JHVEPhoto

By Valuentum Analysts

Pfizer Inc (NYSE:PFE) is a high-quality, high-yielding opportunity in the pharmaceutical world. The company is a tremendous cash flow generator with a bright growth outlook and ample pricing power, backed up by a robust drug portfolio. Shares of PFE yield a juicy ~3.2% as of this writing.

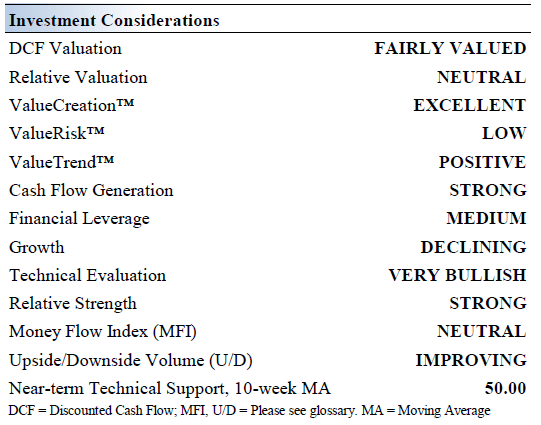

Pfizer’s Key Investment Considerations

Image Source: Valuentum

Pfizer is a research-based, global biopharmaceutical company. The company has a leading portfolio of products and medicines that support wellness and prevention, as well as treatment and cures for diseases across a broad range of therapeutic areas. The firm was founded in 1849 and is headquartered in New York, New York.

In November 2020, Pfizer combined its Upjohn generics business with Mylan which improved Pfizer’s financial health. Pfizer shareholders received 57% of the new entity, Viatris Inc (VTRS), and Mylan shareholders received the remaining 43%. This deal is expected to unlock substantial synergies for both Pfizer and Viatris, and Pfizer received a ~$12 billion cash distribution from Upjohn before the deal closed.

Some of Pfizer’s significant therapeutics include IBRANCE (treats HR-positive and HER2-negative breast cancer), ELIQUIS (treats and prevents blood clots), XELJANZ (treats rheumatoid arthritis, psoriatic arthritis, and ulcerative colitis), and VYNDAQEL/VYNDAMAX (treats transthyretin amyloid cardiomyopathy). Pfizer’s oncology, inflammatory & immunology, RSV, vaccine, and rare disease portfolio is robust both in terms of commercialized and potential opportunities. The company’s longer term outlook is quite bright.

Pfizer developed a COVID-19 vaccine with BioNTech SE (BNTX) which received emergency authorization use from regulatory bodies around the world, and full regulatory approval in the US. The venture secured supply agreements with major governments worldwide including the US, and Pfizer’s revenues have surged in recent years. Eventually, sales of its COVID-19 vaccine will fade alongside the pandemic. The COVID-19 vaccine is branded as COMIRNATY. Pfizer also sells PAXLOVID, an oral treatment for COVID-19, and revenue from this drug should also fade alongside the pandemic.

In August 2022, Pfizer announced a deal to acquire Global Blood Therapeutics Inc (GBT) through a ~$5.4 billion acquisition. The deal gives Pfizer access to OXBRYTA, a treatment for sickle cell disease. OXBRYTA has received regulatory approval in the US, Europe, and elsewhere. We like the acquisition as it further bolsters Pfizer’s pharmaceutical portfolio in an economically attractive space.

Earnings and Guidance Update

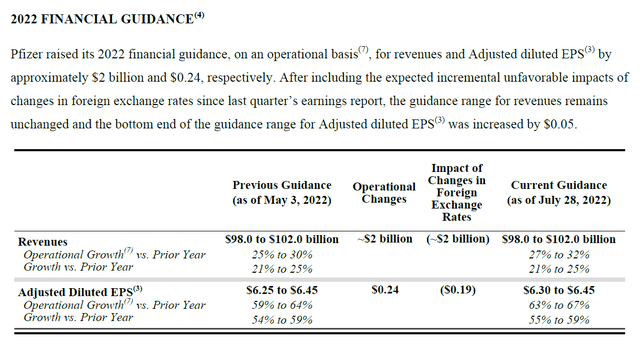

On July 28, Pfizer reported second quarter 2022 earnings that beat consensus top- and bottom-line estimates. Its GAAP revenue grew by 47% year-over-year to reach $27.3 billion and its GAAP diluted EPS rose by 77% year-over-year to reach $1.73. Pfizer benefited from strong operational sales (a non-GAAP metric) across its vaccine, rare disease, internal medicine, and oncology portfolios, keeping in mind foreign currency headwinds (due to a strong US dollar) held back its GAAP financials last quarter. The company also modestly boosted its full-year guidance for 2022 during its latest earnings report as you can see in the upcoming graphic down below.

