alexsl

Investment Thesis

In this article, I discuss why I think a V-shape recovery is highly unlikely to happen in 2022 for the Chinese economy. Despite the excellent returns delivered by Chinese stocks since April 2022 relative to other emerging markets, I believe that political risks associated with the zero-COVID policy, combined with a delayed real estate market recovery will hinder the country’s short-term economic prospects. Unless the Chinese government provides meaningful demand-side stimulus over the next couple of months, I expect the economic recovery to remain sluggish with downside risk stemming from a global recession. As a result, I continue to believe that the safest way to get exposure to China at the moment is through the use of long-dated call options where the investor only risks losing the premium paid for it.

What Has Happened Since My Last Article

I concluded my previous article on the Invesco Golden Dragon China Portfolio ETF (NASDAQ:PGJ) with the following statement:

Chinese equities trade at ~11x forward earnings, which is way below the 25-year average multiple, and much cheaper than what you can find in developed markets at the moment. Moreover, China is now pushing for an expansionary monetary policy, which should be favorable for equities in the future.

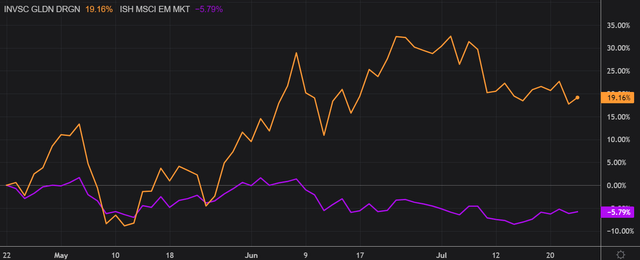

It turns out that Chinese equities have been outperforming emerging market stocks since I wrote that piece. I have compared PGJ’s returns over the previous three months to that of the iShares MSCI Emerging Markets ETF (EEM) to determine which one was a superior investment. PGJ has outperformed EEM by ~25 percentage points, which is a fantastic return when annualized.

