naphtalina/iStock via Getty Images

After I covered the iShares Preferred and Income Securities ETF (PFF) and corporate bonds, my readers questioned the validity of owning preferred shares in light of the Federal Reserve’s policy decisions. These mostly pertain to the fact that many investors view “preferreds” as a workaround to a low-interest rate environment and would rather have corporate bonds in their portfolio for reasons I will enumerate later.

However, my objective with this thesis is to show that in the current economic environment, it makes sense to own preferred shares, and for this purpose, I will use Global X U.S. Preferred ETF (NYSEARCA:PFFD) and the Vanguard Long-Term Corporate Bond Index ETF (NASDAQ:VCLT) which both provide above 4% dividend yields.

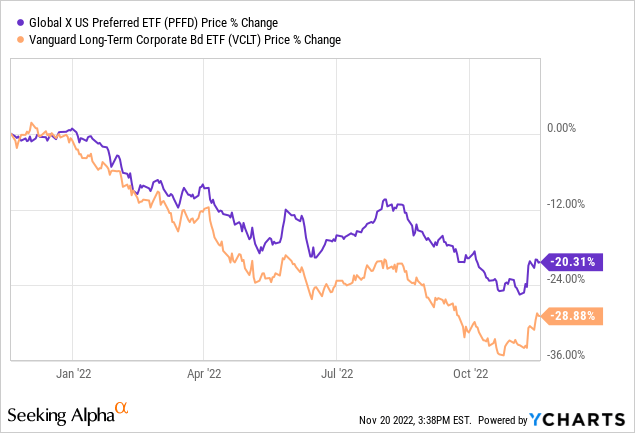

Still, as shown in the chart below, both of these two asset classes are down by more than 20% during the last year which has been volatile for the stock market in general.

Logically then, it is important to assess whether, after such mediocre performances, which have had the effect of a cold shower for investors, it is now time to seize the dip-buying opportunity.

Preparing For a Low-Growth Environment

Part of the answer to this question lies during the last FOMC meeting at the beginning of November when Federal Reserve Chairman hinted that interest rates would be hiked, but possibly at a lesser pace. This opens the possibility of a 50 basis point hike in December. Now, a more dovish tone by the Fed is positive for both fixed income and preferreds as they make fixed payments. As such, they are sensitive to interest rate fluctuations, and with a fall in interest rates, the value of preferreds and bonds normally rises.

Pursuing further, there is another reason for opting for fixed payments, and this has to do with growth. Now, higher rates have been particularly painful to the housing market as higher mortgage rates have discouraged buyers in general resulting in less demand for homes. Additionally, another sector that has suffered is technology as higher borrowing costs have discouraged new investments, while at the same time, a strong dollar constitutes headwinds for big tech which operate on a multinational basis.

Moreover, with the effect of the Fed tightening monetary policy being felt across other sectors of the economy, growth is likely to remain challenged going into 2023 and things are not likely to change overnight even if the U.S. central bank reverses course.

In these circumstances, equities are likely to remain under pressure and it makes sense to add corporate bonds or preferreds to your portfolio, but the question is for which one to opt.

I start by providing insights on PFFD.

PFFD Holds Preference Stocks from the Banking Sector

First, contrary to what some may believe, preferred stocks are not fixed-income securities. Although they pay fixed dividends that look pretty much like bond coupons, they are riskier. Thus, possessing characteristics of both corporate bonds and common stocks, they are also more complex and can be viewed as “hybrid securities”.

Second, just like those who own ordinary shares, the preferred shareholder partially owns the listed company and receives a share of the profits in the form of dividends. On the other hand, for preferred stock, dividends are fixed and effected in advance and usually paid on a perpetual basis. Thus, if the company suspends the payment because it is in bad financial shape, it will then have to prioritize the preferred shareholders before the common stockholders in addition to paying them the arrears in the case of a cumulative dividend.

Still, one will note that in the event of bankruptcy, bondholders have a better chance of getting back (albeit partially) their money than a preferred shareholder simply because of the priority list, which simply states that creditors (bondholders) should be paid before owners (preference or common stockholders).

Noteworthily, this theoretical advantage bonds possess over preferreds becomes less important in the current economic environment due to the nature of PFFD’s assets.

