Spencer Platt/Getty Images News

Swiss-American multinational cigarette and tobacco manufacturing company, Philip Morris (PM) operates in one of the most reviled industries in the world. Buffett’s remark about the industry shows the degree of revulsion in which the industry is held and also, the remarkable economics of the business. The economics are even more astounding when you take into account the declining markets that firms such as Philip Morris have had to operate in. Yet, the company has been profitable and continued to distribute dividends to investors. I believe that investors are missing out on the value created by Philip Morris and also on the chance to engage in transforming the tobacco industry through engagement rather than exclusionary investment practices. The company has aggressively shifted its budget toward reduced-risk products while making significant investments in expanding its heated tobacco manufacturing capacity. Its R&D expenditure is focused on the development of three new reduced-risk product platforms in heated tobacco, cartridges, and nicotine salts. The company has said it is, “devoted to innovative smoke-free products, and we want to lead the way in making cigarettes history.” This stance is backed up by its goal to become a majority smoke-free business by 2025. Philip Morris has the ingredients of a successful transition to smokeless tobacco, as well as a track record of excellent capital allocation that should inspire confidence in its management. Philip Morris is already an industry leader in reduced-harm tobacco, which, unlike traditional tobacco, is a growth market.

A Tale of Doom

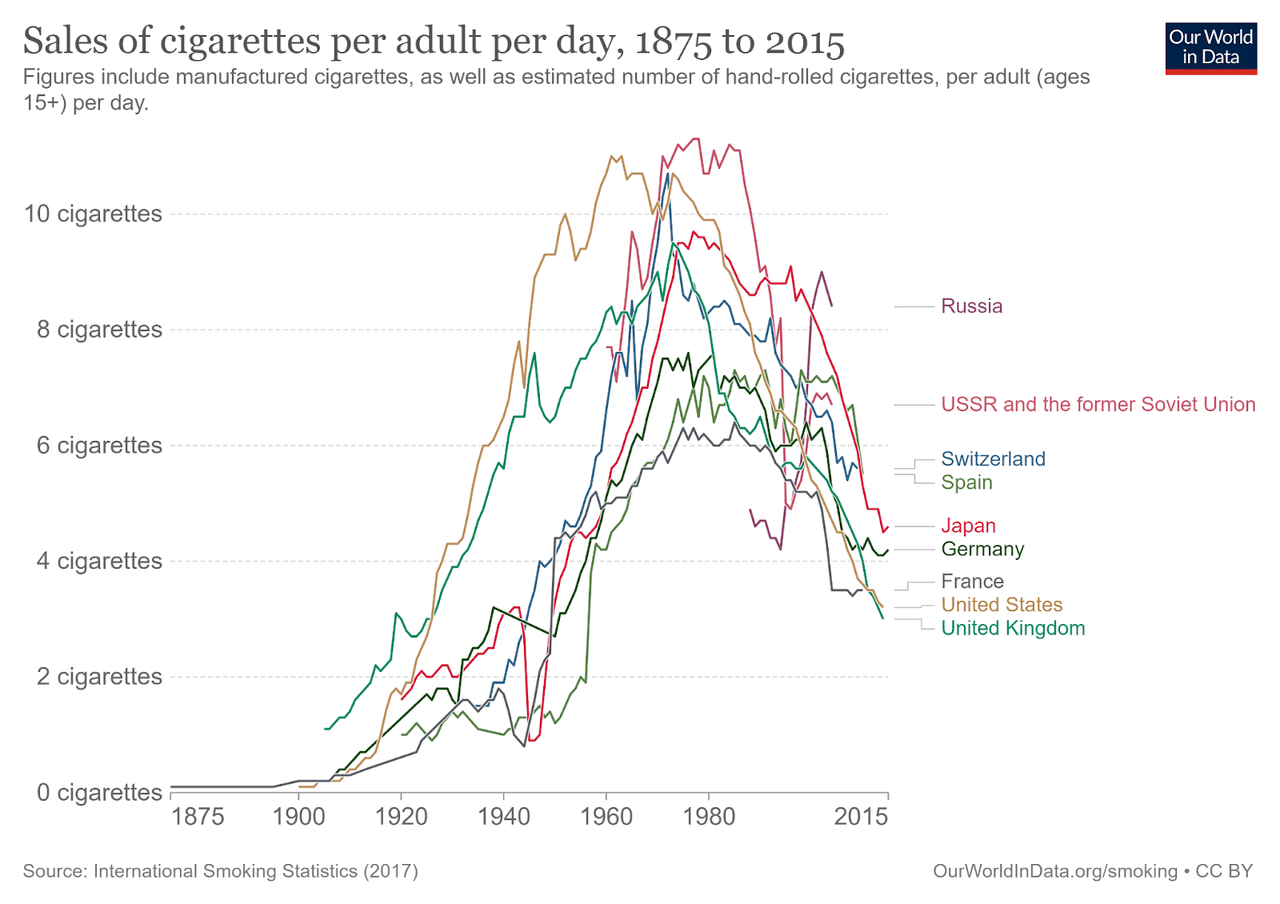

According to Our World in Data, sales of cigarettes in the United States peaked in 1963, with sales in other wealthy countries peaking around that time or in the 1970s. Awareness of the health risks associated with smoking, combined with the effects of tax disincentives on smoking, have driven sales down.