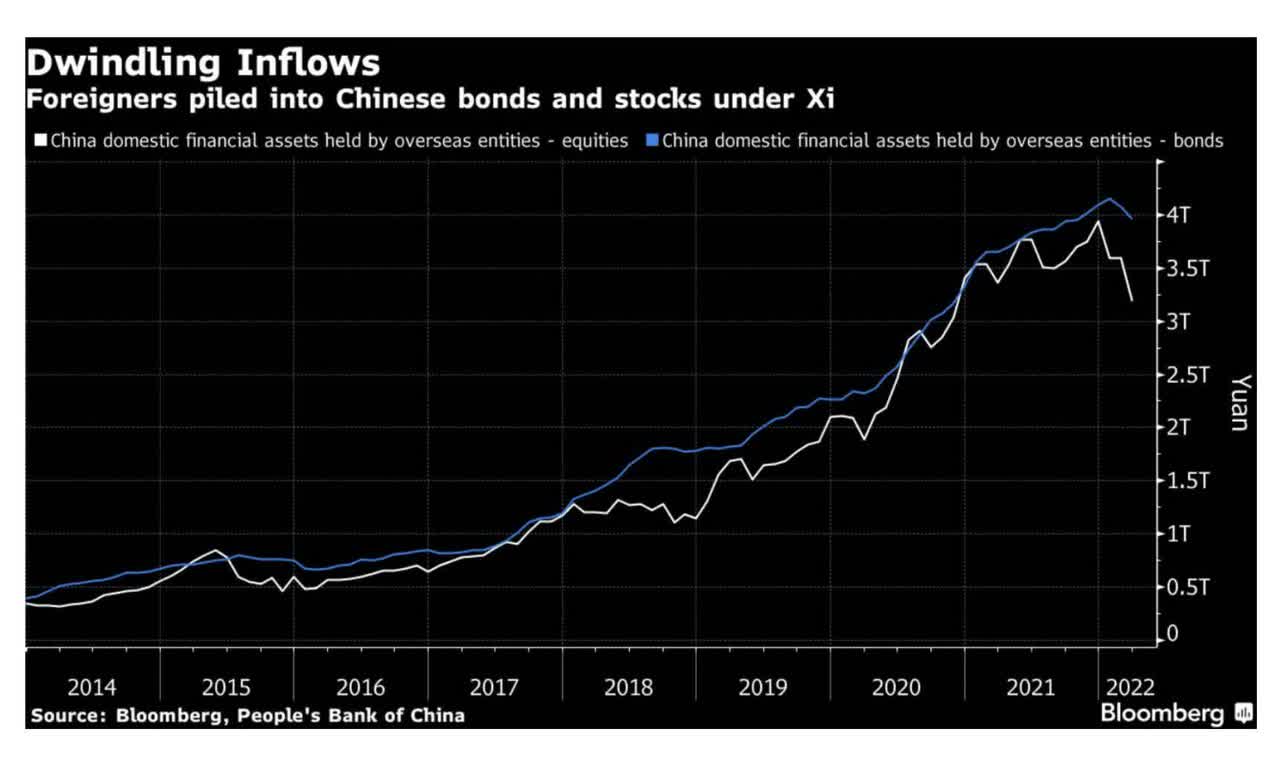

Refinitiv Eikon

Despite positive returns, investors have started to remove part of their exposure to China in light of geopolitical tensions. The war in Ukraine and the Taiwanese issue have polarized nations, and investors are now better grasping their investments’ implications. The foreign equity exposure to Chinese stocks has decreased by nearly one trillion yuan since December 2021, which represents a ~20% decline from the top. In my opinion, this could only be the beginning of this trend given the direction where the world is headed. A more polarized world is likely to be a world where investors will be confronted with legal hurdles, such as the sanctions imposed by Western countries on Russian equities.

Bloomberg

The Chinese Real Estate Sector

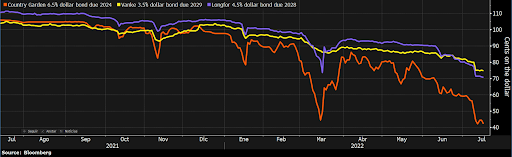

The main issue a few months ago was the pop of the Chinese real estate bubble. While this is a topic that gets less coverage than 6 months ago, I continue to believe it remains of paramount importance to understand where the Chinese economy is today. In my opinion, this bubble is still unfolding. As we can see from the pressure building in the credit market, the real estate issue now seems to be spreading from bankrupt to healthier developers as illustrated by their bond prices getting actively sold during the last weeks.

