet assess what the outcome will be of a class action lawsuit that was filed in court or the outcome of a preliminary investigation started by French prosecutors.

To make matters worse, Philips recently had to inform the FDA that some of the replaced Respironics ventilators were facing new issues. While this is disconcerting news on its own, it becomes even more so when one realizes the new CEO, Jakobs, was responsible for handling the Respironics recall.

This news is the latest in a series of bad news and profit warnings but also demonstrates the remedial efforts are insufficient. Until management gets a handle on quality assurance, performance and communication, I remain bearish.

Conclusion

Philips stock has shown a spectacular decline over the last year as problems at the Respironics division resulted in a goodwill impairment, settlements with the US Department of Justice and class action lawsuits. Additionally, supply chain issues remain persistent and the company showed a lack of pricing power to counter inflation.

Consequently net debt sky-rocketed and as the company has difficulty generating sufficient free cash flow to cover dividends and buybacks, my thesis is shareholders should prepare for a suspension of dividend payments. This thesis is enforced by recent news indicating the company has no grip on the quality assurance of the Respironics recall efforts.

Summarizing, Philips may be a strong brand and has potential as a healthcare company, but before the management team has demonstrated they can improve performance and communication, investors are advised to look for opportunities elsewhere.

Be the first to comment