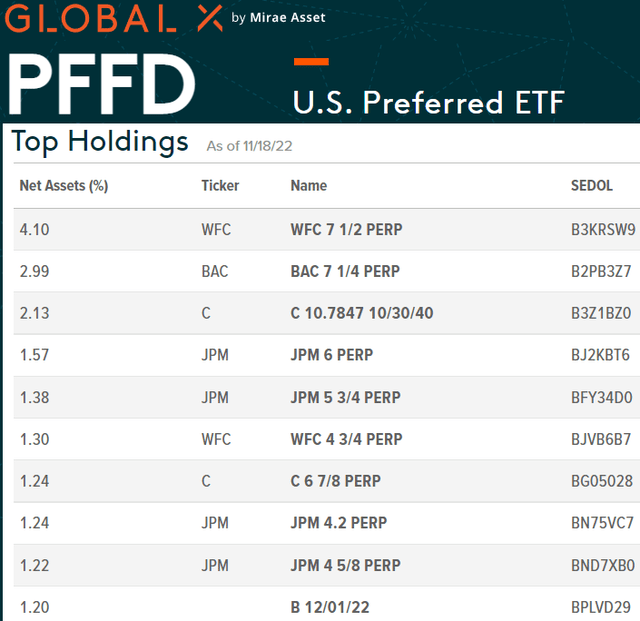

Thus, PFFD’s holdings as evidenced by their tickers in the list below come predominantly from the banking sector. For this matter, the ETF tracks the ICE BofA Diversified Core U.S. Preferred Securities Index.

PFFD Holdings (www.globalxetfs.com)

Further justifying the case for preferreds, contrarily to 2008 when credit risks were high, with banks being part of the problem leading to the great financial crisis, this time around, they remain well capitalized with much fewer default risks.

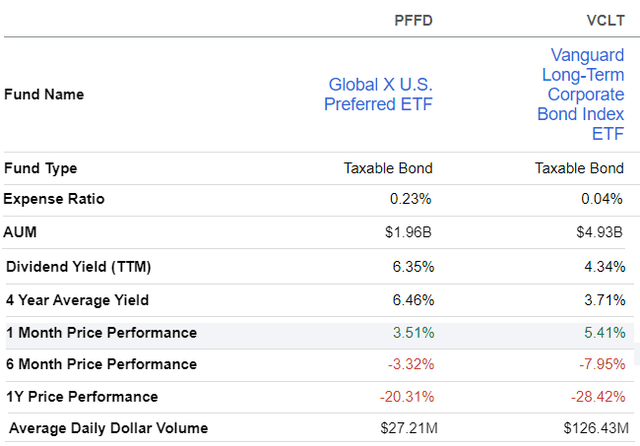

Viewed from this angle, the preferred shares owned by banks are less likely to suffer in the event of a severe economic downturn and this decreases the “theoretical” advantage of debt instruments. Moreover, preferreds tend to pay higher dividend yields than long-duration corporate bonds, which for PFFD, more than offsets its higher fees of 0.23% as shown in the table below.

VCLT’s Investment Grade Long Duration Corporate bonds

On the other hand, the difference between the one-month, six-month, and one-year price performances (table below) show that investors seem to be investing more money into bonds than preferred in the recent past.

Comparison of Metrics (seekingalpha.com)

Moreover, as seen by the average daily dollar volume, the bond market is much more liquid than preferred stocks. This is explained by the fact that many individuals purchase preferred shares to take advantage of the dividend tax credit, making them more attractive relative to bond interest income. However, this tax benefit also comes at the expense of less liquidity.

Thus, with the liquidity factor, which is now taking center stage as the Fed reduces its balance sheet of treasuries and mortgage-backed securities, bonds seem to be regaining some of their shine. For investors, these are essentially debt instruments companies avail to finance themselves, which can be for the short term (maturity of fewer than 5 years), medium term (between 5 and 12 years), or long term (longer than 12 years).