Bloomberg

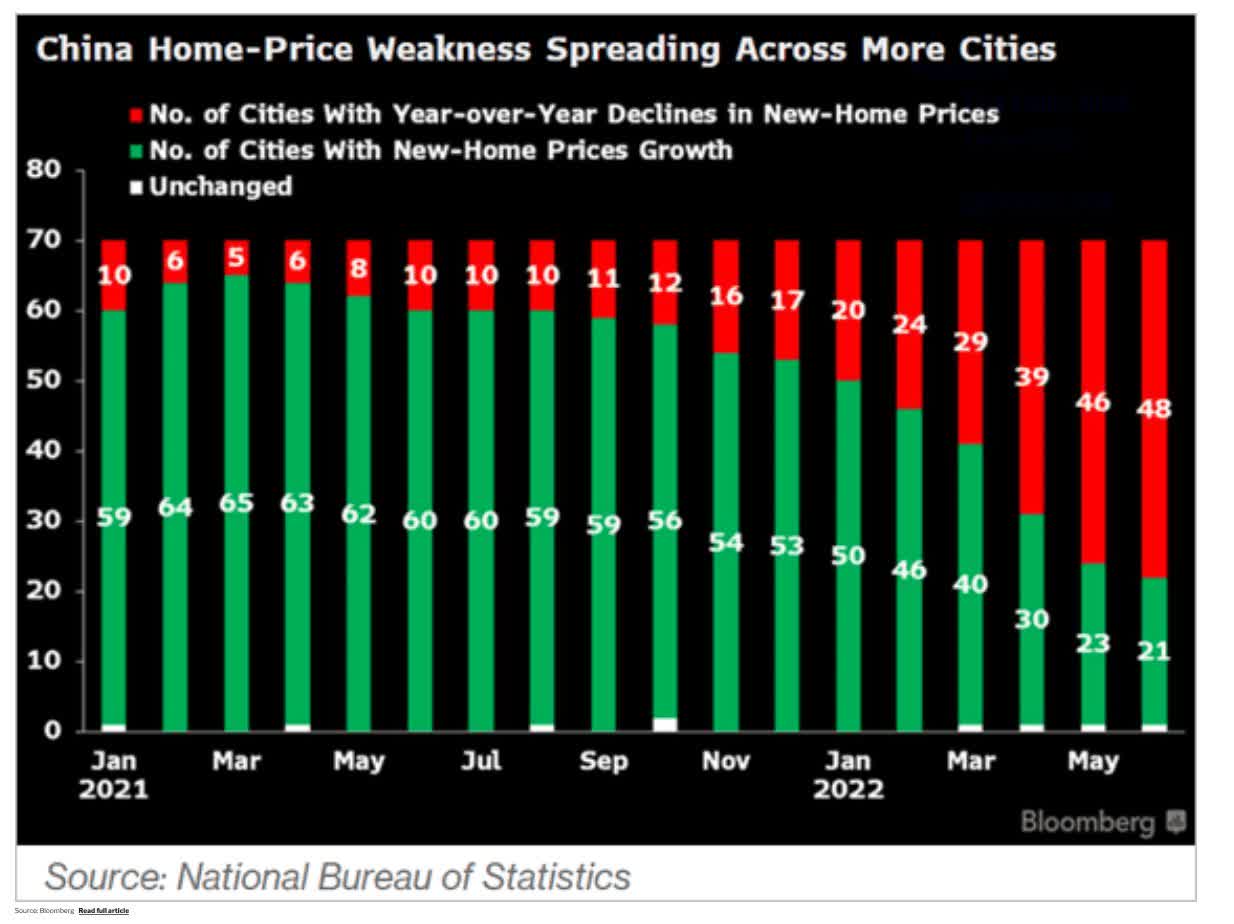

On top of that, house prices are starting to be a major issue in China. Given the fact that the Chinese real estate market was oversupplied for years, the only mechanism in place to correct supply-demand imbalances is a readjustment in house prices. Needless to say, that becomes problematic for the CCP since it creates a massive discontent across households that have seen real estate as their only available vehicle to park their excess savings. To avoid that, some Chinese cities have opted for price caps, but without a real readjustment, the real estate issue is likely to last longer than expected. Some cracks are already starting to pop up in the secondary mortgage market, where borrowers are outright threatening to stop paying their loans.

