winhorse/iStock Unreleased via Getty Images

PetroChina (OTCPK:PCCYF), China’s largest integrated oil & gas company, posted better-than-expected net profit numbers in its latest quarter, outpacing the low-teens % decline in oil prices during the same period. In effect, YTD numbers suggest the company is now on track to deliver the best full-year earnings in the past decade. Whether PetroChina delivers will depend on its pricing power sustaining through the remainder of the year. Given its success thus far, I suspect management’s aggressive winter price hikes should keep import gas losses well under control.

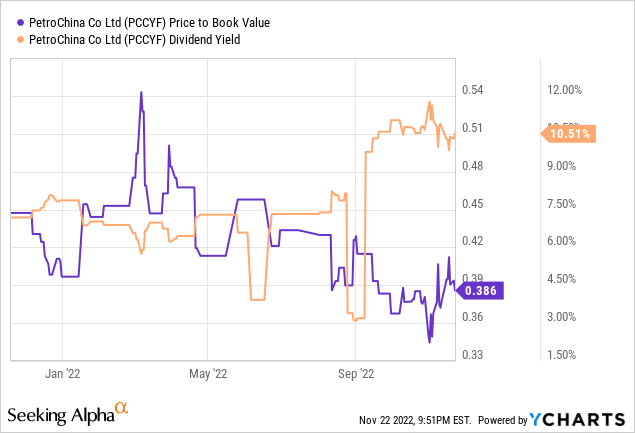

More broadly, PetroChina remains levered to oil prices, and a >$80/bbl scenario should keep upstream profitability elevated. Strong earnings will be well-received by income investors – assuming an in-line 45% payout, a dividend per share of RMB0.32 (or an attractive >10% yield) seems likely. There could be incremental upside to the capital return as well, should management opt to distribute proceeds from recent asset disposals. While there are risks to investing in China at this juncture, the deeply discounted ~0.4x P/B valuation offers an adequate margin of safety to investors.

A Stronger Than Expected Quarter on E&P Outperformance

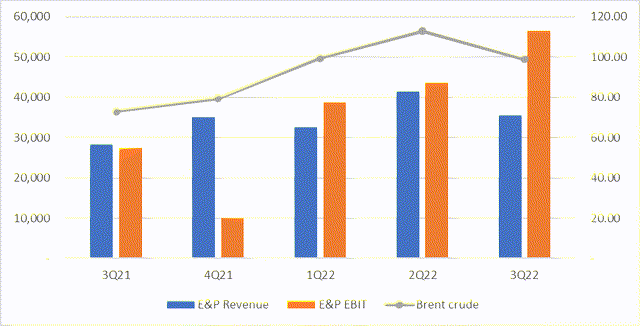

Heading into its latest print, oil prices were down QoQ, so expectations were low. Yet, PetroChina’s gross profit declined by a lesser amount QoQ, outpacing the oil price weakness due to the outperformance of the upstream and natural gas segments. To recap, E&P EBIT was up ~29% QoQ against a low-teens % QoQ decline in benchmark oil prices. While some of the delta was down to the lagged effect of its oil realizations vs. the benchmark, E&P profitability would still have been strong, highlighting PetroChina’s operating leverage gains in the current oil price regime. As a result, the Q3 free cash flow was also robust, further helped by favorable working capital changes and a YoY decline in capex spending.

The only real blemish on the E&P side was total production, which was down by 4% QoQ due to seasonality. Still, on a YTD basis, production remains on track to hit full-year guidance. I wouldn’t rule out a ramp-up from here – peer CNOOC (OTCPK:CEOHF) recently signaled potential mid to long-term production target hikes, and thus, PetroChina management could well follow suit. Going forward, PetroChina’s E&P earnings remain levered to oil prices, with the sweet spot around $85/bbl; beyond this threshold, increased royalties and lower refining income will likely limit the net positive EBITDA impact.