Source: Our World in Data

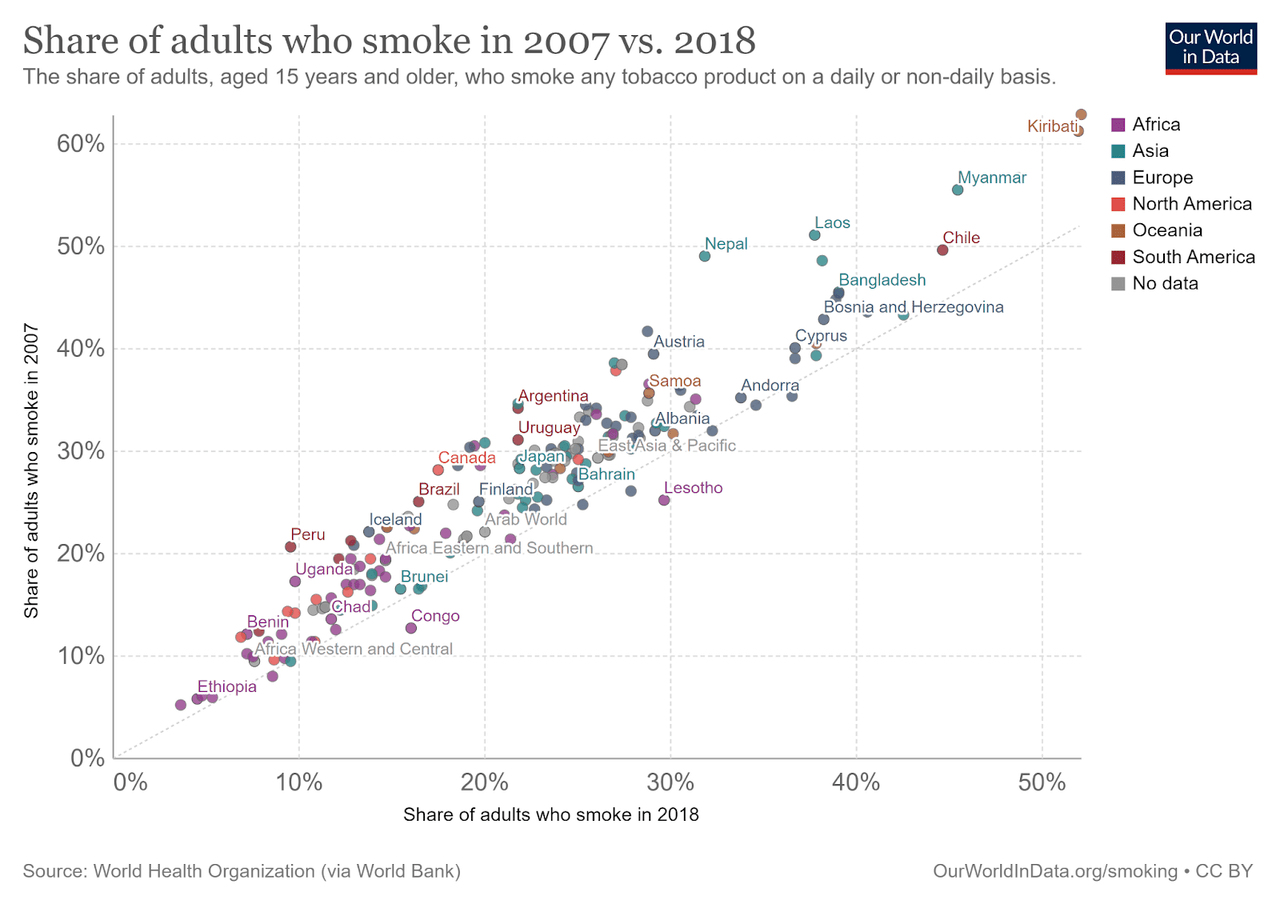

This phenomenon is not restricted to wealthy nations. Consumption has fallen across the world, as a comparison of smoking rates in 2007 and 2018 by Our World in Data shows:

Source: Our World in Data

Consequently, investors have shied away from the industry even when companies such as Altria (MO) and Philip Morris have shown a record of profitability. Shrinking markets have added to depressed valuations, especially in an era where large, growing addressable markets have been wrongly associated with winner-take-all effects -as if everyone can be a winner-. Philip Morris has managed to deliver profits.

The rise of environmental, social, and governance (ESG) investing has put further pressure on the tobacco industry. For instance, Tobacco Free Portfolios encourages investors to commit to “tobacco-free finance”. Stopping Tobacco Organizations and Products (STOP) supports the Global Tobacco Industry Interference Index, which takes an exclusionary approach to tobacco. The results are clear. Investors are typically underweight tobacco. According to Russell Investments, between 2003 and 2018, three-quarters of investors were underweight tobacco in the U.S. large-cap equity universe, with 50% to 70% avoiding tobacco completely. That pattern holds globally, with one-half to three-quarters of the global equity universe underweight tobacco and 36% to 62% avoiding it completely. In that time, investors allocated diminishing sums to the industry, Against that environment, of the 65 to 74 industry groups covered in the Russell 1000 and MSCI World Indexes, tobacco was the second to the third-highest returning industry in some periods, as well as the second to third-lowest performing in others, averaging out to the 11th or 12th best-performing industry under coverage.