Bloomberg

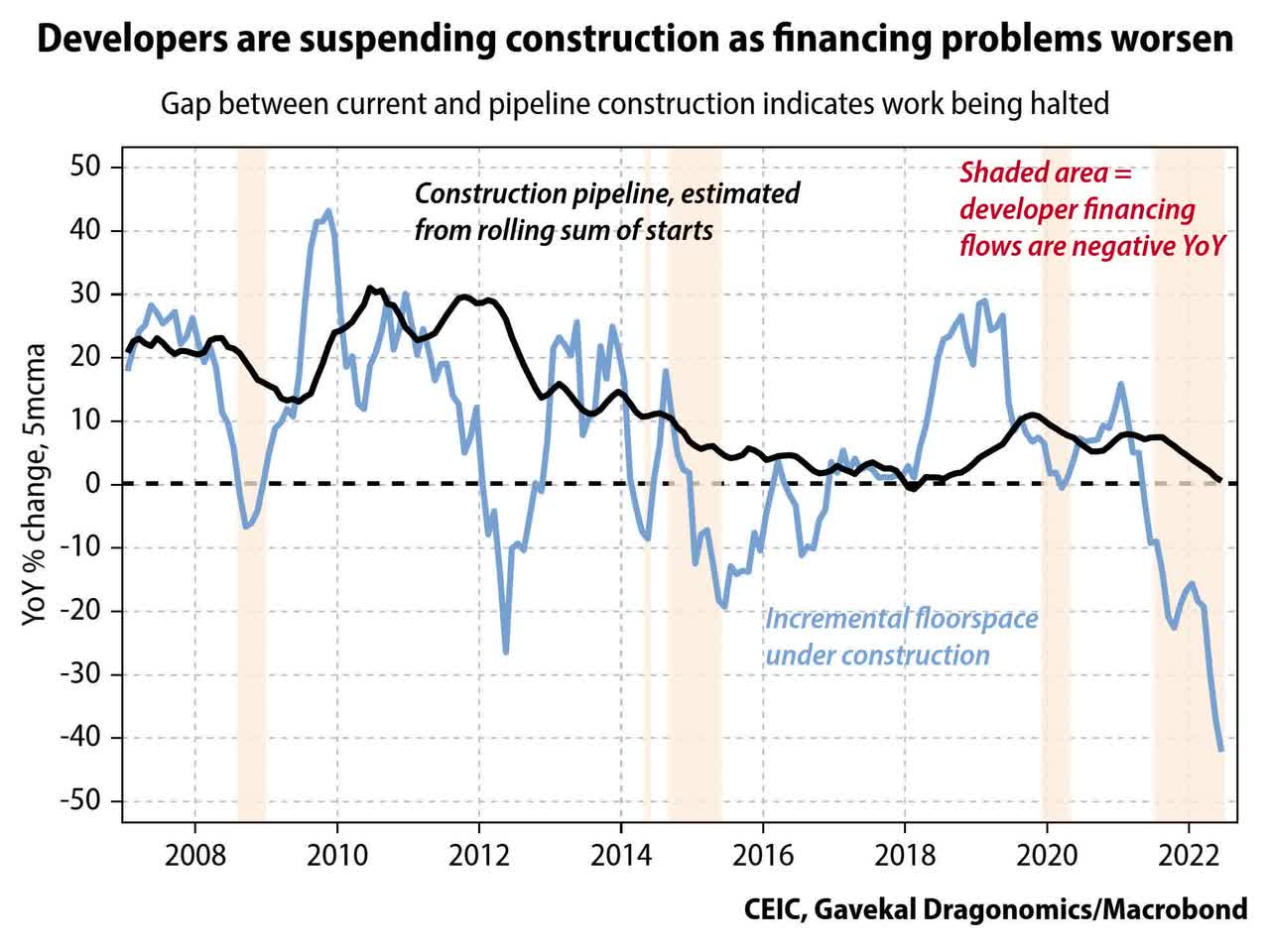

In response to demand pressures, property developers are suspending work on an increasing number of house construction projects as illustrated by the widening disparity between growth in the pipeline of new projects and actual building activity. This gap is now at its widest in a decade. According to a central bank official, China will form a real estate fund to assist property developers in resolving this issue. The price to pay for that? A meager ~300 billion yuan ($44 billion) to boost a multi-trillion dollar sector. I personally believe that much more support is needed at this point in time.

