Lisa Maree Williams

Pfizer (NYSE:PFE) is hard to evaluate using recent data because (1) earnings coming from the COVID vaccine are almost certainly unsustainably high and (2) the spinoff of its Upjohn business to form Viatris (VTRS) in November of 2020. Since closing at an all-time high of $61.25 on December 16, 2021, the shares have fallen 19.4% to reach the current level of $49.37. The bulk of the decline came in early in 2022, with the shares bouncing between about $45 and $55 since early February.

Seeking Alpha

12-Month price history and basic statistics for PFE (Source: Seeking Alpha)

Pfizer’s earnings have been on a substantial upward trend since the start of 2021. The company has also beaten earnings expectations in all but 2 quarters over the past 4 years. On July 28, 2022, the company reported Q2 results, beating EPS expectations by 14.5%. The consensus outlook for earnings is for declines averaging 5.5% per year over the next 3 to 5 years. The projected drop in earnings results from expected declining revenues from the COVID vaccine and Paxlovid, Pfizer’s oral medication to reduce the severity of COVID. The wild card, of course, is that demand for PFE’s COVID vaccine and treatment is very uncertain as the virus continues to mutate rapidly (see slide 18).

ETrade

Trailing (4 years) and estimated future quarterly EPS for PFE. Green (red) values are amounts by which EPS beat (missed) the consensus expected value (Source: ETrade)

PFE’s fundamentals show that the market is discounting expected future earnings rather severely. The forward P/E, 7.7, is quite low compared to historical levels. The dividend yield is 3.2% and the 3-, 5-, and 10-year dividend growth rates are 5.7%, 5.9%, and 6.9% per year, respectively. On the basis of the Gordon Growth Model, we may reasonably expect annualized total returns from PFE of around 9%.

One of PFE’s attractive properties is its low beta with respect to the S&P 500. Over the past 5 years, PFE has had a beta of 0.68. Over the past 10 years, the beta is 0.76. Research has shown that low-beta stocks tend to generate high risk-adjusted returns.

I last wrote about PFE on May 8, 2021, at which time I maintained a buy rating. At that time, the forward dividend yield was 3.98%, and the forward P/E was 10.7. The Wall Street analyst consensus rating was neutral to bullish, and the consensus 12-month price target was about 6.65% above the share price at that time, for an expected total return of 10.6% over the next year. For a low-volatility stock like PFE, this level of return was quite attractive.

In addition to looking at the fundamentals and the Wall Street consensus, I also considered the market-implied outlook, which represents the consensus view implied by the prices of put and call options. The market-implied outlook was neutral, with low volatility. Considering the cheap valuation, the somewhat positive Wall street consensus outlook, and the neutral market-implied outlook, maintaining a buy rating was the most logical choice. Since this analysis was published, PFE shares have risen by 24%, as compared to -2% for the S&P 500.

Seeking Alpha

Previous analysis of PFE and subsequent performance vs. the S&P 500 (Source: Seeking Alpha)

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock is largely determined by the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probabilistic price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper explanation and background, I recommend this monograph published by the CFA Institute.

With more than a year since my last analysis, I have calculated an updated market-implied outlook and compared this with the current Wall Street consensus outlook in updating my rating on PFE.