Philip Morris is a Recognized Leader in Smokeless Tobacco

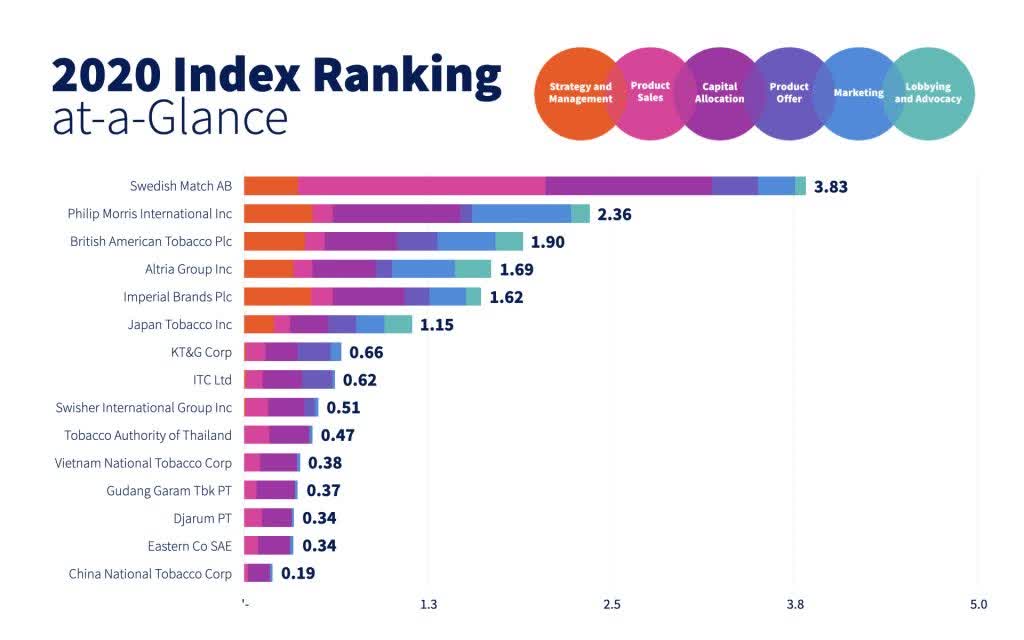

The ESG movement has not left the industry untouched. At least every tobacco firm made at least a rhetorical commitment to “smokeless tobacco”. The Tobacco Transformation Index has highlighted the work done by tobacco firms to live up to their goal of “smokeless tobacco”. (The Index was built on ideas first developed by the Sustainability Accounting Standards Board and other ESG methodologies used in different sectors.)

Philip Morris is one of the few tobacco firms that has taken its commitments seriously. According to the Tobacco Transformation Index’ 2020 Index Ranking Report, it has the second-best results overall of the 15 tobacco firms in the world responsible for producing 92% of the world’s cigarettes. Results are obtained by measuring progress overall, and in terms of strategy and management, product sales, capital allocation, product offer, marketing, and lobbying and advocacy. The industry is far from its goals. Indeed, only Swedish Match AB has truly impressive results, with a score of 3.83 out of 5, compared to Philip Morris’ score of 2.36 out of 5. Yet, the results do show that there is movement in the direction of smokeless tobacco, and Philip Morris is one of the leaders of that. Indeed, the report shows that the company’s capital allocation toward transformation is very high.

Source: Tobacco Transformation Index’ 2020 Index Ranking Report

The Case for Impact Investing

The logic behind efforts such as the Tobacco Transformation Index is a logic that I am in agreement with. There are two ways to handle issues like tobacco: the first is to stay away and hope that that industry dies away. That I think is a fantasy. The second is to engage with the industry and work from within to accelerate transformation. Philip Morris is a tobacco firm that has shown real commitment to smokeless tobacco.