Ceic

Domestic Consumption Remains An Issue

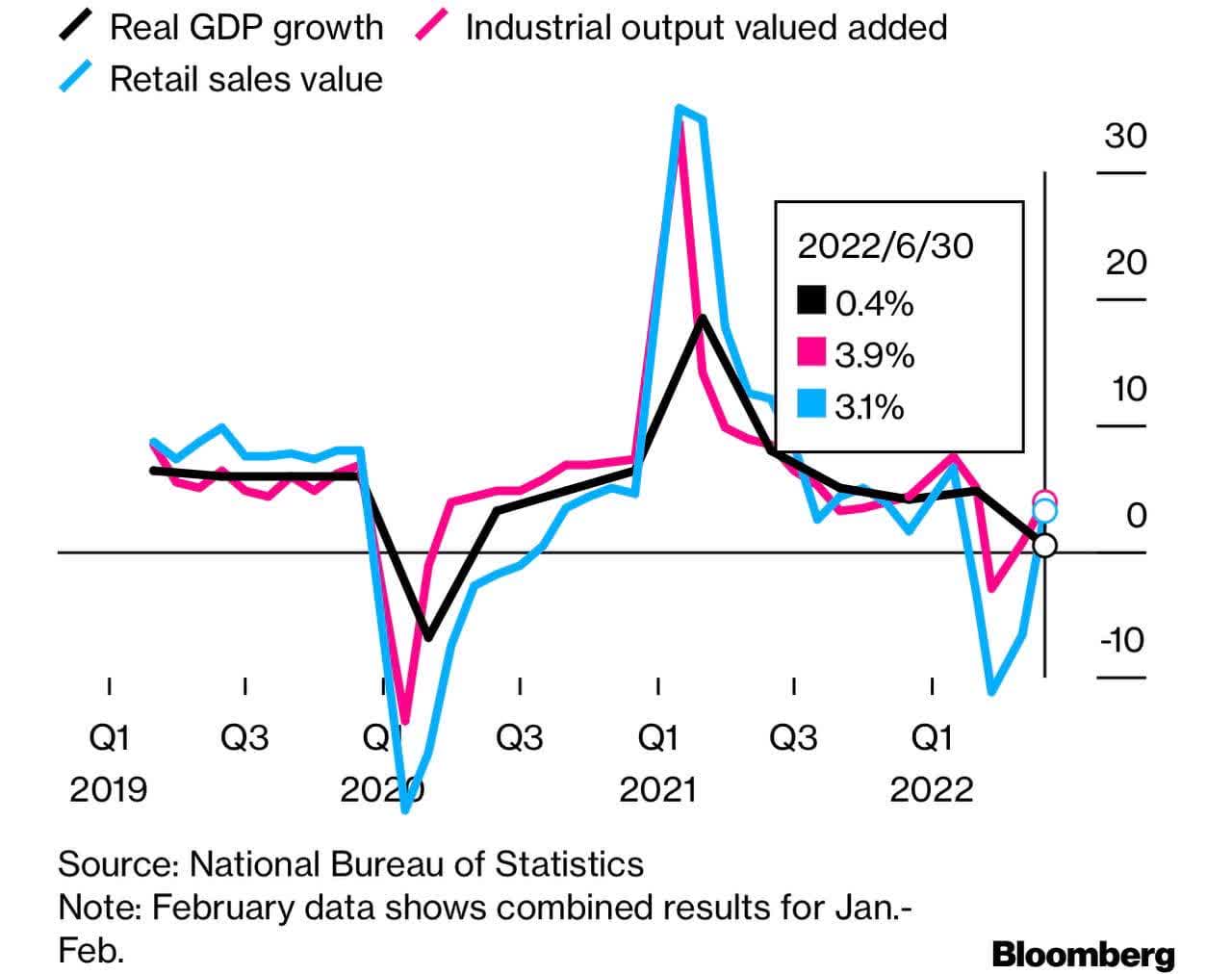

On top of the Chinese real estate crisis, the zero-Covid policy is definitely adding fuel to the fire and weakening domestic consumption. Chinese retail sales plunged by -11% in May 2022 compared to the same month last year, which was far lower than the -3% estimate predicted by analysts. Despite the fact that YoY retail sales have recovered and are now showing positive growth, the country continues to run one of the largest trade balance surpluses as a percent of GDP in its history. There haven’t been many headlines showing significant demand-side stimulus in China, at a time when it needs it most.