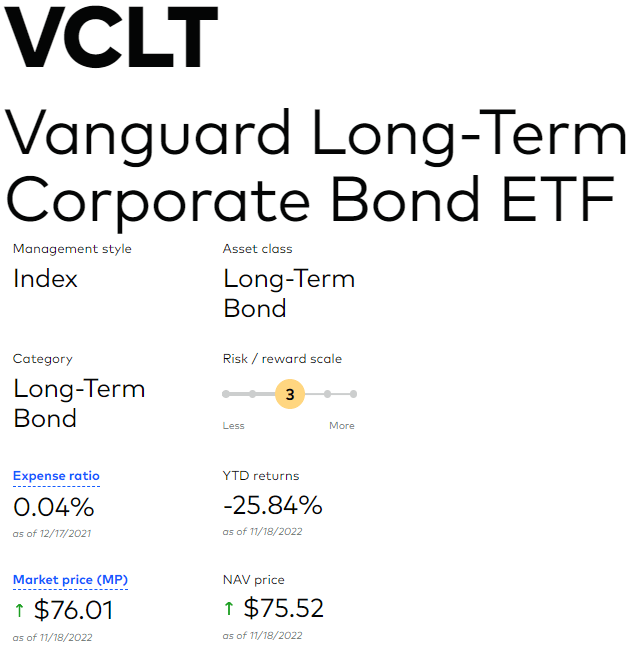

As for VCLT which is pictured below, it holds long-term bonds with a dollar-weighted average maturity of 10 to 25 years, but equally important, it invests primarily in high-quality (investment-grade) corporate bonds which seek to provide a high and sustainable level of current income.

VCLT Profile (investor.vanguard.com)

Moreover, companies that issue bonds do so as an alternative to equity financing, and corporate bonds offer relatively higher yields than U.S. treasuries because they carry relatively higher risks. Along the same lines, the more fragile the balance sheet of a company, the greater the return offered to the investor as is the case when buying high-yield bonds.

With its investment grade bonds, VCLT carries less risk, namely with a score of 3 out of 6 on the Risk/Reward scale, and, as for credit quality, 99.9% of its assets have scores of BBB and above, which is appropriate to navigate the current economic cycle.

However, despite the “theoretical” advantages of bonds over preferreds, there are specific factors, especially relating to the health of the banking sector which needs to be considered as I have touched upon above and will further elaborate on below.

Concluding with the Case for Preferreds

While VCLT does offer some distinct advantages, this thesis has made the case for investment in preferred stocks being better than long-duration and investment-grade corporate bonds in the current economic cycle. The performance of PFFD vs VCLT for the last year further gives credence to this statement.

However, the one-month historical performance indicates that more investors are opting for VCLT, but this period has also been relatively beneficial for risk assets including equities as more market participants expect the Fed to bring a shift in monetary policy, possibly to a more dovish stance after four episodes of 75 basis points hikes.

However, there is a possibility of the contrary happening on November 23 as Fed Minutes are released on Wednesday afternoon when Chairman’s Powell mood is hawkish. For this purpose, do note that decisions about monetary policy remain data-driven, and not based on investors’ sentiment.

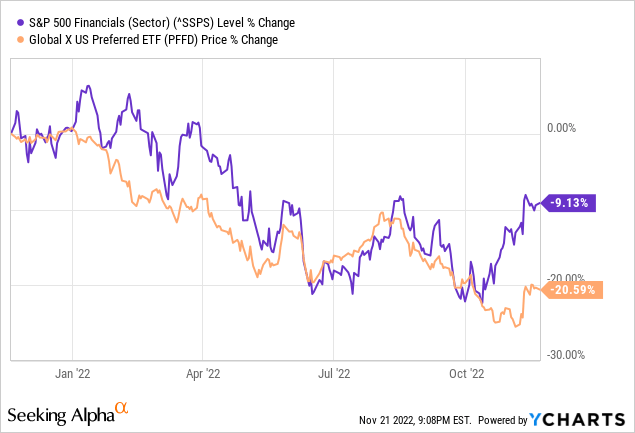

Now, higher interest rates are good for banks that can earn more by loaning out money out of the funds held by depositors to investors at a higher interest rate differential. This effectively increases the yield on their cash pile and means better profitability. Hence, while the broader market (S&P 500) has suffered from a 15.92% one-year downside (while the Fed was hawkish), the S&P 500 Financials sector has been relatively more resilient and underperformed by only 9.13%.

Also as shown in the chart below, PFFD, in orange has a high degree of correlation with the financial sector and in the event that Chairman Powell’s message indicates a 75 basis point hike for December, then PFFD could deliver an upside.

Thus, there could be tailwinds for preferred when more details about monetary policy are released. In the meantime, some may just opt to take a pause, while Chairman Powell delivers his speech.

Finally, even if the latest data point to potential moderation in the pace of interest rate hikes, these will still be raised, and in these circumstances, the above-6% dividends offered by PFFD simply cannot be ignored.

Be the first to comment