Wall Street Consensus Outlook for PFE

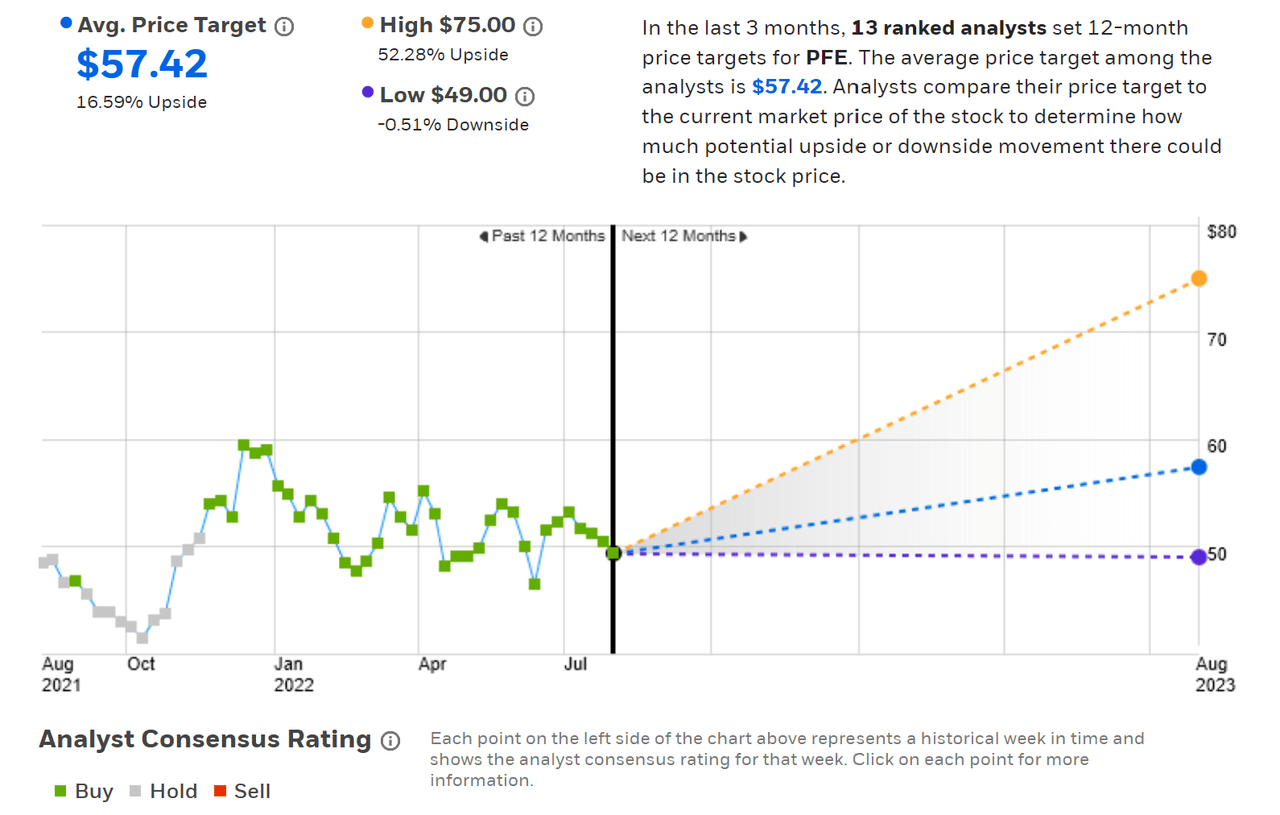

ETrade calculates the Wall Street consensus outlook for PFE using ratings and price targets from 13 ranked analysts who have published their views over the past 3 months. The consensus rating is bullish and the consensus 12-month price target is 16.6% above the current share price. The lowest of the individual price targets is 0.5% below the current share price.

ETrade

Wall Street analyst consensus rating and 12-month price target for PFE (Source: ETrade)