Pfizer boosted its full-year guidance for 2022 during its second quarter earnings update. (Pfizer – Second quarter of 2022 earnings press release)

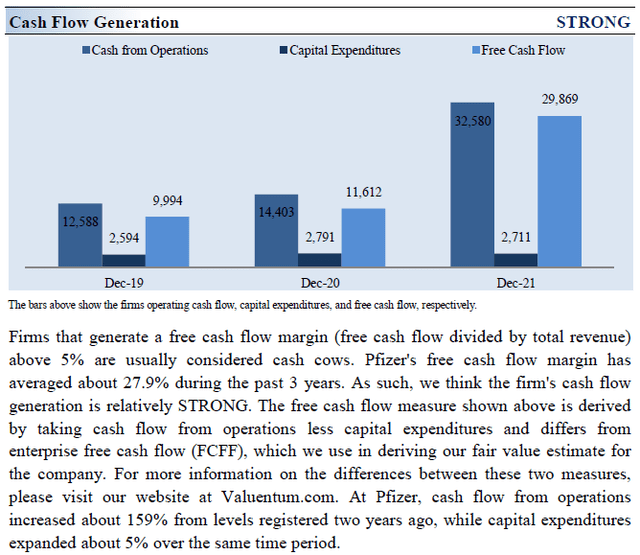

Pfizer is a stellar free cash flow generator, defining free cash flow as net operating cash flow less capital expenditures. From 2019-2021, its annual free cash flows averaged ~$17.5 billion while its run-rate dividend obligations stood at $8.7 billion in 2021. However, the company has a sizable net debt load on the books to be aware of. Additionally, Pfizer’s M&A activity and share repurchases compete for capital against its dividend. With that in mind, Pfizer’s financial health is rock-solid given its bright growth outlook, and we see ample room for Pfizer to grow its per share dividend going forward.

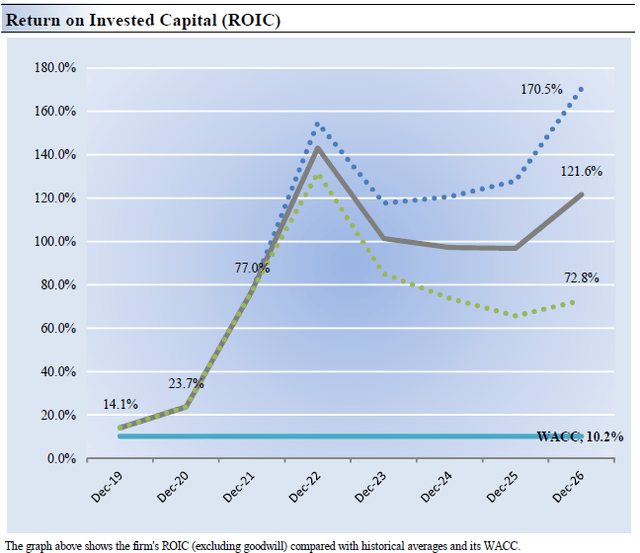

Pfizer’s Economic Profit Analysis

The best measure of a company’s ability to create value for shareholders is expressed by comparing its return on invested capital [‘ROIC’] with its weighted average cost of capital [‘WACC’]. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Pfizer’s 3-year historical return on invested capital (without goodwill) is 38.3%, which is above the estimate of its cost of capital of 10.2%.

In the upcoming chart down below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. Pfizer is a strong economic-value generator.