Activist investors typically take on firms in which there is some resistance to change. The economics work in their favor. Consensus estimates are often correct. Markets are typically efficient. So, prices tend to reflect the underlying realities of a business. It’s when results are unexpected that businesses are rewarded with share price appreciation. Thus, activist investors take advantage of the fact that the general investing public has correctly understood that a business is in difficulties and priced it that way, and then engineer a turnaround that defies those expectations, a turnaround that is met with share price improvement. In the case of Philip Morris, investors are investing in a business that has already shown that it is serious about smokeless tobacco. It feels apt to invest with that company and participate in transforming the industry.

Investors can no longer argue that an exclusionary policy is necessary because it is impossible to track a company’s performance according to ESG standards. Engine No.1’s investment in ExxonMobil is an indicator of how investors can invest in “dirty” industries with an ESG mind frame. This allows investors to have tangible ways to encourage and reward, or if needed, punish business practices that align with ESG goals.

Philip Morris’ moves toward smokeless tobacco gives it a competitive advantage against its peers. In his 2020 Letter to CEOs, Larry Fink noted that:

Over time, companies and countries that do not respond to stakeholders and address sustainability risks will encounter growing skepticism from the markets, and in turn, a higher cost of capital. Companies and countries that champion transparency and demonstrate their responsiveness to stakeholders, by contrast, will attract investment more effectively, including higher-quality, more patient capital.

Although industry effects are the key driver of the cost of capital, managers do have some scope to affect the cost of capital. As Fink noted, those businesses that can respond to investor concerns over sustainable business practices will be able to command lower costs of capital than their peers. Fink also went on to say:

In the discussions BlackRock has with clients around the world, more and more of them are looking to reallocate their capital into sustainable strategies. If ten percent of global investors do so – or even five percent – we will witness massive capital shifts.

Philip Morris meets the criteria of a business that should be the beneficiary of capital shifts in search of more sustainable models.