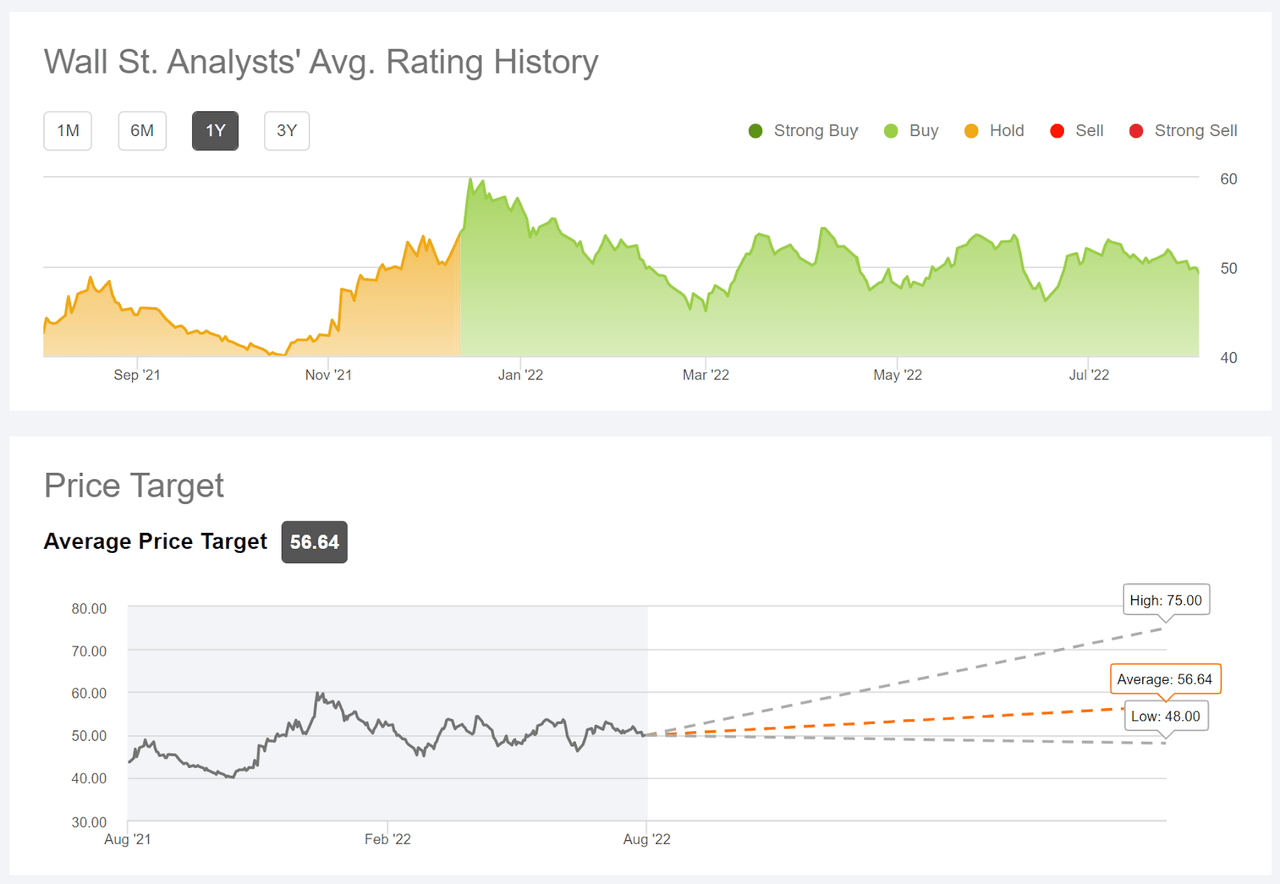

Seeking Alpha’s version of the Wall Street consensus outlook is based on the views of 22 analysts who have published ratings and price targets over the past 90 days. The consensus rating is bullish and the consensus 12-month price target is 15% above the current share price.

Seeking Alpha

Wall Street analyst consensus rating and 12-month price target for PFE (Source: Seeking Alpha)

In results from ETrade and Seeking Alpha, the consensus rating shifted from neutral to positive late in 2021. The consensus price targets imply an expected total return of between 18.2% and 19.8%.