Pfizer’s Cash Flow Valuation Analysis

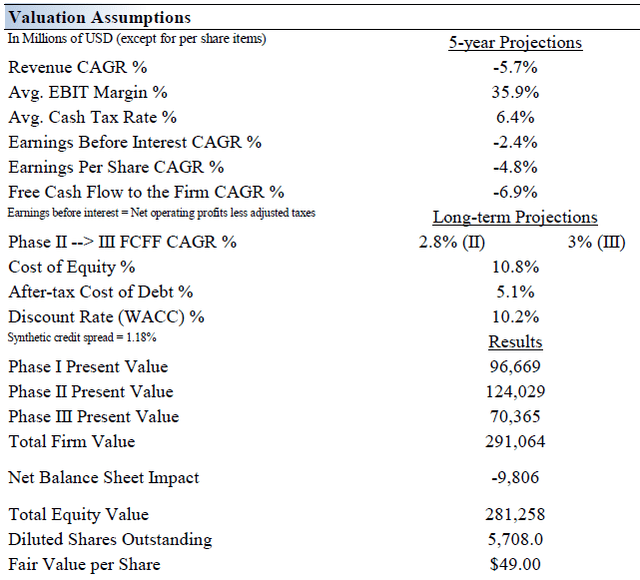

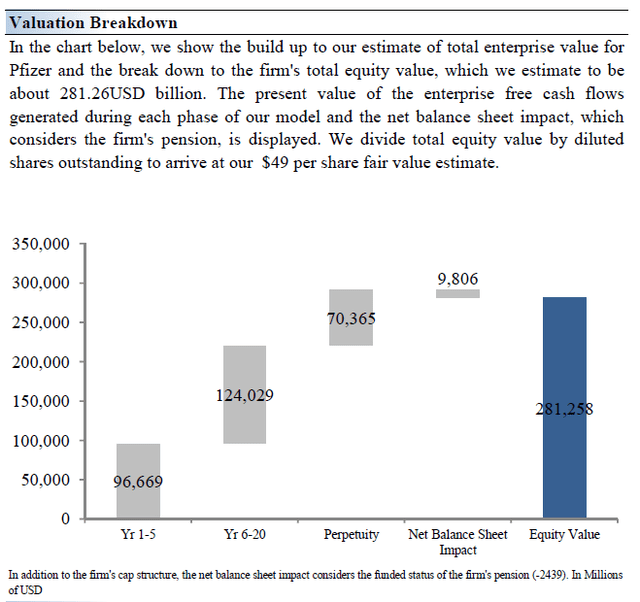

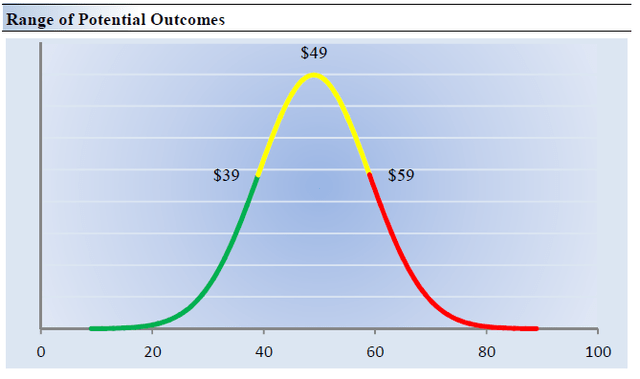

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows, inclusive of the company’s net balance sheet considerations. We think Pfizer is worth $49 per share with a fair value range of $39.00 – $59.00, derived through our enterprise cash flow model. As of this writing, shares of PFE are trading near our fair value estimate.

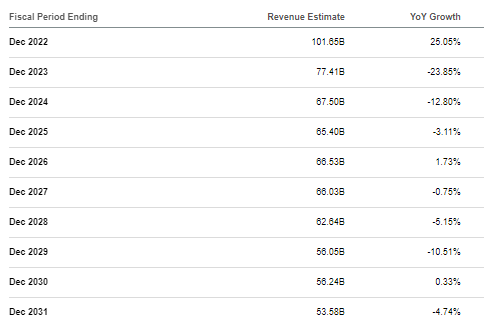

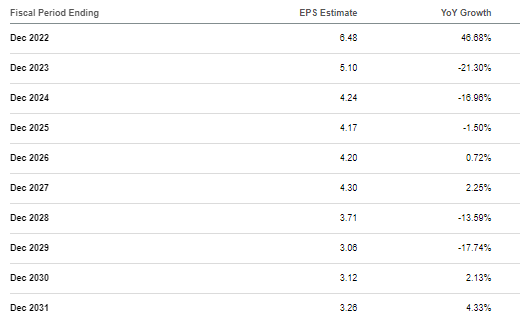

The near-term operating forecasts used in our model evaluating Pfizer, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of -5.7% during the next five years, a pace that is lower than the firm’s 3-year historical compound annual growth rate of 14.9%. Here is an image of what consensus looks like in the coming years, per Seeking Alpha.