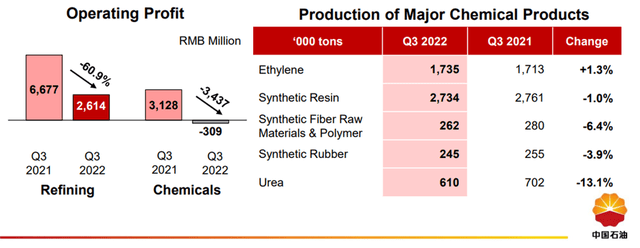

Refining Down but Outperforms Peers

While refining profits were down on inventory losses and weak product spreads, PetroChina’s refining segment is still in the black, albeit with a slim operating margin. By comparison, domestic peers like Sinopec (OTCPK:SNPTY) posted an operating loss, while Rongsheng Petrochemical had even lower margins at ~0.5%.

Things should improve in the coming quarters, though, given the increased product export quota – for context, China recently added 15m tonnes to its 2022 quota for oil products comprising 13.25m tonnes for gasoline, diesel, and jet fuel, with the remaining 1.75m for low sulfur marine fuel. As a refiner with higher domestic crude oil self-sufficiency, PetroChina should also navigate any geopolitical headwinds better than its peers. Meanwhile, better access to discounted crude oil grades (vs. imported Middle Eastern crude) offers an incremental tailwind to profits over the coming quarters.

Leaning on Pricing Power to Protect Natural Gas Margins

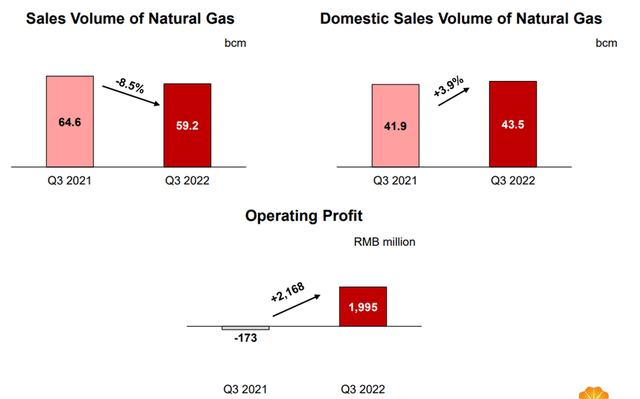

Despite the larger gas import losses, PetroChina’s natural gas marketing business sustained a positive ~2% operating margin in its latest quarter. Of note, import gas losses narrowed slightly this time around amid reduced import volumes QoQ in reaction to the acceleration in domestic gas supply growth. Additional drivers include off-season domestic gas price hikes and a favorable mix shift toward terminal gas sales. With domestic sales volume also up ~4% YoY (relative to flattish gains for the rest of the Chinese market), PetroChina has likely made good domestic market share gains as well through the headwinds.

On a YTD basis, import gas losses (excluding tax rebate) are now at RMB18.5bn, so PetroChina’s RMB20-25bn FY22 import gas loss target seems well within reach. Also helping will be the planned winter gas price hikes this year, which is set to be one of the more aggressive rounds yet, as the company looks to pass through the import gas cost increase to downstream customers. Thus, expect more upside to realized city gate gas prices, which are already running ~35% above the benchmark price so far this year, as an even higher price hike this winter flows through to the P&L.

A Deeply Discounted O&G Play

PetroChina’s strong quarter saw the E&P and Natural Gas division outperform, with even gas import losses coming in better than feared. The refining division was also more resilient than expected, remaining profitable for another quarter despite the headwinds. Over the mid to long term, PetroChina’s upstream business should continue to benefit from tighter supply and higher oil prices, while a favorable mix shift toward low-cost Russian piped gas imports and domestic gas production bode well for gas profitability. Finally, the asset disposals earlier this year, at a premium to book, presents upside to the already high capital return going forward (the current yield stands at >10%). At the current ~60% discount to book, the stock offers compelling value to investors.

Be the first to comment