Indeed, the Foundation for a Smoke-Free World argues that:

Tobacco Free Portfolios, funded by Cancer Research UK, The Danish Cancer Society, and other supporters aims to reduce and ultimately eliminate investment in tobacco. Investors that do not wish to own tobacco company debt and equity are certainly free to do so. However, not all investors will make this choice. As a result, the act of selling (or not buying) an investment for non-financial reasons may only create a better buying opportunity for someone else. For example, a report by Wilshire Associates, the general investment consultant for The California Public Employees’ Retirement System (CalPERS), estimates that the pension system lost $3.581 billion in investment gains by divesting from tobacco stocks during a 17-plus-year period ending June 30, 2018. Deutsche Asset Management suggests that an investor agenda for tobacco, including both divestment and engagement strategies, may emerge, since divestment on its own is unlikely to change tobacco industry practices.

Rather than being against efforts for a tobacco-free world, investing can be a driver toward smokeless tobacco. Unfortunately, as the Foundation points out, existing paradigms have become an impediment to change:

A central point of contention across the programs relates to engagement with the tobacco companies, as reflected by the interpretation of Article 5.3 of the WHO Framework Convention on Tobacco Control. The STOP Global Tobacco Industry Interference Index report states, “Article 5.3 is regarded as the backbone of the Convention and its importance cannot be over-emphasized,” and the “tobacco industry must be denormalized.” To the extent Article 5.3 is interpreted to mean boycott and ban, it has paradoxically become an impediment to change, thereby perpetuating the status quo.

Conserving Attractive Profits with Heated Tobacco

Philip Morris is disrupting itself. In The Innovator’s Dilemma, Clayton Christensen argued for what he called a “law of conservation of attractive profits”:

Formally, the law of conservation of attractive profits states that in the value chain there is a requisite juxtaposition of modular and interdependent architectures, and of reciprocal processes of commoditization and de-commoditization, that exists in order to optimize the performance of what is not good enough. The law states that when modularity and commoditization cause attractive profits to disappear at one stage in the value chain, the opportunity to earn attractive profits with proprietary products will usually emerge at an adjacent stage.

The tobacco industry has not reached that point at which attractive profits have disappeared. It is however at a point in which the long-term (in decades) future of the industry means that managers have to consider novel ways to reconfigure parts of the value chain in order to earn and conserve attractive profits. This is especially urgent because, amidst a decline in cigarette smoking, sales of reduced-harm tobacco products are growing, with heated tobacco growing at a stronger rate than vaping.

The “creative destruction of the cigarette”, as Jacob Grier calls it, is being led by companies such as Philip Morris. Philip Morris has already established itself as a leader in heated tobacco. According to the December 2021 Global Trends in Nicotine Report, the company has a 12.3% market share in cigarettes, 6% in smoking tobacco, and 78.9% of the heated tobacco market.

The heated tobacco market, which includes both tobacco heating devices and consumables, was worth $20.8 billion in 2020. The market remains small, and is only 2.4% of the global nicotine ecosystem, but is growing, and with regulatory concerns over vaping rising, it is expected to grow even faster. Competition is a loser’s game, and Philip Morris has placed itself in a market which, unlike vaping, has quickly consolidated around an oligopoly.

Philip Morris’ IQOS system is at the heart of its efforts to disrupt itself and become a majority smoke-free tobacco company by 2025. The product already makes up 23.8% of the company’s revenues, despite only being launched in Japan in 2016, and is already profitable.

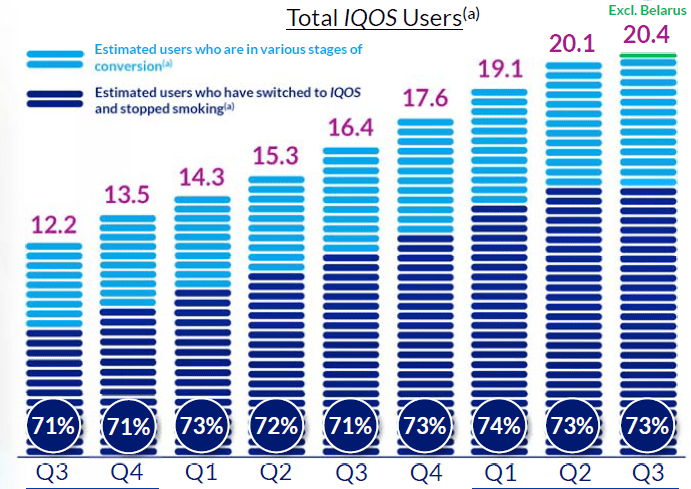

IQOS is a group of heated tobacco products that are part of the company’s “heat-not-burn” campaign. They are currently available in 70 countries. According to the company’s 2020 Annual Report, IQOS has 17.6 million users, and 12.7 million users have switched to IQOS and stopped smoking.