Bloomberg

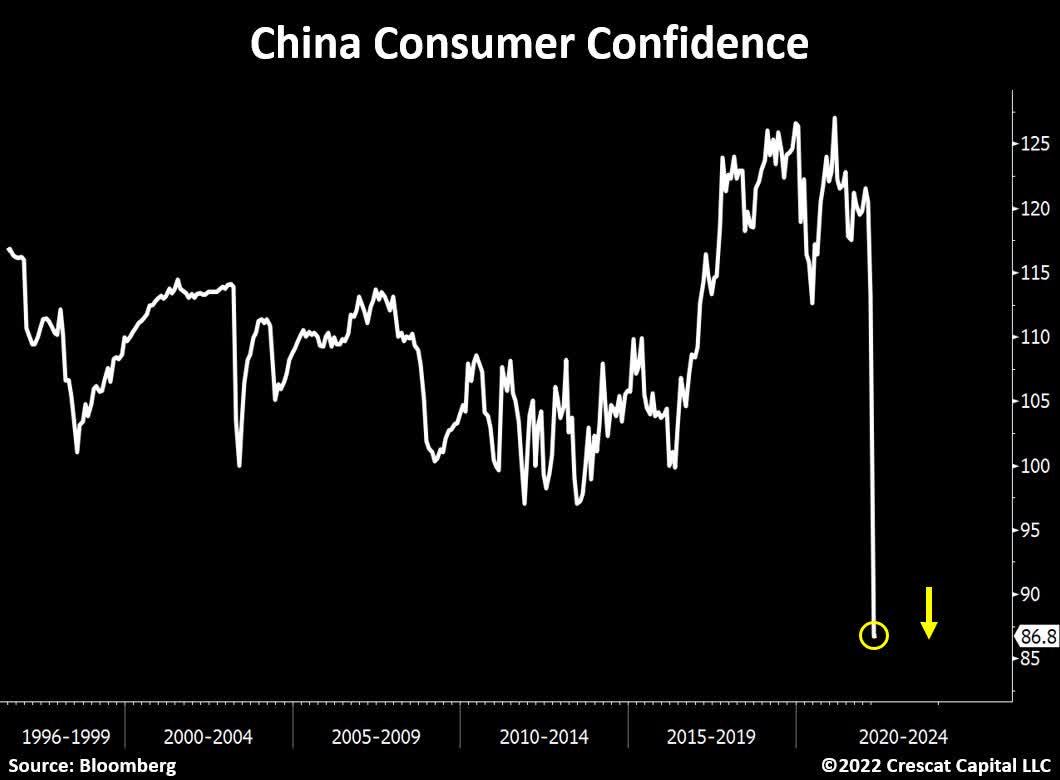

The lack of stimulus in a sluggish economy is reflected in the consumer confidence data, which has reached abysmal levels in recent months. Until we see a clear reversal in this trend, I believe that China will grow at a slower rate than we have been used to in the previous decade.

Bloomberg

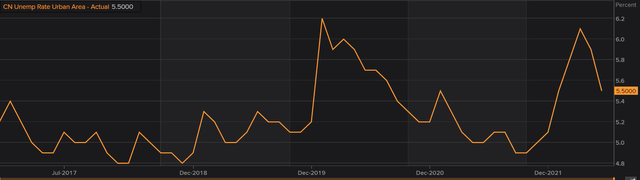

Another damage caused by the real estate crash and the zero-Covid policy can be found in the labor market. The unemployment rate in urban areas increased to a record high of ~6% in May 2022, before slowly coming down. That said, urban unemployment still remains well above the historical average of ~4.8%.

Refinitiv Eikon

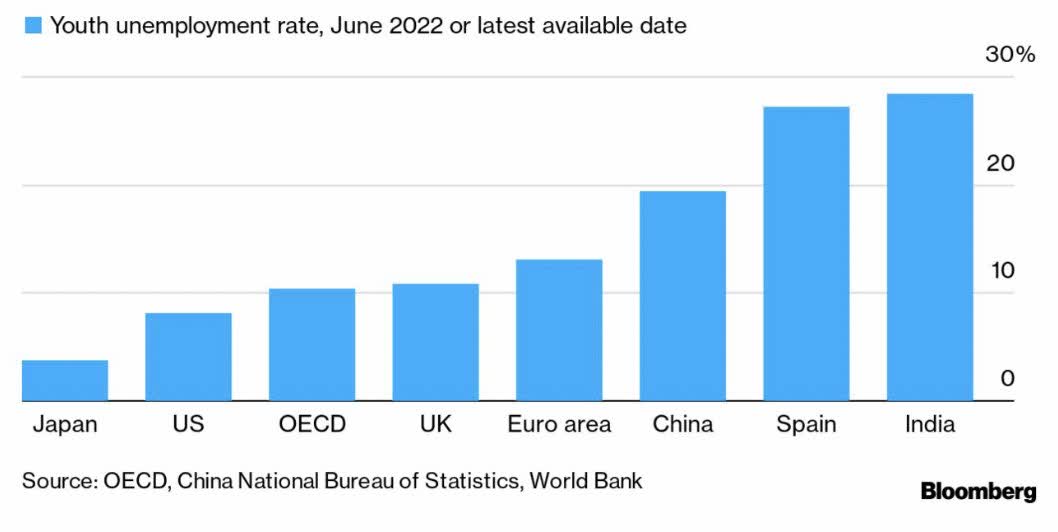

The situation is particularly bad amongst young workers where unemployment has been soaring to near 20% in June 2022.

Bloomberg

Unsurprisingly, YoY growth in domestic loans has hit a multi-decade low this year. In the midst of adverse economic conditions, Chinese investors’ risk appetite is dwindling, despite lower interest rates. All in all, I believe that a V-shape recovery in 2022 remains unlikely. As a result, I continue to believe that the best way to get exposure to the Chinese economy is through the use of long-dated call options.

TradingView

Key Takeaways

Despite the excellent returns delivered by Chinese stocks since April 2022 in comparison to other emerging markets, I believe that the country’s short-term economic prospects will be hampered by political risks associated with the zero-COVID policy, combined with a delayed real estate market recovery. Unless the Chinese government offers considerable demand-side support in the next months, I expect the economic recovery to remain weak, with the prospect of a worldwide recession looming. As a result, I continue to feel that the safest approach to gain exposure to China at the present is to use long-dated call options, where the investor risks only losing the premium paid for it.

Be the first to comment