Wagner Meier

Investment Thesis

Petróleo Brasileiro, commonly called Petrobras (NYSE:PBR), is a Brazilian state-controlled oil company and is one of the largest publicly traded companies in Latin America. Since it began developing the large pre-salt fields off the coast of Brazil, Petrobras has become one of the top producers of oil in the world.

Petrobras unveiled its strategic plan for 2022-2026 which is a huge step forward for streamlining the state-owned giant. It involves divestitures from domestic energy power plants still using fuel oil and reducing about 50% of oil refining capacity (selling off RNEST, REPAR, and REFAP facilities). This divesture will allow for increased natural gas and crude output capacity. Even with divestitures, it does not lose its state-guaranteed dominance in the very rich pre-salt deposits off the coast of Rio de Janeiro.

Recently, Petrobras paid out a record high dividend of an annualized $4.21 (21.33% yield). While some of the reason was political, Petrobras does have a policy of paying out a minimum 25% of net income to shareholders.

Due to huge advantages in oil and gas pricing, along with a massive debt reduction and significant portfolio streamlining planned, we believe that Petrobras is an excellent choice for dividends.

|

Petrobras |

E2022 |

E2023 |

E2024 |

|

Price-to-Sales |

0.9 |

0.9 |

1.0 |

|

Price-to-Earnings |

2.7 |

3.5 |

4.6 |

|

EV/EBITDA |

21.4 |

24.1 |

28.2 |

Broad Strategic Plan

Petrobras unveiled its “Petrobras 2022-2026” strategic plan in late FY21. This plan is an ambitious refooting in the wake of the corruption scandal that rocked the company in 2018, refocusing the large footprint into a cleaner and more diverse firm with a much stronger balance sheet. This plan involves $2.8 billion in CAPEX toward decarbonization (25% reduction in emissions by 2030) and marketing of byproducts such as biofuels.

Modernization and streamlining of the production base is a major focus of Petrobras, estimating it will spend between $15-25 billion streamlining and just over $55 billion in exploration and production (E&P) facilities through the program.

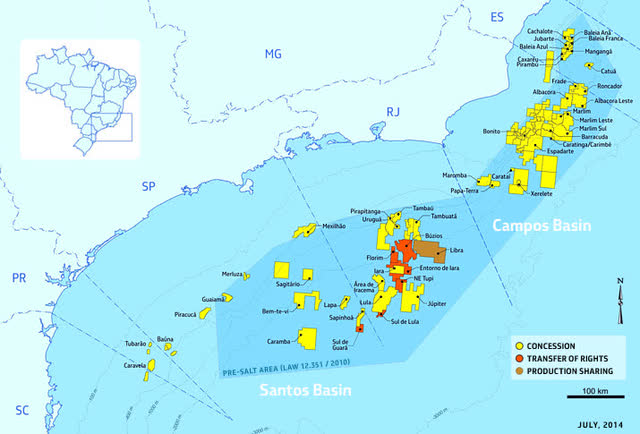

This program finalizes the shift toward pre-salt deposits (of which 67% of E&P CAPEX is dedicated to exploring), which are deep concentrated oil deposits below thousands of feet of salt deposits at the bottom of the ocean. Technology has advanced to the point that the 17 billion barrels of oil in the salt deposits are easily extractable. This is aided by offshore preprocessing and storage floating platforms called FPSOs, which Petrobras will commission 15 new ships in 6 fields – representing 40% of 2026 production.

The forward breakeven price for 2026 is expected to be $20/per barrel (bbl), with the total cost per barrel of oil equivalent (BOE) being broken down as $12 in taxes, $5 in extraction costs, and roughly $12 in depletion allowance.

The major development asset of these is the Campos basin, which will add more than 100 new wells and 3 major platforms, adding as much as 900 mboe/d of production to the basin.

By the end of the program in 2026, Petrobras expects 33% of oil to come from the Búzios presalt offshore reservoir, ~40% to come from other presalt offshores, and the remaining 27% being the remaining postsalt offshore deposits. In a major step toward ESG goals, Petrobras will divest its final near-shore and onshore oil drilling platforms by the end of this plan.

Since 2014, Petrobras has reduced the size of its liabilities by roughly $100 billion, targeting a 40-60 mix of financial debt and leases on the balance sheet. The target of this initiative after reaching the required mix is to maintain a balance sheet at or below $60 billion.