IQOS’ Platform 1 device and consumables have U.S. Food and Drug Administration (FDA) authorization under the premarket tobacco product application (PMTA) pathway. The FDA has also granted a version of it and its consumables “Modified Risk Tobacco Product (MRTP)” status due to the exposure modification benefits of using it.

According to the company’s Q3 2021 earnings report, usage of IQOS has continued to grow, despite supply chain constraints:

Source: Q3 2021 Earnings Report

IQOS has powered the company’s success in the heated tobacco market. British American Tobacco (BTI) is its only meaningful rival, with a 14% market share compared to Philip Morris’ 78.9% market share. Whereas IQOS is available in 70 markets, British American’s heated tobacco products are only available in 20 markets. Philip Morris is the only player with real scale.

Other players are Japan Tobacco, which has a 4% market share and mostly sells its heated tobacco product, Ploom, in Japan. KT&G Corporation has a 2.8% market share and in a sign of Philip Morris; strength in the market, signed a partnership with Philip Morris in 2020 to commercialize its smoke-free products. Altria has the right to sell IQOS in the United States. It must be acknowledged that Philip Morris and Altria are in a patent dispute with R.J. Reynolds over IQOS, a dispute which led to Philip Morris and Atria being barred from importing or selling the system in the United States. However, the signs are that the company is winning in that dispute.

Philip Morris’ Strong Competitive Position

Michael Porter proposed a five-force framework for analyzing the competitive position of a company. Philip Morris’ competitive strength comes out when you view the company through this lens.

-

Bargaining Power of Customers: In the traditional cigarette market, demand remains despite the known health risks of smoking tobacco. Allied to the addictiveness of nicotine, this makes demand hard to kill. Smokeless tobacco offers a reduced exposure to nicotine, without losing the more meditative reasons why people smoke. Consequently, firms have been able to raise prices to compensate for any taxes imposed on them, or to make up for declining demand. Pricing power ensures that revenue can grow even in a declining market. Put that power to work in smokeless tobacco and the economics of the industry look even better.

-

Bargaining Power of Suppliers: The tobacco leaf industry is highly fragmented, allowing cigarette makers to drive prices down. Suppliers are not in a position to control prices.

-

The threat of New Entrants: U.S legislation, replicated across the world, banning the advertising of cigarettes has made the industry uncompetitive. It is impossible to grow market share if you cannot talk about your product. This effect will spill over into heated tobacco because the brands associated with smoking will be familiar to smokers who want reduced-risk exposure to nicotine.

-

The threat of Substitute Products: Philip Morris is already the leader in heated tobacco. It is leading its own disruption.

-

The Intensity of Competitive Rivalry: As we have said several times, the industry dynamics are oligopolistic. Margins are healthy and products are priced rationally.

Investors Will Benefit From Low Valuations

The effect of the competitive position of Philip Morris and its fellow oligopolists is that the company generates a lot of free cash flow. In the twelve trailing months ended September 2021, the company earned nearly $10.5 billion in free cash flow (FCF), compared to $9.2 billion for 2020.

The company has a dividend payout ratio of 0.81, compared to 0.92 in 2020. In other words, the company pays out the vast majority of its earnings in the form of dividends. The company sets a dividend payout target of 0.75. Since going public in 2008, the company has increased its dividend every year, for a cumulative increase of 171.7%, or 8% compounded across that period. The company has a price-to-earnings ratio of 18.05. compared to the S&P 500’s multiple of 25.66. The combination of a high dividend payout ratio and low valuations results in a high dividend yield of 4.8%. Low valuations mean that reinvested dividends will have a higher rate of return than they would if valuations were higher. Thus, low valuations can be an investor’s friend. Throw in the company’s $7 billion share repurchase program, and the company’s yield looks even more attractive.