Market-Implied Outlook for PFE

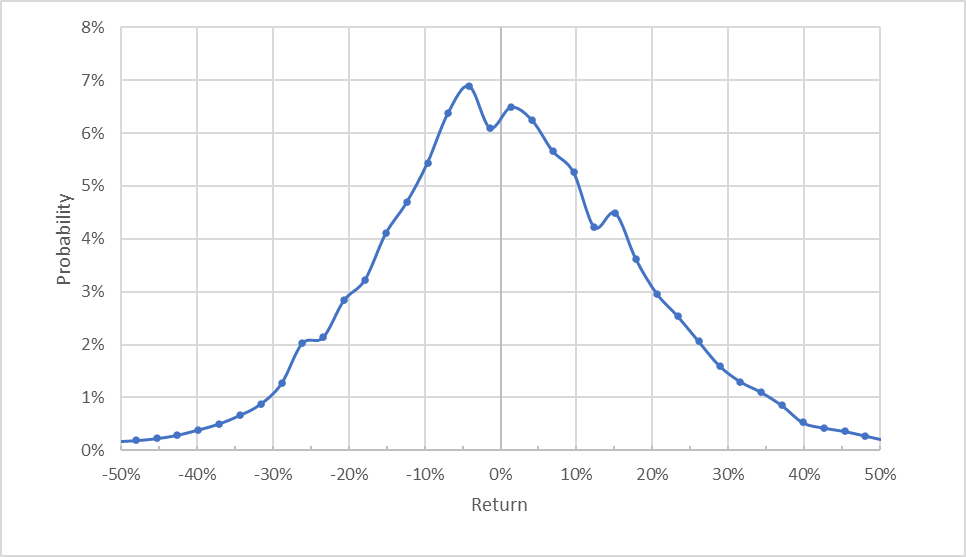

I have calculated the market-implied outlook for PFE for the 5.5-month period from today until January 20, 2023, using the prices of call and put options that expire on this date. I chose this specific expiration date to provide a view through the end of 2022 and because the options expiring in January are very actively traded, adding confidence in the consensus outlook.

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Geoff Considine

Market-implied price return probabilities for PFE for the 5.5-month period from now until January 20, 2023 (Source: Author’s calculations using options quotes from ETrade)

The market-implied outlook for the next 5.5 months is generally symmetric, with comparable probabilities of positive and negative returns of the same magnitude, although the peak in probability is slightly tilted to favor negative returns. The expected volatility calculated from this outlook is 28% (annualized), somewhat higher than the value I calculated in May of 2021, 22%.

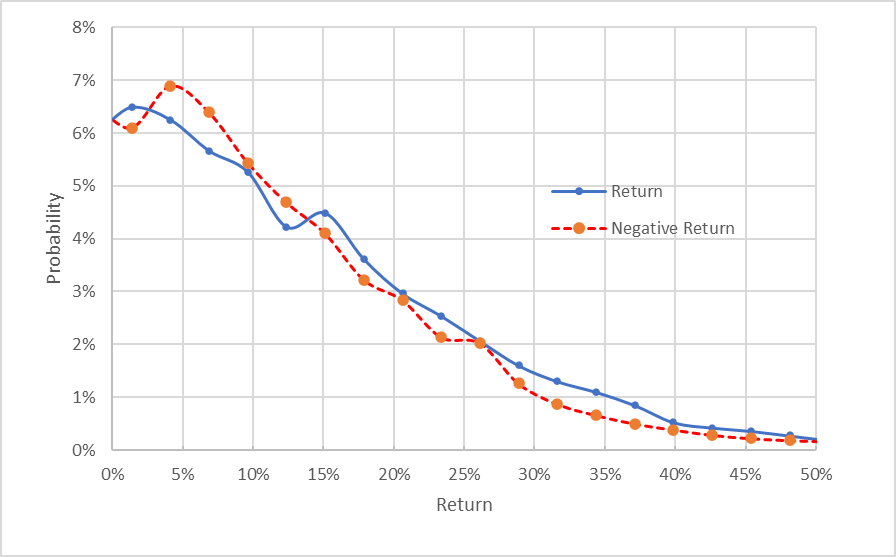

To make it easier to compare the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Geoff Considine

Market-implied price return probabilities for PFE for the 5.5-month period from now until January 20, 2023. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from ETrade)

While there are slightly elevated probabilities of small-magnitude negative returns (the dashed red line is above the solid blue line over the left 20% of the chart above), the probabilities of larger-magnitude returns favor positive outcomes. Overall, the probabilities of positive and negative outcomes match quite closely.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk averse and thus tend to pay more than fair value for downside protection. There is no way to measure the magnitude of this bias, or whether it is even present, however. Considering this potential bias, the market-implied outlook is interpreted as neutral to slightly bullish.

Summary

The market is substantially discounting PFE’s future earnings, even as the company continues to beat expectations. The company has had a substantial earnings windfall from the COVID vaccine and Paxlovid, so it is certainly reasonable to be cautious in the outlook. At the current low valuation, however, the shares look reasonable. The Wall Street consensus rating is bullish, with a 12-month consensus outlook that implies an expected total return of 18.2% to 19.8%.

As a rule of thumb for a buy rating, I want to see an expected return that is at least ½ the expected annualized volatility (28% from the market-implied outlook). PFE is substantially above this threshold, taking the consensus price target at face value. The market-implied outlook is neutral to slightly bullish, and looks more favorable than in May of 2021. In addition, the stock’s low beta provides some portfolio ballast against ongoing volatility. I am maintaining my bullish/buy rating on PFE.

Be the first to comment