Part of this repositioning is a clearer payout plan for dividends, returning a minimum of $4 billion to investors whenever crude prices are above $40/bbl. According to Petrobras, the plan is said to be resilient at prices as low as $35/bbl.

Complex Regulatory Framework Basic Explanation

Under Brazilian law, all crude and natural gas produced from below a certain ground level is legally the property of the Brazilian government. There are 3 ways in which a company – even a state-owned one like Petrobras – can achieve oil rights. Concession, production sharing, and transfer of rights.

Concession (does not include new pre-salt discoveries past 2014) is for higher risk areas; the firm seeking to explore the area assumes all risk in the process. Once a commercial operation is established the firm establishes a contract with the government for royalties and taxes.

Production sharing is usually used for low-risk areas, and operates similar to the concession, but generally has higher royalties. Additionally, Petrobras is guaranteed at least 30% (with first pick) of the oil operations within the production sharing regions. Additionally, the CPNE (the executor of energy policy in Brazil) can choose whether or not the area is of “strategic” value, essentially giving Petrobras 100% rights.

Transfer of Rights is a 40-year contract (ending 2050) between Petrobras and the Brazilian government which grants Petrobras the right to exclusively explore and take all value extracted from the basin to a limit of 5 billion barrels of oil equivalent.

Extraction Assets

Petrobras’ main assets are concentrated in the Campos and Santos basins, averaging $42/boe in costs across all activity.

The largest revitalization and expansion activity is taking place in Marlim and Voador in the Campos basin. This project will replace 9 existing owned production gathering sites with 2 leased FPSOs. This process will increase production by 20% by 2024 while reducing carbon emissions by 60%, drilling 14 new wells and relocating 61 existing wells.

Petrobras decreased production overall in 2Q22 to 2.65 mmboe/d, a 5% decrease. This is due to a production sharing contract going into effect reducing the working interest Petrobras has in certain fields. These effects are not expected to change the FY22 guidance which remains at 2.6 mmboe/d.

Despite this decrease in production, Petrobras realized a 68.7% revenue increase year over year in 1H22 as pricing surged.

Production and Export Assets

A critical component of Petrobras operations is the use of floating production storage and offloading facilities (FPSOs). These large ships are used to gather and preprocess raw oil and gas from drilled wells, before pumping them ashore through a pipeline, or acting as a floating terminal. There are 14 new FPSOs planned with 5 coming online in 2023 – adding 630 mbbl/d in oil capacity and 1236.2 million cubic feet per day (mmcf/d) in natural gas capacity.

Petrobras reported 1,622 million barrels processed per day (mbp/d) in refined products for 2Q22, reporting record-high diesel production. Because of the lower sulfur content of pre-salt deposits, Petrobras has begun shifting toward higher value-added products like bunkering fuel and other non-energy oil products.

Overall, Petrobras increased sales of all products by 3.7% year over year in 1H22.

Risk

The primary risks facing Petrobras are political regarding the controlling ownership by the Brazilian government and the possible corruption that comes with this governmental control. In my opinion, President of Brazil Bolsonaro should be considered an unstable risk, flip flopping on whether or not his administration will take Petrobras private. The dividend increase seen in Petrobras is resultant of the government asking Petrobras to increase dividends to finance extra federal spending.

In addition, the standard oil and gas firm risks market fluctuations in the price of inputs or outputs, adverse regulatory changes, catastrophic accidents, operational failures, environmental damage, and long-term impact on demand from decarbonization apply.

From 2008 to 2018, Petrobras was involved in a wide-ranging corruption scheme in Brazil. While this was a watershed moment for them, several burdens still plague Petrobras – and is one of the primary reasons they are undergoing so many divestitures. Should continuing terms not end amicably for them or breach remaining contracts (including non-prosecution agreements with the SEC and DoJ), it could spell disaster for the firm.

Conclusion

While the state-owned giant has been a giant blob for many decades, its strategy for 2022-2026 in the wake of the 2018 corruption scandal divests many assets dedicated to domestic-only uses. This allows Petrobras to reposition itself to be a global powerhouse for the rich deep water deposits off Brazil, while keeping its government-guaranteed 30% minimum stake in the very cheap waters.

It continues to pay out a 25% minimum of net income above $40/bbl. With gas prices soaring it has been able to support special dividends, including one worth $17 billion most recently. This brought it to the very top of the oil majors, with a 21.3% yield at the time of payout. For this reason we have upgraded our opinion on Petrobras to a Strong Buy.

Be the first to comment