Consensus revenue estimates. (Image Source: Seeking Alpha) Consensus earnings estimates. (Image Source: Seeking Alpha)

Our valuation model reflects a 5-year projected average operating margin of 35.9%, which is above Pfizer’s trailing 3-year average. Beyond Year 5, we assume free cash flow will grow at an annual rate of 2.8% for the next 15 years and 3% in perpetuity. For Pfizer, we use a 10.2% weighted average cost of capital to discount future free cash flows.

Image Source: Valuentum Image Source: Valuentum

Pfizer’s Margin of Safety Analysis

Although we estimate Pfizer’s fair value at about $49 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

In the graphic up above, we show this probable range of fair values for Pfizer. We think the firm is attractive below $39 per share (the green line), but quite expensive above $59 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Dividend Strength

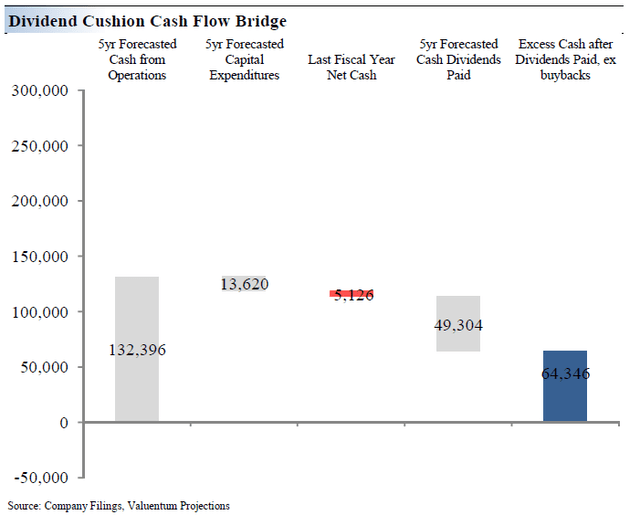

We use our proprietary Dividend Cushion ratio to determine the strength of a company’s future dividend coverage. The Dividend Cushion Cash Flow Bridge, shown in the upcoming graphic down below, illustrates the components of the Dividend Cushion ratio and highlights in detail the many drivers behind it. Pfizer’s Dividend Cushion Cash Flow Bridge reveals that the sum of the company’s 5-year cumulative free cash flow generation, as measured by cash flow from operations less all capital spending, plus its net cash/debt position on the balance sheet, as of the last fiscal year, is greater than the sum of the next 5 years of expected cash dividends paid.

As the Dividend Cushion ratio is forward-looking and captures the trajectory of the company’s free cash flow generation and dividend growth, it reveals whether there will be a cash surplus or a cash shortfall at the end of the 5-year period, taking into consideration the leverage on the balance sheet, a key source of risk. On a fundamental basis, we believe companies that have a strong net cash position on the balance sheet and are generating a significant amount of free cash flow are better able to pay and grow their dividend over time. Firms that are buried under a mountain of debt and do not sufficiently cover their dividend with free cash flow are more at risk of a dividend cut or a suspension of growth, all else equal, in our opinion.

Generally speaking, the greater the ‘blue bar’ to the right is in the positive, the more durable a company’s dividend, and the greater the ‘blue bar’ to the right is in the negative, the less durable a company’s dividend. Overall, Pfizer’s Dividend Cushion ratio of 2.3 indicates robust dividend strength, aided by its stellar free cash flow generating abilities offsetting its net debt load.

Pfizer’s dividend strength is robust. (Valuentum)

Concluding Thoughts

Some income investors may never forgive Pfizer for its dividend cut when it scooped up Wyeth way back in 2009. When it comes to counting on that dividend check, income investors cannot afford an executive team that puts wheeling and dealing first. We think Pfizer has learned from this mistake even if big deals are still its “thing” – the company’s quarterly dividend has now reached levels prior to the Wyeth deal in any case. We will be monitoring Pfizer’s potential M&A activity. Competing capital allocation priorities could weigh on Pfizer’s future dividend growth potential, with an eye towards large potential acquisitions and share repurchases.

Pfizer is a leader in numerous treatment areas within pharmaceutical markets around the world, but emerging markets continue to offer the company meaningful opportunities for growth. Management is optimistic on its potential growth trajectory in oncology, which is expected to be driven by IBRANCE and XTANDI. The firm’s balance sheet could be better, but its free cash flow generation should be sufficient in handling it.

We forecast that Pfizer will steadily grow its per share dividend going forward, aided by its strong financial performance seen of late and bright growth outlook. Though shares look about fairly valued based on our discounted cash flow process, Pfizer is a solid income generation idea for investors seeking a high-quality, high-yielding company.

Be the first to comment