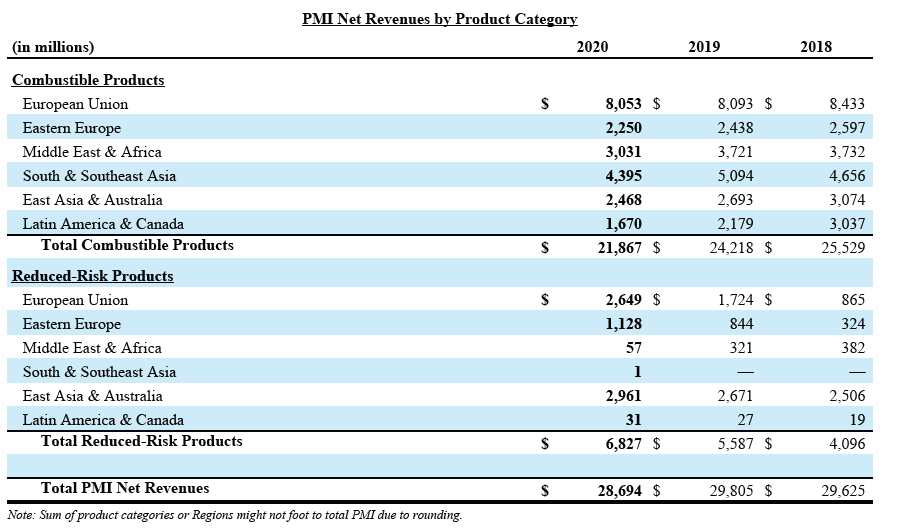

With a dividend yield that has averaged 5.49% in the last five years, investors do not need the company to grow in order to reap rewards. Indeed, revenue has been largely flat. In 2018, revenue was $29.6 billion, a figure which has grown to nearly $30.75 billion in the TTM period. In that time, the company’s EBIT rose from $11.5 billion to $12.9 billion. Q3 numbers show decent levels of growth, largely as a result of heated tobacco and price hikes in the cigarette market, with net revenue rising 7.6% year-over-year and 7.3% for the year-to-date (Sept. 30. 2021). Indeed, smokeless tobacco is the key growth driver for the company:

Source: 2020 Annual Report

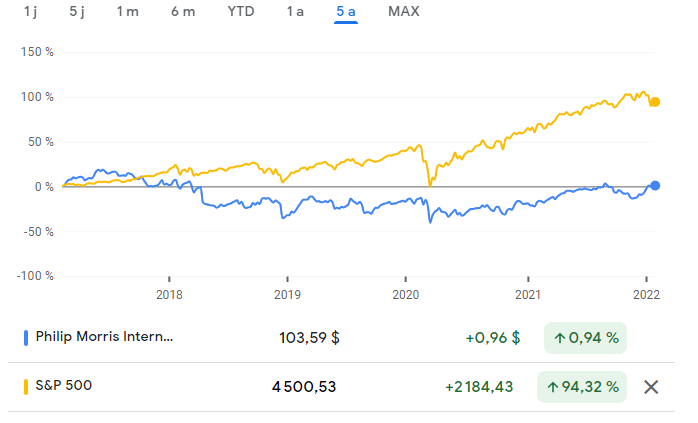

Total returns to shareholders are a function of share price appreciation and dividend yields. In the last five years, Philip Morris’ stock has barely moved:

Source: Google Finance

Yet, thanks to its dividend yield, the company has given investors total returns of 96% in the last five years.

Conclusion

The doomsday scenario of the tobacco industry, coupled with legitimate ethical concerns, has clouded the importance of engagement in achieving ethical targets. It has also masked the great economics of the industry, which, if transferred to smokeless tobacco, can create a powerful engine of shareholder returns. Even in a doomsday scenario, Philip Morris has shown an ability to grow and continue to give shareholders rich dividends. As a capital-light compounder, the company can give investors much of its profits while continuing to grow, and even with declining markets, the company has immense pricing power.

Be the first to comment